DIY Home Improvement Market Size

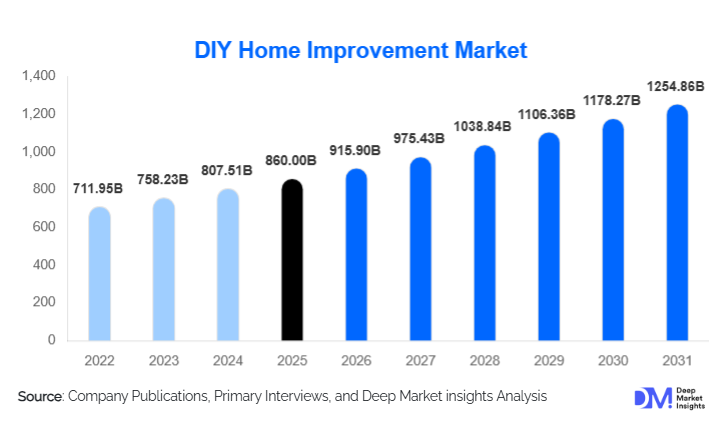

According to Deep Market Insights, the global DIY home improvement market size was valued at USD 860.00 billion in 2024 and is projected to grow from USD 915.90 billion in 2025 to reach USD 1,254.86 billion by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The DIY home improvement market growth is primarily driven by rising homeownership, increasing renovation and remodeling activities, higher labor costs for professional services, and the widespread availability of easy-to-install products supported by digital guidance and e-commerce platforms.

Key Market Insights

- DIY renovation and remodeling projects dominate global demand, as homeowners prioritize cost-effective upgrades over relocation.

- Mid-range DIY products lead consumer spending, offering a balance between affordability, durability, and brand reliability.

- North America remains the largest market, supported by an aging housing stock, high disposable income, and a strong DIY culture.

- Asia-Pacific is the fastest-growing region, driven by urban housing expansion, rising middle-class income, and digital retail adoption.

- Online and omnichannel distribution is reshaping purchasing behavior, with consumers increasingly researching, comparing, and buying DIY products online.

- Sustainability and energy efficiency are becoming core purchasing criteria, influencing demand for insulation, low-VOC paints, and water-efficient fixtures.

What are the latest trends in the DIY home improvement market?

Smart and Technology-Enabled DIY Solutions

The DIY home improvement market is witnessing rapid adoption of smart and connected solutions. Products such as smart lighting, app-enabled power tools, automated climate control systems, and modular electrical components are gaining traction due to their ease of installation and enhanced functionality. Manufacturers are increasingly integrating IoT and AI features into tools and fixtures, allowing users to monitor usage, improve accuracy, and reduce project time. Augmented reality-based visualization tools and mobile applications are also transforming project planning by enabling consumers to preview layouts, colors, and finishes before purchase, significantly improving decision confidence.

Sustainability-Focused Home Improvement

Environmental consciousness is shaping product innovation across the DIY landscape. Demand for energy-efficient insulation materials, recycled flooring, eco-certified wood products, and low-emission paints is rising sharply. Governments across North America and Europe are reinforcing this trend through incentives and rebates for residential energy upgrades. DIY brands are responding by expanding green product portfolios, improving transparency around material sourcing, and aligning with sustainability certifications, making eco-friendly renovation both accessible and economically attractive to homeowners.

What are the key drivers in the DIY home improvement market?

Rising Cost of Professional Labor

Escalating labor costs and shortages of skilled tradespeople are encouraging homeowners to undertake DIY projects. Tasks such as painting, flooring installation, cabinetry assembly, and minor plumbing repairs are increasingly performed without professional assistance, directly boosting DIY product demand. The availability of simplified tools and step-by-step digital tutorials has further accelerated this shift toward self-execution.

Aging Housing Stock and Renovation Cycles

A significant proportion of residential buildings in North America and Europe are over three decades old, requiring continuous maintenance, repair, and modernization. Rather than relocating, homeowners are opting for incremental DIY upgrades to enhance comfort, energy efficiency, and property value. This structural trend ensures sustained long-term demand for DIY materials, tools, and fixtures.

What are the restraints for the global market?

Raw Material Price Volatility

Fluctuations in prices of lumber, metals, resins, and chemicals pose challenges for manufacturers and retailers. Volatile input costs can compress margins and result in price increases that discourage discretionary spending, particularly during periods of high inflation or economic uncertainty.

Regulatory and Safety Limitations

Strict building codes and safety regulations, especially in electrical and plumbing work, limit the scope of DIY adoption. In many regions, compliance requirements restrict homeowners from performing certain tasks independently, redirecting demand toward professional services and slowing market penetration in complex renovation categories.

What are the key opportunities in the DIY home improvement industry?

Energy-Efficient and Green Renovation Solutions

The global push toward carbon reduction and energy efficiency presents significant opportunities for DIY product manufacturers. Homeowners are increasingly investing in insulation upgrades, smart thermostats, water-saving fixtures, and solar-ready installations. Companies offering easy-to-install, regulation-compliant energy solutions can capture premium pricing and benefit from government-backed incentive programs.

Emerging Market Expansion and Localization

Rapid urbanization and housing development in Asia-Pacific, Latin America, and the Middle East are creating first-time DIY consumers. Localization of product sizes, pricing tiers, and instructional content tailored to regional construction styles represents a major growth lever. Digital marketplaces further enable cross-border expansion without heavy physical retail investments.

Product Type Insights

Building materials represent the largest product category, accounting for approximately 34% of the global DIY home improvement market in 2024. Key products, including paints, flooring materials, insulation, and wall panels, dominate demand due to frequent replacement cycles, ease of application, and growing interest in energy-efficient and sustainable home upgrades. The driver for this segment’s leadership is the combination of functional necessity and aesthetic appeal, as homeowners seek both improved performance and enhanced home aesthetics. Hardware and tools follow closely, fueled by strong demand for power tools, fasteners, and safety equipment, particularly from urban DIY enthusiasts seeking time-efficient solutions. Decor and interior fixtures, including lighting, cabinetry, and storage solutions, are gaining traction as aesthetic personalization becomes a priority, further supported by the proliferation of digital design tools and home improvement content platforms.

Project Type Insights

Renovation and remodeling projects lead the market with nearly 38% share, driven by high-value activities such as kitchen and bathroom upgrades, flooring replacement, and interior redesign. The key growth driver for this segment is homeowners’ desire to enhance property value while avoiding relocation costs, coupled with increased availability of easy-to-use DIY kits and step-by-step digital guidance. Repair and maintenance projects form a stable recurring demand base, supporting consistent market volumes, while energy-efficiency upgrades are the fastest-growing project type, reflecting rising consumer awareness around sustainability, government rebates for green home improvements, and growing adoption of energy-efficient insulation, plumbing, and electrical products.

Distribution Channel Insights

Home improvement specialty stores dominate distribution, accounting for roughly 44% of market sales, benefiting from in-store expert assistance, curated product selections, private-label options, and bundled project solutions. Online and e-commerce channels are the fastest-growing segment, driven by the convenience of home delivery, price transparency, wider product selection, and enhanced comparison tools. Direct-to-consumer (D2C) brand platforms are gaining traction through digital marketing, personalized product recommendations, and augmented reality planning tools, further empowering homeowners to execute complex DIY projects with confidence.

End-Use Insights

Owner-occupied residential homes account for approximately 72% of total DIY demand, driven by long-term cost savings, personalization needs, and emotional investment in property upkeep. Rental property owners are a growing segment, as landlords increasingly adopt DIY solutions to reduce maintenance costs and accelerate property turnaround. Small commercial spaces, including cafés, boutique retail outlets, and co-working facilities, are emerging secondary users, particularly for lighting, interior fixtures, and modular workspace upgrades, reflecting the growing trend of low-cost, self-managed commercial renovations.

| By Product Type | By Project Type | By Distribution Channel | By End-Use | By Price Tier |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global DIY home improvement market with approximately 38% share in 2024, with the United States alone contributing nearly 30% of global demand. Market growth is driven by high disposable incomes, a strong DIY culture, and widespread retail penetration. Key drivers include the aging housing stock requiring frequent renovation, high labor costs for professional services encouraging self-execution, and widespread adoption of digital DIY tutorials and smart tools. Government incentives for energy-efficient home improvements further support product adoption, particularly in insulation, plumbing, and energy-efficient lighting solutions.

Europe

Europe accounts for around 26% of the global market, led by Germany, the U.K., and France. The region’s growth is fueled by sustainability-conscious consumers, stringent building regulations encouraging energy-efficient renovations, and established home improvement retail networks. Renovation and remodeling remain the primary drivers, as homeowners aim to enhance property value while aligning with environmental standards. High awareness of eco-friendly materials, smart home integration, and digital DIY guidance also supports continued market expansion, particularly in mid-range and premium product segments.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at over 7% CAGR. China and India are the primary engines of growth due to rapid urban housing development, rising middle-class income, and expanding digital retail ecosystems. Drivers include increasing homeownership rates, adoption of online DIY platforms, and growing interest in energy-efficient and smart home solutions. The proliferation of affordable, locally manufactured DIY tools and materials, combined with rising awareness of sustainable home improvements, is accelerating market penetration across residential and small commercial end-use segments.

Latin America

Latin America holds approximately 6% market share, with Brazil and Mexico leading demand. Growth is driven by urban housing expansion, rising middle-class income, and gradual adoption of DIY practices. Renovation and repair projects dominate, supported by affordability considerations and a growing focus on interior aesthetics. Online distribution platforms are increasingly contributing to regional growth by improving accessibility to tools and materials that were previously limited to urban centers.

Middle East & Africa

The Middle East and Africa represent nearly 4% of global demand, with the UAE and Saudi Arabia as leading contributors. Market expansion is supported by housing investments, rising disposable incomes, and the adoption of modern, modular construction techniques. Renovation and aesthetic improvements in residential and small commercial properties are key drivers, along with government initiatives promoting urban development and energy-efficient construction practices. Growing intra-regional DIY knowledge sharing and e-commerce penetration are further accelerating the adoption of home improvement products in this region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the DIY Home Improvement Market

- Home Depot

- Lowe’s Companies

- Kingfisher plc

- Adeo Group

- Ace Hardware

- Stanley Black & Decker

- Bosch

- Makita

- Sherwin-Williams

- PPG Industries

- 3M

- Masco Corporation

- Illinois Tool Works

- Techtronic Industries (TTI)

- Husqvarna Group