Cold Processing Bakery Additives Market Size

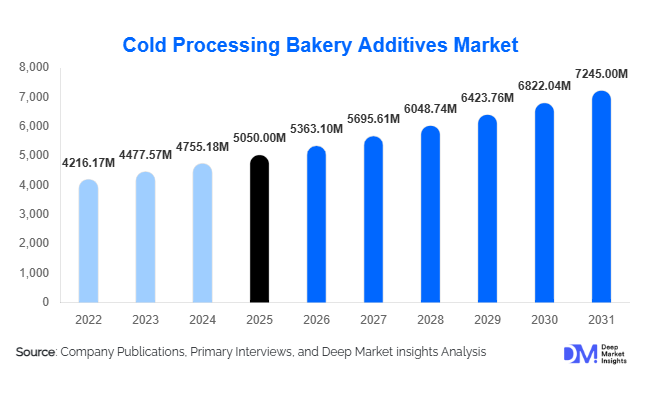

According to Deep Market Insights, the global cold processing bakery additives market size was valued at USD 5,050 million in 2025 and is projected to grow from USD 5,363.10 million in 2026 to reach USD 7,245.00 million by 2031, expanding at a CAGR of 6.2% during the forecast period (2026–2031). The market growth is primarily driven by rising demand for ready-to-eat and frozen bakery products, increasing consumer preference for clean-label and functional bakery items, and technological advancements in energy-efficient cold processing methods.

Key Market Insights

- Emulsifiers and stabilizers dominate the product segment, supporting dough texture, shelf-life, and consistent quality across commercial and retail bakeries.

- Commercial bakeries lead end-use demand, contributing over 50% of global consumption, driven by large-scale production of frozen and functional bakery products.

- Europe and North America account for nearly 58% of the market due to advanced bakery technologies, high consumer spending, and strong frozen bakery adoption.

- Asia-Pacific is the fastest-growing region, led by increasing urbanization, rising disposable incomes, and retail bakery expansion in China and India.

- Functional and clean-label bakery products are emerging as key trends, with consumers preferring natural enzymes, hydrocolloids, and preservative-free formulations.

- Technological integration in cold processing, including enzyme-based conditioners and automated additive dosing systems, is improving efficiency and product consistency.

What are the latest trends in the cold processing bakery additives market?

Rise of Clean-Label and Functional Ingredients

Manufacturers are increasingly incorporating plant-based, organic, and enzyme-based additives to meet consumer demand for healthier bakery products. Clean-label formulations, free from artificial preservatives, are becoming standard in premium bakery segments. Functional additives such as protein-enriched, fiber-fortified, and prebiotic-enhanced ingredients are growing in popularity, offering value-added benefits while maintaining texture and shelf-life in cold-processed baked goods.

Integration of Technology in Production

Automation and advanced additive dosing systems are improving consistency, efficiency, and scalability in commercial bakeries. Smart cold processing equipment integrated with hydrocolloid and enzyme-based formulations ensures precise dough conditioning, enhances product uniformity, and reduces energy consumption. Manufacturers are investing in research and development for multi-functional additives that can serve as emulsifiers, stabilizers, and preservatives simultaneously, streamlining the production process.

What are the key drivers in the cold processing bakery additives market?

Growth in Frozen and Ready-to-Eat Bakery Products

Urbanization and the rising demand for convenient bakery items have accelerated frozen bakery consumption. Cold processing additives are crucial for maintaining freshness, texture, and shelf-life, making them indispensable in mass-produced and retail-ready bakery items. Increasing demand for frozen bread, rolls, pastries, and specialty functional bakery products supports the growth of this market.

Health-Conscious Consumer Preferences

Consumers are opting for products made with natural emulsifiers, enzyme-based conditioners, and preservative-free additives. Plant-based and organic bakery formulations are increasingly favored, driving innovation in cold processing additives that align with clean-label requirements. Functional bakery items, such as protein-rich or fiber-enriched products, are creating additional demand in this segment.

Technological Advancements in Additives

Innovations in enzyme-based conditioners, hydrocolloid stabilizers, and multi-functional emulsifiers are expanding application potential. Cold processing technologies that maintain product quality while reducing energy usage are being widely adopted, especially in commercial bakeries. These advancements allow manufacturers to meet both regulatory standards and consumer expectations for premium bakery products.

What are the restraints for the global market?

High Cost of Specialized Additives

Advanced enzyme-based and natural emulsifiers are often more expensive than conventional additives, posing a barrier for small-scale and price-sensitive bakeries. High ingredient costs can limit adoption in emerging markets where cost competitiveness is crucial.

Regulatory Challenges Across Regions

Varying regulations on food additive types and permissible concentrations across countries can slow product approvals and market entry. Compliance with stringent safety standards, particularly in Europe and North America, requires investment in testing and documentation, which can delay commercialization.

What are the key opportunities in the cold processing bakery additives market?

Expansion in Emerging Economies

Asia-Pacific countries, including China and India, are witnessing rapid urbanization and retail bakery growth. Government initiatives such as “Make in India” and industrial modernization programs in China are creating favorable conditions for both new entrants and established players to scale operations. Rising disposable incomes and changing lifestyles in these regions are generating demand for frozen, functional, and convenience bakery products, fueling additive consumption.

Functional and Clean-Label Product Innovation

Manufacturers have the opportunity to innovate with plant-based, organic, and enzyme-based additives that cater to health-conscious consumers. Products enriched with protein, fiber, or probiotics not only meet consumer preferences but also allow premium pricing. Integration of multi-functional additives that serve as emulsifiers, stabilizers, and preservatives can further streamline production and reduce operational costs.

Export-Driven Market Expansion

European and North American bakeries are exporting large volumes of frozen and functional bakery products. Suppliers of cold processing additives can capitalize on this trend by expanding their global footprint. Export demand incentivizes the development of versatile additives that meet international quality standards, opening new revenue streams for manufacturers.

Product Type Insights

The cold processing bakery additives market is segmented into emulsifiers, stabilizers, dough conditioners, enzymes, natural preservatives, and other functional ingredients. Emulsifiers dominate the global market with a 34% share in 2025, supported by their critical role in improving dough stability, gas retention, crumb softness, and extended shelf-life in frozen and chilled bakery products. The leading segment driver for emulsifiers is the rapid expansion of frozen and par-baked bakery production, where consistency, machinability, and thaw stability are essential. Mono- and diglycerides, lecithin, and DATEM are particularly prominent in industrial-scale operations, ensuring uniform texture and volume across large production batches.

Stabilizers and dough conditioners are witnessing steady growth due to rising demand for clean-label, high-performance bakery formulations. Enzyme-based conditioners are gaining traction as manufacturers seek to reduce chemical additives while maintaining product softness and freshness. Natural preservatives are also expanding rapidly, driven by consumer preference for minimally processed and label-friendly ingredients.

By form, powdered additives account for 46% of total consumption, making them the leading form segment. The key driver for powdered forms is their ease of storage, longer shelf-life, precise dosing capability, and compatibility with automated large-scale production systems. Liquid variants are growing in niche applications but remain secondary due to higher logistics and stability considerations.

Application Insights

Based on application, bread and rolls lead the market with a 28% share in 2025. The primary growth driver for this segment is the high global consumption of staple bakery products combined with increasing industrial-scale production. Cold processing additives are extensively used in bread manufacturing to enhance dough strength, fermentation tolerance, freeze-thaw stability, and shelf-life extension.

Cakes, pastries, and cookies represent the second-largest application category, supported by innovation in premium, indulgent, and frozen dessert offerings. The growing popularity of ready-to-bake and ready-to-eat formats further accelerates additive usage in this segment.

Specialty bakery products—including protein-enriched, gluten-free, and plant-based items—are emerging rapidly, particularly in developed markets. Rising health awareness, fitness-oriented consumption, and demand for functional ingredients are stimulating adoption of advanced cold processing solutions. Frozen bakery products increasingly rely on specialized emulsifiers, enzymes, and stabilizers to maintain texture integrity, moisture retention, and volume after thawing and reheating.

End-Use Insights

Commercial bakeries account for 52% of the global market, making them the largest end-use segment. The leading driver for this segment is the need for high-volume production efficiency, product consistency, and extended distribution cycles in both domestic and export markets. Industrial bakeries rely heavily on cold processing additives to standardize formulations, reduce waste, and improve freeze-thaw performance.

Retail bakeries are increasingly adopting these additives to maintain freshness and diversify premium offerings. Foodservice establishments—including restaurants, hotels, and quick-service chains—are expanding their use of frozen dough and par-baked products, further boosting additive demand.

The fastest-growing end-use areas include functional bakery products and frozen pastries, particularly in Europe and North America, where export-driven demand and organized retail penetration are strong. Integration of automation and digital dosing systems in large bakeries is further enhancing operational efficiency and encouraging additive adoption.

| By Product Type | By Application | By Form | By End-Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounted for 28% of the global market in 2025, led by the U.S. and Canada. Key growth drivers include high per capita consumption of frozen and packaged bakery products, well-established commercial bakery infrastructure, and strong demand for convenience foods. The expansion of private-label bakery brands, increasing clean-label innovation, and widespread adoption of automation in food manufacturing further support regional growth. Additionally, robust cold chain logistics enable large-scale frozen product distribution across the region.

Europe

Europe holds approximately 30% of the global market share in 2025, with Germany, the U.K., and France as leading contributors. Regional growth is driven by advanced bakery technology, strong export-oriented production, and high consumer preference for premium and artisanal bakery products. Clean-label regulations and sustainability standards are accelerating the shift toward enzyme-based and natural additives. Europe’s dominance in frozen pastry exports and cross-border trade further strengthens additive consumption.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, with China and India expanding at an estimated 8–9% CAGR. Growth drivers include rapid urbanization, rising disposable incomes, increasing westernization of diets, and the expansion of organized retail bakery chains. Government initiatives supporting food processing infrastructure, coupled with rising investments in domestic bakery manufacturing, are accelerating additive demand. Mature markets such as Japan and South Korea maintain steady growth, particularly in premium, functional, and convenience bakery segments.

Middle East & Africa

The Middle East & Africa region is experiencing steady growth, led by the UAE, Saudi Arabia, and South Africa. Drivers include expanding retail bakery chains, high demand for imported frozen bakery products, and increasing urban consumer spending. Tourism growth in Gulf countries further stimulates hotel and foodservice bakery demand. In Africa, improving intra-regional trade and gradual development of cold storage infrastructure are creating new opportunities for additive suppliers.

Latin America

Latin America is driven by Brazil, Argentina, and Mexico. Regional growth is supported by increasing urban population, modernization of bakery production facilities, and growing consumer demand for packaged and frozen baked goods. While cold processing infrastructure is still developing, rising exports of premium and functional bakery products are encouraging investment in advanced additive technologies. Retail expansion and the penetration of convenience food formats are further strengthening regional demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Cold Processing Bakery Additives Market

- Cargill, Inc.

- Puratos Group

- AB Mauri

- Chr. Hansen Holding A/S

- Corbion N.V.

- Givaudan S.A.

- International Flavors & Fragrances (IFF)

- DSM Food Specialties

- Kerry Group

- DuPont de Nemours, Inc.

- Lesaffre

- Ingredion Incorporated

- Royal Cosun

- Tate & Lyle PLC

- Bakels Group