Digital Watch Market Size

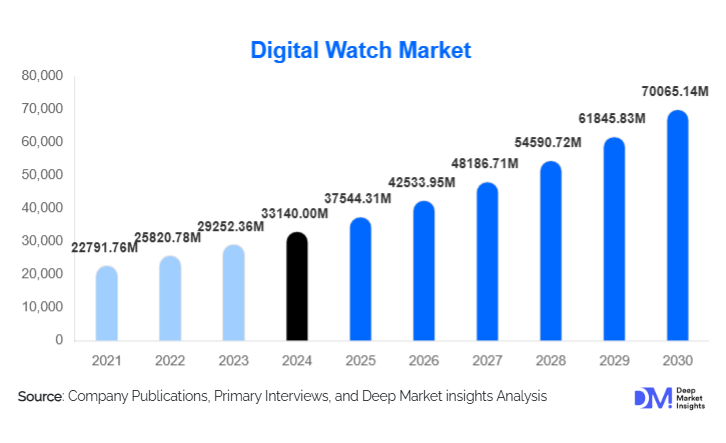

According to Deep Market Insights, the global digital watch market size was valued at USD 33,140.00 million in 2024 and is projected to grow from USD 37,544.31 million in 2025 to reach USD 70,065.14 million by 2030, expanding at a CAGR of 13.29% during the forecast period (2025–2030). The digital watch market growth is primarily driven by the rapid adoption of smartwatches, the rising demand for health-monitoring features, the expansion of e-commerce channels, and the increasing affordability of digital and hybrid watches in emerging markets.

Key Market Insights

- Smartwatches dominate the global digital watch landscape, accounting for over 60–65% of total revenue in 2024 due to strong consumer preference for multifunctional wearable devices.

- Asia-Pacific leads global demand, driven by booming sales in China, India, and Southeast Asia, where disposable incomes and smartphone penetration are rising rapidly.

- Health and fitness tracking features are the top purchase drivers, with sensors such as heart rate, SPO₂, and sleep monitoring becoming standard even in mid-range models.

- Online sales channels are expanding rapidly, now contributing 35–40% of all digital watch purchases globally due to increasing adoption of D2C and marketplace platforms.

- Premium digital and hybrid watches are gaining traction as consumers seek fashionable, tech-integrated wristwear supported by luxury brands entering the digital segment.

- Manufacturing hubs in China and India lead global production, supplying both branded and ODM/OEM watches to international markets.

What are the latest trends in the digital watch market?

Health-Centric Smartwatch Ecosystems Expanding

Digital watches are transitioning from timekeeping devices to sophisticated health-monitoring ecosystems. Brands are integrating advanced biometric sensors, ECG monitoring, stress tracking, and AI-driven wellness insights into compact wearable form factors. These innovations are accelerating medical-grade watches and enabling remote health monitoring, supporting telemedicine growth. Partnerships between smartwatch makers, healthcare providers, and fitness platforms are reshaping how consumers engage with wellness. This shift has also driven demand for affordable health-enabled watches in emerging nations, broadening global adoption.

AI, IoT, and Seamless Connectivity Driving Next-Gen Wearables

AI-driven recommendations, voice assistants, and IoT connectivity are becoming core to digital watch evolution. Smartwatches now integrate seamlessly with smartphones, smart homes, vehicles, and fitness ecosystems. IoT-enabled watches facilitate contactless payments, GPS navigation, emergency alerts, and personalized notifications. Manufacturers are also deploying edge AI to improve battery performance and on-device data processing. These advancements appeal particularly to younger, tech-savvy demographics who expect multipurpose, connected wearable experiences.

What are the key drivers in the digital watch market?

Growing Global Health & Fitness Awareness

Rising awareness of lifestyle diseases, coupled with the desire for real-time health insights, has positioned digital watches with wellness features as essential accessories. The integration of heart-rate monitoring, SPO₂, sleep analysis, and fitness tracking is a significant catalyst behind market expansion. Consumers increasingly rely on wearables to monitor daily activity and improve health outcomes, particularly post-pandemic.

Technological Advancements and Ecosystem Integration

Advances in sensors, display technology, LTE connectivity, and mobile ecosystem integration have elevated the functional value of digital watches. Devices now support calls, messages, NFC payments, streaming controls, and AI-assisted productivity. These innovations significantly enhance user experience and drive replacement demand, contributing meaningfully to market growth.

What are the restraints for the global market?

Market Saturation and Smartphone Cannibalization

In mature markets, many consumers rely on smartphones for fitness, communication, and productivity tasks, reducing perceived need for a smartwatch. This limits first-time adoption among non-tech-focused users and intensifies competition within the wearable ecosystem. Additionally, rapid technology turnover discourages long-term retention for premium models.

Affordability Barriers in Emerging Markets

Although low-cost digital watches are widely available, advanced smartwatches remain expensive for lower-income consumers. Price sensitivity continues to restrict premium segment penetration in regions such as South Asia, Africa, and Latin America. High component costs further challenge manufacturers, making it difficult to offer advanced features at budget-friendly prices.

What are the key opportunities in the digital watch industry?

Expansion of Affordable Smart Health Devices

There is a significant opportunity for brands to introduce low- and mid-tier digital watches with medical-grade biometric features. The growing demand for remote health monitoring and preventive healthcare will accelerate the adoption of price-optimized, high-functionality wearables.

Emerging Market Penetration and Localization Strategies

Asia-Pacific, Latin America, and the Middle East & Africa offer vast untapped potential. Localized features, vernacular app integration, EMI-driven affordability models, and regional assembly create major growth avenues for new entrants. These markets will be key drivers of volume expansion across the forecast period.

Product Type Insights

Smartwatches dominate the market, contributing nearly 60–65% of global revenue due to their multifunctionality and integration with smartphone ecosystems. Basic digital watches remain relevant in the low-cost segment, especially among students and cost-conscious consumers. Sports and fitness watches show strong adoption among athletes and outdoor enthusiasts, while hybrid watches are increasingly popular for users seeking a combination of classic design and digital functionality.

Application Insights

Digital watches are primarily used for health and fitness monitoring, which remains the fastest-growing application area globally. Lifestyle and productivity applications, such as notifications, scheduling, and contactless payments, are also expanding rapidly. Outdoor and sports applications continue to drive demand for rugged, GPS-enabled digital watches. Enterprise and healthcare usage is emerging as a new growth frontier, particularly for remote monitoring and employee wellness programs.

Distribution Channel Insights

Online distribution channels dominate the market, accounting for nearly 35–40% of global sales due to the rise of e-commerce, D2C models, and digital-first product launches. Offline retail, including electronics stores, brand outlets, and hypermarkets, remains significant for premium and mid-tier products, where a physical try-before-buy experience is valued. Influencer-driven marketing and social commerce are becoming powerful tools for digital watch brands, particularly in Asia.

End-User Insights

Men represent the largest end-user segment, contributing 40–45% of total demand in 2024 due to higher adoption of smart and sports watches. Women’s demand is rising rapidly, driven by fashion-centric designs and compact form factors. Unisex watches are gaining popularity, especially in the budget and mid-range categories, where users prioritize functionality over styling.

| By Product Type | By Price Category | By End User | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for 25–30% of the global market share. The region exhibits a strong preference for premium smartwatches due to high disposable incomes, early technology adoption, and robust distribution ecosystems. The U.S. remains the largest single-country market, driven by healthcare-focused wearable usage and integration with iOS and Android ecosystems.

Europe

Europe represents 20–25% of market share and shows strong demand for hybrid watches and premium smartwatches. Germany, France, and the U.K. are key contributors. Sustainability trends are influencing material choices, with the rising adoption of eco-friendly straps and repairable components.

Asia-Pacific

Asia-Pacific leads the market with a 30–35% share and is the fastest-growing region. China and India are high-volume markets due to competitive pricing, strong local manufacturing, and growing health awareness. Japan and South Korea drive demand for premium and technologically advanced digital watches.

Latin America

Latin America holds approximately a 5–7% share. Brazil and Mexico are key markets for affordable digital and hybrid watches, though macroeconomic volatility affects premium-category adoption. Growing online retail infrastructure is unlocking new opportunities for smartwatch penetration.

Middle East & Africa

MEA accounts for 5–8% of global demand. The UAE and Saudi Arabia show rising interest in luxury smartwatches and designer hybrids. Africa’s adoption is driven by low-cost digital watches, supported by increasing smartphone penetration and online retail expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Digital Watch Market

- Apple

- Samsung

- Huawei

- Xiaomi

- Garmin

- Fitbit

- Fossil

- Sony

- Polar

- ASUS

- Michael Kors

- TomTom

- Motorola

- OnePlus

Recent Developments

- In 2025, Apple expanded its health ecosystem with enhanced AI-powered monitoring features, strengthening its leadership in the smartwatch category.

- In 2025, Xiaomi announced new budget smartwatches with upgraded sensors targeted at emerging markets such as India and Indonesia.

- In 2025, Garmin introduced advanced multisport watches with extended battery life aimed at athletes and outdoor professionals.