Egg Grading Machine Market Size

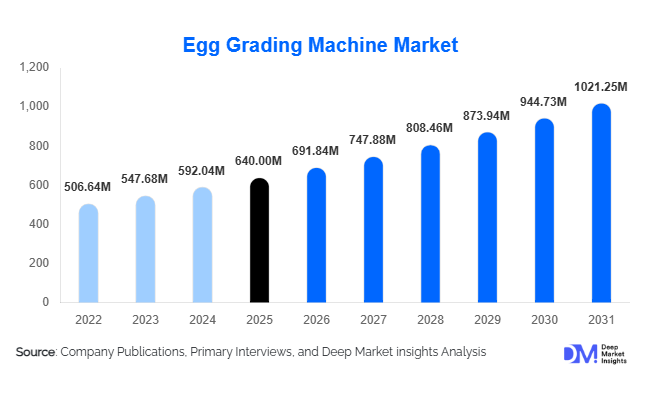

According to Deep Market Insights, the global egg grading machine market size was valued at USD 640 million in 2025 and is projected to grow from USD 691.84 million in 2026 to reach USD 1,021.25 million by 2031, expanding at a CAGR of 8.1% during the forecast period (2026–2031). The egg grading machine market growth is primarily driven by rising global egg consumption, rapid industrialization of poultry farming, increasing automation adoption, and stringent food safety and egg quality regulations across major producing and exporting countries.

Key Market Insights

- Automation-led transformation is reshaping egg grading operations, with fully automated and AI-integrated systems increasingly replacing manual and semi-automated machines.

- High-capacity egg grading machines dominate demand, supported by large-scale commercial layer farms and centralized egg processing plants.

- Asia-Pacific represents the largest market share, driven by China and India’s expanding poultry production base.

- North America remains a mature but technology-driven market, characterized by frequent equipment upgrades and high automation penetration.

- Export-oriented egg processing hubs in Europe and Asia are accelerating the adoption of multi-parameter grading systems.

- Integration of AI, machine vision, and data analytics is becoming a key differentiator among leading manufacturers.

What are the latest trends in the egg grading machine market?

Shift Toward Fully Automated and AI-Enabled Systems

The egg grading machine market is witnessing a strong shift toward fully automated systems equipped with machine vision, AI-based defect detection, and real-time data analytics. These advanced systems can simultaneously assess egg weight, shell integrity, cracks, and internal quality parameters such as blood spots and yolk consistency. Automation reduces labor dependency, minimizes human error, and improves throughput efficiency, making it especially attractive for high-volume egg producers. Leading poultry integrators are increasingly adopting inline grading and packing solutions to streamline operations and ensure consistent quality across large batches.

Rising Adoption of Integrated Grading and Packaging Lines

Another notable trend is the growing preference for inline, fully integrated grading and packaging lines. These systems eliminate intermediate handling, reduce breakage rates, and improve operational efficiency. Integrated solutions are particularly favored by egg processing plants supplying retail chains and export markets, where standardization and traceability are critical. Manufacturers are increasingly offering modular designs that allow producers to scale capacity as demand grows, further driving adoption.

What are the key drivers in the egg grading machine market?

Rising Global Egg Consumption

Eggs remain one of the most affordable and widely consumed sources of animal protein globally. Population growth, urbanization, and changing dietary habits have contributed to steady increases in egg consumption across both developed and emerging economies. This rising demand is compelling poultry producers to expand capacity and improve operational efficiency, directly boosting demand for advanced egg grading machines.

Stringent Food Safety and Quality Regulations

Regulatory frameworks governing egg quality and safety are becoming increasingly strict, particularly in North America, Europe, and parts of Asia. Mandatory grading standards related to egg weight, shell quality, and internal defects require precise and consistent grading processes. Compliance with these regulations is driving poultry producers to invest in technologically advanced grading equipment capable of meeting international standards.

Labor Cost Inflation and Workforce Shortages

Rising labor costs and shortages in the agricultural and food processing sectors are accelerating automation adoption. Egg grading machines significantly reduce reliance on manual labor, offering faster payback periods and long-term cost savings. This driver is particularly strong in developed regions where labor availability and costs remain major operational challenges.

What are the restraints for the global market?

High Initial Capital Investment

Advanced egg grading machines, particularly fully automated and integrated systems, require substantial upfront investment. High-capacity grading lines can cost over USD 1 million, limiting adoption among small and medium-sized poultry farms. This capital intensity remains a key restraint, especially in price-sensitive developing markets.

Technical Skill and Maintenance Challenges

The operation and maintenance of modern egg grading systems require skilled technicians and regular servicing. In regions with limited technical expertise or after-sales support infrastructure, adoption may be slower. Downtime risks and maintenance costs can also deter smaller producers from investing in advanced systems.

What are the key opportunities in the egg grading machine industry?

Automation Penetration in Emerging Markets

Emerging economies in Asia-Pacific, Latin America, and Africa still rely heavily on manual and semi-automated egg grading. As commercial poultry farming expands in countries such as India, Indonesia, Vietnam, Brazil, and Nigeria, there is a significant opportunity for manufacturers to introduce cost-effective, scalable automation solutions tailored to mid-sized producers.

AI-Driven Quality Control and Traceability

Integration of AI, IoT, and data analytics into egg grading machines presents a major growth opportunity. Advanced systems capable of linking egg quality data with traceability platforms and ERP systems are gaining traction, particularly among export-focused producers. These solutions enable premium pricing, improved compliance, and enhanced brand value.

Product Type Insights

Fully automated egg grading machines continue to dominate the global market, accounting for nearly half of total revenue in 2025. These systems are preferred by large commercial farms and egg processing plants due to their high accuracy, speed, and capability to handle multiple grading parameters simultaneously, including weight, shell integrity, cracks, and internal quality assessment. The growing demand for export-standard eggs and stringent regulatory compliance has further reinforced the adoption of fully automated systems. Semi-automated machines continue to serve mid-sized producers, offering a balance between operational efficiency and cost-effectiveness, while manual systems remain primarily limited to small-scale farms and niche producers in developing regions, where investment capacity and technical expertise are more constrained.

Capacity Insights

High-capacity egg grading machines, capable of processing more than 50,000 eggs per hour, represent the leading segment in the market. This dominance is driven by centralized processing facilities, large poultry integrators, and export-oriented egg production, where throughput efficiency and accuracy are critical. Medium-capacity systems cater to regional poultry producers and cooperatives seeking moderate output with cost-effective automation, while low-capacity machines are primarily utilized by smallholders and specialty producers who operate on a smaller scale and require flexible, lower-cost solutions.

End-Use Insights

Egg processing and packaging plants account for the largest share of market demand, driven by the growth of organized retail, private-label egg brands, and increasing export-oriented production. Commercial layer farms also represent a significant segment, particularly in regions with vertically integrated poultry operations where on-site grading enhances operational efficiency. Hatcheries and specialty egg packers are smaller but steadily growing end-use segments, increasingly investing in automated or semi-automated machines to meet rising quality and compliance standards.

| By Product Type | By Capacity | By End-Use Application | By Installation Type | By Distribution Model |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific dominates the global egg grading machine market, accounting for approximately 38% of total revenue in 2025. China leads the region due to its massive egg production capacity and well-established poultry industry, followed by India and Japan. Key drivers include rapid industrialization of poultry farms, government-led modernization initiatives, rising exports of egg and egg products, and increasing adoption of high-capacity, fully automated grading systems to meet international standards. India is the fastest-growing country in the region, driven by expanding commercial layer farms, modernization programs, and rising domestic and export demand for graded eggs. Japan’s focus on technology adoption and quality assurance also contributes to regional growth, especially in high-precision, multi-parameter grading systems.

North America

North America accounts for around 26% of the global market, with the United States as the primary driver. The market is largely replacement-driven, with frequent upgrades to AI-enabled and integrated grading systems in response to stringent food safety regulations and quality standards. Key growth drivers include high automation penetration, labor cost pressures, technological innovation in grading and sorting systems, and demand from large-scale, vertically integrated poultry producers. Canada also contributes through modernization efforts in poultry processing plants, supporting growth in both fully automated and inline integrated grading lines.

Europe

Europe holds approximately 24% of the global egg grading machine market, led by Germany, the Netherlands, and Poland. The region’s growth is driven by strong export orientation, high consumer demand for standardized egg quality, and stringent regulatory frameworks governing egg grading and food safety. Leading European producers are increasingly adopting high-precision, multi-parameter grading systems that enable compliance with EU egg marketing standards and international export requirements. Investment in smart processing lines, AI-enabled inspection systems, and integration with packaging and traceability platforms further drives regional growth.

Latin America

Latin America accounts for around 8% of global demand, with Brazil and Mexico as the major growth markets. Key drivers include expanding poultry production, increasing exports of eggs and egg products, and the gradual modernization of commercial layer farms. Adoption of medium- to high-capacity automated grading systems is increasing as producers seek to improve quality, meet export standards, and reduce labor dependency. Supportive government initiatives and rising private investment in processing infrastructure are further accelerating market growth.

Middle East & Africa

The Middle East & Africa region represents approximately 4% of the global market. Growth in this region is supported by government-led food security initiatives, expanding poultry production, and increasing investments in modern egg processing infrastructure. Countries such as Saudi Arabia, Turkey, and South Africa are adopting high-capacity and semi-automated grading systems to improve efficiency, ensure compliance with international standards, and meet growing domestic and export demand. Rising consumer awareness regarding egg quality and safety is also encouraging broader adoption of automated and inline grading solutions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Egg Grading Machine Market

- Moba Group

- Sanovo Technology Group

- NABEL

- Ovobel Equipment

- Kuhl Corporation

- Big Dutchman

- Facco Poultry Equipment

- Sime-Tek

- Staalkat

- TECNO Poultry Equipment

- Guangzhou Guangxing

- Kyodo International

- Henan Poul Tech

- Jansen Poultry Equipment

- Prinzen (equipment division)