Cranberry (Borlotti) Beans Market Size

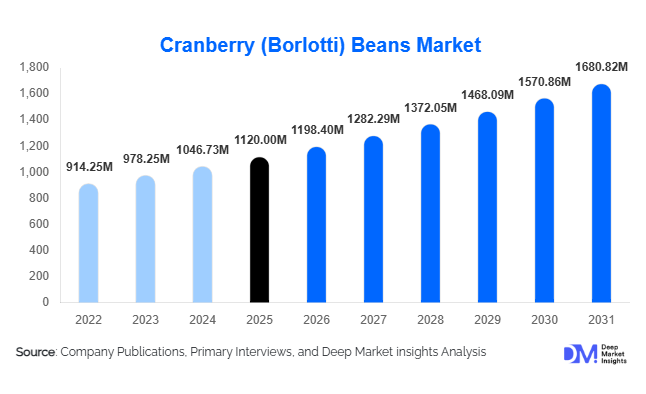

According to Deep Market Insights,the global cranberry (borlotti) beans market size was valued at USD 1,120 million in 2025 and is projected to grow from USD 1,198.40 million in 2026 to reach USD 1,680.82 million by 2031, expanding at a CAGR of 7.0% during the forecast period (2026–2031). The cranberry (borlotti) beans market growth is primarily driven by rising global demand for plant-based protein, increasing consumption of Mediterranean and Latin American cuisines, and expanding applications in processed and ready-to-eat food products. Growing health awareness related to high-fiber, low-fat diets and the expansion of retail distribution networks are further strengthening long-term market prospects.

Key Market Insights

- Dried borlotti beans dominate global consumption, accounting for nearly 48% of total market revenue in 2025, supported by bulk exports and strong household demand.

- Europe leads global demand, contributing approximately 34% of total market share, driven by traditional consumption in Italy, Spain, and France.

- B2B food processing applications account for nearly 46% of total revenue, reflecting increasing usage in canned foods, soups, and plant-based formulations.

- Organic borlotti beans are the fastest-growing segment, expanding at nearly 9% CAGR amid rising clean-label and sustainable food preferences.

- Asia-Pacific is the fastest-growing regional market, registering over 8.5% CAGR, fueled by urbanization and dietary diversification.

- Top five companies hold approximately 33% of the global market share, indicating moderate fragmentation with strong regional leaders.

What are the latest trends in the cranberry (borlotti) beans market?

Shift Toward Plant-Based and Functional Nutrition

Consumer preference for plant-based protein sources is significantly influencing borlotti bean demand. Rich in protein (22–24%) and dietary fiber, borlotti beans are increasingly used in vegan and flexitarian diets. Food manufacturers are incorporating borlotti beans into plant-based burgers, protein snacks, soups, and ready meals. This trend is further supported by sustainability considerations, as legumes require lower water inputs and improve soil nitrogen levels. Retail brands are also marketing borlotti beans as functional superfoods, emphasizing digestive health, cholesterol reduction, and weight management benefits.

Growth of Convenience and Ready-to-Eat Formats

Canned and pre-cooked borlotti beans are witnessing accelerated growth, particularly in North America and Europe. Urban lifestyles and rising dual-income households are boosting demand for convenient, shelf-stable protein sources. Canned borlotti beans are growing at nearly 8% CAGR, supported by expanded supermarket penetration and private-label offerings. Foodservice operators are also adopting pre-cooked variants to reduce preparation time and improve operational efficiency.

What are the key drivers in the cranberry (borlotti) beans market?

Rising Demand for Plant-Based Protein

The global plant-based food industry is expanding rapidly, surpassing USD 25 billion in value for meat alternatives alone. Borlotti beans serve as an affordable and nutritious alternative to animal protein, driving increased demand in both developed and emerging economies. Growing vegan and flexitarian populations in the U.S., Germany, and the U.K. are contributing significantly to this trend.

Expansion of Food Processing Industry

The global packaged food industry, valued at over USD 3 trillion, is incorporating pulses into soups, frozen meals, and ready-to-eat dishes. Borlotti beans are increasingly used in Mediterranean-style ready meals, canned products, and plant-based stews. The food processing segment remains the fastest-growing end-use category.

What are the restraints for the global market?

Climate-Driven Supply Volatility

Borlotti bean production is highly sensitive to climatic conditions. Droughts in Argentina and Southern Europe have previously led to yield fluctuations of 10–15%, impacting global prices and supply stability.

Competition from Alternative Pulses

Chickpeas, kidney beans, and black beans provide similar nutritional value at competitive prices. Substitution effects can limit premium pricing opportunities for borlotti beans in price-sensitive markets.

What are the key opportunities in the cranberry (borlotti) beans industry?

Organic and Sustainable Farming Expansion

Certified organic borlotti beans are gaining traction in North America and Europe. Organic variants currently account for nearly 22% of global revenue and are expanding at approximately 9% CAGR. Sustainability certifications and regenerative agriculture practices are offering premium pricing opportunities.

Emerging Market Penetration

Rapid urbanization in India, China, and Southeast Asia is driving new demand. Increasing retail penetration, e-commerce growth, and adoption of international cuisines are creating untapped opportunities for both dried and processed formats.

Product Type Insights

Dried borlotti beans continue to dominate the global market, accounting for nearly 48% of total revenue in 2025. The leadership of this segment is primarily driven by its extended shelf life, lower transportation and storage costs, and strong cross-border trade flows, particularly from established exporting nations such as Italy and Argentina. Dried variants are highly preferred by food processors and traditional households due to their versatility in soups, stews, and regional culinary preparations. The segment also benefits from price stability compared to processed formats, making it the leading product category across both developed and emerging economies.

Canned borlotti beans represent approximately 28% of the market and are expanding steadily due to the growing demand for convenience foods, ready-to-cook meal solutions, and time-saving culinary options. Urbanization, rising dual-income households, and expansion of organized retail chains have significantly accelerated demand for canned formats. Frozen and ready-to-eat borlotti beans remain niche segments; however, they are witnessing above-average growth, particularly in urban supermarkets and premium grocery chains. Growth in these categories is supported by innovation in packaging, clean-label positioning, and increasing consumer interest in healthy, protein-rich meal components.

Nature Insights

Conventional borlotti beans account for nearly 78% of global revenue in 2025, supported by large-scale commercial cultivation, established supply chains, and competitive pricing structures. The widespread adoption of conventional farming practices ensures consistent supply volumes and cost efficiencies, which are particularly important for food processors and export markets. The segment’s dominance is further reinforced by strong demand in price-sensitive markets across Asia-Pacific and Latin America.

Organic borlotti beans, although representing a smaller share, are expanding at a faster pace. Growth in this segment is driven by increasing consumer awareness regarding sustainable agriculture, chemical-free food production, and traceability. Premium retail channels, specialty health stores, and online grocery platforms are key distribution drivers for organic variants. Rising demand in Western Europe and North America, where consumers are willing to pay price premiums for certified organic pulses, is expected to accelerate long-term growth in this segment.

Distribution Channel Insights

B2B distribution leads the market with approximately 46% of total revenue, driven primarily by food processors, canneries, private-label manufacturers, and institutional buyers. The growth of this segment is supported by increasing demand for pulse-based ingredients in processed foods, ready meals, soups, and plant-based protein formulations. Bulk procurement contracts and long-term supplier relationships further strengthen the B2B channel’s dominance.

Modern retail channels account for nearly 32% of sales, reflecting the expansion of supermarkets, hypermarkets, and organized grocery chains worldwide. Rising consumer preference for packaged and branded pulses contributes significantly to retail sales growth. Meanwhile, online grocery platforms are expanding at over 10% CAGR, particularly in Asia-Pacific and North America. The rapid digitalization of retail, subscription-based grocery delivery services, and increasing smartphone penetration are key drivers accelerating the online distribution channel.

End-Use Industry Insights

Household consumption accounts for approximately 38% of total demand, supported by traditional culinary use in European and Latin American cuisines. Borlotti beans are widely used in soups, salads, casseroles, and regional dishes, ensuring steady baseline demand. The leading driver for this segment is the increasing consumer preference for plant-based protein sources that are affordable, nutritious, and versatile in daily cooking.

The food processing industry contributes nearly 34% of global revenue and is the fastest-growing end-use segment. Growth is driven by rising incorporation of pulses into packaged foods, canned meals, snack products, and functional food formulations. Food manufacturers are increasingly leveraging borlotti beans for protein enrichment and fiber fortification, supporting clean-label and health-focused product innovation.The plant-based meat industry is emerging as a high-potential application area, as pulse proteins are increasingly used in alternative protein formulations. Growing global demand for meat substitutes, sustainability concerns, and advancements in pulse protein extraction technologies are collectively accelerating adoption within this segment.

| By Product Type | By Nature | By Application / End-Use | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

Europe

Europe leads the global borlotti beans market with approximately 34% share in 2025. Italy alone contributes nearly 11% of global demand, reflecting strong cultural integration of borlotti beans in traditional cuisine. Spain, France, and Germany are also significant consumers. Regional growth is driven by well-established pulse consumption patterns, high awareness of plant-based diets, expansion of organic retail networks, and government initiatives promoting sustainable agriculture. The increasing shift toward flexitarian diets and demand for clean-label food products further strengthen Europe’s leadership position.

North America

North America holds around 26% of the global market, with the United States accounting for approximately 21% of worldwide consumption. Regional growth is fueled by plant-based food innovation, rising demand for canned and ready-to-eat beans, and strong retail penetration. Increasing health consciousness, higher protein diet trends, and expansion of private-label pulse brands in supermarkets are additional drivers. The region also benefits from a robust food processing industry incorporating pulses into value-added products.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at approximately 8.5% CAGR. China and India represent key emerging markets due to rapid urbanization, growing middle-class populations, and increasing exposure to international cuisines. Rising adoption of western dietary patterns, growth of modern retail infrastructure, and government focus on improving pulse production to enhance food security are major regional growth drivers. Expansion of online grocery platforms further accelerates market penetration in metropolitan areas.

Latin America

Latin America accounts for nearly 9% of global revenue, with Argentina and Brazil serving as major producers and exporters. Regional growth is supported by strong domestic pulse consumption, favorable agro-climatic conditions, and expanding export opportunities. Government incentives promoting pulse cultivation and increasing global demand for protein-rich crops contribute to sustained regional production and trade growth.

Middle East & Africa

The Middle East & Africa region is experiencing steady growth, driven by rising urban populations and expanding foodservice sectors. The United Arab Emirates and Saudi Arabia are key demand centers due to growing expatriate populations and increasing demand for international cuisines. Rising health awareness, expansion of modern retail formats, and greater reliance on imported pulses to ensure food security are key drivers supporting regional market expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Cranberry (Borlotti) Beans Market

- Goya Foods Inc.

- Conagra Brands Inc.

- Bonduelle Group

- Del Monte Foods Inc.

- Dole Food Company

- Eden Foods Inc.

- La Doria S.p.A.

- B&G Foods Inc.

- Bush Brothers & Company

- Camil Alimentos S.A.

- Ardo Group

- Greenyard NV

- Princes Limited

- Jovial Foods Inc.

- Roland Foods LLC