Dairy Enzymes Market Size

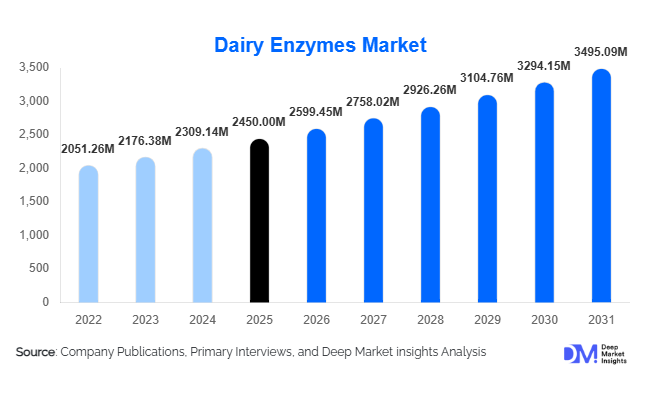

According to Deep Market Insights, the global dairy enzymes market size was valued at USD 2,450 million in 2025 and is projected to grow from USD 2,599.45 million in 2026 to reach USD 3,495.09 million by 2031, expanding at a CAGR of 6.1% during the forecast period (2026–2031). The market growth is primarily driven by rising demand for specialty cheeses, lactose-free and functional dairy products, and technological advancements in enzyme production that enhance product quality, texture, and flavor across the dairy industry.

Key Market Insights

- Rennet enzymes remain dominant, essential for cheese production and contributing significantly to the market due to growing cheese consumption globally.

- Lactase enzymes are fueling the lactose-free dairy segment, catering to the increasing consumer awareness of lactose intolerance and health-conscious preferences.

- Powdered and granular enzyme forms are preferred, offering better shelf life, stability, and dosage control in industrial dairy processing.

- North America and Europe dominate the market, supported by established dairy industries and advanced technological adoption in enzyme processing.

- Asia-Pacific is the fastest-growing region, driven by rising dairy consumption, modernization of processing plants, and supportive government initiatives.

- Export-driven demand is increasing, particularly for specialty cheeses and functional dairy products from the U.S., EU, and New Zealand.

What are the latest trends in the dairy enzymes market?

Technological Advancements in Enzyme Production

Enzyme manufacturers are increasingly adopting microbial fermentation, recombinant DNA technology, and immobilized enzyme solutions. These innovations improve enzyme efficiency, thermal stability, and shelf life, allowing dairy processors to produce high-quality cheese, yogurt, and lactose-free products consistently. Custom enzyme blends are being developed to target specific dairy applications, such as flavor enhancement in artisanal cheeses or texture modification in yogurt. Companies investing in R&D are gaining a competitive edge, offering value-added enzyme solutions tailored to regional consumer preferences.

Rising Adoption of Functional and Specialty Dairy Products

The growing global demand for lactose-free, high-protein, probiotic, and fortified dairy products is reshaping enzyme consumption. Lactases are increasingly incorporated to produce lactose-free milk, yogurt, and ice cream, while lipases and proteases are used to improve flavor and texture in cheeses. Consumers’ preference for healthier and functional foods is accelerating enzyme adoption across commercial dairy processors and SMEs. This trend is particularly strong in North America and Europe, where regulatory frameworks support fortified and functional dairy offerings.

What are the key drivers in the dairy enzymes market?

Growing Cheese and Fermented Dairy Consumption

The surge in specialty cheese consumption globally, including hard, soft, and processed varieties, has amplified the use of rennet and protease enzymes. Cheese production alone accounts for nearly 45% of global enzyme demand in the dairy sector, with microbial rennet increasingly preferred due to ethical, sustainable, and scalability considerations. Fermented dairy products, including yogurt and probiotic variants, further drive the adoption of proteases and lipases.

Increased Demand for Lactose-Free and Functional Dairy

Rising lactose intolerance awareness and health-conscious consumer behavior have boosted lactase enzyme usage. Lactose-free milk, yogurt, and ice cream are expanding rapidly, accounting for around 25% of enzyme consumption. Functional and fortified dairy products are also stimulating growth, particularly in North America, Europe, and APAC.

Technological Innovations

Biotechnological advancements, including microbial fermentation and recombinant enzyme production, enhance enzyme efficiency and product quality. Dairy processors increasingly adopt high-stability and application-specific enzymes to improve flavor, texture, and shelf life, contributing to overall market growth.

What are the restraints for the global market?

High Production Costs

Advanced enzyme production is capital-intensive, especially for recombinant and microbial fermentation-based processes. High costs can limit adoption by small and medium-scale dairy processors, affecting overall market expansion.

Regulatory Compliance Challenges

Strict food safety, labeling, and certification requirements, particularly in the EU and North America, pose barriers to new entrants. Compliance increases operational costs and delays product launches, impacting growth.

What are the key opportunities in the dairy enzymes industry?

Expansion in Emerging Markets

Asia-Pacific and Latin America are rapidly growing markets for dairy enzymes due to rising dairy consumption, modernization of processing facilities, and favorable government initiatives. India, China, and Brazil present significant opportunities for manufacturers to establish local production, partnerships, or distribution networks to tap into the increasing demand for specialty cheeses and functional dairy products.

Advanced Enzyme Formulations

Companies can capitalize on developing immobilized enzymes, enzyme blends, and bioengineered solutions that improve efficiency and product quality. Custom formulations for regional consumer preferences, including flavor-specific enzymes for cheese or textural enzymes for yogurt, are opening new avenues for differentiation.

Regulatory and Government Support

Government initiatives promoting local enzyme manufacturing, dairy modernization, and nutritional standards in regions like India and China create an environment conducive to market growth. Export-driven demand from developed regions further enhances opportunities for global expansion.

Product Type Insights

Rennet enzymes dominate the dairy enzymes market due to their indispensable role in cheese production, accounting for approximately 43% of the 2025 market share. The leadership of rennet enzymes is driven by the continued global expansion of cheese manufacturing, particularly in Europe and North America, where traditional and specialty cheese varieties require precise coagulation and consistent curd formation. The shift toward microbial and fermentation-derived rennet is further accelerating adoption, as these alternatives offer improved scalability, ethical acceptability, and stable performance compared to animal-derived rennet.

Proteases and lipases play a vital role in flavor development, texture modification, and maturation of cheeses and fermented dairy products. These enzymes are increasingly adopted in specialty and premium dairy offerings, where differentiated taste profiles are a key competitive factor. Other specialty enzymes, including amylases and cellulases, serve niche applications such as infant formula, protein-enriched dairy, and dairy-based nutritional products, contributing incremental but high-margin growth to the overall market.

Application Insights

Cheese production remains the largest application segment, representing approximately 46% of the dairy enzymes market in 2025. This dominance is driven by strong global demand for hard, soft, and processed cheeses, coupled with the need for consistent yield, flavor development, and processing efficiency. Enzymes such as rennet, proteases, and lipases are essential across both industrial-scale and artisanal cheese manufacturing, making this segment the cornerstone of enzyme consumption. Yogurt and other fermented dairy products form the second-largest application area, supported by rising consumer demand for probiotic, functional, and high-protein yogurt varieties. Enzymes are increasingly used to improve texture, fermentation efficiency, and shelf life, particularly in value-added yogurt products.

Lactose-free dairy applications are among the fastest-growing segments, driven by lactase usage in milk, yogurt, and ice cream. Meanwhile, butter, ghee, and frozen dairy desserts represent smaller but high-value applications, where enzymes are used to enhance flavor consistency and processing efficiency. Emerging applications in infant nutrition and fortified dairy products are further expanding enzyme utilization beyond traditional categories.

Distribution Channel Insights

Commercial dairy processors dominate enzyme consumption, accounting for approximately 60% of total market demand in 2025. This dominance is attributed to large-scale industrial production of cheese, milk, yogurt, and lactose-free dairy products, where enzymes are critical inputs for efficiency, yield optimization, and quality consistency. Leading dairy processors increasingly form long-term supply agreements with enzyme manufacturers to secure stable pricing and customized formulations.

Small and medium-sized enterprises (SMEs), including artisanal and regional dairy producers, represent a growing distribution segment, particularly in emerging markets. These producers are adopting enzymes to improve product standardization and compete with multinational brands while preserving traditional flavor profiles. Export-driven distribution channels are gaining importance as global trade in specialty cheeses, functional dairy products, and infant formula expands. Dairy exporters in North America, Europe, and New Zealand rely heavily on advanced enzyme solutions to meet international quality, safety, and shelf-life requirements, further strengthening enzyme demand across global supply chains.

End-Use Insights

The fastest-growing end-use segments within the dairy enzymes market include lactose-free milk, functional yogurts, and protein-enriched dairy products. These segments are directly aligned with global consumer trends focused on digestive health, nutrition, and wellness. Enzymes play a crucial role in enabling these products by improving digestibility, protein availability, and sensory attributes.

Infant formula represents a high-value end-use application, where enzymes are used to modify protein structures and enhance nutritional absorption, particularly in premium formulations. Ice cream and frozen desserts are also emerging as growth areas, as manufacturers use enzymes to improve texture, creaminess, and processing stability. Artisanal cheese production continues to support steady enzyme demand, especially in Europe and North America, while export-oriented dairy production ensures consistent adoption across developed markets. Together, these end-use trends are reinforcing the strategic importance of enzymes across both mass-market and premium dairy segments.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for approximately 28% of the global dairy enzymes market in 2025. Growth in the region is driven by high per capita cheese consumption, strong demand for lactose-free and functional dairy products, and widespread adoption of advanced dairy processing technologies. The United States leads regional demand due to its large-scale dairy industry, robust R&D ecosystem, and early adoption of enzyme-based process optimization. Regulatory support for fortified and functional foods further encourages enzyme usage across milk, yogurt, and cheese production.

Europe

Europe remains the largest regional market, holding around 32% share in 2025, led by Germany, France, Italy, and the Netherlands. The region’s dominance is underpinned by its mature dairy industry, strong tradition of specialty and artisanal cheese production, and stringent quality standards that favor enzyme-driven consistency and efficiency. Regulatory encouragement for clean-label and sustainable food production has accelerated the shift toward microbial and fermentation-derived rennet, strengthening enzyme penetration across both industrial and artisanal dairies.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at an estimated CAGR of 7.8%. Growth is driven by rising per capita dairy consumption, rapid urbanization, and modernization of dairy processing infrastructure in countries such as India and China. Government initiatives promoting dairy nutrition, food security, and local processing capabilities are accelerating enzyme adoption. Increasing demand for yogurt, flavored milk, and lactose-free dairy products among urban populations further supports strong regional growth.

Latin America

Latin America, led by Brazil and Argentina, is witnessing steady growth in dairy enzyme demand due to increasing consumption of packaged cheese, milk, and yogurt. Expanding export-oriented dairy operations and gradual modernization of processing facilities are driving the adoption of advanced enzyme solutions. The region is also seeing rising interest in value-added dairy products, supporting incremental enzyme penetration.

Middle East & Africa

The Middle East & Africa region is experiencing moderate but consistent growth, with South Africa, the UAE, and Saudi Arabia emerging as key markets. Growth drivers include increasing imports of specialty cheeses, expanding local dairy processing capacity, and rising consumer awareness of functional and lactose-free dairy products. Intra-African dairy trade and government-led investments in food processing infrastructure are further supporting enzyme adoption across the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Dairy Enzymes Market

- DSM

- Novozymes

- Chr. Hansen

- DuPont Nutrition & Biosciences

- Kerry Group

- Advanced Enzyme Technologies

- Amano Enzyme

- AB Enzymes

- Associated British Foods

- Lallemand

- Takeda Pharmaceutical

- Biocatalysts

- Enzyme Development Corporation

- Enzyme Solutions

- Gist-Brocades