Power Distribution Unit Market Size

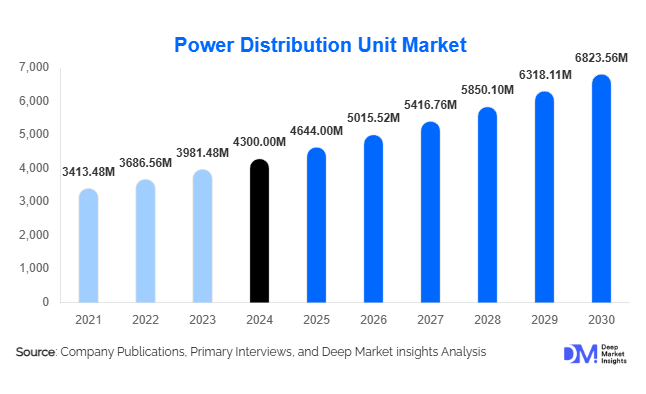

According to Deep Market Insights, the global power distribution unit market size is was valued at USD 4300 million in 2024 and is projected to grow from USD 4644 million in 2025 to USD 6823.56 million by 2030, expanding at a CAGR of 8.0% during the forecast period (2025–2030). This positive growth is driven by rapid data-centre expansion, rising industrial automation, increasing demand for energy-efficient and intelligent power distribution solutions, and regional infrastructure investments.

Key Market Insights

- Intelligent/monitored PDUs are gaining share, as data-centre and industrial operators increasingly deploy units with remote monitoring, outlet-level control, and smart analytics to manage energy usage and uptime.

- Three-phase and high-capacity PDUs are growing faster, reflecting increased loads in hyperscale data centres, industrial plants, and high-density computing environments.

- North America holds the largest regional share, supported by mature cloud and colocation-data-centre infrastructure, strong industrial sector uptake, and early adoption of advanced power-distribution technologies.

- Asia-Pacific is the fastest-growing region, with emerging demand in China, India and Southeast Asia for data centres, manufacturing automation, edge infrastructure and smart buildings.

- Sustainability, modularisation and digital integration shape dynamics, as operators emphasise energy-efficiency, remote/real-time monitoring, flexible deployment (modular PDUs), and embedded connectivity in power distribution systems.

- Edge computing and decentralised power distribution are new drivers, with smaller, distributed facilities and remote installations increasing the need for compact, intelligent PDUs in non-traditional settings.

What are the latest trends in the power distribution unit market?

Adoption of Smart and IoT-Enabled PDUs

Facility operators are increasingly moving from basic power-strips and simple distribution units to PDUs that incorporate network connectivity, sensors and remote management. These intelligent PDUs enable real-time load monitoring, outlet-level switching, fault detection and predictive maintenance, which helps reduce downtime, optimise energy usage and support higher density rack deployments. As the market shifts toward smarter infrastructure, PDU suppliers are offering modules and services rather than purely hardware, aligning with digital facility-management strategies.

Modular, Scalable and Edge-Ready Power Distribution

The power distribution market is trending toward modular, rack-oriented and edge-optimized designs that allow rapid deployment in data centres, colocation facilities, remote sites and industrial campuses. These modular PDUs reduce installation time, offer flexible configuration, and enable standardised global roll-out. In addition, edge computing sites and distributed infrastructure require smaller footprint, robust PDUs able to handle variable inputs (renewables, micro-grids) and remote connectivity. This modularisation improves scalability, reduces CAPEX/time-to-deploy and supports deployment in non-traditional geographies.

Sustainability, Efficiency and High-Capacity Distribution

As energy costs, regulatory pressure and environmental concerns rise, PDU adoption is being driven by features beyond simple power delivery, such as power-factor correction, high-efficiency components, and load balancing. For high-density compute (GPU/AI clusters) and industrial plants, three-phase or higher-capacity PDUs are increasingly used to manage large loads efficiently. Moreover, integration with renewable-microgrid or battery back-up systems is becoming more common, pushing power distribution unit manufacturers to support variable input and smarter distribution control. The push for carbon reduction and operational efficiency is reshaping product requirements and procurement criteria.

What are the key drivers in the global power distribution unit market?

Explosion of Data Centre, Cloud, and Edge Infrastructure

The growth in cloud services, hyperscale data centres and edge facilities is a major driver for the power distribution unit industry. Data-centres require reliable, scalable power distribution for servers, networking equipment and cooling systems, making PDUs a critical component. These facilities increasingly demand intelligent PDUs with monitoring and control functions, driving higher unit value. The rising densities of racks and the build-out of new sites create strong demand for both basic and advanced PDU types.

Manufacturing Automation and Industrial Digitisation

Industries are investing in automation, IoT sensors, robotic production lines and digital manufacturing platforms, all of which increase demand for dependable power-distribution systems. In these settings, three-phase, high-capacity PDUs with monitoring are needed to maintain uptime and performance. As factories across Asia, Latin America and Europe upgrade infrastructure, PDU demand from industrial end-use expands significantly.

Regional Infrastructure Expansion and Energy-Efficiency Imperatives

Global infrastructure programmes, such as data-centre expansion, smart-city build-out, renewable-energy integration and grid modernisation, create tailwinds for PDU growth. Operators are under pressure to reduce energy consumption, manage power loads and ensure uptime. PDUs with enhanced functionality (metering, monitoring, remote switching) become part of the solution. In emerging regions, infrastructure build-out combined with power-upgrade programmes creates new demand for PDUs.

What are the key challenges faced by the global market?

High Upfront Costs and Complexity of Advanced PDUs

Advanced PDUs (intelligent, switched, remote-monitoring enabled) carry higher cost than basic distribution units. Smaller facilities or budget-constrained segments may delay adoption, opting for simpler units. The additional investment in software, sensors and connectivity can slow uptake in cost-sensitive markets.

Compatibility, Standardisation and Supply-Chain Constraints

Global installations face varying voltage standards, rack formats, network protocols and regional certifications. Ensuring compatibility across geographies and integration with existing infrastructure can be complex. Additionally, component shortages (e.g., sensors, semiconductors), rising raw-material costs (copper, steel) and supply-chain disruptions may constrain PDU manufacturers and delay shipments or raise costs.

What are the key opportunities in the power distribution unit industry?

Edge Data-Centres, Micro-Sites and Distributed Architecture

As digital services proliferate (5G/6G, IoT, autonomous systems), smaller edge data centres and micro-sites are being deployed closer to end-users. These sites require compact, efficient PDUs with remote monitoring and often variable power input. PDU vendors can target this emerging model with modular solutions, standardised modules, and managed-services offerings. Serving this niche opens growth beyond traditional hyperscale data-centres.

Smart Manufacturing, Industry 4.0 and Automation Upgrades

Manufacturing plants are modernising with digital tools, connected systems and robotics. This shift demands reliable power distribution with higher intelligence and control. PDU suppliers can tailor products for industrial use-cases, including ruggedised units, higher capacity, three-phase support, environmental monitoring, and integration with factory‐automation software. This creates a strong growth niche within the PDU market beyond IT-only applications.

Renewable-Energy, Micro-Grids & Grid-Edge Integration

With renewable generation, battery energy storage systems (BESS), and micro-grids growing worldwide, there is increasing need for advanced power-distribution infrastructure that handles variable loads, switching dynamics, fault tolerance and load monitoring. PDUs designed for these environments, including three-phase units with intelligent switching and monitoring, present interesting opportunities. Market entrants and incumbents can gain advantage by offering specialised PDUs for renewable/BESS/micro-grid applications, tapping into a less saturated segment.

Component Type Insights

While basic PDUs remain the largest by volume due to broad installation base, higher-value segments such as metered, monitored and intelligent PDUs are growing rapidly. Customers are shifting from simple power distribution toward units that offer data (power usage), control (remote switching) and analytics (load-balancing, fault detection). Vendors bundling hardware with software, analytics and services are gaining traction as customers seek integrated solutions rather than standalone devices.

End-Use Industry Insights

The IT & telecom/data-centre sector remains the largest end-user vertical for PDUs, driven by cloud providers, hyperscalers and telecommunications operators rolling out large compute and storage infrastructure. Beyond this, manufacturing (industrial automation), healthcare (medical equipment and digital diagnostics), commercial buildings (smart offices) and government facilities represent growing demand. Export-driven demand is also rising: equipment manufacturers in North America & Europe supply PDUs or embedded systems to build-out regions in Asia-Pacific and Latin America. As verticals such as AI services, autonomous mobility and smart manufacturing expand, they drive customised PDU demand with specific requirements (high-density racks, rugged environments, remote sites).

| By Product Type | By Power Phase | By Mounting Configuration | By Application | By End Use Industry | By Region |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

North America

North America continues to lead the global power distribution unit market, commanding approximately 30% share in 2024. The region’s dominance stems from its strong cloud-hyperscale infrastructure, wide adoption of advanced power-distribution systems, and mature data-centre and industrial sectors. The United States is the primary contributor, supported by large investments in data-centre campuses, industrial automation and edge deployments. Though mature, the region still offers steady growth (~7–8% CAGR) through upgrades and capacity expansion in secondary markets such as Texas, Virginia and Ohio.

Asia-Pacific

The Asia-Pacific (APAC) region represents the fastest-growing power distribution unit market, with an estimated 25% share in 2024 and a projected double-digit CAGR through 2030. Rapid digitalisation, the expansion of 5G/IoT, and strong data-centre and manufacturing investment in China, India, Japan, South Korea and Southeast Asia fuel growth. China remains the largest country market in the region, backed by government-led infrastructure and cloud-capacity expansion. India is emerging quickly with investments in data-centre clusters and manufacturing electrification. The Southeast Asia region (Singapore, Malaysia, Thailand) is also gaining as colocation and edge hubs shift there. APAC’s dynamic mix of developed and emerging economies, plus favourable policies, makes it a highly competitive region for PDU growth.

Europe

Europe accounted for around 22% of the global market in 2024, underpinned by enterprise and colocation demand across major economies like the UK, Germany, the Netherlands and France. Growth is driven by commercial buildings, data-centre expansions and industrial automation upgrade cycles. The region emphasises sustainability, renewable-powered data centres and retrofit of older infrastructure, which supports incremental PDU demand. Growth rate is moderate (~6–7% CAGR) but product value tends to be higher due to advanced features and retrofit nature of many projects.

Latin America

Latin America currently holds about 8% share of the global market in 2024, with steady growth expected as cloud adoption accelerates and connectivity infrastructure improves. Brazil leads, supported by investments from hyperscale providers and industrial upgrades. Mexico is emerging as a secondary hub due to near-shoring and data-localisation trends. Although power-supply reliability, fibre infrastructure and currency volatility pose challenges, governments are introducing tax incentives and public-private initiatives to attract data-centre and manufacturing investment, which will drive PDU demand.

Middle East & Africa

The Middle East & Africa (MEA) region represents roughly 10% of the global market in 2024 and is rapidly evolving into a strategic growth frontier. Countries such as UAE and Saudi Arabia are investing heavily in data-centre infrastructure, smart cities and industrial zones. South Africa dominates sub-Saharan Africa’s PDU demand currently, but edge and modular facility development is rising in Kenya, Nigeria and other markets. With strong growth potential (~9–11% CAGR) through 2030, MEA is positioned as one of the fastest-growing regions globally in the PDU market.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Global Power Diistribution Unit Market

- Schneider Electric SE

- Eaton Corporation

- Vertiv Group Corp.

- ABB Ltd.

- Legrand SA

- Delta Electronics, Inc.

- CyberPower Systems, Inc.

- Server Technology Inc.

- Rittal GmbH & Co. KG

- HPL Electric & Power Ltd.

- Enlogic Systems LLC

- BACHMANN GmbH

- Tripp Lite (now Eaton) – note: listed via parent market

- Leviton Manufacturing Co., Inc.

- Siemens AG

Recent Developments

- In September 2025, FORVIA HELLA introduced the world’s first intelligent Power Distribution Module (iPDM) featuring electronic fuses (eFuses) to enhance reliability and enable fail-operational power management in automated vehicles. The new system minimizes installation space and overall weight, making it highly suitable for next-generation electronic architectures in modern automotive applications.