Dry Yeast Market Size

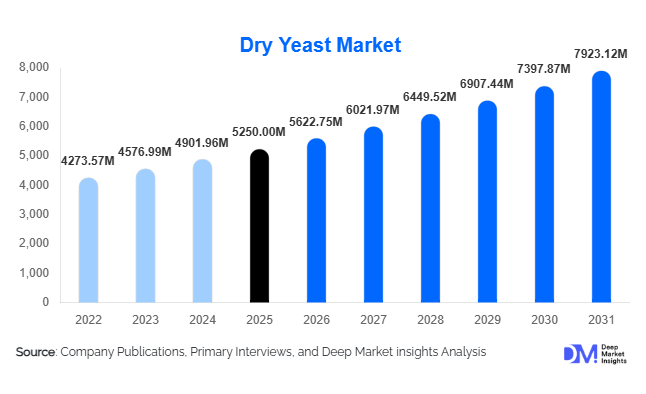

According to Deep Market Insights, the global dry yeast market size was valued at USD 5,250 million in 2025 and is projected to grow from USD 5,622.75 million in 2026 to reach USD 7,923.12 million by 2031, expanding at a CAGR of 7.1% during the forecast period (2026–2031). The dry yeast market growth is primarily driven by the expanding industrial bakery sector, rising consumption of processed and packaged foods, increasing use of yeast-based ingredients in animal nutrition, and growing applications in alcoholic beverages and nutraceuticals.

Key Market Insights

- Instant dry yeast dominates global demand due to its superior shelf stability, rapid activation, and compatibility with automated baking systems.

- Bakery applications account for over half of global consumption, supported by rising bread, bun, and frozen dough production worldwide.

- Asia-Pacific is the fastest-growing region, driven by urbanization, dietary westernization, and large-scale industrial baking expansion.

- Europe remains the largest value contributor due to premium bakery products, craft brewing, and established fermentation infrastructure.

- Animal feed applications are emerging as a high-growth segment, supported by restrictions on antibiotic growth promoters.

- Technological advancements in fermentation and drying are improving yield efficiency, consistency, and sustainability.

What are the latest trends in the dry yeast market?

Shift Toward Value-Added and Functional Yeast Products

The dry yeast market is witnessing a clear transition from commodity-grade yeast toward value-added and function-specific formulations. Manufacturers are increasingly developing yeast strains tailored for specific applications such as frozen dough, high-sugar bakery products, craft beer fermentation, and animal gut health. Inactive dry yeast, particularly nutritional yeast and yeast extracts, is gaining popularity in plant-based foods, savory seasonings, and dietary supplements due to its protein content and natural flavor-enhancing properties. This trend is enabling suppliers to command premium pricing while differentiating their portfolios beyond traditional baking yeast.

Increased Focus on Sustainability and Process Optimization

Sustainability has become a central theme across the dry yeast value chain. Producers are adopting energy-efficient drying technologies, precision fermentation, and circular economy practices such as utilizing agro-industrial by-products as fermentation substrates. These initiatives are reducing production costs, lowering carbon footprints, and aligning operations with global sustainability regulations. Customers, particularly multinational food manufacturers, are increasingly favoring suppliers with strong environmental credentials, accelerating the adoption of low-impact yeast production methods.

What are the key drivers in the dry yeast market?

Expansion of Industrial and Artisanal Bakery Production

The continued expansion of industrial bakeries and organized retail food chains is a major driver for dry yeast demand. Instant and active dry yeast offer consistent fermentation performance, longer shelf life, and ease of storage, making them ideal for large-scale production environments. Growth in frozen bakery products and ready-to-bake dough has further reinforced the preference for dry yeast over fresh yeast across global markets.

Rising Demand from the Alcoholic Beverage and Animal Feed Industries

The growing global beer and wine industries, particularly craft and specialty segments, are driving demand for dry yeast strains that offer precise fermentation control and flavor consistency. In parallel, increasing use of yeast-based additives in animal feed is supporting market growth. Yeast products are increasingly used to enhance gut health, immunity, and feed efficiency, especially as regulatory frameworks restrict antibiotic usage in livestock production.

What are the restraints for the global market?

Volatility in Raw Material Prices

Dry yeast production is highly dependent on sugar- and molasses-based substrates, making manufacturers vulnerable to fluctuations in agricultural commodity prices. Variability in raw material costs can impact production economics and compress margins, particularly for suppliers operating under long-term fixed-price contracts.

High Capital Intensity and Entry Barriers

The dry yeast industry requires significant capital investment in fermentation tanks, drying systems, and quality control infrastructure. These high entry barriers limit new entrants and slow capacity expansion in developing regions, potentially constraining supply in high-growth markets.

What are the key opportunities in the dry yeast industry?

Growth in Nutraceuticals and Functional Foods

Rising health awareness and demand for natural, protein-rich, and functional ingredients present strong opportunities for inactive dry yeast products. Nutritional yeast is increasingly used in vegan foods, immune-support supplements, and sports nutrition, offering manufacturers access to higher-margin segments with strong long-term growth potential.

Emerging Demand in Animal Nutrition and Aquaculture

The shift toward antibiotic-free animal production systems is creating sustained demand for yeast-based feed additives. Poultry, swine, and aquaculture sectors are increasingly adopting dry yeast to improve digestion and disease resistance, opening new revenue streams for yeast producers.

Product Type Insights

Instant dry yeast dominated the global dry yeast market in 2025, accounting for approximately 42% of total revenue. Its leadership is primarily driven by its rapid fermentation performance, extended shelf life, and superior stability across varying temperature and humidity conditions. These attributes make instant dry yeast highly compatible with automated and high-throughput industrial bakery operations, particularly for bread, buns, frozen dough, and ready-to-bake products. The growing penetration of industrial bakeries in emerging economies and the expansion of frozen and packaged bakery products globally continue to reinforce demand for instant dry yeast.

Active dry yeast represents the second-largest product segment, widely utilized in traditional, artisanal, and small-scale bakeries. Its cost-effectiveness, ease of availability, and strong performance in conventional baking methods sustain demand, especially in developing regions and rural markets where automation levels are lower. Meanwhile, inactive dry yeast, including nutritional yeast and yeast extracts, emerges as the fastest-growing product category. Growth in this segment is driven by rising demand for protein-rich, clean-label, and flavor-enhancing ingredients in food processing, dietary supplements, functional foods, and animal feed applications. Increasing adoption in plant-based foods and health-focused products is further accelerating this segment’s expansion.

Application Insights

The bakery application segment continues to dominate the dry yeast market, accounting for nearly 55% of total demand in 2025. This dominance is supported by sustained global consumption of bread, rolls, pastries, and confectionery products, alongside rapid growth in frozen and packaged bakery categories. Urbanization, changing dietary habits, and the expansion of organized retail and quick-service bakery chains are key structural drivers reinforcing yeast demand within this segment.

Alcoholic beverages represent a stable and value-driven application area, supported by consistent demand from the beer, wine, and spirits industries. The rise of craft breweries and premium wine production has increased the need for specialized dry yeast strains that offer fermentation consistency and flavor control. The animal feed segment is the fastest-growing application, expanding at a CAGR exceeding the overall market average. Growth is driven by global restrictions on antibiotic growth promoters, increasing meat consumption, and the rising use of yeast-based additives to improve gut health, immunity, and feed efficiency. Additionally, nutraceutical and functional food applications are emerging as niche but high-margin use cases, benefiting from growing health awareness and demand for natural bioactive ingredients.

Distribution Channel Insights

Industrial and B2B distribution channels account for approximately 68% of total market revenue, reflecting strong and recurring demand from large-scale bakeries, breweries, food processors, and animal feed manufacturers. Long-term supply agreements, consistent quality requirements, and bulk purchasing volumes make B2B channels the preferred route for major end users. Multinational food companies increasingly favor direct procurement models to ensure supply security, cost efficiency, and formulation consistency across global operations.

Retail and consumer-packaged yeast products primarily cater to home bakers, artisanal producers, and small foodservice operators. While this segment represents a smaller share of total revenue, it remains important in mature markets where home baking trends and premium cooking experiences are gaining traction. Growth in e-commerce and direct-to-consumer platforms is also improving accessibility of packaged dry yeast products, supporting incremental demand across urban households.

| By Product Type | By Application | By Distribution Channel | By Form |

|---|---|---|---|

|

|

|

|

Regional Insights

Europe

Europe accounted for approximately 32% of the global dry yeast market share in 2025, making it the largest regional contributor by value. The region’s dominance is driven by strong bakery traditions, high per-capita bread consumption, and widespread use of premium fermented foods. France, Germany, and the U.K. lead demand due to their well-established industrial baking and brewing industries. Additionally, Europe’s thriving craft beer segment and growing demand for clean-label and organic bakery products support higher-value yeast applications. Advanced fermentation technologies, stringent quality standards, and sustainability-focused manufacturing further reinforce Europe’s leadership in the dry yeast market.

North America

North America represented around 26% of global dry yeast demand in 2025, driven primarily by the United States. Key growth drivers include large-scale industrial bakery operations, strong demand for frozen and packaged bakery products, and a well-developed alcoholic beverage industry, particularly craft beer. Rising adoption of yeast-based feed additives in poultry and livestock nutrition, supported by antibiotic-reduction initiatives, is also contributing to regional growth. High technological adoption and consistent investment in fermentation innovation continue to support stable demand across the region.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, expanding at a CAGR exceeding 8%. Growth is fueled by rapid urbanization, rising disposable incomes, and increasing consumption of packaged and western-style foods. China and India dominate volume growth, supported by expanding industrial bakery capacity and growing food processing industries. Increasing investments in domestic fermentation infrastructure, coupled with population growth and rising demand for affordable protein sources, are accelerating yeast consumption across food, beverage, and animal feed applications. Southeast Asian markets are also contributing to growth through rising bakery penetration and expanding export-oriented food manufacturing.

Latin America

Latin America exhibits steady growth, led by Brazil and Mexico. Expanding bakery production, growing consumption of bread and confectionery products, and rising meat production are key drivers of yeast demand in the region. Increasing industrialization of food processing and the gradual adoption of yeast-based feed additives in livestock nutrition are further supporting market expansion. While price sensitivity remains a factor, rising urban populations and improving cold-chain and food distribution infrastructure are strengthening long-term demand fundamentals.

Middle East & Africa

The Middle East & Africa region is witnessing gradual but sustained growth in the dry yeast market. Rising bread consumption, driven by population growth and dietary staples, remains a key demand driver. Countries such as Saudi Arabia, South Africa, and Egypt are investing in domestic food processing capacity, supporting increased industrial yeast usage. The region also relies heavily on dry yeast imports due to limited local fermentation capacity, creating stable demand for international suppliers. Growth in organized retail, government-led food security initiatives, and expanding livestock production are expected to further support yeast consumption across the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Dry Yeast Market

- Lesaffre

- AB Mauri

- Angel Yeast

- Lallemand

- Kerry Group

- DSM-Firmenich

- Chr. Hansen

- Ohly

- Leiber

- Biorigin