Creative LED Screen Market Size

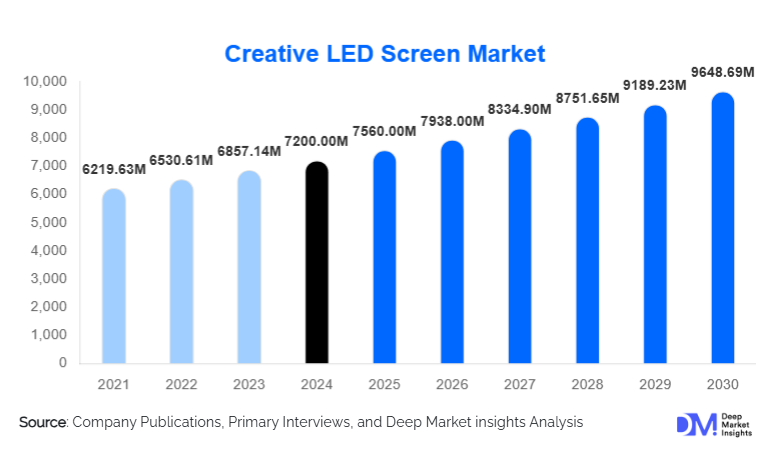

According to Deep Market Insights, the global creative-led screen market size was valued at USD 7,200 million in 2024 and is projected to grow from USD 7,560.0 million in 2025 to reach USD 9,648.69 million by 2030, expanding at a CAGR of 5.0% during the forecast period (2025–2030). The market growth is primarily driven by rising demand for immersive and creative visual displays, adoption of fine-pitch and transparent LED technologies, and increasing applications across advertising, retail, events, and architectural installations.

Key Market Insights

- Creative LED screens are increasingly being integrated into experiential retail and architectural designs, allowing brands and venues to create high-impact, immersive visual experiences.

- Asia-Pacific dominates the market, with China leading manufacturing and deployment, followed by India and Southeast Asia, while North America remains a mature, high-value market.

- Advertising and marketing applications lead globally, accounting for nearly 30% of total market share in 2024, driven by digital out-of-home signage and immersive brand activations.

- Technological innovation, such as fine-pitch, micro-LED, transparent, and flexible displays, is reshaping product offerings, enabling more customized and interactive installations.

- Event and entertainment sectors are growing rapidly, with demand for curved, 360°, and virtual production LED installations driving high-margin opportunities.

- Smart city initiatives and public infrastructure projects are creating opportunities for large-scale creative LED screen deployments in airports, metro stations, and urban environments.

Latest Market Trends

Shift Toward Immersive and Creative Installations

Creative LED screens are moving beyond traditional flat panels to curved, flexible, transparent, and architectural designs. Retailers, entertainment venues, stadiums, and urban spaces increasingly adopt these solutions to deliver immersive brand experiences. Fine-pitch LED and micro-LED technologies enable high-resolution visuals even at close viewing distances, attracting premium applications. The integration of AI, content management platforms, and IoT-enabled controls enhances interactivity and provides measurable engagement metrics. This trend reflects a shift from hardware-only installations to value-added, experience-driven solutions.

Technology Integration and Smart Installations

Emerging technologies, including modular LED systems, transparent displays, and flexible substrates, are transforming creative LED screen applications. Smart LED solutions integrated with AI analytics, interactive overlays, and remote content management platforms are gaining traction in retail, corporate, and public infrastructure projects. Event organizers and broadcasters increasingly deploy curved and immersive walls for concerts, esports, and virtual production, leveraging technology to enhance audience engagement. Integration of energy-efficient LED modules and automated maintenance monitoring is further improving adoption and ROI.

Creative LED Screen Market Drivers

Rising Demand for Digital Out-of-Home and Experiential Advertising

Brands and advertisers are increasingly shifting toward immersive digital signage and high-impact installations to attract consumer attention. Retail stores, malls, and public spaces are deploying creative LED screens to create engaging brand experiences, replacing traditional static signage. This growing demand for experiential advertising drives both volume and higher-margin installations in the market.

Technological Advancements in LED Displays

Innovations in fine-pitch, ultra-fine-pitch, transparent, and flexible LED technologies have expanded the range of applications. Curved walls, see-through façades, and interactive displays are now possible, allowing creative LED screen manufacturers to command premium pricing. Advanced pixel densities and high-resolution modules have enabled applications in corporate lobbies, broadcast studios, and live events, supporting higher adoption across multiple sectors.

Post-Pandemic Resurgence of Events and Entertainment

The revival of live events, esports, stadium upgrades, and virtual production studios is boosting demand for large-scale and immersive LED installations. Curved, 360°, and dome-shaped LED walls are increasingly deployed for concerts, exhibitions, and broadcast productions, creating new revenue streams for creative LED screen manufacturers and integrators.

Market Restraints

High Installation and Lifecycle Costs

Creative LED screens, particularly curved, flexible, or transparent installations, require high upfront investment and complex integration, including specialized control systems and content management. These costs can restrict adoption among smaller businesses or budget-conscious end users.

Content Generation and Maintenance Challenges

Maintaining high-quality visuals, regular calibration, and system upkeep is essential for creative LED screens to deliver value. Limited expertise, high content production costs, and module lifespan concerns may act as restraints, slowing wider market adoption.

Creative LED Screen Market Opportunities

Smart City and Urban Infrastructure Deployments

Governments globally are investing in smart city initiatives, creating opportunities for large-scale LED screen deployments in airports, metro stations, highways, and urban public spaces. Creative LED solutions integrated with IoT and AI-driven content management can offer interactive public information systems, advertising, and city branding opportunities.

Experiential Retail and Branded Environments

Retailers and luxury brands are increasingly adopting immersive LED displays to create unique customer experiences. Curved, transparent, and flexible LED installations allow retailers to blend architecture with dynamic visual content. There is strong potential for new entrants to provide turnkey solutions, integrating hardware, content creation, and analytics for high-margin offerings.

Live Events, Entertainment, and Virtual Production

The growth of live events, esports, and broadcast studios is creating demand for high-resolution, immersive LED installations. Curved, dome, and 360° LED walls are being used for concerts, exhibitions, and virtual sets. Companies can partner with event organizers to offer turnkey solutions, combining hardware, software, and content, opening profitable new avenues.

Product Type Insights

Transparent LED screens are emerging as a leading product type, capturing approximately 20% of the 2024 market (USD 1.46 billion). Their ability to deliver see-through, immersive visual experiences in retail windows, architectural façades, and showrooms has driven adoption. Fine-pitch and flexible LED modules complement this trend, enabling high-resolution installations for close-view, interactive applications.

Application Insights

Advertising and marketing applications dominate the market, accounting for 30% of total market share in 2024 (USD 2.19 billion). Creative LED screens are increasingly replacing traditional signage, with strong demand from digital out-of-home, retail displays, and façade branding. Event & entertainment, retail & hospitality, and sports & stadium segments are also growing rapidly, supported by technological innovation and experiential use cases.

Distribution Channel Insights

Creative LED screens are primarily distributed through system integrators, AV integrators, and specialist rental companies. Direct sales to large retail, entertainment, and corporate clients remain significant. Online channels and digital marketplaces are emerging as complementary routes, particularly for standardized modules and fine-pitch LED kits, while bespoke installations typically require integration services.

End-Use Insights

Retail and experiential spaces, stadiums and arenas, corporate lobbies, airports, and event venues are driving the fastest growth in end-use demand. Retail chains and luxury brands are increasingly investing in interactive, transparent, and curved LED displays. Airport terminals, metro stations, and smart city projects are adopting large-format LED screens, creating export-driven demand from Chinese, South Korean, and other LED manufacturers. Events, esports, and broadcast studios are emerging as high-margin verticals requiring customized solutions.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds 25% of the 2024 market, led by the U.S. and Canada. Demand is driven by stadium upgrades, corporate video walls, experiential retail, and high-end advertising. Mature markets favor fine-pitch, high-resolution, and immersive installations with integrated content management systems.

Europe

Europe accounts for 20% of the global market share, with Germany, the UK, France, and the Netherlands leading demand. Retail, smart buildings, and event installations are primary drivers. Growth is steady, emphasizing high-quality, energy-efficient, and sustainable LED solutions.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing region (40-45% of the 2024 market), driven by China, India, South Korea, and Southeast Asia. Large-scale public infrastructure projects, retail expansions, and stadium installations are fueling growth. China dominates manufacturing and export, while India is emerging as a high-growth market for experiential LED applications.

Middle East & Africa

The Middle East (8-10% share) is experiencing strong demand in the UAE, Saudi Arabia, and Qatar, fueled by luxury retail, events, and stadium deployments. Africa, as a destination for stadium and public infrastructure projects, is also expanding LED adoption. Government-backed urban development and smart city initiatives are key growth drivers.

Latin America

Latin America holds 5-7% of the market, with Brazil, Mexico, and Chile leading adoption. Outdoor advertising, stadium upgrades, and retail projects are driving moderate growth. Demand remains emerging, but with increasing awareness of immersive display technologies.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Creative LED Screen Market

- Leyard Optoelectronic Co., Ltd.

- Daktronics, Inc.

- Barco NV

- Absen Optoelectronic Co., Ltd.

- Samsung Electronics Co., Ltd.

- LG Electronics Inc.

- Sony Corporation

- Unilumin Group Co., Ltd.

- Liantronics Co., Ltd.

- Shenzhen AOTO Electronics Co., Ltd.

- Christie Digital Systems USA, Inc.

- Vizio Inc.

- Epistar Corporation

- Sharp Corporation

- Infinimed Inc.

Recent Developments

- In Q1 2025, Absen launched a new line of transparent and curved LED modules targeting retail flagship stores in China and Southeast Asia.

- In Q2 2025, Leyard expanded its presence in North America with large stadium and arena LED installations, integrating fine-pitch technology with interactive content systems.

- In Q3 2025, Samsung Electronics introduced flexible LED displays for immersive event and broadcast setups, catering to virtual production and experiential marketing segments.