Corn Starch in Paper Making Market Size

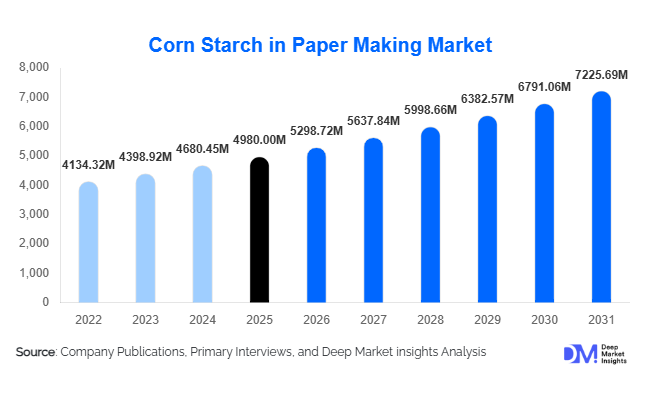

According to Deep Market Insights,the global corn starch in paper making market size was valued at USD 4980 million in 2025 and is projected to grow from USD 5298.72 million in 2026 to reach USD 7225.69 million by 2031, expanding at a CAGR of 6.4% during the forecast period (2026–2031). The market growth is primarily driven by rising demand for packaging paper and paperboard, increasing use of recycled fiber in paper production, and the growing preference for bio-based and biodegradable additives in wet-end processing and surface sizing applications.

Key Market Insights

- Packaging paper and paperboard dominate demand, accounting for over 60% of total corn starch consumption due to rapid growth in e-commerce, food packaging, and logistics sectors.

- Modified corn starch remains the preferred product type, supported by its superior strength enhancement, retention efficiency, and compatibility with recycled fiber systems.

- Asia-Pacific leads global consumption, driven by large-scale paper production capacities in China and India.

- Recycled fiber-based paper manufacturing is accelerating starch usage, as mills require higher starch loading to offset reduced fiber strength.

- Wet-end processing represents the largest application stage, reflecting the critical role of starch in fiber bonding and retention optimization.

- Technological upgrades in paper mills, including advanced surface sizing and liquid starch systems, are improving performance efficiency and value realization.

What are the latest trends in the corn starch in paper making market?

Rising Adoption of Modified and Functional Starches

Paper manufacturers are increasingly shifting from native corn starch toward modified variants such as cationic, oxidized, and enzyme-modified starches. These products offer enhanced bonding strength, improved drainage control, and higher retention efficiency, particularly in high-speed paper machines. The trend is strongly linked to the growing use of recycled fibers, which require functional additives to restore mechanical properties. Modified starches also allow mills to reduce reliance on synthetic polymers, aligning with sustainability and cost-optimization objectives.

Integration of Sustainability and Bio-Based Chemistry

Environmental regulations and corporate sustainability commitments are reshaping additive selection in paper manufacturing. Corn starch, being renewable and biodegradable, is increasingly positioned as a strategic alternative to petrochemical-based binders. Mills are adopting higher starch dosages per ton of paper to improve recyclability and reduce chemical load. This trend is particularly prominent in Europe and North America, where regulatory scrutiny on paper chemicals is intensifying.

What are the key drivers in the corn starch in paper making market?

Expansion of Packaging and Corrugated Paper Production

The rapid expansion of packaging paper production remains the primary growth driver. Corrugated boxes, folding cartons, and paperboard require enhanced compression strength and surface quality, both of which are supported by corn starch. Growth in global trade, food delivery, pharmaceuticals, and consumer goods packaging continues to drive steady starch demand.

Growth in Recycled Paper Manufacturing

Recycled fiber-based paper production is increasing globally due to cost advantages and environmental mandates. However, recycled fibers exhibit reduced bonding strength, necessitating higher starch usage. Corn starch plays a critical role in restoring tensile strength and improving paper machine efficiency, directly boosting consumption volumes.

What are the restraints for the global market?

Volatility in Corn Raw Material Prices

Corn starch pricing is closely linked to agricultural output and global corn supply dynamics. Weather disruptions, biofuel demand, and trade policies can create raw material price volatility, impacting margins for starch producers and increasing procurement risk for paper manufacturers.

Competition from Alternative Additives

Alternative starches such as tapioca and potato starch, along with synthetic polymers, compete with corn starch in cost-sensitive markets. While corn starch remains dominant, pricing pressure and substitution risks persist in regions with limited performance differentiation.

What are the key opportunities in the corn starch in paper making industry?

Technological Upgradation in Emerging Markets

Paper mills in Asia-Pacific, Latin America, and Africa are investing in modern wet-end and surface sizing technologies. These upgrades favor higher-value liquid and enzyme-modified corn starch products, enabling suppliers to improve margins and establish long-term supply relationships.

Policy Support for Bio-Based Manufacturing

Government initiatives promoting sustainable manufacturing, such as “Make in India” and industrial efficiency programs in China, are encouraging the use of renewable inputs. This creates opportunities for domestic starch producers to expand capacity and reduce reliance on imports.

Product Type Insights

Modified corn starch dominates the global market, accounting for approximately 58% of total demand, primarily driven by its superior performance in strength enhancement, retention, and surface properties across multiple paper grades. Its ability to improve paper quality while supporting higher machine speeds makes it the preferred choice for modern paper mills, particularly in packaging and coated paper applications.

Native corn starch continues to be widely used in cost-sensitive and low-performance applications, especially in developing markets where price competitiveness remains critical. Meanwhile, liquid starch is gaining traction due to its ease of handling, precise dosing, and compatibility with high-speed paper machines, reducing operational complexity and energy consumption for manufacturers.

Application Stage Insights

Wet-end processing represents the largest application stage, holding nearly 42% of total market share. The dominance of this segment is driven by starch’s critical role in fiber bonding, retention control, drainage efficiency, and improved paper formation, all of which are essential for maintaining production efficiency and consistent paper quality.

Surface sizing follows closely, supported by increasing demand for enhanced surface strength, printability, and resistance to ink penetration, particularly in packaging, printing, and specialty paper grades. Growing emphasis on value-added paper products continues to support surface sizing starch consumption.

Paper Grade Insights

Packaging paper and paperboard dominate overall consumption, accounting for over 61% of market demand. This leadership is driven by the rapid expansion of e-commerce, food packaging, and consumer goods, which require high-strength, lightweight, and recyclable paper materials.

Printing and writing paper demand remains relatively stable, supported by educational, commercial, and administrative applications, although digitalization continues to limit long-term growth. In contrast, tissue and hygiene paper is witnessing steady growth, particularly in emerging economies, fueled by rising disposable incomes, urbanization, and increasing hygiene awareness.

End-Use Industry Insights

The food and beverage packaging industry leads end-use demand, driven by the global rise in packaged and processed food consumption and the need for safe, sustainable packaging solutions. Starch-based additives support strength, printability, and recyclability requirements in this segment.

E-commerce and logistics represent the fastest-growing end-use segment, supported by increased demand for corrugated boxes, protective packaging, and lightweight paperboard. Additionally, personal care and hygiene applications continue to expand, particularly in Asia-Pacific and Africa, driven by population growth and improving living standards.

| By Product Type | By Application Stage | By Paper Grade | By Paper Manufacturing Process | By End-Use Industry |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global market with approximately 46% share in 2025, supported by large-scale paper production capacity and strong downstream demand. China accounts for the largest consumption volume due to its dominant packaging and industrial paper manufacturing base, while India represents the fastest-growing market.

Key growth drivers in the region include rapid urbanization, expanding e-commerce activity, rising consumption of packaged foods, and government support for manufacturing and exports. Increasing investments in modern paper mills and sustainable packaging further accelerate starch demand.

North America

North America holds around 22% of global market share, led by the United States. The region benefits from advanced paper manufacturing technologies, high recycled fiber usage, and a strong focus on operational efficiency.

Growth is supported by sustainability-driven additive selection, where starch is favored as a biodegradable and renewable solution. Stable demand from packaging, food service, and e-commerce industries continues to underpin market performance.

Europe

Europe accounts for approximately 20% of global demand, with Germany, France, and Italy as major contributors. The region’s growth is underpinned by strict environmental regulations, recycling mandates, and circular economy initiatives.

Paper manufacturers increasingly adopt starch-based additives to improve recycling efficiency, fiber utilization, and compliance with biodegradable material standards, supporting consistent market growth despite mature demand conditions.

Latin America

Brazil and Mexico lead demand in Latin America, supported by the expansion of packaging paper production, food processing industries, and rising industrial output. Increasing domestic consumption and export-oriented paper manufacturing contribute to steady starch demand.

The region demonstrates moderate but consistent growth, driven by investments in modern paper machines and improving supply chain infrastructure.

Middle East & Africa

The Middle East & Africa region is experiencing gradual growth, driven by the expanding packaging and hygiene paper industries in countries such as Saudi Arabia, South Africa, and the UAE.

Key drivers include infrastructure development, industrial diversification initiatives, population growth, and increasing demand for packaged food and consumer goods. Rising investments in local paper production capacity further support long-term market expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Corn Starch in Paper Making Market

- Cargill Incorporated

- Archer Daniels Midland (ADM)

- Ingredion Incorporated

- Roquette Frères

- Tate & Lyle

- AGRANA Group

- Tereos Group

- COFCO Biochemical

- Global Bio-chem Technology

- Zhucheng Xingmao

- Gulshan Polyols

- Sanstar Limited

- Angel Starch & Food

- SMS Corporation

- Universal Starch-Chem Allied