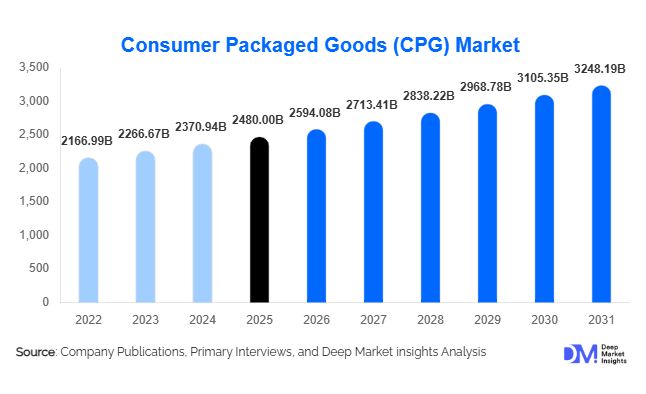

Consumer Packaged Goods Market Size

According to Deep Market Insights, the global consumer packaged goods (CPG) market size was valued at USD 2,480 billion in 2025 and is projected to grow from USD 2,594.08 billion in 2026 to reach USD 3,248.19 billion by 2031, expanding at a CAGR of 4.6% during the forecast period (2026–2031). The consumer packaged goods market growth is primarily driven by rising urbanization, increasing disposable incomes, rapid expansion of organized retail and e-commerce channels, and strong demand for convenience-oriented and health-focused products.

The market remains structurally resilient due to recurring household consumption across food & beverages, personal care, home care, health & wellness, and pet care categories. Emerging markets in Asia-Pacific, Latin America, and Africa are contributing disproportionately to volume growth, while North America and Europe continue to lead in value growth through premiumization, clean-label innovation, and sustainability-driven product differentiation.

Key Market Insights

- Food & beverages dominate the global CPG market, accounting for approximately 58% of total revenue in 2025, supported by strong demand for packaged snacks, ready-to-eat meals, and functional beverages.

- E-commerce and direct-to-consumer (D2C) channels are rapidly expanding, now representing nearly 20% of total global CPG sales, particularly in beauty, supplements, and premium packaged foods.

- Asia-Pacific holds the largest regional share at around 34% of global revenue, led by China, India, and Japan.

- North America remains the largest value-driven market, with the United States contributing nearly 85% of regional CPG demand.

- Private label and premium tiers are gaining traction simultaneously, reflecting consumer polarization across affordability and aspirational consumption.

- Sustainable packaging and ESG compliance are reshaping investment priorities, with companies accelerating biodegradable materials adoption and plastic-reduction initiatives.

What are the latest trends in the consumer packaged goods market?

Premiumization and Functional Product Innovation

Premiumization remains one of the strongest structural trends across the global CPG industry. Consumers are increasingly trading up to higher-value offerings in categories such as organic snacks, plant-based dairy alternatives, dermatologist-tested skincare, and fortified beverages. Functional benefits such as immunity support, digestive health, cognitive enhancement, and protein enrichment are influencing purchasing decisions. This shift has allowed manufacturers to command higher margins, particularly in developed markets where brand loyalty and health awareness are strong. In emerging economies, rising middle-class households are accelerating the transition from unbranded or loose goods to branded packaged products, further strengthening premium growth.

Digital Commerce and Data-Driven Retail Transformation

The rapid expansion of online grocery platforms and direct-to-consumer channels is transforming CPG distribution models. Brands are leveraging AI-driven demand forecasting, personalized marketing, and subscription-based replenishment systems to enhance consumer retention. Data analytics is being deployed to optimize SKU assortments, pricing strategies, and promotional campaigns. Social commerce, influencer-led product launches, and real-time consumer engagement tools are further reshaping brand-consumer relationships. As digital penetration rises, manufacturers are allocating higher budgets to e-commerce fulfillment infrastructure and omnichannel integration strategies.

What are the key drivers in the consumer packaged goods market?

Urbanization and Rising Disposable Income

Rapid urban migration, particularly across the Asia-Pacific and Africa, is driving increased consumption of packaged food, beverages, and personal care products. Urban lifestyles favor convenience-oriented formats such as ready-to-cook meals, single-serve beverages, and compact hygiene products. Growing disposable incomes are enabling consumers to shift toward premium and branded alternatives, strengthening overall market value.

Expansion of Organized Retail and Modern Trade

The proliferation of hypermarkets, supermarkets, and wholesale clubs has improved product accessibility and category visibility. Organized retail now accounts for a significant share of CPG distribution in both developed and emerging markets. Improved cold-chain logistics and inventory management systems have enhanced supply efficiency, enabling broader penetration into semi-urban and rural regions.

Health and Wellness Awareness

Preventive healthcare awareness is driving strong demand for vitamins, dietary supplements, low-sugar beverages, natural personal care products, and clean-label foods. Consumers are increasingly scrutinizing ingredient transparency, nutritional labeling, and sustainability claims, pushing companies to reformulate products and enhance regulatory compliance.

What are the restraints for the global market?

Raw Material Price Volatility

Fluctuations in agricultural commodities, petrochemical derivatives used in packaging, and transportation costs directly affect production margins. Rising input costs often lead to pricing pressures, particularly in price-sensitive markets where private label competition is strong.

Regulatory and Sustainability Compliance Costs

Governments across North America and Europe are introducing stricter regulations related to sugar taxation, plastic usage, labeling transparency, and carbon emissions. Compliance with evolving ESG frameworks increases operational costs and may compress margins, particularly for smaller manufacturers lacking scale advantages.

What are the key opportunities in the consumer packaged goods industry?

Sustainable Packaging Innovation

Transitioning toward recyclable, biodegradable, and refill-based packaging presents a significant opportunity. Companies investing early in circular packaging models are gaining regulatory advantages and strengthening brand equity among environmentally conscious consumers.

Emerging Market Manufacturing Expansion

Government initiatives such as “Make in India” and “Made in China 2026” are encouraging domestic production of consumer goods. Local manufacturing reduces import dependency, improves cost competitiveness, and enhances responsiveness to regional consumer preferences.

Product Type Insights

Food & Beverages remain the dominant product category, contributing approximately 58% of total global CPG revenue in 2025. The leadership of this segment is primarily driven by high purchase frequency, essential consumption nature, and continuous product innovation. Within this category, packaged snacks, ready-to-eat (RTE) meals, and non-alcoholic beverages are the leading sub-segments. Urbanization, dual-income households, and time-constrained lifestyles are accelerating demand for convenience-driven formats such as single-serve packaging, frozen meals, and on-the-go beverages. Additionally, premiumization trends, including organic, plant-based, low-sugar, and fortified products, are enabling higher average selling prices (ASPs), strengthening value growth in both developed and emerging markets.

Home Care contributes approximately 12% of global CPG revenue, led by laundry care products that maintain stable, recurring demand across all income groups. Innovation in concentrated detergents, eco-friendly cleaning solutions, and fragrance-enhanced formats supports value growth. Hygiene awareness post-pandemic continues to reinforce steady demand across surface cleaners and disinfectants. Health & Wellness CPG products represent about 7% of total revenue, with dietary supplements accounting for nearly 45% of this segment. Preventive healthcare awareness, aging populations in developed economies, and immunity-focused consumption trends are key drivers. Pet Care, accounting for around 5% of the market, is among the fastest-growing segments globally. Rising pet humanization trends, premium pet nutrition, and subscription-based pet food models are accelerating growth, particularly in North America, Europe, and urban Asia.

Distribution Channel Insights

Hypermarkets and supermarkets account for approximately 45% of global CPG sales, maintaining dominance due to strong supplier relationships, wide SKU assortments, and efficient supply chain infrastructure. Their leadership is supported by impulse purchases, promotional bundling, and bulk-buying behavior. E-commerce contributes nearly 20% of total global sales and remains the fastest-growing channel, expanding at high single-digit growth rates. Growth is driven by digital payment penetration, last-mile delivery improvements, subscription models, and direct-to-consumer (D2C) strategies. Beauty, supplements, specialty foods, and premium products show particularly strong online conversion rates due to targeted digital marketing and influencer-driven engagement.

Convenience stores play a key role in impulse-driven purchases and urban micro-markets, while specialty retailers support premium and niche categories such as organic foods and dermatological skincare. Wholesale clubs and cash-and-carry models are expanding in emerging markets, supporting price-sensitive consumers and small business buyers.

End-Use Insights

Household consumption accounts for over 90% of global CPG demand, making it the foundational end-use segment. Growth in this segment is closely linked to demographic expansion, urban housing development, and increasing per-capita spending. Single-person households and nuclear family trends are further influencing packaging sizes and premium SKUs. Institutional buyers, including hospitality, healthcare facilities, educational institutions, and corporate offices, represent a growing secondary end-use segment. Bulk procurement of packaged foods, hygiene products, and cleaning supplies supports steady demand. The global online grocery sector, valued at over USD 600,000 million, is expanding at more than 8% CAGR, significantly influencing consumption behavior and inventory planning strategies.

Export-driven demand remains strong in premium personal care, processed foods, and health supplements. The United States, China, and Germany rank among the largest importing countries for branded CPG products, driven by consumer preference for global brands and high-quality formulations.

| By Product Type | By Distribution Channel | By Pricing Tier |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for approximately 26% of global CPG revenue in 2025. The United States dominates regional demand due to high per-capita consumption, strong brand penetration, and premium product adoption. Key growth drivers include advanced retail infrastructure, high e-commerce penetration, innovation in functional foods, and strong consumer purchasing power. Health-conscious consumption patterns and subscription-based replenishment models are further accelerating growth. Canada contributes to steady expansion, supported by private label growth and rising demand for sustainable and clean-label products.

Europe

Europe holds nearly 24% of the global market share, with Germany, the United Kingdom, France, and Italy leading regional demand. Growth in Europe is strongly influenced by regulatory frameworks emphasizing sustainability, carbon neutrality, and packaging waste reduction. Consumer preference for organic, plant-based, and ethically sourced products drives premium segment expansion. Additionally, aging populations in Western Europe support a stable demand for health supplements and pharmaceutical CPG products.

Asia-Pacific

Asia-Pacific leads globally with around 34% market share and remains the primary volume growth engine. China accounts for nearly 14% of global CPG demand, driven by rapid urbanization, middle-class expansion, digital commerce dominance, and strong domestic manufacturing capabilities. India is the fastest-growing major market, with growth exceeding 7% CAGR, supported by rising disposable incomes, expanding organized retail, and favorable government manufacturing initiatives. Japan remains a mature but innovation-driven market, particularly in premium skincare, functional beverages, and advanced packaging technologies. Southeast Asia is emerging as a key growth cluster due to population expansion and retail modernization.

Latin America

Latin America contributes approximately 9% of global revenue, led by Brazil and Mexico. Growth drivers include expanding supermarket chains, increasing urbanization, and rising brand penetration in tier-2 cities. Economic stabilization in key economies and improving digital payment infrastructure are supporting gradual e-commerce expansion. Price sensitivity remains a defining characteristic, encouraging private label and value-tier growth.

Middle East & Africa

The Middle East & Africa account for roughly 7% of global demand and represent the fastest-growing region at over 6% CAGR. Growth is driven by rapid urbanization, young demographics, and expanding modern trade networks. The UAE and Saudi Arabia benefit from high disposable income and premium product demand, while South Africa serves as a manufacturing and distribution hub for the African continent. Increasing foreign direct investment in retail infrastructure and local manufacturing capacity is further strengthening long-term regional growth prospects.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Consumer Packaged Goods Market

- Procter & Gamble

- Nestlé

- Unilever

- PepsiCo

- The Coca-Cola Company

- Johnson & Johnson

- L'Oréal

- Mondelez International

- Colgate-Palmolive

- Kimberly-Clark

- Danone

- Reckitt

- Kraft Heinz

- General Mills

- Mars Incorporated