Data Center Support Infrastructure Market Size

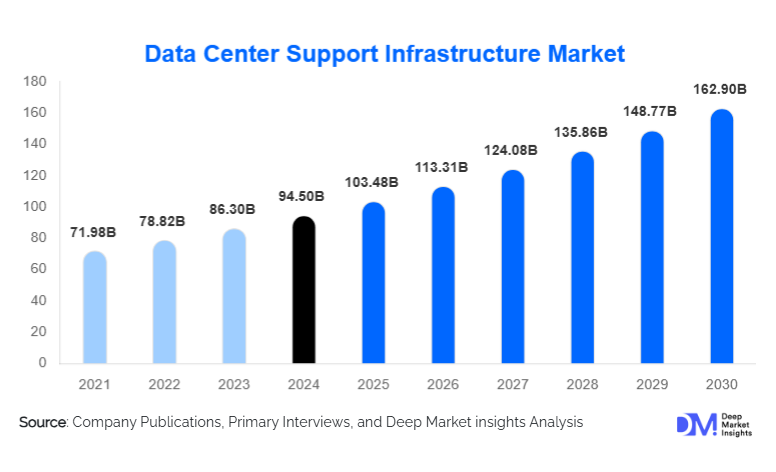

According to Deep Market Insights, the global data center support infrastructure market size was valued at USD 94.5 billion in 2024 and is projected to grow from USD 103.48 billion in 2025 to reach USD 162.90 billion by 2030, expanding at a CAGR of 9.5% during the forecast period (2025–2030). The market growth is primarily driven by increasing data center deployments worldwide, rising adoption of cloud services, and the growing need for energy-efficient and reliable infrastructure to support enterprise, hyperscale, and colocation data centers. Enhanced government regulations and incentives for digital transformation, combined with advanced technology integrations such as AI-based monitoring and smart cooling solutions, are further fueling the market expansion.

Key Market Insights

- Power management and backup systems dominate the market, ensuring high reliability and uninterrupted operations in critical data centers.

- Cooling infrastructure is evolving toward energy-efficient and liquid cooling solutions, driven by rising IT equipment density and sustainability mandates.

- North America accounts for the largest share, led by the U.S. and Canada due to extensive hyperscale data center growth and strong enterprise IT investments.

- Asia-Pacific is the fastest-growing region, driven by digital transformation initiatives in China, India, and Japan, and increasing adoption of cloud and colocation services.

- Europe remains a key market for green and energy-efficient data center infrastructure, supported by stringent environmental regulations and government-backed incentives.

- Technological integration, including IoT-enabled monitoring, AI-driven predictive maintenance, and intelligent power management, is improving operational efficiency and reducing downtime.

What are the latest trends in the data center support infrastructure market?

Adoption of Energy-Efficient and Liquid Cooling Systems

Increasing data center density and environmental sustainability mandates have driven the adoption of advanced cooling technologies, such as liquid immersion cooling, in-row cooling, and free-air cooling systems. These solutions help reduce energy consumption, improve reliability, and lower operational costs. Integration with AI-based monitoring platforms enables predictive temperature control, enhancing overall efficiency. Leading enterprises and hyperscale data centers are increasingly retrofitting existing infrastructure with energy-efficient cooling, reflecting a market-wide shift toward sustainable operations.

Intelligent Power and Backup Systems

High uptime requirements have led to the deployment of intelligent UPS systems, modular power distribution units (PDUs), and renewable-energy-powered backup solutions. These systems offer real-time load monitoring, predictive fault detection, and automated energy optimization. Integration of lithium-ion batteries and hybrid power systems further strengthens reliability and reduces the total cost of ownership. Market players are prioritizing modular and scalable power solutions to meet fluctuating demand across enterprise, hyperscale, and edge data centers.

Integrated Monitoring and Management Solutions

Data center operators increasingly rely on software-driven infrastructure management platforms to monitor IT assets, power, and cooling in real time. These platforms utilize AI and machine learning to detect inefficiencies, predict failures, and optimize energy consumption. Remote monitoring capabilities and automation allow operators to manage multiple facilities with reduced personnel, improving operational efficiency and resilience. This trend is particularly significant in colocation and hyperscale segments where operational complexity is high.

What are the key drivers in the data center support infrastructure market?

Rising Demand for Cloud and Colocation Services

The surge in cloud computing, SaaS adoption, and colocation services has necessitated robust data center infrastructure. Enterprises are investing in scalable power, cooling, and monitoring systems to meet SLAs and maintain uptime. Hyperscale data centers require high-capacity, energy-efficient infrastructure to support AI, big data, and edge computing workloads. This trend is accelerating investments in modernized data center support systems, particularly in regions witnessing rapid cloud adoption, such as North America and APAC.

Increasing Energy Efficiency Regulations

Government mandates and green initiatives, including energy efficiency standards and incentives, are driving the adoption of eco-friendly infrastructure solutions. Cooling systems, UPS solutions, and monitoring platforms are being upgraded to reduce PUE (Power Usage Effectiveness) and carbon footprint. Europe, North America, and parts of Asia-Pacific have implemented regulatory frameworks that encourage sustainable practices, making energy-efficient systems a core growth driver.

Technological Advancements and Smart Infrastructure

Advancements in AI, IoT, and cloud-based monitoring have enabled predictive maintenance, fault detection, and resource optimization in real time. Smart racks, automated cooling, and intelligent PDUs improve operational efficiency and reduce downtime. Adoption of edge data centers and modular designs has further increased demand for integrated and adaptable support infrastructure.

What are the restraints for the global market?

High Capital Expenditure Requirements

Deployment of modern data center support infrastructure involves significant upfront investment, particularly for hyperscale and enterprise-class facilities. Costs associated with power systems, advanced cooling solutions, and intelligent management platforms can restrict adoption for mid-sized and small operators. Budget constraints and long ROI periods remain key challenges for expanding infrastructure deployment.

Complex Integration and Maintenance Challenges

Integrating new systems with legacy infrastructure can be technically challenging, requiring specialized knowledge and high operational expertise. Improper integration may lead to downtime, inefficiencies, or higher maintenance costs. As data center environments become increasingly complex, ensuring seamless operation across power, cooling, and monitoring systems remains a restraint to rapid market adoption.

What are the key opportunities in the data center support infrastructure market?

Expansion in Emerging Economies

Emerging markets in Asia-Pacific, Latin America, and the Middle East are witnessing rapid digitalization, fueling demand for new data centers and support infrastructure. Governments are promoting smart city projects, e-governance, and digital payments, which require scalable and reliable infrastructure. This presents an opportunity for global providers to expand their footprint and tailor solutions to cost-sensitive but high-growth markets.

Integration of Renewable Energy and Green Data Centers

Adoption of solar, wind, and hybrid energy solutions in data centers is gaining traction, driven by regulatory mandates and corporate sustainability goals. Providers offering green infrastructure solutions, including energy-efficient cooling and smart power management, can capture market share while supporting carbon neutrality objectives. Companies integrating energy storage and microgrid solutions are poised to lead this segment.

Edge Computing and Modular Data Centers

The rise of edge computing and IoT devices creates demand for smaller, modular data centers with reliable support infrastructure. Modular solutions, pre-fabricated systems, and containerized data centers allow faster deployment and scalable growth, offering opportunities for vendors to provide turnkey infrastructure solutions in both urban and remote locations. Integration of AI-enabled monitoring and automated management in modular systems enhances operational efficiency and opens new market segments.

Product Type Insights

Power infrastructure, including UPS systems and PDUs, accounts for the largest share of the market at approximately 35% of the 2024 market, reflecting critical requirements for uptime and reliability. Cooling systems are rapidly adopting liquid and in-row solutions, representing 28% of market share, as enterprises focus on efficiency and sustainability. Racks, enclosures, and monitoring platforms collectively hold about 20% of the market, driven by AI-based solutions and IoT-enabled monitoring adoption. Software and management platforms are witnessing high growth due to the need for predictive maintenance, automation, and centralized control of multi-site data centers.

Application Insights

Hyperscale data centers are the largest application segment, driven by cloud service providers and web-scale enterprises. Colocation facilities follow closely, fueled by outsourcing trends and shared infrastructure adoption. Enterprise data centers are increasingly upgrading support infrastructure to meet energy efficiency and uptime requirements. Edge data centers represent an emerging application, catering to latency-sensitive applications, IoT, and 5G deployments.

Distribution Channel Insights

Direct sales from manufacturers dominate, particularly for hyperscale and enterprise clients, offering customized solutions and long-term service agreements. System integrators and solution providers play a key role in modular and edge deployments. Online B2B platforms are growing for small-to-medium deployments, enabling configuration, ordering, and after-sales support. Strategic partnerships between hardware providers, software vendors, and cloud operators are also becoming significant channels for infrastructure deployment.

End-Use Insights

IT & telecom industries represent the largest end users, accounting for over 40% of demand, driven by cloud services, hyperscale expansion, and enterprise digital transformation. BFSI and government sectors are rapidly investing in secure, reliable infrastructure, contributing to high growth rates. Emerging sectors such as healthcare, retail, and manufacturing are adopting advanced data center support solutions, driven by AI, big data, and IoT integration. Export-driven demand from global hyperscale operators also fuels infrastructure sales, particularly in APAC and Europe.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America leads the market with approximately 38% share in 2024, driven by strong cloud adoption, hyperscale data center expansion, and high enterprise IT spending. The U.S. dominates the region, while Canada supports secondary growth through digitalization initiatives. Demand is concentrated on energy-efficient power and cooling systems, with AI-based monitoring increasingly adopted.

Europe

Europe accounts for 25% of the market, with Germany, the U.K., and France leading adoption. Regulatory mandates on energy efficiency and carbon neutrality drive investments in green infrastructure. The region is witnessing steady growth in colocation and enterprise upgrades, with AI-based monitoring and modular infrastructure gaining momentum.

Asia-Pacific

APAC is the fastest-growing region (12% CAGR), driven by China, India, and Japan. Government digitalization programs, cloud adoption, and new data center construction fuel infrastructure demand. Expansion of hyperscale facilities by global cloud providers is a key growth driver.

Middle East & Africa

The Middle East, led by the UAE and Saudi Arabia, is witnessing rapid growth in hyperscale and colocation data centers, supported by government-backed smart city projects. Africa sees emerging demand, particularly in South Africa, Nigeria, and Kenya, primarily for enterprise and regional colocation facilities.

Latin America

Latin America is a smaller yet growing market (6% share), with Brazil, Mexico, and Chile leading demand. Investments are mainly driven by digital transformation and cloud adoption in the enterprise and telecom sectors.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Data Center Support Infrastructure Market

- Schneider Electric

- ABB Ltd.

- Vertiv Holdings Co.

- Siemens AG

- Emerson Electric Co.

- Huawei Technologies Co., Ltd.

- Hitachi, Ltd.

- Rittal GmbH & Co. KG

- Delta Electronics, Inc.

- STULZ GmbH

- Legrand SA

- HPE (Hewlett Packard Enterprise)

- IBM Corporation

- Cisco Systems, Inc.

- Fujitsu Ltd.

Recent Developments

- In June 2025, Schneider Electric launched a next-generation modular data center power system with integrated AI monitoring for energy optimization.

- In April 2025, Vertiv announced the deployment of liquid immersion cooling systems across hyperscale data centers in APAC to improve energy efficiency by 25%.

- In February 2025, ABB introduced an intelligent UPS solution combining lithium-ion storage and predictive maintenance capabilities for enterprise and colocation data centers.