Elderberry Market Size

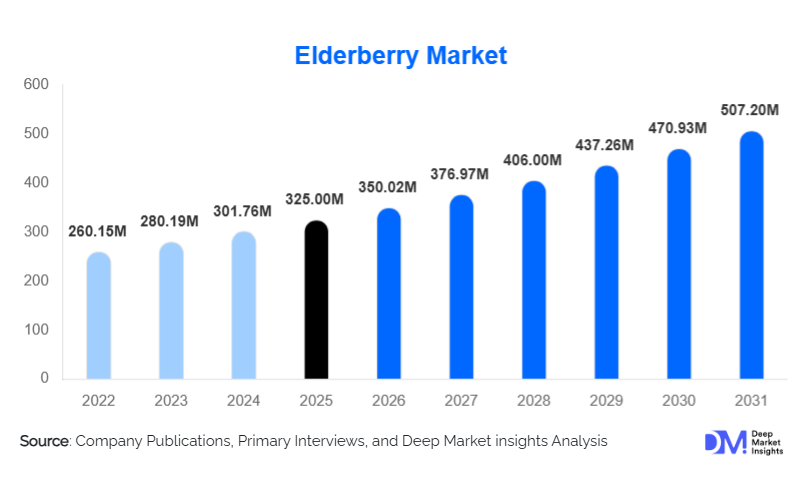

According to Deep Market Insights, the global elderberry market size was valued at USD 325.00 million in 2025 and is projected to grow from USD 350.02 million in 2026 to reach USD 507.20 million by 2031, expanding at a CAGR of 7.7% during the forecast period (2026–2031). The elderberry market growth is primarily driven by rising consumer awareness of immune health, increasing adoption of plant-based and preventive healthcare solutions, and the rapid expansion of dietary supplements and functional food industries globally.

Key Market Insights

- Elderberry-based dietary supplements dominate global demand, supported by strong clinical backing for immune and respiratory health benefits.

- Extracts represent the leading product form, owing to high anthocyanin concentration, formulation flexibility, and longer shelf life.

- Europe leads global production and consumption, supported by established herbal medicine traditions and strong regulatory frameworks.

- North America remains the largest consumer market, driven by high supplement usage and premium wellness spending.

- The Asia-Pacific region is the fastest-growing, driven by rising disposable incomes, urbanization, and the adoption of Western-style supplements.

- Organic elderberry products are gaining traction, benefiting from clean-label, sustainability, and premium pricing trends.

What are the latest trends in the elderberry market?

Expansion of Functional Foods and Beverages

Elderberry is increasingly being incorporated into functional foods and beverages such as immunity shots, fortified juices, gummies, and nutrition bars. Manufacturers are leveraging elderberry’s antioxidant and antiviral positioning to create daily-consumption wellness products that go beyond traditional supplements. This trend is expanding the addressable consumer base by integrating elderberry into mainstream diets, particularly among younger demographics seeking convenient immunity solutions.

Standardization and Clinical Validation

Market players are investing in advanced extraction technologies and clinical research to standardize anthocyanin content and validate health claims. Products with clinically supported dosages are gaining consumer trust and commanding premium pricing. This trend is strengthening brand differentiation and encouraging regulatory compliance across major markets.

What are the key drivers in the elderberry market?

Rising Demand for Immune Health Solutions

Growing global focus on preventive healthcare has significantly increased demand for natural immune-support ingredients. Elderberry’s strong association with antiviral and antioxidant benefits has positioned it as a core botanical in immunity-focused supplements, particularly for respiratory wellness. Aging populations and post-pandemic health awareness continue to drive sustained consumption.

Growth of the Global Dietary Supplements Industry

The rapid expansion of the dietary supplements sector is a major driver for elderberry demand. Supplements in the form of syrups, capsules, tablets, and gummies are increasingly preferred due to ease of consumption and perceived safety. Strong retail penetration through pharmacies, health stores, and online platforms has further accelerated market growth.

What are the restraints for the global market?

Raw Material Supply Volatility

Elderberry cultivation is geographically concentrated, making supply vulnerable to climatic variability and agricultural yield fluctuations. Seasonal shortages and inconsistent harvests can lead to price volatility, affecting manufacturer margins and long-term supply contracts.

Regulatory Variability Across Regions

Differences in herbal supplement regulations, approved health claims, and dosage limits across regions pose challenges for global market expansion. Regulatory delays and compliance costs can slow product launches, particularly in emerging markets.

What are the key opportunities in the elderberry industry?

Emerging Market Penetration

Asia-Pacific and Latin America present significant growth opportunities due to rising middle-class populations and increasing health awareness. Localized product formulations, culturally aligned branding, and partnerships with regional nutraceutical companies can unlock substantial untapped demand.

Technological Innovation in Extraction and Formulation

Advanced extraction techniques such as solvent-free processing and membrane filtration are improving product potency, stability, and bioavailability. Companies investing in proprietary formulations and personalized nutrition platforms are well-positioned to capture premium market segments.

Product Type Insights

Elderberry extracts dominate the market, accounting for approximately 42% of the total market value in 2025. Their dominance is driven by high potency, ease of formulation, and suitability for supplements and beverages. Whole elderberries, including fresh and dried forms, serve niche culinary and herbal medicine applications. Syrups and concentrates remain popular in pediatric and family immunity products, while capsules and tablets cater to convenience-focused consumers. Functional elderberry ingredients standardized for anthocyanin content are increasingly used in B2B nutraceutical and food manufacturing.

Application Insights

Dietary supplements represent the largest application segment, holding nearly 48% of the global market in 2025. Functional food and beverage applications are the fastest-growing, supported by innovation in wellness drinks and fortified snacks. Pharmaceutical and medicinal uses are expanding gradually as research into elderberry’s antiviral properties progresses. Cosmetics and personal care applications are emerging, driven by antioxidant and anti-aging benefits.

Distribution Channel Insights

B2B ingredient sales account for roughly 40% of global demand, as elderberry is widely used by supplement and food manufacturers. Pharmacies and drug stores remain key retail channels, particularly in North America and Europe. Online retail and direct-to-consumer platforms are growing rapidly, driven by digital health awareness, subscription models, and influencer-led marketing.

End-Use Industry Insights

The dietary supplements industry is the largest end-use sector, with a market size exceeding USD 1.0 billion in 202. Functional foods and beverages represent the fastest-growing end-use segment, expanding at over 13% CAGR. Pharmaceutical, cosmetics, and animal nutrition applications are smaller but steadily expanding, contributing to long-term diversification of demand.

| By Product Form | By Application | By Distribution Channel | By Source |

|---|---|---|---|

|

|

|

|

Regional Insights

Europe

Europe accounts for approximately 38% of the global elderberry market, led by Germany, Italy, Poland, and the U.K. The region benefits from strong herbal medicine traditions, established cultivation, and high consumer trust in botanical supplements.

North America

North America holds a market share of around 32%, with the United States accounting for nearly three-quarters of regional demand. High supplement consumption, premium wellness spending, and strong retail infrastructure support sustained growth.

Asia-Pacific

Asia-Pacific is the fastest-growing region, registering over 14% CAGR. China, India, Japan, and South Korea are driving demand due to rising disposable incomes, urbanization, and increasing adoption of Western health products.

Latin America

Latin America accounts for a modest but growing share of global demand, led by Brazil and Mexico. Rising health awareness and the gradual expansion of the nutraceutical industry are supporting market growth.

Middle East & Africa

The Middle East & Africa region is an emerging market, driven by premium supplement demand in the UAE and Saudi Arabia, along with growing healthcare investments in South Africa.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|