Convenience Food Market Size

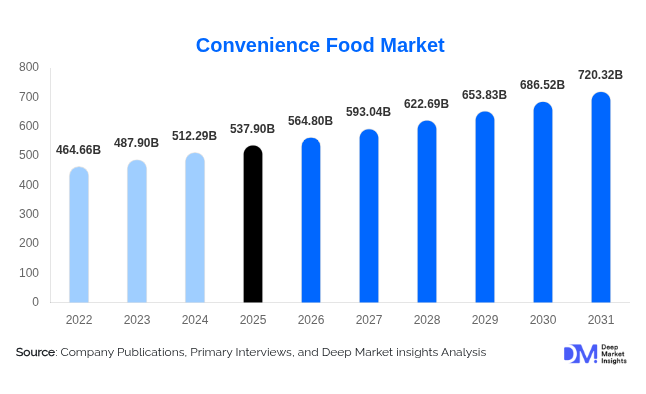

According to Deep Market Insights, the global convenience food market size was valued at USD 537.90 billion in 2025 and is projected to grow from USD 564.80 billion in 2026 to reach USD 720.32 billion by 2031, expanding at a CAGR of 5.0% during the forecast period (2026–2031). The convenience food market growth is primarily driven by changing consumer lifestyles, rapid urbanization, increasing working population, and rising demand for ready-to-eat, ready-to-cook, and instant food products that reduce meal preparation time without compromising taste and quality.

Key Market Insights

- Ready-to-eat and frozen convenience foods dominate global demand, supported by expanding cold-chain infrastructure and retail penetration.

- Asia-Pacific is the fastest-growing region, driven by rising disposable incomes, urban lifestyles, and westernization of diets in China and India.

- Supermarkets and hypermarkets remain the largest distribution channel, while online and quick-commerce platforms are gaining rapid traction.

- Health-oriented convenience foods, including low-sodium, high-protein, and plant-based options, are reshaping product innovation.

- Foodservice and cloud kitchens are accelerating bulk demand for frozen and semi-prepared convenience foods.

- Packaging and preservation innovations are improving shelf life, food safety, and product portability.

What are the latest trends in the convenience food market?

Premiumization and Health-Focused Convenience Foods

Consumers are increasingly demanding convenience foods that balance speed with nutrition and quality. This has led to strong growth in premium ready meals, organic frozen foods, and clean-label instant products. Manufacturers are reformulating offerings to reduce preservatives, artificial additives, and sodium while enhancing protein content, fiber, and micronutrients. Plant-based convenience foods, including meat alternatives and vegan ready meals, are witnessing double-digit growth, especially in North America and Europe. Functional claims such as immunity-boosting, gut-health, and calorie-controlled meals are further driving product differentiation.

Digital Retail and Quick-Commerce Expansion

The rapid growth of online grocery platforms and quick-commerce services is transforming convenience food consumption patterns. Products such as frozen meals, instant noodles, and packaged snacks are among the most frequently ordered categories online due to their long shelf life and ease of storage. Manufacturers are optimizing packaging for e-commerce, introducing smaller pack sizes, and collaborating with delivery platforms to improve visibility. Subscription-based meal kits and D2C convenience food brands are also gaining popularity, particularly among urban millennials.

What are the key drivers in the convenience food market?

Changing Lifestyles and Urbanization

Longer working hours, increasing female workforce participation, and a growing number of single-person households are driving demand for convenient meal solutions. Urban consumers prioritize time-saving food options, making ready-to-eat, frozen, and instant foods essential components of daily diets. This driver is particularly strong in emerging economies where urban populations are expanding rapidly.

Growth of Foodservice and Cloud Kitchens

The expansion of quick-service restaurants, cafeterias, and cloud kitchens is significantly boosting demand for frozen and semi-prepared convenience foods. These establishments rely on standardized products to reduce labor costs, improve consistency, and scale operations efficiently. Institutional foodservice in hospitals, schools, and corporate offices is also contributing to steady volume growth.

What are the restraints for the global market?

Health Perception and Regulatory Scrutiny

Despite innovation, convenience foods continue to face criticism related to high sodium content, preservatives, and ultra-processing. Regulatory authorities in Europe and North America are enforcing stricter labeling and nutritional standards, increasing compliance costs for manufacturers. Negative health perceptions can limit consumption among health-conscious consumers.

Raw Material and Energy Cost Volatility

Fluctuating prices of meat, dairy, edible oils, grains, and packaging materials directly impact production costs. Frozen and chilled convenience foods are particularly vulnerable due to energy-intensive cold storage and transportation requirements. Margin pressure remains a key challenge for manufacturers.

What are the key opportunities in the convenience food industry?

Emerging Market Penetration

Asia-Pacific, Africa, and Latin America present significant growth opportunities due to rising incomes and expanding urban middle-class populations. Localized flavors, affordable pricing, and region-specific product innovation can unlock untapped demand. Government support for food processing infrastructure further enhances market attractiveness.

Technology Integration and Automation

Automation in food processing, AI-driven demand forecasting, and smart packaging technologies offer opportunities to improve efficiency, reduce waste, and enhance profitability. Companies investing in advanced freezing, high-pressure processing, and sustainable packaging are expected to gain competitive advantages.

Product Type Insights

Ready-to-eat (RTE) meals represent the largest product segment in the global convenience food market, accounting for approximately 34% of total demand in 2025. The leading driver for this segment is rising consumer preference for time-saving, fully prepared meals, particularly among working professionals, urban households, and single-person families. Within this category, frozen meals dominate due to their extended shelf life, consistent quality, and compatibility with modern cold-chain infrastructure.

Ready-to-cook foods are gaining traction as consumers increasingly seek a balance between freshness and convenience. These products appeal to health-conscious buyers who prefer minimal processing while still reducing meal preparation time, supporting steady growth in this sub-segment.

Preservation Technology Insights

Frozen convenience foods lead the market with nearly 41% share in 2025. The primary growth driver for this segment is the global expansion of cold-chain logistics and rising demand from foodservice operators, including quick-service restaurants and institutional caterers. Advancements in freezing technology have also improved taste, texture, and nutritional retention, further strengthening consumer acceptance.

Shelf-stable convenience foods remain essential in emerging and developing markets, where limited refrigeration infrastructure and cost considerations influence purchasing decisions. These products offer long storage life and supply stability, making them critical for rural and semi-urban consumption.

Distribution Channel Insights

Supermarkets and hypermarkets account for approximately 45% of total convenience food sales. The leading driver for this channel is the availability of wide product assortments, competitive pricing, and private-label offerings, which attract both value-oriented and premium consumers. These stores also benefit from strong in-store promotions and one-stop shopping convenience.

Online retail is the fastest-growing distribution channel, expanding at double-digit growth rates. Growth is driven by increasing smartphone penetration, digital payment adoption, and demand for doorstep delivery, particularly among urban consumers. Subscription models and quick-commerce platforms are further accelerating online sales.

End-Use Insights

Household consumption dominates the convenience food market with approximately 63% market share. The primary driver of this segment is growing reliance on retail-purchased ready meals and snacks for daily consumption, supported by changing lifestyles, smaller household sizes, and increased participation of women in the workforce.

The foodservice segment is growing at a faster pace, registering a CAGR of over 8%. Growth is driven by the rapid expansion of quick-service restaurants (QSRs), cloud kitchens, and institutional catering services, which increasingly rely on convenience foods to ensure consistency, cost control, and operational efficiency.

| By Product Type | By Preservation Technology | By Distribution Channel | By End Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 32% of the global convenience food market in 2025, led by the United States. Regional growth is driven by high per capita consumption of processed foods, a well-developed retail ecosystem, and strong demand for premium, health-oriented, and functional convenience products. Continuous product innovation, including plant-based, low-calorie, and high-protein offerings, further supports market expansion.

Europe

Europe represents around 26% of the global market, with major demand coming from the U.K., Germany, France, and Italy. Growth in the region is primarily driven by rising consumer preference for clean-label, organic, and plant-based convenience foods. Strong regulatory oversight, sustainability initiatives, and demand for locally sourced ingredients are shaping product development and market growth across Europe.

Asia-Pacific

Asia-Pacific holds nearly 30% market share and is the fastest-growing regional market. China, India, Japan, and South Korea are key contributors, driven by rapid urbanization, rising disposable incomes, longer working hours, and increasing adoption of Western dietary habits. The expansion of modern retail, food delivery platforms, and cold-chain infrastructure is further accelerating convenience food consumption across the region.

Latin America

Latin America accounts for approximately 7% of global demand, led by Brazil and Mexico. Regional growth is supported by expanding modern retail formats, improving cold-storage infrastructure, and increasing consumer acceptance of frozen and packaged foods. Urban population growth and evolving lifestyles are also contributing to rising convenience food demand.

Middle East & Africa

The Middle East & Africa region contributes around 5% of the global convenience food market. Growth is driven by strong institutional and foodservice demand, particularly in Gulf Cooperation Council (GCC) countries. Rising expatriate populations, tourism growth, and government investments in food security and cold-chain infrastructure are supporting increased consumption in markets such as the UAE and Saudi Arabia, while South Africa remains a key hub in sub-Saharan Africa.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Convenience Food Market

- Nestlé

- Conagra Brands

- General Mills

- Tyson Foods

- Kraft Heinz

- Unilever

- Ajinomoto

- McCain Foods

- Hormel Foods

- Kellogg’s

- JBS

- BRF

- Nomad Foods

- Maple Leaf Foods

- Grupo Bimbo