Dried Herbs Market Size

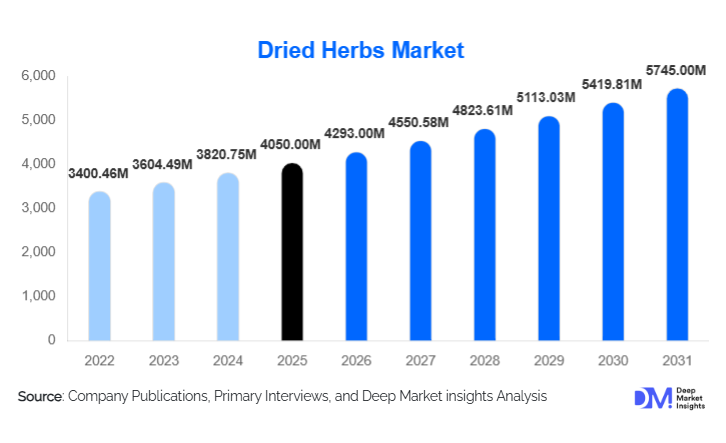

According to Deep Market Insights, the global dried herbs market size was valued at USD 4,050 million in 2025 and is projected to grow from USD 4,293 million in 2026 to reach USD 5,745 million by 2031, expanding at a CAGR of 6.0% during the forecast period (2026–2031). The dried herbs market growth is primarily driven by increasing consumer preference for natural and organic ingredients, rising demand from processed foods and nutraceutical sectors, and technological advancements in drying and preservation methods.

Key Market Insights

- Rising health consciousness and clean-label trends are fueling demand for dried herbs as natural flavoring and functional ingredients across food, beverage, and nutraceutical products.

- Technological innovations in drying and packaging, including vacuum and freeze-drying, are improving product quality, shelf life, and export potential.

- North America dominates the market, with the U.S. and Canada leading in consumption due to high health awareness and well-developed retail channels.

- Asia-Pacific is the fastest-growing region, driven by rising middle-class income, urbanization, and increasing export opportunities from India and China.

- Europe maintains a strong demand for organic and premium herbs, particularly in countries like Germany, Italy, and France, where culinary traditions heavily rely on herbs.

- Online and direct-to-consumer channels are transforming distribution, enabling producers to reach global consumers with specialty and organic herb products.

What are the latest trends in the dried herbs market?

Shift Toward Organic and Clean-Label Herbs

Consumers are increasingly seeking herbs that are organically sourced, additive-free, and sustainably grown. Retailers and food processors are responding with organic-certified dried herbs, which command premium pricing. Clean-label initiatives are also driving product innovation in nutraceuticals and functional foods, where herbs serve as natural preservatives, antioxidants, and flavor enhancers. Traceability and certification have become key differentiators, particularly in North America and Europe.

Advanced Drying and Preservation Technologies

Emerging methods such as vacuum drying, freeze-drying, and microwave-assisted drying are enhancing the quality of dried herbs by preserving essential oils, aroma, and bioactive compounds. These technologies allow producers to offer premium products for high-value markets, including herbal supplements, cosmetic applications, and export-oriented culinary uses. Improved drying efficiency also reduces waste and increases production scalability.

What are the key drivers in the dried herbs market?

Growing Demand for Health-Oriented Foods

Increasing consumer awareness about the health benefits of natural ingredients is propelling demand for dried herbs. Products like basil, oregano, rosemary, and thyme are used not only as flavor enhancers but also as functional ingredients in foods, beverages, and dietary supplements. The global trend toward plant-based and wellness-focused products further accelerates market growth.

Expansion of Processed and Convenience Foods

With the proliferation of ready-to-eat meals, packaged snacks, and global fusion cuisines, dried herbs are increasingly incorporated into industrial formulations. Their stability, concentrated flavors, and extended shelf life make them ideal for large-scale food production, contributing significantly to market demand.

Rising Online Retail and Direct-to-Consumer Channels

The growth of e-commerce has enabled herb producers to reach consumers directly, including premium and specialty segments. Digital platforms allow for subscription-based herb boxes, personalized blends, and transparent sourcing information, enhancing brand loyalty and repeat purchase behavior.

What are the restraints for the global market?

Raw Material Price Volatility

Herb cultivation is highly dependent on weather conditions, seasonality, and crop yields. Price fluctuations can impact production costs, particularly in import-dependent markets. Freight and logistics challenges further exacerbate cost instability, affecting both profitability and supply reliability.

Quality Control and Adulteration Concerns

Dried herbs are susceptible to contamination or adulteration, which can compromise flavor, safety, and consumer trust. Strict compliance with quality standards and certifications is essential, increasing operational complexity and costs, especially for small and medium-sized producers.

What are the key opportunities in the dried herbs industry?

Organic and Specialty Herb Production

There is a growing opportunity for producers to expand into certified organic and premium herbs, which are in high demand among health-conscious consumers and specialty food manufacturers. Investments in traceable, sustainable farming practices enable differentiation and higher profit margins.

Export Expansion from Asia-Pacific

Countries like India and China are strategically positioned to supply global demand due to favorable climate, labor costs, and established horticultural infrastructure. Export-oriented growth, supported by government initiatives and modern processing technologies, presents opportunities for international market penetration.

Technological Integration and Product Innovation

Advanced drying, processing, and packaging technologies allow companies to develop high-value herbal extracts, blends, and ready-to-use powders. These innovations cater to nutraceuticals, cosmetics, and functional food sectors, creating diversified revenue streams and increasing global competitiveness.

Product Type Insights

Basil dominates the product type segment, holding approximately 23% of the global dried herbs market in 2024. Its versatility in culinary applications, along with antioxidant and antimicrobial properties, drives demand across food, beverage, and nutraceutical industries. Other leading herbs include oregano, rosemary, thyme, and mint, all contributing to a broad portfolio of global usage.

Application Insights

Food and beverages remain the largest application segment, accounting for around 42% of the market. Processed foods, snacks, sauces, and ready meals are key drivers. Nutraceuticals and dietary supplements are the fastest-growing applications, leveraging the functional benefits of herbs. Additional applications include herbal teas, personal care, cosmetics, aromatherapy, and animal feed additives, highlighting the diverse market potential.

Distribution Channel Insights

Retail stores, including supermarkets, specialty stores, and organic outlets, account for approximately 50% of global sales, supported by strong consumer trust and accessibility. Online and direct-to-consumer channels are rapidly expanding, enabling producers to offer personalized blends and premium organic products directly to global consumers. HoReCa and B2B channels continue to provide stable demand from industrial food processors and hospitality sectors.

| By Product Type | By Form | By Drying Method | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the dried herbs market, holding 30–35% of the global share. High health awareness, strong retail penetration, and demand for organic products drive growth. The U.S. dominates regional consumption, while Canada is witnessing rising demand for organic and premium herbs. The market benefits from established supply chains and high disposable incomes.

Europe

Europe accounts for approximately 25–30% of the market. Western European countries like Germany, Italy, and France dominate demand due to culinary reliance on herbs and preference for organic products. Eastern Europe is emerging, supported by urbanization and growing processed food consumption.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with a CAGR of 6–7%. Rising urbanization, middle-class income growth, and increasing processed food consumption are key drivers. India and China serve as both major producers and exporters, fueling domestic and global demand. Southeast Asia shows strong growth potential due to traditional herb usage and wellness trends.

Latin America

Latin America holds 8–10% of the market, with Brazil, Argentina, and Mexico driving consumption. Export-oriented herb production contributes to regional demand, complemented by growing processed food adoption.

Middle East & Africa

The Middle East & Africa account for 5–7% of the market. Gulf countries import significant volumes to meet demand for processed foods and culinary use. Local production in North Africa supports domestic culinary consumption, while tourism and hospitality industries further contribute to regional demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Dried Herbs Market

- McCormick & Company

- Olam International

- Döhler GmbH

- Frontier Co-op

- Starwest Botanicals

- Pacific Botanicals

- Euroma Group

- The Fuchs Group

- Organic Herb Inc.

- Husarich GmbH

- U.S. Spice Mills

- Badia Spices

- Spice Islands

- Simply Organic

- Mountain Rose Herbs