Mirrorless Camera Market Size

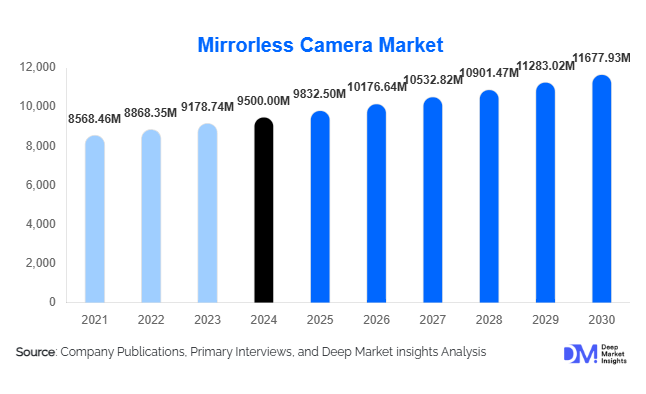

According to Deep Market Insights, the global mirrorless camera market size was valued at USD 9,500 million in 2024 and is projected to grow from USD 9,832.5 million in 2025 to reach USD 11,677.93 million by 2030, expanding at a CAGR of 3.5% during the forecast period (2025–2030). The growth of the mirrorless camera market is primarily driven by rising demand for lightweight, high-performance imaging devices, rapid adoption among content creators and professional photographers, and continuous innovations in autofocus, AI-driven image processing, and 8K video capabilities.

Key Market Insights

- Mirrorless cameras are rapidly replacing DSLRs as the preferred choice for professionals and enthusiasts due to superior portability, faster shooting speeds, and advanced video features.

- Full-frame and APS-C models dominate the market, with growing traction in medium-format and entry-level compact categories.

- North America and Europe remain leading markets, driven by high adoption among professional photographers, media creators, and vloggers.

- Asia-Pacific is the fastest-growing region, supported by rising disposable incomes, social media-driven photography trends, and growing demand from China, Japan, and India.

- Integration of AI, computational photography, and real-time connectivity with smartphones and editing platforms is reshaping user experiences.

- Video-first adoption, fueled by YouTube, TikTok, and streaming platforms, is driving demand for mirrorless cameras with superior video capabilities.

What are the latest trends in the mirrorless camera market?

AI-Powered Imaging and Autofocus Systems

Manufacturers are increasingly embedding AI into autofocus, subject recognition, and image enhancement. Eye-tracking, real-time subject detection, and predictive focus capabilities are becoming standard across premium and mid-range models. These technologies improve precision in sports, wildlife, and cinematic applications while making professional-grade results more accessible to hobbyists.

Hybrid Photo-Video Cameras for Creators

With the boom in content creation, hybrid mirrorless cameras optimized for both photography and high-resolution video (4K/8K) are gaining traction. Compact designs with in-body stabilization, fast frame rates, and pro-level codecs appeal to vloggers, filmmakers, and livestreamers. Accessories like vertical grips, wireless mics, and modular rigs are expanding ecosystems around hybrid cameras.

What are the key drivers in the mirrorless camera market?

Rise of Social Media and Influencer Culture

The demand for high-quality content on platforms like Instagram, TikTok, and YouTube is fueling sales of mirrorless cameras. Content creators prioritize portability, sharp 4K/8K video, and wireless transfer features to maintain high-quality outputs while engaging digital audiences.

Shift from DSLR to Mirrorless Systems

Leading brands such as Canon, Sony, and Nikon are phasing out DSLR models in favor of mirrorless systems. Advantages such as lighter weight, faster shooting speeds, and electronic viewfinders with live previews are compelling photographers and filmmakers to transition rapidly.

What are the restraints for the global market?

High Cost of Professional Models

Flagship mirrorless cameras remain cost-intensive, limiting accessibility for beginners and hobbyists. Professional-grade lenses, accessories, and upgrades add to the total cost of ownership, restraining adoption in price-sensitive markets.

Competition from Smartphones

Rapid advances in smartphone cameras, featuring computational photography, periscope zooms, and AI image processing, are reducing demand for entry-level mirrorless models. Smartphones remain more convenient for casual users, posing a major challenge to the lower segment of the mirrorless market.

What are the key opportunities in the mirrorless camera industry?

Expansion in Emerging Economies

Rising disposable income in Asia-Pacific, Latin America, and the Middle East is creating new growth opportunities. Localized marketing, influencer partnerships, and installment-based purchasing options are helping brands penetrate these fast-growing markets.

Integration with Cloud and Editing Ecosystems

Mirrorless cameras are increasingly being equipped with Wi-Fi, Bluetooth, and cloud integration for seamless content transfer. Partnerships with editing platforms such as Adobe Lightroom and DaVinci Resolve are opening new opportunities to position cameras as part of an end-to-end content creation workflow.

Product Type Insights

Full-frame mirrorless cameras dominate the premium segment, offering superior image quality and low-light performance. APS-C models cater to enthusiasts and semi-professionals seeking affordability with advanced features. Medium-format cameras remain niche but are gaining adoption in commercial photography. Entry-level compact mirrorless models are targeting vloggers, travelers, and hobbyists seeking an upgrade from smartphones.

Application Insights

Professional photography and filmmaking remain the largest application, driven by demand for superior optics and video capabilities. Vlogging and content creation are rapidly growing, supported by hybrid features. Wildlife and sports photography benefit from fast continuous shooting and advanced autofocus. Travel and lifestyle users favor compact, lightweight models with wireless transfer features.

Distribution Channel Insights

Online platforms dominate sales, enabling users to compare specifications, reviews, and bundle deals. Specialized camera retailers continue to serve professional buyers seeking hands-on experiences. Direct-to-consumer (D2C) brand stores are growing with personalized promotions and exclusive launches. Rental platforms are also expanding, especially among filmmakers and students who prefer access over ownership.

| Sensor Format | Camera Class | Lens Ecosystem |

|---|---|---|

|

|

|

Regional Insights

North America

North America remains a dominant market, driven by high adoption among professionals and creators. The U.S. leads with strong demand for hybrid cameras, cinematic production, and premium lenses, supported by a mature distribution network.

Europe

Europe is a key growth region, with Germany, the U.K., and France leading demand. Strong interest in sustainable products and professional-grade content creation supports adoption. The region also benefits from a vibrant wedding, event, and documentary photography industry.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by China, Japan, and India. Rising middle-class affluence, booming influencer culture, and government support for creative industries are fueling demand. Japan remains a manufacturing hub, with domestic adoption further supporting market growth.

Latin America

Latin America is showing gradual adoption, particularly in Brazil and Mexico, where social media-driven demand and emerging creative industries are stimulating growth. Economic volatility and price sensitivity remain key challenges.

Middle East & Africa

Wealthy consumer bases in the UAE, Saudi Arabia, and South Africa are driving the adoption of premium mirrorless cameras. Expanding creative industries and media production, along with government investments in digital transformation, are supporting market growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Mirrorless Camera Market

- Sony Corporation

- Canon Inc.

- Nikon Corporation

- Fujifilm Holdings Corporation

- Panasonic Corporation

- Olympus Corporation (OM Digital Solutions)

- Leica Camera AG

Recent Developments

- In June 2025, Sony launched a new flagship mirrorless model with advanced AI autofocus and 8K recording capabilities, targeting professional filmmakers and sports photographers.

- In May 2025, Canon expanded its EOS R lineup with new APS-C models aimed at vloggers and content creators, featuring lightweight designs and enhanced connectivity.

- In April 2025, Fujifilm introduced a medium-format mirrorless camera with enhanced computational photography tools, expanding its reach in commercial and studio applications.