Elderberry Gummy Market Size

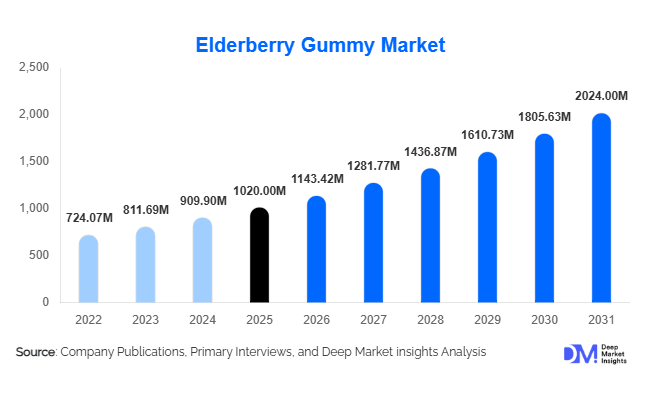

According to Deep Market Insights,the global elderberry gummy market size was valued at USD 1,020 million in 2025 and is projected to grow from USD 1,143.42 million in 2026 to reach USD 2,024.11 million by 2031, expanding at a CAGR of 12.1% during the forecast period (2026–2031). The elderberry gummy market growth is primarily driven by rising consumer awareness regarding preventive healthcare, increasing demand for plant-based immunity supplements, and the growing popularity of gummy-based nutraceutical delivery formats across children and adult populations.

Key Market Insights

- Immunity-focused formulations dominate the market, accounting for over 60% of global revenue, as consumers prioritize daily immune support products.

- Adult consumers represent the largest age group segment, contributing more than 50% of overall demand due to increased supplement adoption post-pandemic.

- Online retail leads distribution, supported by subscription models, influencer marketing, and direct-to-consumer (D2C) channels.

- North America holds the largest regional share, driven by high dietary supplement penetration and strong retail infrastructure.

- Asia-Pacific is the fastest-growing region, fueled by rising middle-class income and preventive health awareness.

- Vegan, organic, and sugar-free innovations are reshaping product development and premium pricing strategies.

What are the latest trends in the elderberry gummy market?

Clean-Label and Plant-Based Formulations

Consumers are increasingly favoring clean-label elderberry gummies formulated without gelatin, artificial colors, or synthetic preservatives. Vegan pectin-based gummies are rapidly replacing gelatin-based alternatives, particularly in North America and Europe. Organic-certified elderberry extract, non-GMO ingredients, and allergen-free formulations are becoming mainstream expectations rather than niche offerings. Manufacturers are also reformulating products with reduced sugar content or natural sweeteners such as tapioca syrup and monk fruit to align with broader health trends. This clean-label movement enables brands to command price premiums of 20–30% while strengthening brand loyalty among health-conscious consumers.

Functional Blends and Multi-Ingredient Immunity Support

Elderberry gummies are increasingly combined with complementary ingredients such as vitamin C, zinc, echinacea, and probiotics. These multi-functional blends enhance perceived efficacy and differentiate products in a competitive retail landscape. Brands are also exploring targeted formulations for children, seniors, and respiratory health segments. Innovation in microencapsulation technology is improving bioavailability and stability of active ingredients, allowing higher dosage strengths without compromising taste or texture. Personalized supplement subscriptions and digital health integrations are further enhancing consumer engagement and repeat purchases.

What are the key drivers in the elderberry gummy market?

Growing Preventive Healthcare Awareness

Post-pandemic behavioral shifts have normalized daily supplementation, significantly boosting demand for immunity-enhancing products. Elderberry, recognized for its antioxidant-rich anthocyanin content, has become a preferred botanical ingredient for immune support. Increasing consumer education through digital platforms and healthcare professionals has accelerated mainstream adoption across developed and emerging markets.

Expansion of the Gummy Supplement Format

The global gummy supplement category is expanding at double-digit growth, outperforming traditional tablets and capsules. Gummies offer superior taste, convenience, and higher compliance, particularly among pediatric and elderly consumers. This format innovation is a major structural driver for elderberry gummy sales globally.

What are the restraints for the global market?

Raw Material Price Volatility

Elderberry extract sourcing is highly dependent on agricultural yields in Europe and North America. Climatic fluctuations and supply constraints can cause 8–12% annual price volatility, impacting manufacturer margins and retail pricing consistency.

Regulatory and Health Claim Limitations

Strict regulatory frameworks, including FDA dietary supplement guidelines and EFSA claim approvals, restrict disease-related marketing claims. Compliance requirements increase operational costs and limit aggressive promotional strategies.

What are the key opportunities in the elderberry gummy industry?

Emerging Market Expansion

Asia-Pacific and Latin America present high-growth opportunities as rising disposable income and urbanization boost nutraceutical adoption. Countries such as China and India are witnessing increasing acceptance of Western-style gummy supplements. Local manufacturing partnerships and region-specific flavor customization can accelerate penetration.

Premium Organic and Sugar-Free Segments

The organic segment, though currently smaller, is growing at a faster rate than conventional products. Sugar-free and low-calorie elderberry gummies are also gaining traction among diabetic and weight-conscious consumers. These premium categories provide opportunities for margin expansion and brand differentiation.

Nature Insights

The conventional segment continues to dominate the global elderberry gummies market, accounting for approximately 72% of total revenue in 2025. The leading position of conventional products is primarily driven by their competitive pricing, large-scale manufacturing efficiencies, and widespread availability across supermarkets, pharmacies, and mass retail chains. Established supply chains and lower certification costs allow manufacturers to maintain attractive price points, which significantly enhances consumer accessibility in both developed and emerging markets. In addition, conventional elderberry extracts are more readily sourced, enabling high-volume production to meet mainstream immune-support demand.

However, the organic segment is expanding at a significantly faster CAGR of nearly 14%, supported by rising consumer preference for clean-label, non-GMO, and pesticide-free supplements. Growth is particularly strong in North America and Europe, where organic certification standards and transparent sourcing practices strongly influence purchasing decisions. Increasing regulatory clarity around organic labeling, coupled with heightened health consciousness following global health crises, is encouraging premiumization within the category. As a result, while conventional products remain volume leaders, organic variants are progressively strengthening their value share through higher average selling prices and brand differentiation strategies.

Dosage Strength Insights

Medium-strength formulations containing 100–200 mg per gummy lead the market with an estimated 48% share in 2025. This segment’s leadership is driven by its alignment with commonly recommended daily immune-support intake levels, offering an optimal balance between efficacy, safety perception, and affordability. Consumers increasingly prefer formulations that provide clinically relevant dosing without exceeding typical daily nutritional requirements, making this range highly attractive for routine preventive supplementation.

High-strength variants exceeding 200 mg are gaining traction within premium and therapeutic positioning segments, particularly among adults seeking enhanced immune defense during seasonal outbreaks. These formulations command higher margins and are frequently marketed through digital platforms and specialty health stores. Meanwhile, lower-dose variants continue to serve pediatric and first-time supplement users who prioritize gradual supplementation and flavor compliance. The dosage segment overall is benefiting from growing scientific communication, clearer labeling practices, and increasing consumer understanding of standardized extract concentrations.

Age Group Insights

Adults aged 20–59 years account for approximately 54% of global demand, making them the leading consumer group. The segment’s dominance is supported by strong workforce participation, preventive healthcare awareness, and repeat purchase behavior. Subscription-based buying models and digital health marketing strategies have further strengthened brand loyalty within this demographic. Working professionals particularly favor gummy formats for their convenience, portability, and improved taste compared to traditional capsules.

Pediatric formulations represent one of the fastest-growing sub-segments, driven by parental demand for immune-support supplements in chewable, flavored formats that improve compliance. Senior consumers are also emerging as an important growth driver, as aging populations increasingly prioritize immune resilience and antioxidant intake. Collectively, demographic shifts toward preventive wellness and family-focused supplementation strategies are broadening the consumer base of elderberry gummies across all age categories.

Distribution Channel Insights

Online retail is the leading distribution channel, contributing nearly 37% of total global revenue. The channel’s growth is primarily driven by expanding e-commerce ecosystems, direct-to-consumer (D2C) brand strategies, and subscription-based purchasing models that encourage recurring sales. Digital platforms allow transparent pricing comparisons, consumer reviews, personalized recommendations, and targeted marketing campaigns, significantly improving customer acquisition and retention rates.

Pharmacies and drugstores remain strong secondary channels, particularly for clinically positioned or premium elderberry formulations that emphasize immune and respiratory benefits. Supermarkets and hypermarkets continue to play a crucial role in volume sales, especially for conventional and mid-priced products. The increasing integration of omnichannel retail strategies, including click-and-collect models and cross-border e-commerce, is further strengthening distribution efficiency and global accessibility.

End-Use Insights

The nutraceutical and OTC wellness industry remains the primary end-use sector for elderberry gummies, supported by a global dietary supplement industry valued at over USD 350 billion. The leading growth driver within this segment is the rising consumer shift toward preventive healthcare and natural immune-support solutions. Elderberry’s established antioxidant and antiviral properties position it strongly within daily wellness routines and seasonal immunity regimens.

Pediatric immunity and senior wellness applications are expanding at approximately 13–14% CAGR, reflecting demographic shifts and growing family-oriented supplement consumption. Export-driven demand is particularly strong from the United States and Germany, both recognized as major supplement exporters with advanced manufacturing capabilities and strict quality standards. Emerging applications include respiratory health blends, antioxidant-focused formulations, and integration into broader multivitamin portfolios, enabling manufacturers to diversify product offerings and increase cross-category penetration.

| By Nature | By Dosage Strength | By Age Group | By Functional Positioning | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 42% of global market share in 2025, maintaining its position as the largest regional market. The United States leads regional demand, supported by dietary supplement penetration exceeding 70% among adults and a highly developed nutraceutical ecosystem. Key growth drivers include strong consumer awareness of botanical supplements, advanced retail and e-commerce infrastructure, and high disposable income levels. The presence of established supplement brands, aggressive digital marketing strategies, and robust regulatory frameworks further strengthen market maturity. Canada contributes significantly through rising demand for certified organic and clean-label products, supported by regulatory acceptance of botanical extracts and growing preventive healthcare trends.

Europe

Europe holds approximately 28% market share, with Germany, the United Kingdom, and France serving as primary demand centers. Regional growth is driven by strong herbal medicine traditions, high regulatory standards that enhance product credibility, and growing consumer preference for plant-based immunity solutions. Germany plays a dual role as both a major consumer and exporter of elderberry extract, benefiting from advanced phytopharmaceutical expertise. Increasing demand for organic-certified supplements and premium formulations across Western Europe continues to elevate average selling prices and support steady revenue growth.

Asia-Pacific

Asia-Pacific represents the fastest-growing region, expanding at nearly 15% CAGR. China, India, Japan, and South Korea are key growth engines, supported by rising middle-class incomes, urbanization, and increasing awareness of preventive healthcare. Rapid expansion of e-commerce platforms and cross-border supplement trade has significantly improved product accessibility. China’s role as both a major importer of elderberry raw materials and a growing local manufacturer further strengthens regional supply chains. In India and Southeast Asia, expanding pharmacy retail networks and digital health campaigns are accelerating category penetration among younger consumers.

Latin America

Brazil and Mexico lead regional demand, supported by expanding middle-class populations, growing healthcare awareness, and improving pharmacy distribution networks. Increased exposure to global wellness trends through digital platforms is driving interest in immune-support supplements. While the region currently represents a smaller revenue share compared to North America and Europe, rising disposable incomes and regulatory modernization are expected to unlock significant long-term growth potential.

Middle East & Africa

The Middle East & Africa region is gradually emerging as a growth frontier, with the UAE and South Africa acting as primary hubs. Rising preventive healthcare awareness, increasing expatriate populations, and the expansion of modern retail and pharmacy chains are key regional drivers. Although overall demand remains comparatively modest, improving regulatory clarity and growing consumer preference for natural wellness solutions are steadily strengthening market expansion prospects across the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Elderberry Gummy Market

- Nature’s Way

- Sambucol

- Garden of Life

- Zarbee’s Naturals

- Nature Made

- Olly Nutrition

- NOW Foods

- Gaia Herbs

- Solgar

- Goli Nutrition

- Herbaland

- Jamieson Wellness

- Vitafusion

- Swisse Wellness

- Blackmores