Diamond Market Size

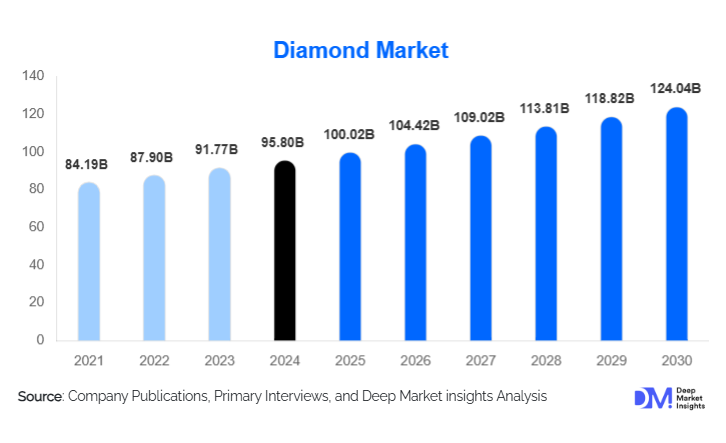

According to Deep Market Insights, the global diamond market size was valued at USD 95.80 billion in 2024 and is projected to grow from USD 100.02 billion in 2025 to reach USD 124.04 billion by 2030, expanding at a CAGR of 4.4% during the forecast period (2025–2030). The diamond market growth is primarily driven by rising demand for luxury jewelry, increasing adoption of laboratory-grown diamonds, and expanding industrial applications in electronics, automotive, and medical sectors.

Key Market Insights

- Natural diamonds continue to dominate high-value jewelry due to scarcity, heritage appeal, and strong resale value, while lab-grown diamonds are gaining traction among environmentally conscious and price-sensitive consumers.

- Industrial diamond demand is rising for applications such as cutting, drilling, abrasives, and advanced electronics, creating diversified revenue streams beyond traditional jewelry.

- Asia-Pacific is the fastest-growing region, fueled by China and India’s growing middle-class population, expanding domestic consumption, and strong diamond processing capabilities.

- North America remains a leading value market, driven by high disposable incomes and steady demand for premium bridal and luxury jewelry.

- Technological integration, including AI-based grading, blockchain certification, and lab-grown diamond synthesis, is enhancing transparency, efficiency, and consumer trust.

What are the latest trends in the diamond market?

Rise of Laboratory-Grown Diamonds

Laboratory-grown diamonds are becoming mainstream in both jewelry and industrial applications. They provide a sustainable, ethically sourced, and cost-effective alternative to natural diamonds. Millennials and Gen Z consumers increasingly favor lab-grown stones for engagement rings, fashion jewelry, and eco-conscious purchases. The adoption of CVD and HPHT technologies has improved yield and quality, enabling brands to offer a variety of shapes and sizes at competitive prices. Blockchain-based certification is also used to assure authenticity, further boosting market acceptance.

Technology-Enhanced Industrial Applications

Advanced manufacturing industries are driving growth in industrial diamond applications. Diamonds are widely used in electronics for heat sinks, in automotive for cutting tools, and in medical devices for precision instruments. Emerging applications in quantum computing, optics, and semiconductor technologies are opening high-margin opportunities. Companies are investing in R&D for synthetic diamonds optimized for industrial performance, resulting in increasing adoption across high-tech sectors.

What are the key drivers in the diamond market?

Growing Luxury Jewelry Demand

Diamonds remain a symbol of status, wealth, and long-term value, particularly in bridal and luxury segments. Increased disposable incomes in North America, Europe, and Asia-Pacific, along with rising global wedding rates, are driving demand for high-quality polished diamonds. Branded jewelry retailers are expanding omnichannel offerings, premium services, and bespoke products to capture affluent consumers.

Emergence of Lab-Grown Diamonds

Lab-grown diamonds are expanding the total addressable market by making diamond jewelry more accessible. They appeal to younger, environmentally conscious buyers and enable product innovations in fashion, daily wear, and custom designs. Lower price points increase affordability while maintaining visual and chemical parity with natural diamonds, positively impacting overall market volumes.

Expansion of Industrial Applications

Industrial diamonds are critical in cutting, drilling, electronics, and medical sectors due to their hardness and thermal conductivity. Growth in advanced manufacturing, EVs, and precision engineering is boosting demand for synthetic diamonds optimized for industrial performance, providing a stable, high-volume revenue stream for producers.

What are the restraints for the global market?

Price Volatility of Natural Diamonds

The natural diamond market experiences price fluctuations due to geopolitical risks, concentrated mining supply, and shifts in luxury spending. Volatility affects inventory planning and profit margins, posing challenges for retailers and manufacturers.

Changing Consumer Preferences

Young consumers increasingly prioritize experiences, sustainability, and alternative luxury items over traditional diamond purchases. This trend pressures average selling prices and requires brands to innovate through ethical sourcing, lab-grown alternatives, and digital engagement strategies.

What are the key opportunities in the diamond market?

Growth of Lab-Grown Diamonds

Rising environmental awareness and ethical concerns are driving lab-grown diamond adoption. Companies investing in CVD and HPHT production can gain cost advantages and attract younger demographics, expanding both volume and market penetration.

Emerging Markets in Asia-Pacific

Asia-Pacific is experiencing strong growth, particularly in India and China. India benefits from both large-scale processing capacity and rising domestic demand, while China is becoming a key consumer market for luxury and industrial diamonds. Strategic regional investments can unlock significant market potential.

Industrial and High-Tech Applications

Industrial diamonds are increasingly used in electronics, medical devices, aerospace, and quantum computing. Technological advancements in synthetic diamond manufacturing provide opportunities for high-margin, non-cyclical growth beyond jewelry applications.

Product Type Insights

Polished diamonds dominate the global diamond market, accounting for approximately 68% of total revenue in 2024. This dominance is primarily driven by sustained demand from the bridal and luxury jewelry segments, where polished stones are essential for finished jewelry products. Among polished diamonds, round brilliant and princess cuts remain the most popular shapes globally, benefiting from their superior light performance, standardized grading, and strong consumer recognition. These cuts are particularly favored in engagement rings, which represent the highest-value jewelry category.

Rough diamonds form the upstream foundation of the value chain and are largely traded between mining companies, large diamantaires, and cutting and polishing centers before being converted into polished stones. While rough diamonds contribute a lower direct revenue share, their pricing dynamics significantly influence downstream margins. Meanwhile, lab-grown polished diamonds are gaining market share at a rapid pace due to their affordability, consistent quality, and ethical sourcing credentials. This segment is increasingly driving volume growth, particularly in fashion jewelry and entry-level bridal categories, making polished diamonds, both natural and lab-grown, the clear product type leader globally.

Application Insights

Jewelry applications account for approximately 85% of the global diamond market in 2024, making it the largest and most influential application segment. Demand is led by rings, necklaces, earrings, and bracelets, with engagement and wedding jewelry serving as the primary revenue drivers due to higher per-unit pricing and emotional purchasing behavior. Cultural traditions, rising disposable incomes, and increasing brand-driven premiumization continue to reinforce jewelry’s dominance across developed and emerging markets.

Industrial and technical applications, while smaller in value contribution, represent the fastest-growing application segment, supported by rising adoption in electronics, automotive manufacturing, construction, cutting tools, and precision optics. Diamonds’ exceptional hardness and thermal conductivity make them indispensable in advanced manufacturing. Emerging high-tech applications, such as thermal management in semiconductors, quantum computing substrates, laser optics, and precision medical instruments, are accelerating industrial diamond demand. This diversification is improving market resilience by reducing reliance on discretionary luxury spending.

Distribution Channel Insights

Specialty jewelry retailers hold the largest distribution share at approximately 42% in 2024, benefiting from strong consumer trust, in-store expertise, customization capabilities, and premium brand positioning. These retailers play a critical role in high-value purchases such as bridal jewelry, where consumers seek assurance on quality, certification, and after-sales services.

Direct-to-consumer (D2C) and online channels are the fastest-growing distribution segment, driven by the rising acceptance of lab-grown diamonds, transparent pricing models, and digital-first marketing strategies. Online platforms enable wider product comparison, certification access, and customization tools, appealing strongly to younger buyers. Wholesalers and diamond bourses remain essential for rough and polished diamond trading, particularly in major hubs such as Antwerp, Dubai, Mumbai, and Hong Kong. Meanwhile, long-term OEM supply contracts dominate industrial diamond distribution, ensuring stable demand from electronics and manufacturing companies.

Traveler Type Insights

From a consumer segmentation perspective, high-net-worth individuals (HNWIs) dominate demand for natural diamonds and luxury jewelry, driven by their preference for exclusivity, rarity, and long-term value retention. This segment supports premium pricing and sustains demand for high-carat, high-quality polished diamonds.

In contrast, millennials and Gen Z consumers are the primary growth drivers for lab-grown diamonds, favoring affordability, sustainability, and ethical sourcing. Their purchasing behavior is strongly influenced by digital platforms, social media, and transparency. Industrial buyers, including electronics manufacturers, automotive OEMs, and medical device companies, form a stable, long-term demand base, often operating under multi-year procurement contracts that provide predictable revenue streams for synthetic diamond producers.

| By Product Type | By Application | By Distribution Channel | By End-User Type |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 38% of the global diamond market, with the United States representing the largest single-country consumer market. Regional growth is driven by high disposable incomes, strong bridal jewelry demand, and a deeply ingrained cultural affinity for diamonds in engagement and wedding traditions. The presence of well-established luxury retail chains, advanced e-commerce infrastructure, and rising acceptance of lab-grown diamonds further support sustained demand. Technological adoption, including blockchain-based certification and omnichannel retail strategies, is enhancing consumer confidence and market penetration.

Europe

Europe holds around 18% of the global market, led by the United Kingdom, Germany, France, Italy, and Switzerland. Regional growth is supported by strong luxury branding, heritage jewelry craftsmanship, and increasing consumer emphasis on ethical sourcing and sustainability. European buyers show a high preference for certified, responsibly sourced diamonds, which is driving demand for traceable natural stones and lab-grown alternatives. Stable economic conditions and steady luxury consumption ensure consistent market expansion.

Asia-Pacific

Asia-Pacific represents approximately 34% of the global diamond market and is the fastest-growing region, expanding at an estimated 6.8% CAGR. Growth is fueled by rising middle-class incomes, rapid urbanization, and expanding luxury consumption in China and India. India plays a dual role as the world’s largest diamond cutting and polishing hub and a fast-growing consumer market, while China drives demand through luxury gifting and branded jewelry. Expanding digital retail platforms and government support for manufacturing and exports further strengthen regional growth.

Latin America

Latin America accounts for approximately 3% of global diamond demand, with Brazil and Mexico as key contributors. Market growth is driven by expanding luxury consumption among affluent urban populations and increasing exposure to international jewelry brands. While overall penetration remains limited, improving economic stability and rising aspirational spending are gradually supporting demand for both luxury and mid-range diamond jewelry.

Middle East & Africa

Africa remains the core global supply region, particularly Botswana, South Africa, Namibia, and Angola, supported by rich natural diamond reserves and government-backed mining frameworks. The Middle East, led by the UAE and Saudi Arabia, is an increasingly important demand hub, driven by high-income populations, luxury retail expansion, and Dubai’s role as a global diamond trading center. Strong tourism inflows, tax-free trade zones, and rising bridal jewelry demand are key growth drivers, while intra-regional trade continues to strengthen market connectivity.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Leading Manufacturers in the Diamond Industry

- De Beers Group

- ALROSA

- Rio Tinto Diamonds

- Chow Tai Fook

- Signet Jewelers

- LVMH (Jewelry Division)

- Tiffany & Co.

- Harry Winston

- Pandora

- Rajesh Exports

- Rosy Blue

- Graff Diamonds

- Chow Sang Sang

- Lucara Diamond

- Blue Nile