Data Center Infrastructure Market Size

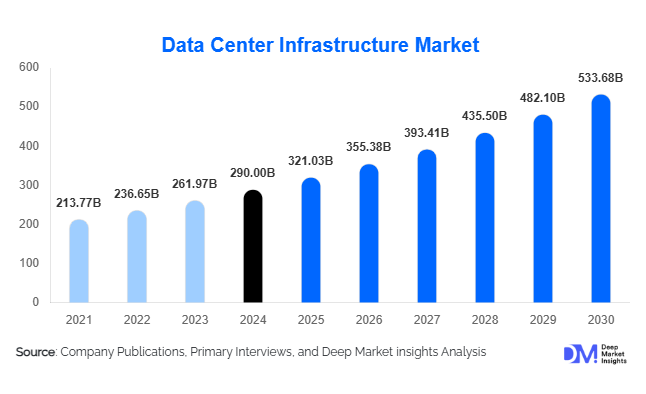

According to Deep Market Insights, the global data center infrastructure market size was valued at USD 290 billion in 2024 and is projected to grow from USD 321.03 billion in 2025 to USD 533.68 billion by 2030, expanding at a CAGR of 10.7% during the forecast period (2025-2030). Rapid proliferation of cloud services, hyperscale data-center build-outs, growth of edge computing and AI-driven workloads, plus increasing demand for energy-efficient infrastructure are the primary growth drivers of this market.

Key Market Insights

- Hardware infrastructure remains the largest component segment, reflecting the capital-intensive nature of data-center build-outs and upgrades driven by higher rack densities and AI/ML workloads.

- Cloud/hyperscale and colocation deployments dominate the type segment, as large cloud providers and third-party operators expand global footprint to meet demand for data-storage, processing and edge-services requiring resilient infrastructure.

- North America holds the largest regional share, due to mature infrastructure, strong hyperscale presence, favourable power/telecom infrastructure and early adoption of advanced cooling and modular designs.

- Asia-Pacific is the fastest-growing region, with emerging economies such as India, China and Southeast Asia driving data-centre infrastructure demand through digital-transformation, localisation of data, 5G/IoT roll-out and incentive policies.

- Sustainability and modular infrastructure integration are reshaping market dynamics, with operators prioritising energy-efficient power-distribution, liquid-cooling, prefabricated modular builds and smart infrastructure management.

- Edge-data-centres and distributed infrastructure are gaining traction, enabling lower-latency services, regional compute and new use-cases in sectors such as manufacturing, smart cities and autonomous systems.

What are the latest trends in the data center infrastructure market?

Modular and Prefabricated Infrastructure Deployment

Data-center operators are increasingly turning to modular and prefabricated infrastructure to accelerate capacity deployment and enhance scalability. These systems include pre-engineered power units, cooling modules, and IT racks that can be assembled rapidly, reducing construction timelines by up to 40% compared to conventional builds. Modular solutions also enable standardization across geographies, support flexible capacity planning, and allow faster response to demand surges from AI and cloud workloads. Additionally, the shift toward edge computing makes modular deployments vital in remote or secondary locations where traditional builds are less feasible.

Green, Energy-Efficient Data Centres and Liquid Cooling Adoption

Sustainability has become a defining trend shaping the future of data-center infrastructure. Operators are focusing on renewable power procurement, grid-interactive energy systems, and innovative cooling strategies to lower operational emissions. The adoption of direct-to-chip and immersion liquid cooling is expanding, particularly for high-density AI and HPC clusters, as it enables better heat management and reduces overall PUE (power usage effectiveness) ratios. Circular-economy practices such as equipment reuse, efficient power distribution units (PDUs), and heat recovery systems are also being integrated into facility design. These developments align with corporate net-zero goals and evolving environmental regulations across the U.S., EU, and Asia-Pacific.

What are the key drivers in the data center infrastructure market?

Explosion of Data, AI/ML Workloads and Cloud Migration

The exponential increase in global data generation driven by streaming, IoT, connected devices, and AI applications is pushing data centers to upgrade and expand infrastructure at unprecedented speed. The rise of AI/ML workloads requires more GPU-intensive architectures, high-bandwidth networking, and power-dense cooling environments. Enterprises and cloud providers are transitioning to hybrid and multi-cloud ecosystems, intensifying demand for resilient, scalable, and software-defined infrastructure. These combined trends are not only expanding the physical footprint of data centers but also accelerating innovation in electrical distribution, thermal systems, and intelligent monitoring solutions.

Hyperscale and Colocation Provider Expansion

Global hyperscalers and colocation providers continue to drive market growth through extensive buildouts in both developed and emerging regions. Multi-billion-dollar campus-style facilities are being constructed to meet rising cloud-service demand, often incorporating next-generation power architectures and integrated cooling systems. This expansion supports robust supply chains for equipment manufacturers and engineering firms involved in design, commissioning, and facility operations. Moreover, as enterprises increasingly outsource their data-center operations, colocation and managed-service providers are capturing a larger share of infrastructure investments, creating strong recurring revenue streams for supporting vendors.

Edge Computing and Data-Localization Legislation

The surge in low-latency applications, 5G connectivity, and regional data-sovereignty requirements is reshaping infrastructure strategies. Edge data centers, small, distributed facilities located closer to end users, are emerging as key enablers of real-time analytics, autonomous systems, and content delivery. Simultaneously, countries implementing data-localization mandates are driving domestic infrastructure investment to ensure data is stored and processed within national borders. This combination of regulatory and technological factors is fueling demand for compact, modular, and scalable infrastructure solutions optimized for distributed architectures and regional compliance frameworks.

What are the key challenges in the global industry

High Capital Expenditure and Operating Costs

The development of modern data centers requires substantial upfront investment in land, construction, grid interconnection, and advanced infrastructure systems such as power distribution and cooling. These facilities demand redundant systems, advanced monitoring, and high-density configurations to meet enterprise and hyperscale standards. As a result, total capital expenditure can reach tens or even hundreds of millions of dollars per site. Operating costs, including energy, maintenance, and skilled labor, remain high, particularly in regions with volatile electricity pricing or limited renewable energy access. These financial pressures often deter new entrants and slow expansion in developing economies where financing and power reliability are limited.

Power, Resource, and Regulatory Constraints

Power availability, water resources, and regulatory complexity continue to pose structural challenges for data-center infrastructure growth. In many markets, grid capacity is strained, leading to competition between industrial and data-center users for reliable supply. Cooling requirements add further stress on water and energy systems, particularly in high-temperature regions. Environmental regulations, lengthy permitting processes, and community concerns around land use and emissions can delay project timelines by several months or even years. As governments tighten sustainability standards, operators must navigate a complex compliance environment, which increases both project costs and time-to-market, restraining overall industry expansion.

What are the key opportunities in the data center infrastructure industry?

Rapid Retrofit & Upgrade Market for Legacy Data Centres

As over 40% of the world’s data-center capacity was built before 2015, retrofitting existing facilities represents a major near-term opportunity. Upgrades to high-efficiency UPS systems, liquid-cooling modules, intelligent PDUs, and AI-driven management platforms are being prioritized to extend asset life and improve sustainability metrics. Vendors offering integrated retrofit packages and minimal downtime solutions are likely to see strong demand from enterprise and colocation operators seeking to optimize existing footprints rather than invest solely in new builds.

Emerging Markets Expansion & Regional Data-Localization Projects

Emerging regions including Southeast Asia, India, the Middle East, and Latin America are rapidly becoming strategic growth zones as governments invest in digital transformation and enforce data-localization laws. Infrastructure providers can benefit from public-private partnerships, special economic zones, and energy-incentive programs designed to attract data-center development. Regional customization such as modular cooling for high-temperature zones and renewable microgrids for off-grid sites will be essential to capturing these high-growth, underserved markets.

Integration of AI/ML, High-Density Compute and Edge Applications

AI-driven data centers are creating new opportunities across hardware, infrastructure software, and services. Vendors specializing in high-density rack design, advanced liquid-cooling systems, and power optimization for GPU clusters stand to benefit from the shift toward compute-intensive workloads. Moreover, the integration of AI into facility management through predictive maintenance, dynamic cooling, and automated workload balancing will redefine operational efficiency. As edge applications proliferate, opportunities extend to micro data centers, modular edge nodes, and managed infrastructure services designed for distributed, low-latency operations.

Component Type Insights

By component, the data center infrastructure market is segmented into Hardware, Software, and Services.

Hardware remains the dominant category, comprising servers, storage, networking equipment, power distribution units (PDUs), and cooling systems that represent the bulk of capital investments. Software components such as Data Center Infrastructure Management (DCIM), orchestration, and virtualization platforms are witnessing steady growth as operators pursue automation, visibility, and energy optimization. The services segment, including consulting, installation, integration, and managed services, is expanding rapidly as organizations prioritize end-to-end lifecycle management and hybrid infrastructure support.

Data Center Type Insights

Based on data center type, the data center infrastructure industry is divided into Enterprise Data Centers, Colocation Data Centers, Hyperscale Data Centers, and Edge Data Centers.

Hyperscale facilities account for the largest share, driven by massive cloud service providers and content delivery networks. Colocation centers are growing as enterprises seek flexible capacity without major capital outlays, while edge data centers are emerging to support low-latency applications and regional digital expansion. Enterprise-owned facilities continue to evolve through modular and hybrid designs that combine on-premises and cloud-based resources.

Deployment Model Insights

In terms of deployment, the market is segmented into On-Premises, Cloud, and Hybrid models.

Hybrid deployment dominates current investment trends as enterprises balance security, control, and scalability. Cloud-based data centers are expanding rapidly due to cost-efficiency and elastic storage capabilities, while on-premises systems retain importance in regulated industries such as BFSI and healthcare. Increasing integration between public and private clouds is reshaping infrastructure procurement strategies globally.

End-Use Industry Insights

By end-use industry, the market includes IT & Telecom, BFSI, Healthcare, Manufacturing, Government & Public Sector, Retail & E-commerce, Energy, and Others.

The IT & Telecom segment leads, driven by hyperscalers and telecom operators building new capacity for AI workloads, 5G rollout, and data-intensive services. BFSI institutions are investing in high-security infrastructure to support digital transactions and risk analytics. Healthcare is witnessing steady growth due to telemedicine and electronic records, while manufacturing and energy sectors are adopting industrial IoT platforms that demand edge and private cloud capacity. The public sector and retail industries are also key contributors to overall market expansion.

| By Component | By Data Center Type | By Deployment Model | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America continues to lead the global data center infrastructure market, commanding approximately 38% share in 2024. The region’s dominance stems from its extensive hyperscale presence, robust cloud infrastructure, and concentration of leading technology providers. The United States remains the largest contributor, supported by large-scale investments from hyperscalers such as Amazon Web Services, Microsoft, Google, and Meta. These companies are continuously expanding capacity through sustainable and AI-optimized facilities. Canada is also seeing notable growth driven by increasing data localization laws and the expansion of renewable-powered data centers, particularly in Ontario and Quebec. The region benefits from reliable power supply, mature fiber networks, and advanced cooling technologies, which collectively enhance operational efficiency. Despite its maturity, ongoing digital transformation initiatives and rising AI workloads are expected to sustain steady growth of around 7–8% CAGR through 2030, particularly in secondary markets such as Texas, Virginia, and Oregon, where favorable tax incentives and real estate availability continue to attract new investments.

Asia-Pacific

The Asia-Pacific (APAC) region represents the fastest-growing market, with a 22% share in 2024 and a projected double-digit CAGR through 2030. Rapid digitalization, the expansion of 5G and IoT ecosystems, and a surge in data localization mandates are propelling demand across China, India, Japan, Australia, and Southeast Asia. China continues to lead regional investments, supported by government-backed digital infrastructure projects and green data center initiatives. India has emerged as a critical global hub, with planned investments exceeding USD 10 billion through 2030 in major clusters like Mumbai, Hyderabad, and Chennai. Japan and South Korea remain mature yet innovative markets focusing on high-efficiency and disaster-resilient infrastructure. Meanwhile, Singapore and Indonesia serve as major colocation and cloud gateways for Southeast Asia, although Singapore’s temporary data center moratorium has redirected investments to Malaysia and Thailand. Overall, APAC’s dynamic mix of developed and emerging economies, along with favorable policies such as “Digital India” and “China’s New Infrastructure Plan,” makes it the most competitive region for future capacity expansion.

Europe

Europe accounted for around 25% of the global market in 2024, underpinned by strong enterprise and colocation demand across major economies including the UK, Germany, the Netherlands, France, and the Nordics. The region’s growth is primarily fueled by strict data protection laws (GDPR), government-backed sustainability frameworks, and the ongoing transition toward renewable-powered facilities. The UK and Germany lead in cloud adoption and hyperscale data center development, while the Netherlands remains a key connectivity hub due to its strategic location and advanced digital infrastructure. Nordic countries such as Sweden, Finland, and Denmark are emerging as green data center destinations, leveraging abundant renewable energy and cooler climates to lower operational costs. Although Europe’s overall growth rate is moderate at 6.5% CAGR, the emphasis on carbon neutrality and next-generation cooling technologies positions the region as a leader in sustainable infrastructure innovation.

Latin America

Latin America currently holds a 6% share of the global data infrastructure industry in 2024, with steady growth expected as cloud adoption accelerates and connectivity infrastructure improves. Brazil leads regional development, supported by major investments from hyperscalers like AWS, Google Cloud, and Microsoft Azure. Mexico is emerging as a secondary hub, driven by nearshoring trends, data localization policies, and strong demand from financial and manufacturing sectors. Chile and Colombia are also attracting attention for renewable-powered data centers, leveraging hydro and solar resources. Despite challenges such as inconsistent power supply, limited fiber coverage, and currency volatility, regional governments are increasingly introducing tax incentives and public-private partnerships to attract foreign investment. Over the next decade, the combination of improved digital infrastructure and growing demand for cloud-based services is expected to elevate Latin America’s position in the global data center landscape.

Middle East & Africa

The Middle East and Africa (MEA) region represents approximately 5% of the global market in 2024 but is rapidly evolving into a strategic growth frontier. The UAE and Saudi Arabia are spearheading this expansion through national digitalization programs such as “Vision 2030” and large-scale investments in hyperscale and colocation facilities. These countries are positioning themselves as regional data hubs connecting Europe, Asia, and Africa. South Africa dominates sub-Saharan Africa’s data center landscape, accounting for more than 50% of the region’s installed capacity, followed by Kenya and Nigeria, which are seeing rising investments in modular and edge facilities to support fintech and telecom growth. Increasing submarine cable deployments and government incentives for renewable energy use are further improving market viability. With a projected CAGR exceeding 11% through 2030, MEA is poised to become one of the fastest-growing regions globally, driven by expanding digital ecosystems, smart city projects, and localized cloud infrastructure initiatives.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Companies in the Data Center Infrastructure Market

- Dell Technologies

- Hewlett Packard Enterprise

- Cisco Systems

- IBM

- Schneider Electric

- ABB

- Vertiv

- Huawei Technologies

- Intel

- Nvidia

- Legrand

- Eaton Corporation

- Microsoft

- Amazon Web Services (AWS)

- Google (Alphabet)

Recent Developments

- In August 2025, Google LLC announced a USD 9 billion investment to develop new AI-ready data center facilities across Virginia, strengthening its North American infrastructure footprint. The company also committed to advancing large-scale renewable energy projects to sustainably power its rapidly expanding operations.

- In July 2025, Microsoft Corporation expanded its global data center capacity by more than 2 gigawatts over the past year, underscoring its continued investment in cloud infrastructure. The company’s Azure platform surpassed USD 75 billion in annual revenue, reflecting strong enterprise demand for scalable and AI-integrated cloud services.