Egg Replacer for Baking Market Size

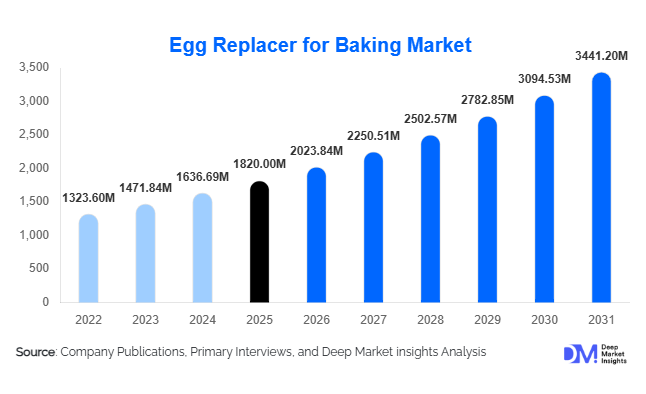

According to Deep Market Insights, the global egg replacer for baking market size was valued at USD 1,820 million in 2025 and is projected to grow from USD 2,023.84 million in 2026 to reach USD 3,441.2 million by 2031, expanding at a CAGR of 11.2% during the forecast period (2026–2031). The egg replacer for baking market growth is primarily driven by the rapid adoption of plant-based diets, increasing volatility in egg supply and pricing, rising demand for allergen-free baked goods, and sustained innovation in functional plant-based ingredients for commercial and industrial baking applications.

Key Market Insights

- Egg replacers are transitioning from niche vegan substitutes to mainstream baking ingredients, particularly in industrial and commercial bakery formulations.

- Starch- and protein-based egg replacers dominate demand, offering cost efficiency, functional reliability, and scalability for high-volume baking.

- North America leads global consumption, supported by advanced bakery manufacturing, high vegan penetration, and strong clean-label adoption.

- Europe remains a mature but innovation-driven market, shaped by allergen regulations, sustainability mandates, and plant-based food policies.

- Asia-Pacific is the fastest-growing region, driven by urbanization, Western-style bakery expansion, and rising demand for egg-free formulations.

- Technological advancements, including fermentation-derived proteins and multi-functional ingredient blends, are reshaping product performance and cost structures.

What are the latest trends in the egg replacer for baking market?

Shift Toward Multi-Functional Egg Replacer Blends

One of the most prominent trends in the egg replacer for baking market is the development of multi-functional blends capable of replicating multiple egg properties simultaneously, including binding, leavening, moisture retention, and emulsification. Manufacturers are increasingly moving away from single-ingredient solutions toward customized blends of starches, plant proteins, fibers, and enzymes. These formulations reduce the need for multiple additives, improve texture consistency, and simplify bakery production processes, particularly for industrial-scale manufacturers seeking uniformity across batches.

Rising Demand for Clean-Label and Allergen-Free Baking Ingredients

Clean-label positioning has become a decisive purchasing criterion across both B2B and retail segments. Egg replacers formulated with recognizable, non-GMO, and minimally processed ingredients are gaining preference among bakeries and consumers alike. Additionally, as eggs remain a major food allergen globally, allergen-free egg replacers are increasingly used in institutional baking, packaged foods, and export-oriented products. This trend is reinforcing demand for fiber-based and starch-based alternatives with transparent labeling and regulatory compliance.

What are the key drivers in the egg replacer for baking market?

Expansion of Plant-Based and Vegan Bakery Products

The global shift toward plant-based diets is a core driver of the egg replacer for baking market. Vegan and flexitarian consumers are driving demand for egg-free cakes, cookies, muffins, and pastries across retail and foodservice channels. Large commercial bakeries are reformulating product lines to capture this growing consumer base, leading to sustained demand for functional egg replacers that deliver comparable taste, texture, and appearance.

Egg Price Volatility and Supply Chain Disruptions

Recurring disruptions in global egg supply caused by avian influenza outbreaks, rising feed costs, and logistics challenges have resulted in frequent price fluctuations. Industrial bakeries are increasingly adopting egg replacers to stabilize input costs and reduce dependence on volatile animal-based supply chains. This economic driver has significantly accelerated adoption among high-volume bakery manufacturers.

What are the restraints for the global market?

Performance Limitations Across Diverse Baking Applications

Despite technological progress, egg replacers do not yet deliver uniform performance across all bakery applications. Products such as sponge cakes and premium pastries require precise aeration and emulsification, which can be challenging to replicate fully with plant-based alternatives. This performance variability limits adoption among artisanal bakers and smaller manufacturers lacking formulation expertise.

Higher R&D and Formulation Costs

Advanced protein-based and algae-based egg replacers involve higher research, development, and processing costs. While these products offer superior functionality, their higher pricing can deter adoption in cost-sensitive markets, particularly in emerging economies where bakery margins remain tight.

What are the key opportunities in the egg replacer for baking industry?

Government Support for Sustainable and Alternative Proteins

Government initiatives promoting plant-based foods, food security, and sustainable agriculture present strong growth opportunities. Policies and funding programs in Europe, China, and India are indirectly supporting egg replacer production by incentivizing food processing infrastructure, protein innovation, and clean-label manufacturing. These initiatives reduce entry barriers and encourage domestic production.

Rapid Expansion of Commercial Bakeries in Emerging Markets

Asia-Pacific, Latin America, and the Middle East are witnessing rapid growth in commercial bakery capacity driven by urbanization and changing dietary habits. Local manufacturers are increasingly adopting egg replacers to meet halal, vegan, and allergen-free requirements while managing costs. This regional expansion creates opportunities for localized formulations and regional production hubs.

Product Type Insights

Starch-based egg replacers dominate the global egg replacer for baking market, accounting for approximately 38% of total market share in 2025. The segment’s leadership is primarily driven by its cost-effectiveness, wide raw material availability, neutral flavor profile, and dependable binding and structural performance in baked goods. Starch-based solutions are extensively used in high-volume applications such as cookies, biscuits, snack bars, and basic cakes, where consistency and affordability are critical.

Protein-based egg replacers represent the fastest-growing product segment, supported by rising demand for enhanced texture, moisture retention, aeration, and nutritional value in premium and functional baked goods. Proteins derived from soy, pea, wheat, and chickpea are increasingly adopted in cakes, muffins, and specialty bakery products targeting vegan, high-protein, and clean-label consumers.

Form Insights

Powdered egg replacers hold the largest share of the market, contributing nearly 64% of global demand. The dominance of powdered formats is driven by their extended shelf life, ease of transportation, precise dosing capabilities, and compatibility with automated industrial bakery systems. These advantages make powdered egg replacers the preferred choice for large-scale commercial and industrial bakeries.

Liquid egg replacers are primarily utilized in foodservice channels and fresh bakery operations, where immediate usability and minimal preparation time are essential. Although they hold a smaller share, demand remains stable in quick-service restaurants and in-store bakeries.Granular and premix formats are emerging as high-growth form segments, particularly within ready-to-bake mixes, home-baking kits, and specialty bakery applications. Their convenience, formulation consistency, and ability to combine multiple functional ingredients in a single solution are driving adoption.

Application Insights

Cakes and pastries represent the largest application segment, accounting for approximately 34% of the global egg replacer for baking market. Growth in this segment is supported by the increasing popularity of vegan cakes, premium desserts, and specialty formulations requiring precise texture, volume, and moisture control.

Cookies and biscuits follow closely, driven by high-volume industrial production and the strong suitability of starch-based egg replacers for binding and structure. These products benefit from cost stability and formulation simplicity, making egg replacers a practical alternative to shell eggs.Bread, muffins, brownies, and specialty baked goods—including gluten-free, keto, and allergen-free products—are emerging as high-growth applications. Innovation in functional blends that combine starches, proteins, and fibers is expanding the applicability of egg replacers across a wider range of bakery products.

End-Use Insights

Industrial and commercial bakeries dominate end-use demand, accounting for nearly 47% of total market consumption. This segment prioritizes cost stability, scalability, supply chain reliability, and formulation consistency, making egg replacers an attractive alternative amid volatile egg prices.

Food manufacturers producing packaged, frozen, and ready-to-eat bakery products represent a fast-growing end-use segment. Growth is driven by extended shelf-life requirements, export-oriented production, and rising demand for plant-based packaged foods.Artisanal bakeries and household consumers are contributing to incremental market growth, particularly through premium baking trends, home-baking culture, and rising awareness of vegan and allergen-free ingredients.

| By Product Base | By Functionality | By Form | By Application | By Distribution Channel | By End User |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 32% of the global egg replacer for baking market in 2025, with the United States as the primary contributor. Regional growth is driven by high adoption of plant-based diets, a well-established commercial bakery industry, and strong consumer demand for allergen-free and clean-label products. Frequent egg price volatility and advanced food innovation ecosystems further support the adoption of egg replacers across industrial and retail bakery channels.

Europe

Europe holds around 29% market share, led by Germany, the United Kingdom, and France. Growth in the region is supported by stringent food labeling regulations, strong sustainability initiatives, and high consumer awareness of vegan and environmentally friendly food products. The presence of established bakery manufacturers and rising demand for organic and plant-based baked goods continue to fuel market expansion.

Asia-Pacific

Asia-Pacific represents nearly 23% of the global market and is the fastest-growing region, registering a CAGR exceeding 13%. China and India are key growth engines, driven by rapid urbanization, expanding commercial bakery sectors, increasing disposable incomes, and growing demand for egg-free and vegetarian food formulations. Cost efficiency and scalability make egg replacers particularly attractive in this price-sensitive yet high-volume market.

Latin America

Latin America accounts for approximately 9% of global demand, with Brazil and Mexico leading regional consumption. Growth is supported by the expansion of packaged bakery products, increasing modernization of bakery manufacturing, and rising awareness of allergen-free and cost-stable ingredient solutions. Economic volatility and egg price fluctuations further encourage the use of egg replacers.

Middle East & Africa

The Middle East & Africa region holds about 7% market share, with notable growth in the UAE and Saudi Arabia. Key drivers include rising bakery consumption, increasing vegan and flexitarian populations, and strong demand for halal-compliant and shelf-stable ingredients. Expanding foodservice sectors and growing investment in commercial bakery infrastructure are expected to support long-term market growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Egg Replacer for Baking Market

- Ingredion Incorporated

- Cargill, Incorporated

- Archer Daniels Midland (ADM)

- Tate & Lyle PLC

- Corbion N.V.

- Kerry Group

- Puratos Group

- DSM-Firmenich

- IFF (DuPont Nutrition)

- Roquette Frères

- Glanbia PLC

- BENEO GmbH

- Avebe

- Palsgaard

- Axiom Foods