Flashlights Market Size

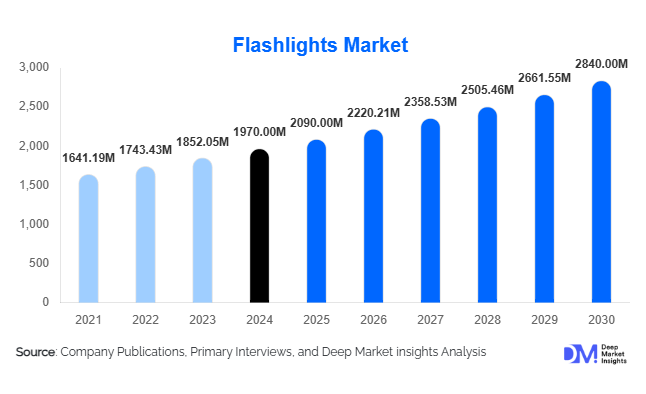

According to Deep Market Insights, the global flashlights market size was valued at USD 1,970 million in 2024 and is projected to grow from USD 2,090 million in 2025 to reach USD 2,840 million by 2030, expanding at a CAGR of 6.23% during the forecast period (2025–2030). The growth of the flashlights market is primarily driven by increasing adoption of LED technology, rising demand for portable and energy-efficient lighting solutions, and expansion of industrial, outdoor, and emergency applications across emerging and developed markets.

Key Market Insights

- LED flashlights dominate the market, accounting for 70% of total revenue in 2024, owing to their high efficiency, durability, and superior brightness compared to traditional incandescent models.

- Outdoor and recreational usage is surging, driven by rising global interest in camping, adventure sports, and hiking activities that require reliable portable lighting.

- Online retail channels are increasingly influential, offering consumers easy access to a wide range of flashlight products, comparison options, and doorstep delivery.

- Industrial and emergency use cases remain critical demand drivers, including mining, construction, security, and disaster management applications.

- Asia-Pacific is the fastest-growing regional market, led by rising urbanization, outdoor leisure activities, and domestic demand in China and India.

- Technological integration, including rechargeable lithium-ion batteries, USB charging, solar power, and smart connectivity features, is enhancing user experience and boosting market growth.

Latest Market Trends

LED Technology Revolutionizing Flashlights

LED flashlights are rapidly replacing traditional incandescent models due to superior brightness, longer lifespan, and energy efficiency. Manufacturers are focusing on adjustable beam focus, multiple lighting modes, and eco-friendly rechargeable batteries. This trend is particularly strong in outdoor, industrial, and emergency segments, where reliability and efficiency are critical. Enhanced portability, lightweight designs, and rugged construction are also influencing consumer preference, making LED flashlights the primary choice in global markets.

Smart and Sustainable Flashlights

Technological innovations, such as rechargeable lithium-ion batteries, USB charging, solar power options, and hand-crank energy systems, are expanding product appeal. Smart flashlights with Bluetooth connectivity and app-based control systems are emerging, targeting tech-savvy users. Sustainable solutions, including solar-powered models and energy-efficient LEDs, are increasingly integrated, aligning with global demand for eco-friendly consumer electronics.

Flashlights Market Drivers

Rising Demand for Portable Lighting Solutions

The increasing need for portable and reliable lighting in outdoor activities, industrial work, and emergency scenarios is a major driver. Consumers and professionals alike prioritize compact, high-performance flashlights for fieldwork, power outages, and recreational activities. The surge in adventure sports, camping, and hiking is fueling consumer adoption globally.

Advancements in LED and Battery Technology

Continuous improvements in LED efficiency and battery longevity have enhanced product reliability and performance. Rechargeable lithium-ion batteries provide longer runtime, faster charging, and reduced environmental impact. As a result, LED flashlights with rechargeable capabilities are gaining popularity in both consumer and professional markets.

Growing Awareness of Energy Efficiency

Environmental consciousness and regulatory focus on energy efficiency are prompting consumers and industrial buyers to adopt LED and rechargeable flashlights. Energy-efficient products reduce long-term operating costs and align with sustainability initiatives, further driving market adoption.

Market Restraints

High Initial Cost of Advanced Flashlights

Despite long-term savings, advanced LED and rechargeable flashlights have a higher upfront cost compared to incandescent or battery-powered alternatives. This price sensitivity is particularly evident in emerging markets, limiting broader adoption.

Battery Life Limitations

Although technology is improving, limited runtime for rechargeable flashlights can be a concern for users needing extended illumination, such as in industrial inspections or prolonged outdoor activities. This can temporarily slow market penetration among professional users.

Flashlights Market Opportunities

Integration of Smart Features

Smart flashlights with app-based controls, Bluetooth connectivity, and programmable lighting modes represent a growing opportunity. These features appeal to tech-savvy consumers and professional users who value convenience, precision, and advanced functionality. Product differentiation through innovation can create competitive advantages in both consumer and industrial segments.

Expansion in Emerging Markets

Rapid urbanization, increased industrialization, and rising disposable incomes in Asia-Pacific and Latin America are driving flashlight demand. Manufacturers can capitalize on this growth by offering region-specific products, establishing local manufacturing units, and optimizing pricing strategies to appeal to both mass and premium consumers.

Adoption in Industrial and Emergency Applications

Industries such as construction, mining, oil & gas, and security require reliable portable lighting. Emergency services, including firefighting, military, and disaster management, also depend on high-performance flashlights. Expanding product lines to meet specific industrial standards and certifications presents a key opportunity for market participants.

Product Type Insights

LED flashlights dominate the market, representing 70% of 2024 sales due to their durability, energy efficiency, and higher brightness. Rechargeable flashlights are growing rapidly, particularly in developed regions, supported by increasing demand for eco-friendly and cost-effective solutions. Incandescent flashlights maintain niche use in low-cost and emergency scenarios, while disposable flashlights are primarily used in temporary emergency kits.

Application Insights

Outdoor and recreational use leads the market, driven by rising adventure sports, camping, and hiking activities. Industrial applications, including construction, mining, and inspection, are a close second. Emergency and safety applications, particularly in disaster-prone areas and industrial safety operations, are fueling steady demand. Household use remains consistent, catering to general-purpose illumination and power outage scenarios.

Distribution Channel Insights

Online retail dominates the market due to convenience, wide selection, and competitive pricing. Offline retail, including electronics and specialty stores, remains significant for impulse purchases and professional-grade flashlights. Wholesale and B2B channels serve industrial and government buyers, providing bulk solutions for operational needs.

End-Use Insights

Consumer households contribute significantly to overall market demand, while industrial applications are the fastest-growing segment, driven by mining, construction, and maintenance operations. Government and defense sectors consistently adopt high-performance flashlights for emergency response, security, and operational efficiency. Export demand from manufacturing hubs such as China is increasing, particularly for LED and rechargeable products in Europe and North America.

| By Product Type | By Application | By Power Source | By Distribution Channel | By End-Use Industry |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds 35% of the global market in 2024, led by the U.S., with high adoption of LED and rechargeable flashlights for both household and industrial applications. Canada shows steady growth, supported by outdoor recreation and industrial demand.

Europe

Europe accounts for 25% of the market, with Germany and the U.K. leading adoption in industrial, household, and emergency sectors. The region favors energy-efficient LED flashlights and sustainable designs.

Asia-Pacific

The Asia-Pacific region is the fastest-growing, driven by China and India. Rising urbanization, outdoor leisure activities, and industrialization contribute to high demand. Local manufacturing and exports to global markets further strengthen growth.

Latin America

Brazil and Argentina are the major markets, with growing adoption of portable and industrial flashlights. Rising outdoor activities and construction projects are supporting steady demand.

Middle East & Africa

South Africa leads the MEA region, driven by industrial, emergency, and outdoor applications. High reliance on solar-powered flashlights in rural areas further drives market penetration. The Middle East shows steady growth, supported by high-income populations and industrial usage.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Flashlights Market

- Maglite

- Fenix

- Streamlight

- Olight

- SureFire

- Coast

- Nite Ize

- Anker Innovations

- Black Diamond

- LED Lenser

- Goal Zero

- Pelican Products

- Duracell

- Energizer

- Rayovac

Recent Developments

- In March 2025, Maglite introduced a rechargeable LED flashlight with USB-C charging and extended battery life for industrial and household use.

- In January 2025, Fenix launched a smart flashlight with Bluetooth connectivity and app-controlled light modes for outdoor enthusiasts and professional users.

- In February 2025, Streamlight expanded its industrial flashlight portfolio, integrating ruggedized designs and longer battery runtimes for mining and construction sectors.