Edible Oil Market Size

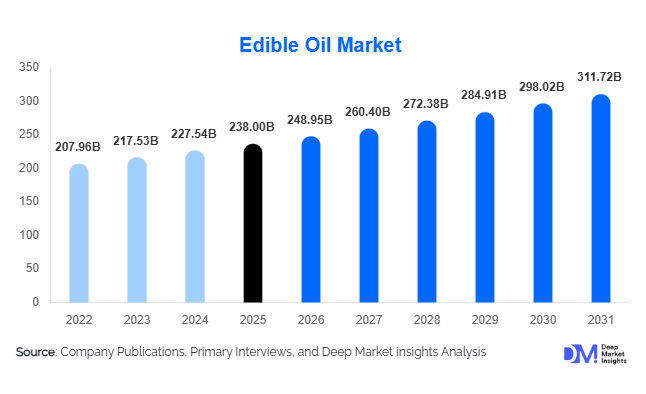

According to Deep Market Insights, the global edible oil market size was valued at USD 238 billion in 2024 and is projected to grow from USD 248.95 billion in 2025 to reach USD 311.72 billion by 2030, expanding at a CAGR of 4.6% during the forecast period (2025–2030). The edible oil market growth is primarily driven by rising global food consumption, increasing demand from food processing industries, population growth in emerging economies, and a gradual shift toward healthier and functional oil variants.

Key Market Insights

- Vegetable oils dominate the global edible oil market, accounting for more than four-fifths of total consumption, led by palm, soybean, and rapeseed oils.

- Asia-Pacific is the largest consuming region, driven by population density, cooking oil dependency, and rapid growth in packaged food consumption.

- Food processing and HoReCa sectors are expanding steadily, increasing demand for bulk and industrial-grade edible oils.

- Health-oriented oils, such as olive, rice bran, and high-oleic sunflower oil, are witnessing above-average growth in developed markets.

- Price volatility of oilseeds remains a critical concern, influencing procurement strategies and profit margins.

- Sustainability and traceability initiatives are becoming central to the palm and soybean oil trade, particularly in Europe and North America.

What are the latest trends in the edible oil market?

Rising Demand for Healthier and Functional Oils

Consumers are increasingly shifting toward oils perceived as healthier, including olive oil, rice bran oil, avocado oil, and flaxseed oil. This trend is driven by rising awareness of cardiovascular health, cholesterol management, and clean-label food products. Manufacturers are responding by launching fortified oils, low-trans-fat blends, and cold-pressed variants. In developed markets, premiumization is evident, with consumers willing to pay higher prices for oils with nutritional benefits and transparent sourcing.

Sustainability and Certified Sourcing Gaining Importance

Sustainability has emerged as a defining trend, particularly for palm and soybean oils. Food manufacturers and retailers are increasingly demanding certified sustainable oils to comply with deforestation-free regulations and ESG commitments. Traceability technologies, supplier audits, and sustainability certifications are being integrated across supply chains, reshaping procurement and trade flows in the global edible oil market.

What are the key drivers in the edible oil market?

Growing Global Food Consumption

Rising population levels and urbanization are increasing per capita consumption of edible oils, particularly in Asia, Africa, and Latin America. Edible oils remain a staple calorie source, supporting consistent baseline demand across income groups. The expansion of packaged and convenience foods is further amplifying oil usage in food manufacturing.

Expansion of Food Processing and Quick-Service Restaurants

The rapid growth of food processing industries and QSR chains is driving bulk demand for edible oils. Oils such as palm and soybean are widely used due to their frying stability, availability, and cost efficiency. This driver is particularly strong in emerging economies where organized foodservice is expanding rapidly.

What are the restraints for the global market?

Raw Material Price Volatility

Fluctuations in oilseed prices caused by climate conditions, geopolitical tensions, and trade disruptions pose a significant challenge. Price instability impacts profit margins for refiners and food manufacturers, often leading to frequent retail price adjustments.

Regulatory and Health Concerns

Increasing regulatory scrutiny on saturated fats and palm oil sustainability is restricting growth in certain regions. Compliance costs related to labeling, sustainability certification, and reformulation are rising, particularly in Europe.

What are the key opportunities in the edible oil industry?

Growth of Premium and Specialty Oils

There is strong growth potential in specialty oils such as olive, avocado, and sesame oil, especially in North America and Europe. Companies focusing on branding, origin labeling, and functional benefits can achieve higher margins and customer loyalty.

Emerging Market Capacity Expansion

Governments in Asia and Africa are promoting domestic oilseed cultivation and refining capacity to reduce import dependence. This creates opportunities for new refining plants, private-label manufacturing, and B2B supply agreements.

Product Type Insights

Vegetable oils continue to dominate the global edible oil market, accounting for approximately 82% of total market value in 2024. This dominance is driven primarily by palm oil, which benefits from high yield per hectare, cost efficiency, and widespread industrial adoption for frying and processed foods. Soybean and rapeseed oils follow, driven by their nutritional profile, versatility, and significant production in North and South America. Animal-based oils, including butter and lard, represent a smaller share of the market and are largely confined to specific regional cuisines and traditional culinary practices. Specialty oils, such as olive, avocado, sesame, and flaxseed oils, are emerging as the fastest-growing product segment globally. This growth is fueled by increasing health consciousness, premiumization in diets, and a rising preference for functional foods with cardiovascular and antioxidant benefits. Consumer awareness of trans-fat reduction and the demand for cold-pressed and extra-virgin oils further amplify the growth of specialty oils.

Application Insights

Household consumption remains the largest application segment, accounting for around 55% of global demand. Growth in this segment is driven by population expansion in emerging economies, rising disposable income, and increasing penetration of packaged cooking oils into urban and semi-urban households. Food processing represents the fastest-growing application segment, propelled by the rising demand for bakery products, snacks, ready-to-eat meals, and confectionery. The HoReCa (Hotels, Restaurants, and Catering) sector continues to contribute significantly to global demand, particularly in urban markets and tourism-driven economies, supported by the growth of QSR chains, hotels, and international cuisine offerings. Nutraceutical and functional food applications are emerging as high-margin niches due to rising consumer focus on health, immunity, and functional nutrition, while animal feed usage remains a smaller yet stable segment, largely driven by by-product utilization.

Distribution Channel Insights

Modern retail channels, including supermarkets, hypermarkets, and organized retail chains, dominate edible oil sales globally, particularly in urban and developed markets. This dominance is driven by consumer preference for branded oils, consistent quality, and promotional activities. Traditional retail channels remain crucial in emerging markets where smaller kirana stores and local shops continue to serve large rural populations. Online channels and direct-to-consumer platforms are rapidly gaining traction, especially for premium and specialty oils, due to convenience, home delivery, and increasing e-commerce penetration. Industrial and B2B distribution channels maintain a substantial share, supplying large-scale food processors, bakeries, and QSR chains, driven by bulk demand and long-term supply contracts.

End-Use Industry Insights

The food processing industry is the fastest-growing end-use segment, expanding at over 5% CAGR, underpinned by rising global consumption of packaged and convenience foods. Growth is particularly strong in bakery, snack foods, and ready-to-eat product categories, where edible oils are essential ingredients. Nutraceutical and functional food applications are expanding as manufacturers incorporate fortified oils to improve nutritional profiles. Although animal feed accounts for a smaller proportion of total demand, its growth remains stable due to the efficient utilization of edible oil by-products, providing a secondary revenue stream for manufacturers.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific dominates the global edible oil market, accounting for approximately 41% of the market in 2024. China and India are the largest consumers, driven by large populations, rising per capita consumption, and high demand for palm, soybean, and mustard oils. India alone contributes around 15% of global demand, heavily reliant on imports of palm and soybean oil due to domestic production shortfalls. The region’s growth is supported by rising urbanization, increasing disposable income, and the expansion of the packaged food and QSR sectors. Additionally, government initiatives to promote local oilseed cultivation and improve refining infrastructure in countries such as Indonesia, Malaysia, and India are further boosting regional market growth.

Europe

Europe accounts for around 18% of the global market share, with strong demand for olive oil, sunflower oil, and other specialty oils. Key countries include Italy, Spain, Germany, and France. Growth in Europe is driven by health-conscious dietary patterns, increasing adoption of Mediterranean diets, and regulatory focus on sustainability and traceable supply chains. Consumers’ preference for premium, cold-pressed, and organic oils, combined with the demand from food processing and HoReCa industries, is contributing to steady expansion. The push for certified sustainable palm oil and reduced saturated fat content in processed foods further accelerates market growth.

North America

North America represents approximately 16% of the global market, led by the United States. The region benefits from a mature food processing industry, strong QSR expansion, and growing consumer preference for canola, avocado, and specialty oils. Rising health awareness, adoption of functional and clean-label products, and innovation in frying-stable oil blends are major drivers. Additionally, government and industry initiatives promoting non-GMO and sustainably sourced oils contribute to steady market growth.

Latin America

Latin America holds roughly 13% of global demand, supported by large soybean oil production in Brazil and Argentina. Growth is driven by rising domestic consumption, increasing packaged food demand, and export-oriented production. The expansion of industrial processing facilities, modern retail penetration, and growing urban populations further support market growth in this region. Brazil’s role as a major global exporter also provides consistent investment and trade-driven growth.

Middle East & Africa

MEA accounts for approximately 12% of global edible oil demand and is the fastest-growing region, with Africa registering a CAGR of over 6%. The region is heavily import-dependent, particularly on palm and soybean oils. Growth drivers include increasing urbanization, rising disposable income, expansion of modern retail, and growing foodservice and HoReCa demand in key markets such as Saudi Arabia, the UAE, and Egypt. Government programs aimed at improving food security, as well as investments in refining capacity in North Africa, are also supporting market expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Edible Oil Market

- Wilmar International

- Cargill

- ADM

- Bunge

- COFCO

- Louis Dreyfus Company

- Sime Darby Plantation

- Golden Agri-Resources

- Marico

- Olam Group

- Conagra Brands

- Fuji Oil Holdings

- J-Oil Mills

- Ebro Foods

- Nestlé (Edible Oils Segment)