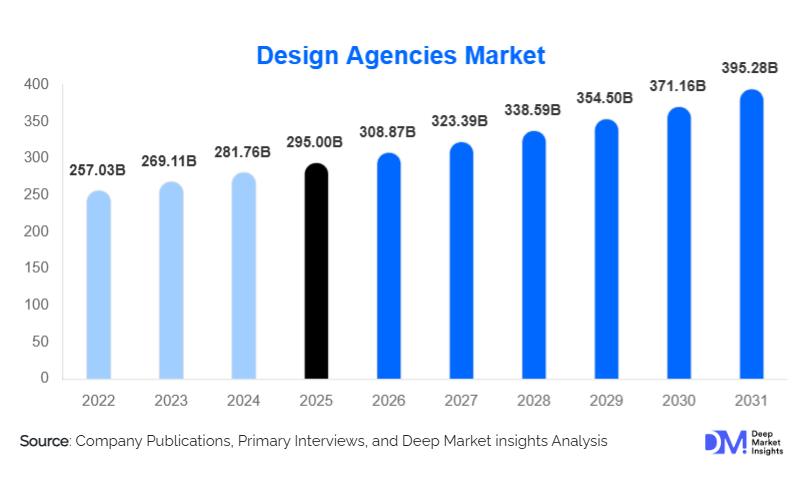

Design Agencies Market Size

According to Deep Market Insights, the global design agencies market size was valued at USD 295.00 billion in 2025 and is projected to grow from USD 308.87 billion in 2026 to reach USD 395.28 billion by 2031, expanding at a CAGR of 4.7% during the forecast period (2026–2031). The growth of the design agencies market is primarily driven by increasing demand for digital transformation, the rising importance of branding and corporate identity, and the rapid adoption of innovative design solutions across industries such as technology, retail, healthcare, and manufacturing.

Key Market Insights

- Digital-first and UI/UX design services are becoming core offerings, fueled by the surge in e-commerce, mobile apps, and web-based platforms.

- Sustainable and eco-friendly design initiatives are gaining traction, with agencies focusing on packaging, product, and architectural design that align with ESG principles.

- North America dominates the design agencies market, driven by mature enterprises and a high concentration of tech companies demanding comprehensive branding solutions.

- Asia-Pacific is the fastest-growing region, driven by startup proliferation, SMEs seeking professional design services, and digital adoption in countries like India and China.

- Full-service design agencies lead globally, providing end-to-end solutions spanning branding, digital, and industrial design.

- Technological integration, including AI-driven tools, AR/VR prototyping, and collaborative cloud platforms, is reshaping creative workflows and client delivery models.

What are the latest trends in the design agencies market?

Digital & UI/UX Design as a Growth Driver

Organizations are increasingly prioritizing digital experiences, making UI/UX design a major growth driver. Agencies are leveraging advanced design tools, AI-based prototyping, and immersive interfaces to enhance website and app usability. Demand for digital-first solutions is especially strong among tech startups and e-commerce companies, which rely on intuitive and visually engaging digital platforms to attract and retain customers. This trend has led digital design services to account for approximately 32% of the global market share in 2025, reflecting its dominant position in the industry.

Sustainable and Eco-Friendly Design

Environmental consciousness is reshaping client expectations across design services. Agencies offering eco-friendly packaging, energy-efficient product design, and green architectural solutions are experiencing increased demand. Regulatory pressures, coupled with rising consumer preference for sustainability, have prompted firms to integrate circular economy principles, sustainable materials, and ESG-compliant design practices into their portfolios. Agencies specializing in sustainable design are poised to capture high-value projects from global corporations focused on reducing environmental impact.

What are the key drivers in the design agencies market?

Rising Importance of Branding

Companies are recognizing branding as a strategic tool to differentiate themselves in competitive markets. Branding services, including corporate identity, logo design, and integrated marketing campaigns, accounted for 28% of the global market share in 2025. Businesses are increasingly outsourcing branding to agencies that can deliver consistent messaging, high-quality visuals, and market-relevant design solutions, enhancing customer engagement and loyalty.

Digital Transformation Across Industries

The global shift toward digital-first operations has expanded the need for websites, mobile apps, and digital marketing collateral. This trend has accelerated the adoption of digital and UI/UX design services, particularly in retail, healthcare, and technology sectors. Agencies that provide end-to-end digital solutions are experiencing rapid revenue growth due to rising client reliance on interactive and customer-centric design platforms.

Technological Integration in Design

Advanced technologies such as AI, AR/VR, and cloud-based collaboration tools are transforming design workflows. These innovations enable faster prototyping, real-time client collaboration, and enhanced visualization of products and spaces. Agencies integrating these technologies are gaining competitive advantages, allowing them to deliver premium, innovative solutions across multiple sectors, thereby driving market expansion.

What are the restraints for the global market?

High Competition and Market Fragmentation

The design agencies market is highly fragmented, with numerous freelancers, boutique firms, and global players competing for business. This increases pricing pressure and reduces profit margins, particularly in the digital and graphic design segments. Smaller agencies often struggle to compete with full-service firms offering integrated solutions, creating a barrier to scaling operations.

Talent Scarcity

There is a shortage of skilled designers experienced in emerging technologies, such as AR/VR, advanced prototyping, and sustainable design. Recruitment and training costs are high, limiting the ability of agencies to expand service offerings quickly. This scarcity of talent is particularly acute in emerging markets, which could slow growth if not addressed.

What are the key opportunities in the design agencies market?

Expansion of Digital Transformation Services

As companies increasingly embrace digital-first strategies, there is significant potential for agencies specializing in UI/UX, app design, and interactive web solutions. Startups and SMEs are actively seeking affordable yet high-quality design services to establish a strong online presence, representing a rapidly expanding client base.

Green and Sustainable Design Initiatives

Rising awareness of environmental sustainability presents opportunities for agencies to offer eco-friendly packaging, energy-efficient product design, and sustainable architectural solutions. Regulatory incentives and corporate ESG commitments are creating demand for design services that align with environmental standards, enabling agencies to capture high-value contracts.

Growing Demand in Emerging Markets

Countries in the Asia-Pacific and Latin America are witnessing rapid growth in startups, SMEs, and corporate investments, driving demand for design services. Governments promoting entrepreneurship, such as India’s “Make in India” initiative, are indirectly boosting opportunities for agencies offering branding, digital, and industrial design solutions.

Service Type Insights

Digital design services dominate the market, reflecting the ongoing shift toward mobile apps, websites, and interactive platforms. Branding and identity design remain critical, particularly for large enterprises aiming for consistent corporate messaging. Industrial and product design are increasingly sought after in technology, consumer goods, and automotive sectors, while interior and architectural design are growing due to urbanization and commercial infrastructure expansion. Advertising and campaign design are evolving to integrate digital marketing, social media, and experiential campaigns, driving demand for multi-channel creative solutions.

Application Insights

Corporate and enterprise clients remain the largest end-users, accounting for 35% of the global market in 2025, due to investments in comprehensive branding, digital platforms, and integrated campaigns. Retail and e-commerce segments are rapidly growing, driven by the need for product packaging, website interfaces, and promotional campaigns. Healthcare, education, and government sectors are increasingly adopting professional design services for digital communication, awareness campaigns, and institutional branding. Emerging applications include AI-assisted product prototyping, immersive AR/VR marketing experiences, and eco-conscious packaging design.

| By Service Type | By End-Use Industry | By Delivery Model |

|---|---|---|

|

|

|

Regional Insights

North America

North America dominates the global design agencies market, contributing approximately 40% of the market in 2025. Strong demand from technology companies, large enterprises, and startups drives growth. The U.S. is the largest country market, with agencies benefiting from high digital adoption, advanced infrastructure, and corporate investment in branding and design innovation.

Europe

Europe accounts for roughly 25% of the market, with the U.K., Germany, and France being key contributors. Growth is supported by corporate branding needs, technological adoption, and digital transformation initiatives. European agencies are also leveraging sustainability trends, focusing on green and socially responsible design solutions.

Asia-Pacific

APAC is the fastest-growing region, driven by emerging startups, SMEs, and digital adoption in countries like India, China, and Southeast Asia. Increasing investments in digital marketing, e-commerce, and technology platforms are driving the adoption of UI/UX, branding, and industrial design services. Growth in urban infrastructure and consumer products is also fueling demand for architectural and product design services.

Latin America

Brazil, Argentina, and Mexico are emerging as important markets. The demand for branding, digital, and advertising design is growing, particularly among startups and SMEs looking to establish market presence. International collaborations and export-driven demand are gradually increasing the market share from this region.

Middle East & Africa

Africa, as a hub of emerging businesses and infrastructure projects, is witnessing rising demand for design services, particularly in branding and architectural design. The Middle East, led by the UAE and Saudi Arabia, is investing heavily in luxury branding, corporate identity, and innovative architectural projects, supporting the market growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Design Agencies Market

- IDEO

- Frog Design

- Landor & Fitch

- Pentagram

- Wolff Olins

- FutureBrand

- MetaDesign

- R/GA

- Sagmeister & Walsh

- Turner Duckworth

- AKQA

- Huge Inc.

- Smith & Milton

- Blue Fountain Media

- VMLY&R