Dairy Products Culture Market Size

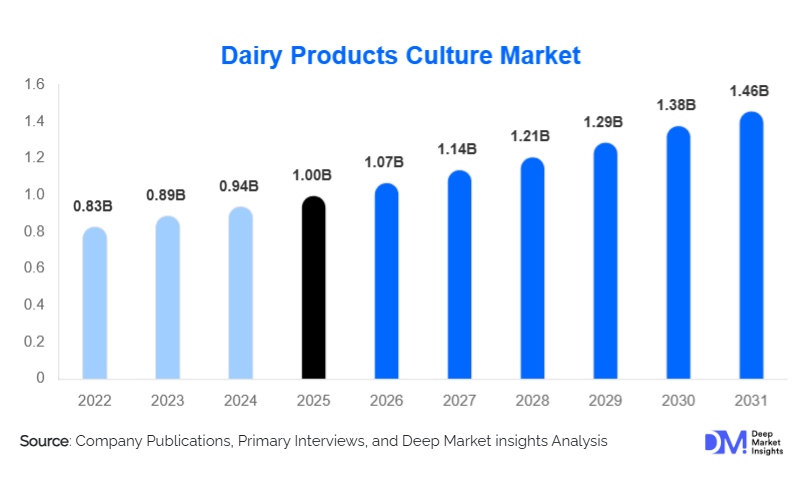

According to Deep Market Insights, the global dairy products culture market size was valued at USD 1.0 billion in 2025 and is projected to grow from USD 1.07 billion in 2026 to reach USD 1.46 billion by 2031, expanding at a CAGR of 6.5% during the forecast period (2026–2031). The dairy products culture market growth is primarily driven by rising demand for fermented and functional dairy products, increasing adoption of advanced microbial cultures in industrial dairy production, and the rapid expansion of dairy processing infrastructure across emerging economies.

Key Market Insights

- Fermented and probiotic dairy products are increasingly influencing culture demand, as consumers globally adopt yogurts, kefir, and specialty cheeses for digestive and immune health benefits.

- Technological advancements, including encapsulated and freeze-dried cultures, multi-strain probiotic blends, and digital fermentation monitoring, are driving premiumization and efficiency in culture utilization.

- Europe dominates the market, driven by strong cheese-making traditions, advanced dairy processing, and regulatory compliance ensuring high-quality cultures.

- Asia-Pacific is the fastest-growing region, fueled by rising urbanization, increased disposable income, and growing adoption of Western-style yogurts and functional dairy products.

- North America remains a mature, high-value market, with the U.S. and Canada leading in industrial dairy adoption and premium yogurt production.

- Export demand is rising, as Europe and North America export specialized cultures and fermented dairy products to emerging markets in APAC, the Middle East, and Latin America.

What are the latest trends in the dairy products culture market?

Rise of Functional and Probiotic Cultures

Manufacturers are increasingly developing cultures that offer added health benefits, such as improved gut health, immunity, and even mental wellness support. Multi-strain probiotic blends, encapsulated cultures for extended shelf life, and tailored thermophilic and mesophilic cultures are gaining adoption in both industrial and artisanal dairy products. The trend aligns with consumers’ demand for clean-label, natural, and functional dairy products, driving growth in specialty yogurts, kefir, skyr, and probiotic-enriched cheeses.

Technological Integration in Cultural Manufacturing

Advanced fermentation technologies, including freeze-drying, microencapsulation, and digital monitoring of microbial viability, are improving product consistency and reducing waste in industrial dairy production. These innovations also enable faster R&D cycles for culture strain optimization. Companies investing in biotech and process automation are able to supply more resilient cultures suitable for emerging markets with less-developed cold chains, expanding market reach globally.

What are the key drivers in the dairy products culture market?

Growing Demand for Fermented and Premium Dairy Products

The increasing consumption of yogurt, cheese, kefir, and other fermented dairy products is a major driver. Health-conscious consumers are seeking probiotic and functional options, and dairy processors are adopting specialized cultures to maintain consistent flavor, texture, and microbial benefits at scale. Industrial dairy plants benefit from high-performing cultures that reduce fermentation time and improve product quality, reinforcing market growth.

Expansion of Industrial Dairy Processing Infrastructure

Large-scale dairy plants and modern processing facilities are adopting standardized microbial cultures to ensure consistent quality. Investments in automated processing, cold-chain logistics, and process monitoring enable widespread adoption of advanced cultures, particularly in North America, Europe, and APAC. These capabilities allow manufacturers to scale operations efficiently and meet the rising demand for both domestic and export markets.

Innovation in Microbial Culture Technology

Advances in encapsulation, freeze-dried cultures, and multi-strain probiotics are enabling more stable and versatile culture applications. Such innovations support functional dairy product development, improve shelf life, and enhance sensory qualities. Companies leveraging these technologies can differentiate offerings and command higher margins, driving overall market growth.

What are the restraints for the global market?

Cold Chain and Storage Requirements

Dairy cultures are live microorganisms that require precise temperature control during transport and storage. In regions with limited cold-chain infrastructure, maintaining viability is challenging, potentially limiting market expansion. Any disruption in the cold chain can affect fermentation efficiency and product quality, acting as a key barrier.

Price Volatility and Regulatory Compliance

The cost of raw materials, combined with regional differences in regulatory approvals for microbial cultures and probiotics, can restrict growth. Compliance with labeling, safety, and microbial efficacy standards increases operational costs for manufacturers, especially when distributing cultures globally.

What are the key opportunities in the dairy products culture market?

Expansion into Functional & Personalized Nutrition

There is strong potential to develop specialized culture blends targeting gut health, immunity, and personalized nutrition. Dairy culture suppliers can partner with brands to co-create products aligned with health trends, extending market penetration beyond traditional fermentation applications.

Emerging Market Penetration

Asia-Pacific, Latin America, and parts of the Middle East and Africa present significant growth potential. Urbanization, increasing dairy consumption, and rising awareness of functional dairy products drive adoption. Infrastructure improvements, such as cold-chain expansion, further enhance the feasibility of culture utilization in these regions.

Integration of Biotech & Digital Manufacturing Technologies

Investing in R&D, encapsulation, freeze-drying, and digital process monitoring offers competitive advantages. Producers leveraging biotech innovations can improve culture stability, optimize fermentation, and expand into adjacent markets such as plant-based fermented foods, capturing new revenue streams.

Product Type Insights

Thermophilic cultures dominate the global dairy products culture market, representing approximately 43% of total revenues in 2025, primarily due to their indispensable role in the production of yogurt, hard cheeses, and high-protein fermented dairy products. These cultures operate efficiently at elevated fermentation temperatures, enabling faster processing cycles, improved texture development, and enhanced flavor consistency, making them the preferred choice for large-scale industrial dairy processors. Their dominance is further reinforced by the global rise in yogurt consumption, particularly Greek yogurt, skyr, and probiotic-enriched variants.

Mesophilic cultures continue to play a vital role in soft cheeses, cultured creams, sour cream, and buttermilk production. Their steady demand is supported by traditional dairy consumption patterns in Europe and North America, as well as artisanal cheese manufacturing, where precise flavor and ripening control are essential. Meanwhile, probiotic and specialty functional cultures are the fastest-growing product segment, driven by consumer demand for gut-health, immunity-boosting, and clean-label dairy products. These cultures are increasingly used in premium yogurts, functional drinks, and fortified dairy snacks, commanding higher margins. Adjunct cultures are gaining prominence in artisan and specialty cheese segments, where manufacturers seek differentiated flavor profiles, improved mouthfeel, and controlled maturation processes.

Application Insights

Cheese production remains the largest application segment, accounting for approximately 38% of global dairy culture consumption in 2025. This leadership is driven by rising global cheese consumption, expansion of specialty and artisan cheese varieties, and increasing exports from Europe and North America. Cheese manufacturing requires highly specific starter and adjunct cultures to control fermentation, texture, and aging, making culture selection a critical input cost and quality determinant.

Yogurt and fermented milk products form the second-largest application segment, with particularly strong growth in Asia-Pacific, where urbanization, changing dietary habits, and rising health awareness are fueling consumption. Drinkable yogurts, probiotic beverages, and high-protein fermented milks are key growth subsegments. Emerging applications such as kefir, skyr, cultured dairy snacks, and functional dairy beverages are expanding the scope of culture utilization beyond traditional dairy categories. These applications rely heavily on advanced probiotic and multi-strain cultures, supporting higher value addition and innovation-driven growth.

Distribution Channel Insights

Direct B2B sales dominate the dairy products culture market, accounting for approximately 60% of total distribution in 2025. This channel is preferred by large industrial dairy processors, as it allows close collaboration with culture suppliers for strain customization, fermentation optimization, technical support, and quality assurance. Long-term supply agreements and co-development partnerships further strengthen the dominance of direct sales.

Distributors and ingredient platforms play a critical role in serving small and mid-sized dairy manufacturers, particularly in emerging markets and artisanal segments. E-commerce and digital ingredient marketplaces are gaining traction, enabling global access to specialty and probiotic cultures with improved transparency and faster procurement cycles. Additionally, contract manufacturing and licensing agreements are expanding as dairy processors seek cost efficiencies and localized culture production, especially in regions with growing dairy capacity but limited in-house fermentation expertise.

End-Use Insights

Industrial dairy processors represent the largest end-use segment, accounting for approximately 50% of global culture demand. These players rely on standardized, high-performance cultures to ensure consistency, scalability, and regulatory compliance across high-volume production lines. Their dominance is supported by investments in automated processing, cold-chain logistics, and advanced quality control systems.

Artisanal and SME dairy producers are emerging as a high-growth segment, particularly in Europe and North America, driven by rising demand for specialty cheeses, organic yogurts, and region-specific fermented products. Food and beverage manufacturers are increasingly incorporating dairy cultures into functional drinks, protein snacks, and hybrid dairy formulations, expanding demand beyond traditional dairy processors. Export-driven consumption is rising steadily, with Europe and North America supplying both cultures and fermented dairy products to the Asia-Pacific, the Middle East, and Latin America, reinforcing cross-border culture demand.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for approximately 32% of the global dairy products culture market, led by the United States and Canada. Regional growth is driven by high per-capita consumption of yogurt and cheese, strong demand for probiotic and functional dairy products, and advanced industrial dairy processing infrastructure. The presence of large multinational dairy processors, coupled with continuous innovation in high-protein and clean-label dairy offerings, sustains stable culture demand. Additionally, robust cold-chain systems and favorable regulatory frameworks support the adoption of advanced and premium culture solutions.

Europe

Europe represents the largest regional market, accounting for nearly 40% of global revenues. France, Germany, Italy, and the Netherlands lead demand due to deep-rooted cheese-making traditions, extensive variety of regional cheeses, and strict quality and safety regulations that necessitate high-performance cultures. Growth is further supported by the strong presence of artisanal cheese producers, rising consumption of functional yogurts, and continued innovation in specialty dairy products. Export-oriented dairy production and strong intra-European trade further reinforce cultural consumption across the region.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, driven by rapid urbanization, rising disposable incomes, and changing dietary preferences in China, India, Japan, and Southeast Asia. Growth is fueled by increasing adoption of Western-style yogurts, fermented milk drinks, and premium dairy products. Government initiatives to modernize dairy infrastructure, investments in cold-chain logistics, and expansion of organized retail are accelerating culture adoption. Additionally, APAC’s growing role as an importer of specialized cultures from Europe and North America supports sustained regional growth.

Latin America

Latin America exhibits moderate but steady growth, led by Brazil, Mexico, and Argentina. Rising urban dairy consumption, expansion of local cheese production, and increasing exports of regional dairy products are key growth drivers. While infrastructure limitations and economic volatility pose challenges, improving cold-chain capabilities and growing demand for functional yogurts and flavored fermented dairy products are supporting culture market expansion.

Middle East & Africa

The Middle East & Africa region is witnessing gradual growth, with GCC countries such as the UAE, Saudi Arabia, and Qatar driving demand for premium and functional dairy products due to high disposable incomes and strong reliance on dairy imports and processing. Africa remains an important production hub for yogurt and fresh cheeses, with rising local consumption and intra-regional trade. Growth is further supported by tourism-driven dairy demand, expanding urban populations, and increasing investments in dairy processing infrastructure across select African economies.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Dairy Products Culture Market

- Chr. Hansen

- Danisco

- DSM

- Lallemand

- Sacco System

- BDF Ingredients

- Lactina

- LB Bulgaricum

- Anhui Jinlac Biotech

- Probio-Plu

- Cargill (Culture Portfolio)

- ADM (Culture & Food Solutions)

- Alltech (Fermentation Solutions)

- Kerry Group (Culture Products)

- Kerry-Bio Sciences