Data Center Outsourcing Market Size

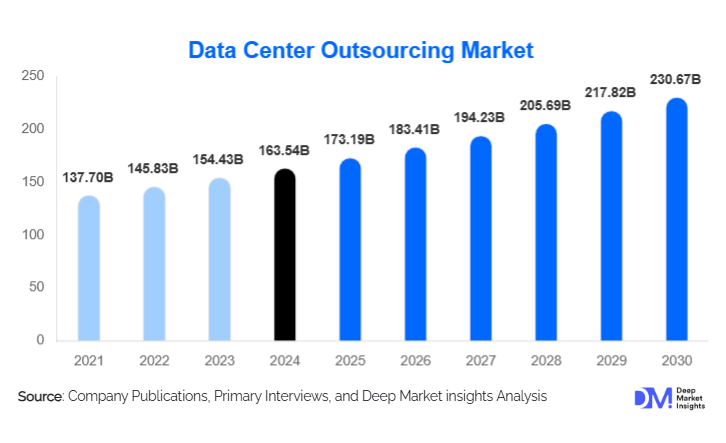

According to Deep Market Insights, the global data center outsourcing market size was valued at USD 163.54 billion in 2024 and is projected to grow from USD 173.19 billion in 2025 to reach USD 230.67 billion by 2030, expanding at a CAGR of 5.90% during the forecast period (2025–2030). The growth of the data center outsourcing market is driven by the rising adoption of cloud computing, increasing demand for scalable IT infrastructure, and the growing need for disaster recovery and managed hosting services across enterprises globally.

Key Market Insights

- Cloud adoption and hybrid IT strategies are accelerating demand for outsourced data center services, enabling enterprises to reduce capital expenditure and optimize operational costs.

- Managed hosting and colocation services dominate the market, driven by the growing need for secure, scalable, and cost-efficient IT infrastructure solutions.

- North America remains the largest market, supported by high cloud penetration, the presence of leading data center service providers, and extensive enterprise IT investments.

- Asia-Pacific is the fastest-growing region, fueled by rapid digital transformation, government initiatives supporting IT infrastructure, and rising demand from SMEs.

- Technological integration, including AI-driven monitoring, automated management, and energy-efficient solutions, is reshaping the data center outsourcing landscape.

What are the latest trends in the data center outsourcing market?

Hybrid and Multi-Cloud Strategies

Enterprises are increasingly adopting hybrid and multi-cloud strategies to enhance flexibility, scalability, and resilience. Data center outsourcing providers are integrating public and private cloud environments, enabling seamless workload migration, disaster recovery, and high availability. Multi-cloud deployments reduce vendor lock-in and provide performance optimization across geographies, attracting global enterprises seeking agility and cost-efficiency. Providers are also offering tailored SLAs, automated orchestration, and cloud-native services to support these complex IT strategies, which is driving a shift in outsourcing models.

Energy-Efficient and Green Data Centers

With rising environmental concerns and increasing energy costs, service providers are focusing on green and energy-efficient data centers. Adoption of renewable energy sources, advanced cooling techniques, and AI-based power management is becoming mainstream. Enterprises prefer providers with sustainable infrastructure to align with corporate ESG goals and reduce operational expenses. These initiatives also contribute to government compliance and attract environmentally conscious customers, reinforcing the trend of sustainable data center outsourcing.

What are the key drivers in the data center outsourcing market?

Rising Cloud and Digital Transformation Initiatives

Global enterprises are heavily investing in digital transformation, cloud adoption, and IT modernization programs. Data center outsourcing enables organizations to access advanced infrastructure without the need for significant capital expenditure. Increasing deployment of AI, IoT, and big data analytics requires scalable, secure, and high-performance hosting solutions, driving demand for colocation, managed hosting, and IaaS services. This trend is particularly evident among large enterprises in the BFSI, IT, and healthcare sectors.

Focus on Cost Optimization and Operational Efficiency

Outsourcing data center operations helps enterprises optimize costs by shifting from CAPEX-intensive models to flexible OPEX structures. Managed services, colocation, and cloud hosting reduce the need for in-house IT staff, lower energy costs, and mitigate risks of downtime or service disruptions. Organizations increasingly prefer providers offering monitoring, automation, and predictive maintenance, ensuring business continuity and operational efficiency. Cost optimization remains a top priority, especially for SMEs and mid-market enterprises looking for scalable infrastructure without major upfront investments.

What are the restraints for the global market?

Data Security and Compliance Concerns

Data breaches, cybersecurity threats, and compliance regulations are critical challenges for enterprises outsourcing data center operations. Stringent regional regulations, such as GDPR in Europe, require robust data governance frameworks. Concerns about data privacy and third-party access can slow adoption rates, particularly among highly regulated industries like healthcare and BFSI. Providers must invest in advanced security protocols, regular audits, and regulatory compliance certifications to mitigate these restraints.

High Initial Integration Costs

Transitioning to outsourced data center solutions often involves significant upfront costs for integration, migration, and system alignment. Legacy systems may require customization to work with external infrastructure, creating additional complexity. Enterprises may face downtime risks during migration and require specialized consulting services, which can act as a restraint, especially for smaller organizations with limited budgets.

What are the key opportunities in the data center outsourcing industry?

Growth in Emerging Markets

Asia-Pacific and Latin America present significant opportunities due to rising digital adoption, government-backed IT infrastructure initiatives, and increasing SME penetration. Countries like India, China, and Brazil are witnessing high demand for cloud-based services, managed hosting, and colocation, making them prime targets for expansion. Providers can leverage these markets to scale operations, introduce localized solutions, and benefit from government incentives for digital infrastructure development.

Integration of AI and Automation in Data Centers

AI-driven monitoring, predictive maintenance, and automated management solutions are transforming outsourced data center operations. Providers that integrate machine learning algorithms for energy management, workload optimization, and security monitoring can offer differentiated services. Automation reduces human errors, enhances operational efficiency, and enables faster deployment of services, creating a strong growth opportunity for technology-forward providers.

Disaster Recovery and Business Continuity Services

Enterprises increasingly prioritize uninterrupted operations in the face of natural disasters, cyberattacks, or system failures. Outsourced disaster recovery (DR) and backup services provide cost-effective solutions for risk mitigation. Cloud DR, replication, and geographically distributed backup facilities are gaining traction, particularly in finance, healthcare, and e-commerce sectors. Expanding these services offers providers opportunities to capture high-value contracts and long-term service agreements.

Service Type Insights

Managed hosting services lead the market, capturing approximately 28% of the 2024 market share. Organizations prefer fully managed solutions that include monitoring, maintenance, and security services, reducing internal IT burdens. Colocation services hold 22% market share, driven by enterprises seeking scalable infrastructure with guaranteed uptime and connectivity. IaaS and cloud outsourcing account for 25%, expanding rapidly due to digital transformation and multi-cloud adoption. Disaster recovery services represent around 10% of the market, with growing awareness of business continuity risks. PaaS and SaaS-related outsourcing are emerging segments focused on application hosting and DevOps support.

End-Use Insights

IT & Telecom remains the largest end-use segment, accounting for approximately 30% of 2024 market demand, driven by the need for high-performance infrastructure and global connectivity. BFSI follows with 18%, prioritizing secure and compliant hosting solutions. Healthcare and life sciences are rapidly growing due to electronic medical records, telemedicine, and regulatory requirements. Retail and e-commerce sectors are adopting outsourced solutions for scalability and peak season traffic management. Export-driven demand is increasing as multinational corporations centralize IT operations in outsourced facilities to serve global markets efficiently.

| By Service Type | By Deployment Model | By Enterprise Size | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America is the largest market with a 38% share in 2024, led by the U.S. and Canada. High cloud adoption, mature IT infrastructure, and the presence of leading service providers drive demand. Enterprises in BFSI, IT, and healthcare actively outsource data center operations to improve cost efficiency and scalability.

Europe

Europe accounts for 28% of the 2024 market share, with the U.K. and Germany being the largest contributors. Stringent data protection regulations and increasing cloud adoption are driving managed hosting and colocation demand. Germany is the fastest-growing country due to industrial digitalization and government incentives for IT infrastructure upgrades.

Asia-Pacific

Asia-Pacific is the fastest-growing region, fueled by India, China, and Japan. Rising digital transformation, SME adoption, and government-backed IT initiatives are increasing demand. Cloud-based services, hybrid IT models, and colocation are major growth drivers.

Middle East & Africa

The Middle East, particularly the UAE and Saudi Arabia, is witnessing growing investments in IT infrastructure and cloud services. Africa’s data center adoption is gradually rising with new colocation facilities in South Africa and Nigeria. Demand is primarily driven by BFSI, telecom, and government sectors.

Latin America

Brazil, Mexico, and Argentina are emerging markets for data center outsourcing. Enterprises are adopting cloud and managed hosting services to enhance scalability, driven by digitalization and e-commerce growth. Adoption remains moderate due to infrastructure gaps, but CAGR is projected to exceed 12% during 2025–2030.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Data Center Outsourcing Market

- IBM

- Equinix

- Digital Realty

- NTT Communications

- Hewlett Packard Enterprise (HPE)

- Fujitsu

- Oracle

- Atos

- CyrusOne

- China Telecom

- NTT Ltd.

- Telefonica

- Rackspace Technology

- Amazon Web Services (AWS)

- Microsoft Azure

Recent Developments

- In March 2025, Equinix announced a new hyperscale data center in Singapore with renewable energy-powered operations to support growing APAC demand.

- In January 2025, Digital Realty expanded its European footprint with a new colocation facility in Germany, focusing on hybrid cloud solutions and AI-driven management.

- In December 2024, IBM launched AI-powered data center monitoring and predictive maintenance services across North America, enhancing managed hosting offerings.