Deodorization System Market Size

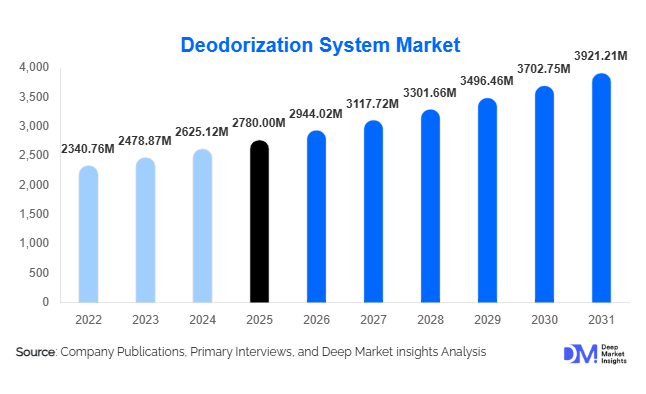

According to Deep Market Insights, the global deodorization system market size was valued at USD 2,780 million in 2025 and is projected to grow from USD 2,944.02 million in 2026 to reach USD 3,921.21 million by 2031, expanding at a CAGR of 5.9% during the forecast period (2026–2031). The deodorization system market growth is primarily driven by tightening environmental regulations, expansion of municipal wastewater infrastructure, and increasing industrial compliance requirements related to odor and volatile organic compound (VOC) emissions.

Deodorization systems are widely deployed across municipal wastewater treatment plants, solid waste management facilities, food processing units, oil refineries, chemical plants, and pulp & paper mills. Rapid urbanization and rising waste generation volumes are accelerating investments in odor control infrastructure globally. Additionally, increasing ESG-linked capital expenditure and public pressure for improved air quality are compelling industries to upgrade legacy odor masking methods to advanced biological, chemical, and hybrid deodorization technologies.

Key Market Insights

- Biological deodorization systems account for nearly 38% of the global market share in 2025, driven by lower operating costs and environmental sustainability.

- New installations represent approximately 62% of total revenue, supported by greenfield wastewater and waste management projects in Asia-Pacific and the Middle East.

- Asia-Pacific dominates the market with around 36% share, led by China and India’s rapid infrastructure expansion.

- Municipal wastewater treatment plants contribute about 34% of total demand, making it the largest end-use segment globally.

- The top five players hold approximately 41% of the global market, reflecting moderate consolidation with strong technological competition.

- Hybrid and modular skid-mounted systems are gaining traction, particularly in retrofit applications across developed economies.

What are the latest trends in the deodorization system market?

Shift Toward Biological and Hybrid Systems

Biological systems such as biofilters and biotrickling filters are increasingly replacing conventional chemical scrubbers due to their lower operating costs and sustainability benefits. Hybrid systems combining biological treatment with adsorption or chemical scrubbing are gaining popularity in large municipal projects, where multi-stage odor elimination is required. These systems offer improved removal efficiency for hydrogen sulfide (H₂S), ammonia, and VOCs while reducing long-term chemical consumption. Modular biological units are particularly popular in mid-sized municipal plants, where scalability and low energy consumption are key purchasing criteria.

Digitalization and Smart Monitoring Integration

Advanced deodorization systems are being integrated with IoT-enabled odor sensors, predictive maintenance platforms, and AI-based process control systems. Real-time monitoring allows operators to adjust airflow rates, chemical dosing, and microbial conditions, optimizing performance and reducing downtime. Smart monitoring systems are increasingly required in North America and Europe, where regulatory compliance audits demand transparent operational data. The digitalization trend also enables remote diagnostics and lifecycle cost optimization, strengthening aftermarket service revenue streams for manufacturers.

What are the key drivers in the deodorization system market?

Stringent Environmental Regulations

Governments across North America, Europe, and Asia are implementing strict emission control standards to regulate odor and VOC discharge from industrial and municipal facilities. Environmental protection agencies are enforcing odor threshold compliance and imposing penalties for violations. This regulatory pressure compels plant operators to install advanced deodorization systems, particularly in wastewater and landfill operations located near residential zones.

Rapid Urbanization and Waste Generation

Global municipal solid waste and wastewater volumes continue to rise due to population growth and urban expansion. Emerging economies are investing heavily in sewage treatment plants and solid waste processing infrastructure. Each new facility requires integrated odor control systems, driving strong greenfield demand. Asia-Pacific and Middle Eastern countries are particularly active in funding large-scale wastewater treatment expansions.

What are the restraints for the global market?

High Capital Expenditure Requirements

Advanced systems such as regenerative thermal oxidizers (RTOs) and multi-stage chemical scrubbers require significant upfront investment. Smaller municipalities and mid-scale industrial plants often delay adoption due to budget limitations, especially in developing markets where financing options are limited.

Operational and Technical Complexity

Biological systems require continuous microbial management, moisture control, and monitoring. Lack of skilled personnel in emerging markets can lead to operational inefficiencies, discouraging adoption. Maintenance costs and periodic replacement of activated carbon or catalysts also impact the total cost of ownership.

What are the key opportunities in the deodorization system industry?

Expansion of Urban Sanitation Projects

Large-scale public infrastructure spending on wastewater and sanitation projects presents substantial growth opportunities. Countries such as India, Indonesia, and Saudi Arabia are investing heavily in urban sewage systems. Suppliers that localize manufacturing and partner with EPC contractors can secure long-term contracts in these fast-growing markets.

ESG-Driven Industrial Upgrades

Corporations are increasingly aligning with ESG standards, investing in environmentally responsible air treatment solutions. Food processing, pharmaceutical, and petrochemical industries are upgrading odor control systems to enhance community relations and meet sustainability benchmarks. Green financing and sustainability-linked loans further incentivize capital investment in high-efficiency deodorization systems.

Technology Type Insights

Biological treatment systems dominate the deodorization system market with approximately 38% share in 2025. These systems are favored primarily for municipal wastewater applications due to their low operational costs, eco-friendly performance, and ability to handle large-scale odor emissions effectively. Their popularity is further supported by the global push toward sustainable and energy-efficient solutions, as well as regulatory incentives for reducing chemical use in wastewater treatment. Chemical scrubbers account for nearly 27% of the market, widely deployed in chemical and petrochemical industries to manage high-concentration gas streams. These systems are preferred where precise control of acidic and odorous emissions is critical, particularly in industrial clusters with strict local emission standards.

Thermal and catalytic oxidation systems represent about 18% of the market. They are applied extensively in industrial VOC destruction applications where high efficiency is critical, such as refineries, chemical plants, and pharmaceutical manufacturing facilities. The adoption of these systems is driven by stringent environmental regulations that require near-complete odor and VOC elimination. Adsorption systems, including activated carbon solutions, hold nearly 13% market share. These are typically used in smaller industrial facilities, laboratories, and localized odor control applications. Their modularity and ease of integration make them attractive for facilities with space or budget constraints.

Installation Type Insights

New installations account for nearly 62% of total market revenue in 2025. This growth is driven by the expansion of greenfield wastewater treatment projects, modern landfill facilities, and new industrial plants, particularly in the Asia-Pacific and the Middle East. Urbanization, population growth, and government-funded sanitation projects are key drivers for greenfield installations.

Retrofit and upgradation projects contribute around 38% of the market, predominantly in North America and Europe. Aging wastewater and industrial infrastructure in these regions, combined with stricter environmental regulations, is compelling facility operators to replace traditional odor masking techniques with advanced deodorization systems. The need for compliance with ESG mandates and operational efficiency improvements is further boosting retrofit demand.

System Configuration Insights

Centralized deodorization systems dominate the market with approximately 58% share. They are preferred in large municipal and industrial complexes due to higher treatment capacity, more consistent airflow management, and centralized maintenance efficiency. Increasing focus on large-scale urban and industrial wastewater treatment projects is a primary driver of centralized system adoption.

Decentralized and modular systems account for 42% of the market and are growing in popularity among smaller facilities and phased expansion projects. The flexibility of modular systems allows operators to scale capacity incrementally, making them particularly suitable for emerging markets and facilities with budget constraints. Advances in compact biological and adsorption systems are accelerating the adoption of decentralized configurations.

End-Use Industry Insights

Municipal wastewater treatment leads the market with nearly 34% share in 2025. Rising urban populations, increasing sewage generation, and stringent odor control regulations are driving demand in this segment. Solid waste management facilities follow at 19% share and represent the fastest-growing segment, with a CAGR exceeding 7%. Rapid expansion of landfills, composting operations, and waste-to-energy plants is fueling growth in solid waste-related deodorization solutions.

Food & beverage processing accounts for approximately 14% of the market, driven by stricter hygiene and odor emission standards. Oil & gas, pulp & paper, chemical, and pharmaceutical industries collectively contribute the remaining market share, supported by regulatory compliance mandates, ESG initiatives, and increasing focus on worker safety and community acceptance.

| By Technology Type | By Installation Type | By System Configuration | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific holds approximately 36% of the global market share in 2025. China represents nearly 14% of global demand, driven by extensive investments in urban wastewater infrastructure, new landfill construction, and industrial expansion. India is the fastest-growing country in the region, with an estimated CAGR of 8%, propelled by government initiatives such as the Smart Cities Mission and Swachh Bharat program, which prioritize modern wastewater and sanitation infrastructure. Other countries like Indonesia, Thailand, and Vietnam are witnessing rising adoption of both centralized and modular deodorization systems due to industrial growth and urban waste management needs.

Key regional growth drivers include large-scale government funding, rapid urbanization, and increasing awareness of environmental and public health concerns. The adoption of modular hybrid systems is also expanding due to the need for cost-effective, scalable solutions in emerging urban centers.

North America

North America contributes roughly 27% of the global market, with the United States accounting for around 22% share. Strong EPA regulations, tightening odor emission limits, and aggressive infrastructure modernization programs are key drivers for both retrofit and new installations. Municipalities and industrial operators are increasingly upgrading aging wastewater treatment plants and industrial facilities with centralized and hybrid systems to improve operational efficiency and maintain compliance. The region’s growth is further supported by the availability of skilled labor for biological system maintenance, government incentives for sustainable technologies, and increased industrial ESG compliance requirements.

Europe

Europe represents approximately 23% of global demand, led by Germany, France, and the UK. The primary drivers include strict environmental regulations, ESG compliance mandates, and investment in the modernization of aging municipal and industrial infrastructure. Hybrid and centralized systems are widely adopted in industrial parks, chemical plants, and urban wastewater facilities to meet odor and VOC emission standards. Additional growth is supported by strong public-private partnerships, the availability of advanced air treatment technologies, and government-led initiatives to encourage sustainable wastewater and waste management practices across the continent.

Middle East & Africa

The region holds around 8% share, with Saudi Arabia and the UAE leading demand. Drivers include large-scale urban wastewater projects, rapid expansion of desalination plants, and industrial park development. The high reliance on centralized treatment systems in megacities and industrial zones is driving the adoption of biological, chemical, and hybrid deodorization technologies. Environmental regulations and growing public awareness of air quality further accelerate market growth.

Latin America

Latin America represents approximately 6% of the market, led by Brazil and Mexico. Drivers include ongoing sanitation improvements, urbanization, and government investment in municipal wastewater treatment projects. Emerging demand for solid waste treatment and landfill modernization is also contributing to market expansion. The region increasingly adopts modular systems for smaller-scale applications, offering flexibility and cost-effectiveness for municipalities with limited budgets.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|