Electronic Products Rental Market Size

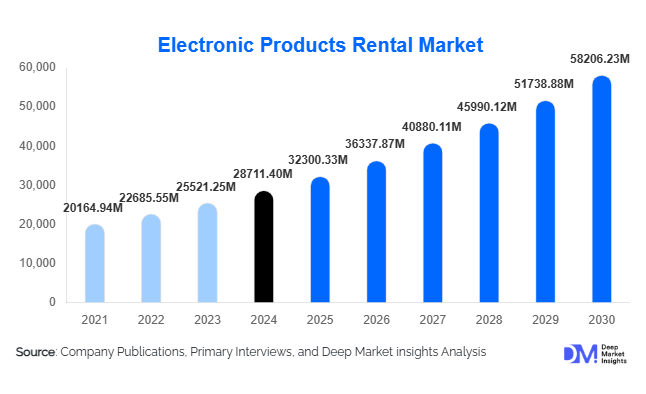

According to Deep Market Insights, the global electronic products rental market size was valued at USD 28,711.40 million in 2024 and is projected to grow from USD 32,300.33 million in 2025 to reach USD 58,206.23 million by 2030, expanding at a CAGR of 12.50% during the forecast period (2025–2030). The market growth is primarily propelled by rising adoption of subscription-based electronics access models, the increasing cost of premium consumer devices, enterprise demand for flexible IT provisioning, and global momentum toward circular-economy and sustainability-driven usage models.

Key Market Insights

- Subscription and Device-as-a-Service (DaaS) models are becoming the dominant commercial structure, particularly for smartphones, laptops, and enterprise IT fleets.

- Asia-Pacific leads global demand, driven by affordability pressures, large consumer bases, and rapid adoption of rental-fintech models.

- Smartphones and mobile devices account for the largest product share due to short upgrade cycles and high replacement costs.

- Online rental platforms and OEM-led rental programs dominate distribution, benefiting from low customer acquisition costs and scalable logistics.

- Corporate and SME demand is accelerating as hybrid work, short-term staffing, and IT cost optimization reshape device procurement.

- Circular-economy policies and sustainability mandates in Europe, the U.S., and parts of Asia are fueling growth in refurbishment, reuse, and rental lifecycle programs.

What are the latest trends in the electronic products rental market?

Subscription-Led Ownership Replacement

Consumers are increasingly shifting from outright device ownership to flexible subscription access. Monthly rental models for smartphones, laptops, and wearables now include upgrade benefits, damage protection, and bundled accessories. Device-as-a-Service programs are rapidly becoming the preferred option for both consumers and enterprises due to predictable monthly costs, frequent upgrades, and included maintenance. This trend is reshaping OEM distribution strategies, with major manufacturers integrating rental pathways alongside traditional buy-and-own channels.

Growth of Circular-Economy Partnerships

Environmental regulations and corporate sustainability commitments are driving collaboration between rental companies, OEMs, and refurbishing facilities. High-quality refurbished electronics are increasingly being reintegrated into rental fleets, reducing acquisition costs and improving margins. Governments in Europe and Asia are promoting device reuse, recycling, and second-life programs, encouraging institutional customers to adopt rental as a low-impact alternative to repeated device purchases.

Enterprise Technology-as-a-Service Expansion

Corporate demand for temporary and flexible device provisioning is rising sharply. Enterprises are adopting DaaS bundles that include device configuration, security management, remote wipe capabilities, and rapid swap-out SLAs, making rental contracts more comprehensive and high-value. This trend is accelerating with hybrid work models and contractor-heavy industries where short-term device needs fluctuate frequently.

What are the key drivers in the electronic products rental market?

Rising Cost of High-End Consumer Electronics

Premium smartphones, laptops, and wearables continue to climb in retail price, making one-time ownership economically challenging for many consumers. Rental models provide affordable access to top-tier devices without upfront costs. This affordability advantage is particularly impactful in emerging markets where disposable incomes lag behind device price inflation.

Enterprise Shift Toward OpEx-Based Technology Procurement

Companies are increasingly replacing capital expenditure (CapEx) with operational expenditure (OpEx) models. Device rental supports rapid workforce scaling, flexible deployment, and predictable spending. Enterprises benefit from outsourced maintenance, improved IT lifecycle management, and lower security risks due to standardized device provisioning. As a result, enterprise DaaS is one of the fastest-growing segments globally.

Sustainability and Government Push for Electronics Reuse

Regulators and institutions are encouraging device reuse to reduce e-waste. Rental systems extend product lifecycles, making them attractive for public procurement, schools, healthcare institutions, and corporate ESG strategies. Circular digital infrastructure, including certified refurbishment and reverse logistics centers, is becoming integral to national sustainability policies in Europe and Asia, amplifying rental adoption.

What are the restraints for the global market?

High Logistics, Refurbishment, and Depreciation Costs

Electronics rental companies face significant cost burdens across testing, repairs, shipping, and refurbishment. Rapid device depreciation, particularly for smartphones and laptops, compresses margins and requires high utilization rates to remain profitable. Smaller operators often struggle to maintain efficient reverse logistics networks and competitive refurbishment capabilities.

Fraud, Credit Risk, and Regulatory Complexities

Rent-to-own and subscription platforms must manage high levels of fraud risk, identity theft, and device non-return. Local consumer protection laws, VAT rules, and import regulations vary widely across regions, complicating global expansion. Compliance costs and risk management place considerable strain on new entrants and cross-border operators.

What are the key opportunities in the electronic products rental industry?

Enterprise Managed Device Fleets

As businesses adopt hybrid work models, demand for managed device rental contracts is growing rapidly. Companies are increasingly outsourcing device configuration, security, fleet management, and hardware refresh cycles. This creates significant opportunities for rental providers offering DaaS platforms with integrated MDM, compliance, and insurance services. Enterprise contracts offer multi-year revenue visibility and significantly higher ARPU compared to consumer rentals.

Emerging Market Penetration Through Rent-to-Own Models

In large developing economies such as India, Indonesia, Nigeria, and Brazil, rent-to-own and micro-subscription models offer consumers affordable access to premium electronics. Coupled with mobile-first credit scoring and embedded device insurance, this provides a substantial opportunity for growth. Fintech-driven rentals are expanding rapidly, supported by government digital inclusion programs and education device procurement.

OEM Partnerships and Circular-Economy Innovation

Manufacturers increasingly view rental as a channel to extend product lifespans, reduce returns, and monetize refurbished inventory. Collaborative models such as OEM-managed refurbishment, warranty integration, and certified second-life deployments offer rental companies access to cheaper inventory and higher reliability. This opportunity is reinforced by regulatory pressure for sustainable device ecosystems.

Product Type Insights

Smartphones & Mobile Devices dominate the market, accounting for approximately 28% of global 2024 revenue. This segment benefits from extremely short upgrade cycles, high depreciation costs, and strong consumer desire for premium flagship models. Laptops and desktops represent the second-largest category, driven by enterprise DaaS demand and remote work. Cameras, wearables, gaming consoles, and VR headsets form growing niches, particularly for short-term rentals and content creation. Small home appliances, including robotic vacuums and compact fridges, are emerging as a strong supplementary segment as consumers embrace subscription-based household management.

Application Insights

Consumer applications contribute the largest share, fueled by demand for affordable premium smartphones, gaming devices, and home electronics. Enterprise applications are the fastest-growing segment, supported by IT fleet rentals, temporary workforce provisioning, and event-based equipment needs. Educational institutions increasingly rely on tablet and laptop rentals for classroom digitization, while healthcare uses rented tablets and portable devices for patient data collection. Production and media industries continue to drive demand for high-end cameras, drones, and audio equipment.

Distribution Channel Insights

Online Direct Platforms lead the market with more than 55% share, benefitting from digital onboarding, automated credit checks, and scalable logistics. OEM-led rental programs are rising rapidly as brands integrate rental as part of their lifecycle management strategy. Brick-and-mortar rental outlets maintain relevance in regional markets and high-touch enterprise deployments. Peer-to-peer rental channels are growing as niche platforms support photography and event equipment exchanges, though they remain limited by insurance and reliability constraints.

Customer Type Insights

Individual consumers represent approximately 38% of the market and remain the largest customer group, driven by cost savings and upgrade flexibility. SMEs and large enterprises form the next major segment, with enterprise rental demand accelerating due to hybrid work. Education and healthcare entities increasingly rely on device rental for periodic upgrades and cost-efficient scaling. Events and production houses remain heavy users of high-end equipment rentals, particularly for cameras, lighting, and drones.

Age Group Insights

Younger demographics (18–35 years) drive consumer rental adoption due to financial flexibility and digital-first behavior. The 31–50 age group represents the highest-value segment, showing a strong preference for premium device subscriptions. Older demographics adopt rentals primarily for large appliances, tablets, and health-compatible devices. As device prices rise globally, rental models are gaining acceptance across all age clusters, especially in urban markets.

| By Product Type | By Rental Model | By Distribution Channel | By Customer Type |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds approximately 29% of the global market, driven by advanced logistics networks, high enterprise DaaS adoption, and strong rent-to-own infrastructure. The U.S. dominates regional demand, particularly for production equipment rentals and corporate device leases. Canada shows steady growth through education-focused laptop and tablet rental programs.

Europe

Europe accounts for around 18% of global revenue, supported by strict sustainability policies and strong adoption of circular-economy models. Germany, the U.K., and France lead demand, with rental growth driven by refurbished device acceptance and enterprise renewals. Nordic countries exhibit the highest per-capita rental penetration due to advanced ESG mandates.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing region, representing nearly 34% of global market share. China leads in volume due to massive device consumption and refurbishment capacity, whereas India demonstrates the highest percentage growth, driven by affordability constraints and fintech-enabled rental models. Japan, South Korea, and Southeast Asia are increasingly adopting rental services across consumer electronics, education, and gaming.

Latin America

Latin America represents approximately 12% of the market, with Brazil and Mexico accounting for the majority of regional demand. High device prices and restricted consumer credit are driving rent-to-own adoption. Growing e-commerce penetration is accelerating digital rental platform growth.

Middle East & Africa

The region accounts for around 7% of the global share, driven by premium device rentals in the Gulf Cooperation Council (GCC) and education-based programs in Africa. The UAE and Saudi Arabia exhibit rapid growth, fueled by high-income consumers and enterprise fleet deployments. Africa’s demand is expanding through low-cost smartphone rentals and NGO-supported digital education programs.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Companies in the Electronic Products Rental Market

- Rent-A-Center / Aaron’s

- Grover

- RentoMojo

- Fat Llama

- FlexShopper

- CORT Device Leasing

- Lendis

- LeasePlan (device leasing program divisions)

- Regional APAC rental companies (China, SEA)

- Major LATAM device rental platforms

Recent Developments

- In March 2025, Grover expanded its refurbishment facility in Germany, doubling its processing capacity to support circular device programs across Europe.

- In January 2025, RentoMojo introduced a rent-to-own smartphone program integrated with micro-insurance for customers in Tier-2 and Tier-3 Indian cities.

- In November 2024, several enterprise DaaS providers announced multi-year corporate fleet contracts in North America, supporting hybrid workplace digital transformation initiatives.