Digestive Health Market Size

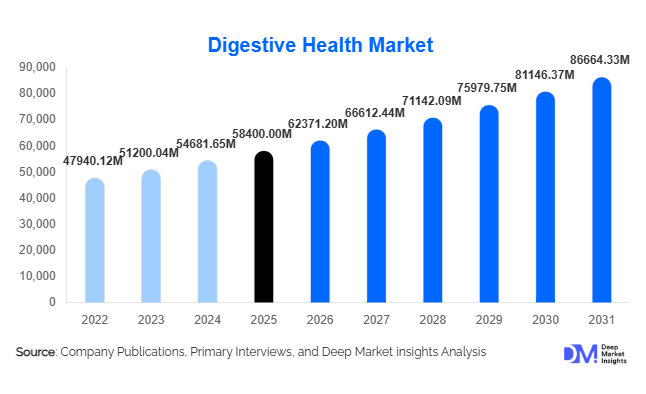

According to Deep Market Insights, the global digestive health market size was valued at USD 58,400 million in 2025 and is projected to grow from USD 62,371.20 million in 2026 to reach USD 86,664.33 million by 2031, expanding at a CAGR of 6.8% during the forecast period (2026–2031). The digestive health market growth is primarily driven by increasing awareness of gut microbiome health, rising prevalence of gastrointestinal disorders, and expanding adoption of preventive healthcare solutions worldwide. Growing consumer demand for probiotics, prebiotics, digestive enzymes, and fiber-based supplements across the nutraceutical, pharmaceutical, and functional food industries continues to fuel revenue expansion. In addition, innovation in clinically validated strains, clean-label formulations, and personalized gut-health solutions is reshaping competitive dynamics across global markets.

Key Market Insights

- Probiotics dominate the global market, accounting for nearly 42% of total revenue in 2025 due to strong clinical backing and consumer trust.

- Capsules and tablets remain the leading dosage form, contributing approximately 48% of total sales because of convenience and longer shelf life.

- North America leads the global market, holding about 34% market share in 2025, supported by high supplement consumption and advanced retail infrastructure.

- Asia-Pacific is the fastest-growing region, expanding at over 8% CAGR due to rising middle-class income and increasing awareness of gut health.

- Online retail and DTC channels are rapidly expanding, driven by subscription models and personalized nutrition offerings.

- Functional food and beverage integration is emerging as a major growth engine, particularly in dairy alternatives and fortified drinks.

What are the latest trends in the digestive health market?

Personalized Microbiome-Based Nutrition

Personalized digestive health solutions are gaining strong traction globally. Advances in microbiome sequencing and AI-driven nutritional recommendations are enabling companies to offer customized probiotic and synbiotic formulations tailored to individual gut profiles. Subscription-based models are expanding, where consumers receive ongoing gut-health assessments and personalized supplement packs. This trend is particularly prominent in North America, Japan, and South Korea, where consumers are willing to pay premium prices for scientifically validated, individualized wellness solutions. Companies are also investing heavily in next-generation strains targeting specific conditions such as IBS, lactose intolerance, and immune modulation. As a result, personalization is becoming a key differentiator in an otherwise competitive and moderately consolidated market.

Expansion of Digestive Health in Functional Foods

Digestive health ingredients are increasingly incorporated into everyday food and beverage products, including yogurt alternatives, kombucha, fortified cereals, plant-based beverages, and snack bars. Consumers are shifting toward “food as medicine” concepts, preferring natural sources of gut-support ingredients rather than standalone pills. Clean-label positioning and plant-based formulations are strengthening consumer appeal. Food manufacturers are partnering with probiotic strain developers to ensure shelf stability and regulatory compliance, further accelerating integration into mainstream consumption channels.

What are the key drivers in the digestive health market?

Rising Prevalence of Gastrointestinal Disorders

Increasing cases of irritable bowel syndrome (IBS), inflammatory bowel disease (IBD), acid reflux, constipation, and lactose intolerance are major growth drivers. Urbanization, dietary transitions toward processed foods, and sedentary lifestyles have significantly increased digestive complications globally. This has directly expanded demand for OTC digestive supplements and clinically tested probiotics, particularly in developed economies.

Growing Preventive Healthcare Awareness

Consumers are increasingly prioritizing preventive health rather than reactive treatment. The growing understanding of the gut-brain axis and the microbiome’s role in immunity has strengthened the link between digestive health and overall wellness. Post-pandemic immunity awareness has further boosted probiotic and synbiotic adoption across age groups. Governments and healthcare institutions are also promoting nutritional supplementation, indirectly supporting market expansion.

What are the restraints for the global market?

Regulatory Complexity Across Regions

Digestive health products face varying regulations across North America, Europe, and the Asia-Pacific regarding health claims, labeling, and strain approval. Differences in EFSA, FDA, and regional regulatory standards increase compliance costs and delay product launches, particularly for multinational companies.

Price Sensitivity in Emerging Markets

Premium probiotic formulations remain relatively expensive for mass adoption in developing countries. Limited reimbursement policies and lower awareness levels in rural markets further restrict penetration, particularly for advanced synbiotic or clinically specialized products.

What are the key opportunities in the digestive health industry?

Emerging Market Expansion

Rapid urbanization and dietary shifts in India, China, Brazil, and Indonesia present substantial growth opportunities. Governments in these countries are increasingly promoting preventive healthcare and domestic nutraceutical manufacturing, creating favorable regulatory and manufacturing environments. Affordable, localized probiotic formulations tailored to regional diets can unlock significant untapped demand.

Integration with Animal Nutrition and Antibiotic Replacement

The growing push to reduce antibiotic usage in livestock production is creating new demand for probiotic-based feed additives. Digestive health solutions in animal nutrition are gaining traction in North America, Europe, and China. This segment offers strong volume growth potential and long-term institutional demand from commercial farming operations.

Product Type Insights

Probiotics remain the leading product segment, accounting for approximately 42% of total market revenue in 2025, making them the single largest contributor to global digestive health sales. The dominance of probiotics is primarily driven by strong clinical validation, growing scientific consensus around the gut microbiome’s role in immunity and mental health, and high consumer awareness across developed economies. Multi-strain probiotic formulations are gaining preference due to broader functional claims covering immunity, digestive regularity, and nutrient absorption. Additionally, advancements in strain stabilization technologies and delayed-release capsules have improved product efficacy and shelf life, further accelerating adoption.

Prebiotics and fiber-based supplements are expanding steadily, supported by consumer preference for natural, plant-derived ingredients and increasing demand for digestive regularity solutions. Inulin, FOS, and GOS are widely incorporated into both supplements and functional foods, benefiting from clean-label positioning. Digestive enzymes hold significant demand within the pharmaceutical and OTC segments, particularly for lactose intolerance, pancreatic insufficiency, and age-related enzyme deficiencies. This segment benefits from physician recommendations and rising diagnosis rates. Synbiotics, though currently smaller in revenue share, represent one of the fastest-growing niches due to their synergistic action, targeted microbiome modulation, and increasing incorporation into premium formulations.

Application Insights

General gut health and immunity applications account for nearly 35% of the total market, reflecting a decisive shift from reactive treatment to preventive health consumption. The growing understanding of the gut-brain and gut-immune axis has significantly expanded this category beyond traditional digestive relief products. Consumers increasingly purchase probiotic and fiber supplements as daily wellness products rather than condition-specific treatments, which has broadened the addressable market.

Irritable Bowel Syndrome (IBS) and constipation management remain major therapeutic drivers within OTC digestive health, particularly in North America and Europe, where diagnosis rates are higher. Lactose intolerance management products are witnessing rising demand in the Asia-Pacific region due to increasing dairy consumption and dietary westernization. Meanwhile, inflammatory bowel disease (IBD) support supplements remain niche but clinically significant within pharmaceutical channels, supported by specialist recommendations and hospital-based prescribing trends. The application landscape is steadily evolving toward long-term gut maintenance rather than short-term symptom relief.

Distribution Channel Insights

Pharmacies and drug stores hold approximately 38% market share in 2025, supported by strong consumer trust, pharmacist recommendations, and availability of clinically positioned brands. This channel particularly dominates in North America and Europe, where OTC digestive supplements are frequently purchased alongside prescription medications. The perceived medical endorsement associated with pharmacies strengthens premium probiotic sales.

Online retail channels are the fastest-growing distribution segment, driven by subscription models, personalized nutrition offerings, and direct-to-consumer (DTC) brand strategies. E-commerce platforms provide access to detailed product reviews, strain transparency, and educational content, which are critical in influencing purchase decisions. Supermarkets and hypermarkets remain important for mass-market fiber supplements, digestive gummies, and entry-level probiotic products, especially in developed economies where organized retail penetration is high. The growth of omnichannel retail strategies is enabling brands to maintain both accessibility and premium positioning.

End-Use Industry Insights

The nutraceutical and dietary supplements industry accounts for nearly 46% of total demand, making it the largest end-use segment. This leadership is driven by increasing consumer self-medication trends, expanding supplement penetration in developed economies, and rising preventive health awareness globally. Branded probiotic capsules, synbiotic blends, and fiber supplements form the core of this segment’s revenue base.

Functional food and beverage applications are growing at over 8% CAGR, driven by probiotic yogurt, kefir, kombucha, plant-based beverages, and fortified cereals. Food manufacturers are investing in shelf-stable probiotic strains to ensure product viability through distribution cycles. Pharmaceutical applications remain stable with consistent OTC demand for digestive enzymes and condition-specific probiotic formulations. Meanwhile, animal nutrition is emerging as a strategic high-growth segment due to global antibiotic reduction initiatives in livestock production, which are encouraging probiotic-based feed additives as sustainable alternatives.

| By Product Type | By Application | By Distribution Channel | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds approximately 34% of the global digestive health market in 2025, making it the largest regional contributor. The United States drives the majority of regional demand due to high dietary supplement penetration, strong consumer awareness of microbiome science, and advanced retail infrastructure. The presence of leading global brands and well-established DTC channels further supports market expansion. Preventive healthcare culture, rising IBS prevalence, and increasing physician recommendations for probiotic use are key growth drivers. Canada complements regional growth with the steady adoption of premium and clinically validated probiotic formulations.

Europe

Europe accounts for nearly 27% of global revenue, led by Germany, France, the U.K., Italy, and Spain. Growth in the region is driven by high consumer health consciousness, expanding aging populations, and increasing demand for natural and plant-based digestive solutions. Although strict regulatory frameworks under EFSA limit aggressive health claims, they also enhance product credibility and quality perception. Rising interest in clean-label and organic supplements, particularly in Germany and the Nordic countries, is further strengthening demand. Western Europe remains mature, while Eastern Europe presents moderate growth opportunities due to improving healthcare access.

Asia-Pacific

Asia-Pacific represents around 29% of the global market share and is the fastest-growing region, expanding at over 8% CAGR. China leads regional demand, supported by rapid growth in e-commerce supplement sales, expanding domestic manufacturing, and increasing middle-class healthcare expenditure. Government support for biotechnology and nutraceutical production is further accelerating industry development. Japan remains a mature functional food market, with long-standing probiotic beverage consumption habits. India demonstrates strong growth potential due to rising digestive disorder prevalence, dietary shifts, and expanding pharmacy networks. Southeast Asian markets such as Indonesia and Thailand are also witnessing increasing supplement penetration.

Latin America

Brazil and Mexico drive regional demand, supported by expanding pharmacy retail infrastructure, rising middle-class disposable income, and growing awareness of preventive health. Urbanization and dietary westernization are increasing digestive disorder prevalence, indirectly supporting supplement adoption. Local manufacturing expansion and import partnerships are also strengthening supply availability across the region.

Middle East & Africa

The UAE and South Africa are leading markets within the region, driven by premium supplement adoption and increasing preventive healthcare awareness. High-income populations in Gulf countries are supporting demand for imported probiotic brands, while healthcare modernization initiatives in South Africa are expanding access to OTC digestive products. Although the region currently holds a smaller global share, rising urbanization, retail expansion, and improving healthcare infrastructure provide long-term growth potential.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Digestive Health Market

- Danone

- Nestlé Health Science

- Procter & Gamble

- Abbott Laboratories

- Bayer AG

- Yakult Honsha

- Chr. Hansen

- DSM-Firmenich

- GlaxoSmithKline

- Amway

- Herbalife

- Nature's Bounty

- Garden of Life

- NOW Foods

- BioGaia