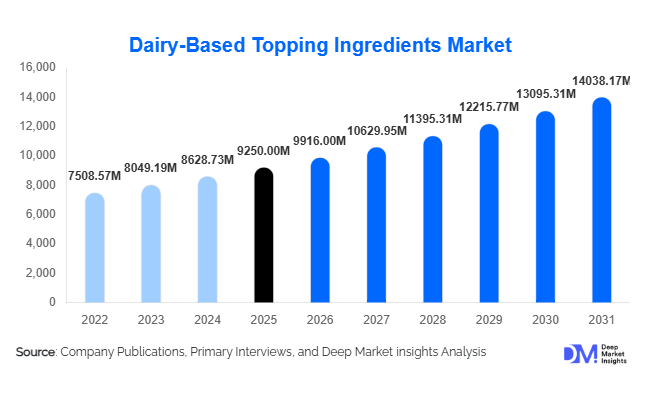

Dairy-Based Topping Ingredients Market Size

According to Deep Market Insights, the global dairy-based topping ingredients market size was valued at USD 9,250 million in 2025 and is projected to grow from USD 9,916.00 million in 2026 to reach USD 14,038.17 million by 2031, expanding at a CAGR of 7.2% during the forecast period (2026–2031). The market growth is primarily driven by rising demand for premium bakery and confectionery products, rapid expansion of specialty café culture, and increasing consumer preference for authentic dairy-based ingredients over synthetic alternatives. Growth in quick-service restaurants (QSRs), packaged desserts, and indulgent ready-to-eat foods is further strengthening global demand for whipped cream, dairy sauces, butter-based toppings, and cream cheese-based formulations.

Key Market Insights

- Whipped cream remains the dominant product segment, accounting for nearly 32% of the global market share in 2025, supported by strong demand from bakery chains and specialty beverage outlets.

- Bakery & confectionery applications lead consumption, contributing approximately 38% of total market revenue in 2025.

- Europe holds the largest regional share (30%), driven by strong dairy heritage and premium patisserie demand.

- Asia-Pacific is the fastest-growing region, expanding at over 8.5% CAGR due to urbanization and rising disposable incomes.

- Direct B2B distribution dominates, representing more than 50% of global sales through food manufacturers and industrial bakeries.

- Organic and clean-label variants are gaining traction, growing faster than conventional products due to rising health awareness.

What are the latest trends in the dairy-based topping ingredients market?

Premiumization and Clean-Label Formulations

Consumers are increasingly gravitating toward high-quality dairy toppings made from natural ingredients, grass-fed milk, and minimally processed formulations. Clean-label demand has encouraged manufacturers to reduce artificial stabilizers and emulsifiers while enhancing product transparency. Organic-certified whipped creams and dairy dessert sauces are expanding shelf presence in developed markets, while premium bakery brands are emphasizing authentic dairy richness as a differentiator. This shift toward premiumization is enabling manufacturers to command higher price points and improve margins, particularly in North America and Europe.

Technological Advancements in Shelf-Stable Dairy

Innovations in ultra-high temperature (UHT) processing, spray-drying, and advanced emulsification technologies are significantly improving shelf stability and export potential. Shelf-stable whipped creams and powdered dairy toppings are enabling expansion into emerging markets with limited cold-chain infrastructure. Automation in dairy processing facilities is also enhancing production efficiency and cost optimization, supporting scalability for global foodservice and industrial buyers.

What are the key drivers in the dairy-based topping ingredients market?

Expansion of the Global Bakery Industry

The global bakery sector, valued at over USD 600 billion, continues to grow steadily, creating strong downstream demand for cream-based toppings used in cakes, pastries, donuts, and celebration desserts. Rising urbanization and increasing celebration culture are reinforcing bakery consumption globally, directly boosting topping ingredient demand.

Growth of Specialty Beverage Culture

The rapid proliferation of specialty coffee chains and milk-based beverages is driving consumption of whipped cream and dairy foams. Customization trends in beverages, including flavored toppings and layered desserts, are strengthening product innovation and increasing volume demand.

What are the restraints for the global market?

Volatility in Raw Milk Prices

Fluctuations in global milk procurement prices significantly impact production costs and profit margins. Price volatility driven by climatic conditions, feed costs, and trade disruptions remains a persistent challenge for manufacturers.

Rising Popularity of Plant-Based Alternatives

The increasing adoption of plant-based whipped toppings and vegan dessert creams presents competitive pressure, particularly in North America and Europe. Manufacturers must invest in differentiation strategies to sustain dairy-based product relevance.

What are the key opportunities in the dairy-based topping ingredients industry?

Emerging Market Expansion in Asia & Middle East

Countries such as India, China, Saudi Arabia, and Indonesia are witnessing rapid growth in café chains and modern retail infrastructure. Rising disposable incomes and Westernized consumption patterns create substantial opportunity for dairy topping manufacturers to expand regional production and partnerships.

Organic and High-Protein Dairy Toppings

Health-focused consumers are increasingly seeking protein-enriched and reduced-fat dairy toppings. Manufacturers can tap into this segment by launching fortified variants catering to fitness-oriented and calorie-conscious consumers.

Product Type Insights

Whipped cream continues to dominate the global dairy toppings market, contributing approximately 32% of total revenue in 2025. Its versatility across bakery items, beverages, and desserts ensures consistent consumer demand worldwide. Dairy dessert sauces, including caramel and butterscotch formulations, are emerging as a high-growth sub-segment, fueled by the rising popularity of packaged desserts and ready-to-eat indulgent treats. Butter-based toppings maintain robust demand in premium bakery glazing applications, particularly in Europe, where traditional pastry and confectionery consumption remains strong. Meanwhile, cream cheese-based toppings are witnessing rapid adoption in North America, driven by the increasing popularity of cheesecakes and specialty pastries among urban consumers.

Form Insights

Liquid dairy toppings dominate with nearly 46% market share, largely due to their convenience for foodservice operators and consistency in applications such as beverage toppings and dessert garnishes. Semi-solid formats are commonly employed in bakery fillings and decorative applications, offering structural stability and enhanced texture. Powdered dairy toppings are gaining traction in export-oriented markets and regions with limited cold-chain infrastructure, where longer shelf life and reduced refrigeration dependency provide a clear advantage for manufacturers and distributors.

Application Insights

The bakery and confectionery segment leads the global market, accounting for approximately 38% share in 2025, supported by sustained demand for cakes, pastries, and desserts. Dairy desserts and ice cream applications follow closely, driven by consumer preference for premium and indulgent products. Beverage applications represent one of the fastest-growing areas, expanding at a CAGR of nearly 9%, fueled by the rapid proliferation of café culture, specialty coffee, and ready-to-drink dessert beverages. Additionally, ready-to-eat packaged foods are emerging as a promising application, particularly in Asia-Pacific, where urban lifestyles and on-the-go consumption patterns are driving demand for convenient dessert solutions.

Distribution Channel Insights

Direct B2B distribution channels account for approximately 52% of total sales, reflecting bulk procurement by industrial bakeries, food manufacturers, and large-scale hospitality operators. Retail channels, including supermarkets and hypermarkets, remain significant for aerosol whipped cream and smaller consumer packs, particularly in mature markets. Online retail is expanding rapidly, especially for premium, organic, and specialty variants, offering convenience and access to niche consumer segments.

| By Product Type | By Form | By Application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds around 28% of the global market share in 2025, with the United States contributing nearly 75% of regional demand. Market growth is driven by high per capita dairy consumption, well-established bakery and dessert sectors, and the widespread presence of café chains. Innovation in cream-based beverages and specialty desserts further propels regional adoption, while premium and organic offerings cater to evolving health-conscious and gourmet consumer preferences.

Europe

Europe dominates the market with a 30% share in 2025, led by countries such as Germany, France, Italy, and the Netherlands. Demand is supported by a strong dairy processing infrastructure, a rich patisserie culture, and high-quality culinary standards. Export-oriented dairy manufacturing enhances Europe’s global supply position. Additionally, increasing consumer preference for indulgent and artisanal desserts and the growth of premium bakery and café chains are key drivers of regional expansion.

Asia-Pacific

Asia-Pacific is the fastest-growing region, projected to expand at an 8.5% CAGR. Rapid urbanization, rising disposable incomes, and the proliferation of bakery and café chains in China and India are fueling demand for dairy toppings. Japan and Australia represent mature yet stable markets with high-quality dairy consumption, while emerging Southeast Asian markets are experiencing a surge in demand for ready-to-eat desserts, specialty beverages, and convenience-oriented bakery products.

Latin America

Latin America accounts for roughly 10% of the global market, with Brazil and Mexico leading consumption. Growth is driven by an expanding middle-class population, increasing disposable income, and the rising presence of quick-service restaurants and café chains. Regional culinary trends emphasizing desserts and sweet bakery items further support market expansion, alongside local manufacturing initiatives that enhance product availability and variety.

Middle East & Africa

The Middle East & Africa region is experiencing strong growth, primarily fueled by hospitality-driven demand in countries such as Saudi Arabia and the UAE. The expansion of luxury hotels, café chains, and international dessert brands encourages premium dairy topping consumption. Additionally, rising urbanization, increasing tourism, and growing consumer preference for indulgent desserts and specialty beverages are key factors contributing to regional market growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Dairy-Based Topping Ingredients Market

- Nestlé S.A.

- Danone S.A.

- Arla Foods

- Fonterra Co-operative Group

- Lactalis Group

- FrieslandCampina

- Saputo Inc.

- Land O'Lakes, Inc.

- GCMMF (Amul)

- Kerry Group

- Schreiber Foods

- Ornua Co-operative

- Rich Products Corporation

- Dairy Farmers of America

- Yili Group