CVD Lab-Grown Diamonds Market Size

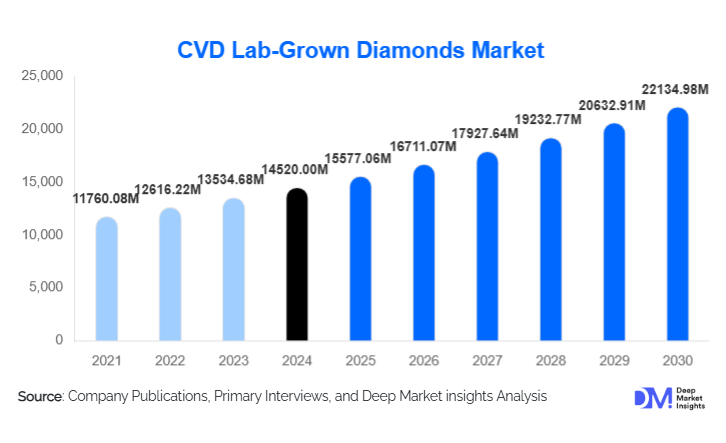

According to Deep Market Insights, the global CVD lab-grown diamonds market size was valued at USD 14,520.00 million in 2024 and is projected to grow from USD 15,577.06 million in 2025 to reach USD 22,134.98 million by 2030, expanding at a CAGR of 7.28% during the forecast period (2025–2030). Market growth is driven by rising consumer preference for sustainable diamonds, rapid advancements in CVD reactor technologies, and accelerating adoption of CVD diamonds in electronics, semiconductors, photonics, and quantum applications. Increasing acceptance among global jewelry brands and expanding industrial applications are reshaping the dynamics of the diamond industry.

Key Market Insights

- Type IIa CVD diamonds dominate global adoption due to their exceptional purity and suitability for luxury jewelry and semiconductor-grade applications.

- Jewelry remains the largest application segment, accounting for more than 60% of global demand, fueled by sustainable luxury trends.

- Industrial applications are expanding rapidly, especially in thermal management, optics, precision tools, and quantum computing.

- APAC is the fastest-growing regional market due to rising manufacturing capacity in China and India, and increasing semiconductor investments.

- Online retail channels are gaining significant traction, driven by transparent pricing, digital certifications, and direct-to-consumer luxury brands.

- Growing CapEx in CVD reactors and purification technologies is improving product consistency and lowering production costs.

What are the latest trends in the CVD Lab-Grown Diamonds Market?

Advancements in CVD Reactor Technology

Recent innovations in continuous-flow CVD reactors and plasma-enhanced growth systems have significantly increased production efficiency and purity. Manufacturers are deploying AI-controlled reactor environments, optimizing gas flow ratios, and enhancing substrate stability to yield larger and higher-quality diamond crystals. These advancements enable the production of premium Type IIa diamonds at scale, while also reducing cost per carat. Automation in post-processing, such as plasma polishing and laser refinement, further strengthens grading consistency, positioning CVD diamonds as a technologically superior and sustainable alternative to mined stones.

Growing Adoption in Semiconductors and Quantum Technologies

CVD diamonds are gaining unprecedented traction in next-generation electronics due to their exceptional thermal conductivity, hardness, and wide bandgap characteristics. Semiconductor manufacturers are increasingly integrating diamond heat spreaders into high-power devices for EVs, 5G infrastructure, aerospace electronics, and data centers. In quantum applications, nitrogen-vacancy (NV) centers created within ultra-pure Type IIa diamonds are enabling breakthroughs in sensing, cryptography, and quantum communication. As governments deepen investments in advanced material ecosystems, demand for high-purity CVD diamonds is accelerating across Japan, the U.S., South Korea, and Germany.

What are the key drivers in the CVD Lab-Grown Diamonds Market?

Shift Toward Ethical & Sustainable Diamonds

Global consumers increasingly prioritize sustainability, transparency, and ethical sourcing in luxury purchases. CVD diamonds align perfectly with these expectations, offering a conflict-free, environmentally efficient alternative to mined stones. Major jewelry brands have integrated lab-grown collections, reinforcing demand for Type IIa and colorless CVD diamonds. With younger demographics accounting for the largest share of diamond jewelry purchases worldwide, sustainable luxury remains one of the strongest market accelerators.

Rising Industrial Demand Across High-Performance Applications

Industries such as aerospace, EVs, photonics, and medical imaging rely on materials with superior durability and thermal performance. CVD diamonds outperform sapphire, silicon carbide, and cubic zirconia on key metrics, driving adoption in cutting tools, semiconductor wafers, optical windows, and quantum sensors. With industrial-grade CVD diamond demand growing above 14% annually, manufacturers are expanding reactor capacity to cater to high-tech end-use sectors.

What are the restraints for the global market?

Price Pressure and Margin Compression

As manufacturing capacity expands, particularly in China and India, CVD diamond prices have gradually decreased, impacting producer profit margins. Competition among mid-tier companies and technological standardization has reduced premium pricing advantages. Without product differentiation, many producers face margin dilution, especially in commoditized jewelry-grade segments.

Limited Consumer Awareness in Emerging Markets

While North America and Europe demonstrate high acceptance of lab-grown diamonds, awareness remains limited in Latin America, the Middle East, and parts of Southeast Asia. Traditional jewelers are hesitant to promote CVD alternatives, fearing cannibalization of mined diamond sales. This restrains market expansion and requires robust consumer education, certification transparency, and retail ecosystem development.

What are the key opportunities in the CVD Lab-Grown Diamonds Industry?

Electronics, Semiconductor & Quantum Integration

The fastest-growing opportunity lies in the electronics and semiconductor space, where CVD diamonds serve as ideal thermal spreaders, high-frequency substrates, and photonic materials. With global semiconductor revenue exceeding USD 600 billion, even a small penetration of diamond-based components represents a multi-billion-dollar opportunity. Governments are investing in quantum research, further accelerating industrial-grade diamond adoption.

ESG-Driven Luxury and Retail Transformation

The shift toward ethical luxury is expanding rapidly. Premium jewelry houses are launching lab-grown collections emphasizing sustainability, traceability, and responsible sourcing. Blockchain-based authentication and digital certificates are becoming standard, enabling retailers to build consumer trust. This ESG-driven transformation creates opportunities for brands specializing in ultra-pure Type IIa and colorless stones.

Product Type Insights

Type IIa CVD diamonds dominate the global market due to their unmatched purity, clarity, and suitability for both high-end jewelry and advanced semiconductor applications. They account for approximately 42% of total market revenue. Type I diamonds are preferred for mainstream jewelry, while Type IIb diamonds serve niche applications such as electronic-grade semiconductors. Increasing availability of high-purity diamonds at competitive costs further strengthens the dominance of Type IIa segments.

Application Insights

Jewelry remains the leading application, representing about 62% of global CVD diamond demand. Consumer adoption is driven by sustainability, affordability, and growing brand participation. Industrial applications, including cutting tools, optical windows, laser systems, and thermal spreaders, represent the fastest-growing category, with a CAGR exceeding 14%. Semiconductor and quantum applications are emerging segments with strong long-term scalability, supported by government and private R&D investments.

Distribution Channel Insights

Online platforms dominate sales due to transparent pricing, digital certification tools, and expanding D2C brands. They represent approximately 34% of global distribution. Traditional jewelry stores remain essential for high-value purchases, but their share is declining as digital adoption accelerates. B2B industrial sales are growing steadily as semiconductor and aerospace manufacturers secure long-term supply contracts with high-purity CVD diamond producers.

End-Use Insights

Consumer jewelry is the largest end-use segment, driven by global adoption of sustainable luxury. Electronics and semiconductors are the fastest-growing end-use categories, leveraging diamond’s superior thermal and optical properties. Aerospace, medical imaging, and quantum sensing represent expanding niche applications, further diversifying demand. Export-driven demand is strong from Japan, South Korea, and Germany, where industrial diamond components are integrated into high-precision systems.

| By Diamond Type | By Carat Size | By Color Grade | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds approximately 28% of the global market share, led by the United States, with strong adoption in both jewelry and industrial applications. High consumer awareness, large luxury markets, and robust semiconductor R&D investments support regional growth. Retailers and tech manufacturers are increasingly partnering with domestic CVD producers to secure high-purity material supply.

Europe

Europe holds around 22% of the global market, with Germany, the U.K., France, and Belgium as key hubs. Germany leads industrial consumption, driven by optics and semiconductor applications. The U.K. and France dominate jewelry adoption. Strict ESG regulations strengthen demand for sustainable CVD diamonds across the luxury and industrial sectors.

Asia-Pacific

APAC is the fastest-growing region with a projected CAGR of 14–16%. China and India drive both production and consumption. China dominates reactor manufacturing and industrial-grade diamond production, while India excels in polishing, jewelry retail, and export processing. Japan and South Korea lead in quantum and semiconductor-grade CVD diamond adoption.

Latin America

LATAM shows steady growth, with Brazil and Mexico leading jewelry demand. Awareness of lab-grown diamonds is increasing gradually, supported by expanding e-commerce and rising middle-class consumption.

Middle East & Africa

The Middle East, especially the UAE and Saudi Arabia, demonstrates rising interest in luxury CVD jewelry. Africa remains a growing market for industrial-grade diamonds, particularly in manufacturing clusters in South Africa and Kenya. However, mined diamond traditions slow consumer transition to lab-grown alternatives.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Manufacturers in the CVD Lab-Grown Diamonds Industry

- Diamond Foundry

- WD Lab Grown Diamonds

- Pure Grown Diamonds

- Lusix

- ALTR Created Diamonds

- IIa Technologies

- Applied Diamond Inc.

- New Diamond Technology

- Zhongnan Diamond

- Henan Huanghe Whirlwind

- Jinan Zhongwu New Materials

- Scio Diamond Technologies

- Shanghai Zhengshi Technology

- Sumitomo Electric Industries

- Advanced Diamond Technologies

Recent Developments

- In March 2025, Diamond Foundry expanded its U.S. CVD reactor facility, increasing production capacity for semiconductor-grade diamonds.

- In January 2025, Lusix launched a new solar-powered CVD plant in Israel, reinforcing sustainability in diamond manufacturing.

- In February 2025, IIa Technologies introduced a next-generation high-purity CVD diamond line optimized for quantum sensing applications.