Cognitive Supplement Market Size

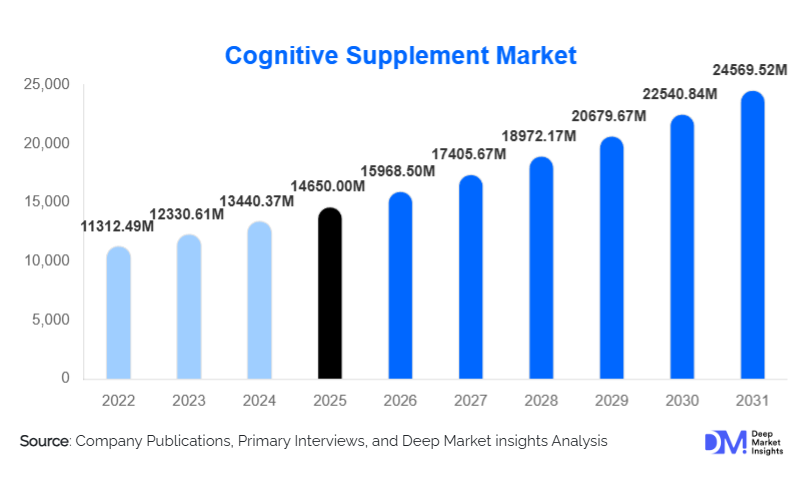

According to Deep Market Insights, the global cognitive supplement market size was valued at USD 14,650.00 million in 2025 and is projected to grow from USD 15,968.50 million in 2026 to reach USD 24,569.52 million by 2031, expanding at a CAGR of 9.0% during the forecast period (2026–2031). The cognitive supplement market growth is driven by rising awareness of brain health, increasing cognitive workload across professional and academic populations, and growing adoption of preventive healthcare solutions among aging demographics.

Key Market Insights

- Cognitive supplements are transitioning from niche nootropics to mainstream wellness products, supported by clinical validation of ingredients such as omega-3 DHA, citicoline, and adaptogenic herbs.

- Multi-functional cognitive stacks dominate demand, as consumers increasingly prefer all-in-one solutions addressing memory, focus, mood, and stress.

- North America leads the global market, supported by strong DTC penetration, high disposable incomes, and established nutraceutical brands.

- Asia-Pacific is the fastest-growing region, driven by academic competition, workplace productivity pressures, and rising middle-class incomes.

- Online and subscription-based distribution models are reshaping purchasing behavior, improving consumer education, and promoting repeat consumption.

- Regulatory tightening in developed markets is improving quality standards, favoring established and clinically backed players.

What are the latest trends in the cognitive supplement market?

Rise of Multi-Functional Cognitive Stacks

Consumers are increasingly gravitating toward multi-functional cognitive supplements that combine ingredients for memory enhancement, focus improvement, mood regulation, and neuroprotection. These stacks reduce pill burden and simplify daily routines, making them attractive to working professionals and aging consumers alike. Brands are leveraging advanced formulation science, such as sustained-release capsules and bioavailability enhancers, to differentiate products. This trend has positioned multi-functional stacks as the leading product type, accounting for more than one-third of global market demand.

Digital-First and Personalized Nutrition Integration

Technology is playing a growing role in the cognitive supplement market through AI-driven personalization, wearable integrations, and digital wellness platforms. Subscription models offering customized supplement stacks based on cognitive goals, stress levels, and lifestyle factors are gaining traction, particularly in North America and Europe. Personalized nutrition not only enhances perceived efficacy but also supports premium pricing and higher customer lifetime value.

What are the key drivers in the cognitive supplement market?

Growing Cognitive Stress and Mental Health Awareness

Modern lifestyles characterized by constant digital engagement, high academic expectations, and demanding work environments are increasing cognitive stress globally. Cognitive supplements addressing focus, mental clarity, and stress resilience are increasingly viewed as productivity and wellness essentials rather than optional enhancements. This shift has significantly expanded the addressable consumer base.

Aging Population and Preventive Brain Health Focus

The global aging population is a major driver of long-term demand. Older adults are increasingly adopting cognitive supplements as part of preventive healthcare routines to support memory retention and delay age-related cognitive decline. Governments and healthcare systems promoting preventive nutrition are indirectly supporting market expansion.

What are the restraints for the global market?

Regulatory Constraints on Health Claims

Stringent regulations governing cognitive and neurological claims in markets such as the U.S., Europe, and Japan limit marketing flexibility and increase compliance costs. Companies must invest heavily in clinical studies and regulatory approvals, which can slow product launches and innovation cycles.

Price Sensitivity in Emerging Economies

Premium cognitive supplements remain relatively expensive in developing markets, restricting adoption among price-sensitive consumers. Limited purchasing power and lower awareness of preventive brain health slow penetration unless localized pricing and formulation strategies are adopted.

What are the key opportunities in the cognitive supplement industry?

Healthy Aging and Geriatric Nutrition Integration

The integration of cognitive supplements into geriatric nutrition programs represents a significant opportunity. Products positioned for healthy aging, neuroprotection, and memory support can benefit from partnerships with healthcare providers, elder-care institutions, and insurance-backed wellness initiatives.

Rapid Expansion in Asia-Pacific Markets

Asia-Pacific presents substantial growth opportunities, particularly in China and India. Academic competition, rising disposable incomes, and cultural acceptance of herbal ingredients are driving double-digit growth. Localization using traditional botanicals combined with modern nootropics offers strong differentiation potential.

Product Type Insights

Multi-functional cognitive stacks lead the market, accounting for approximately 34% of global revenue in 2025, driven by consumer preference for comprehensive solutions. Memory enhancement supplements remain a core category, particularly among aging consumers, while focus and attention supplements see strong uptake among students and professionals. Mood and stress regulation supplements are gaining momentum as mental wellness becomes a central component of cognitive health.

Ingredient Category Insights

Herbal and botanical extracts dominate the ingredient landscape with nearly 38% market share, reflecting consumer preference for natural and traditional formulations. Amino acids and derivatives such as L-theanine and citicoline represent a fast-growing segment due to strong scientific backing. Fatty acids, particularly omega-3 DHA, continue to play a critical role in neuroprotection-focused products.

Distribution Channel Insights

Online direct-to-consumer channels account for roughly 37% of global sales, making them the leading distribution route. Pharmacies and drug stores remain important for trust-based purchases, particularly among older consumers. Subscription-based models are emerging as a high-growth channel, driving repeat purchases and personalized engagement.

Age Group Insights

Working professionals aged 36–55 years represent the largest consumer segment, accounting for approximately 41% of market demand due to productivity and burnout concerns. Young adults aged 19–35 drive demand for focus-enhancing products, while consumers aged 56 and above are a high-value segment for memory and neuroprotection supplements.

| By Product Type | By Ingredient Category | By Dosage Form | By Distribution Channel | By End-User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds the largest market share at approximately 38% in 2025, led by the United States. High awareness of cognitive health, strong DTC ecosystems, and widespread supplement adoption support regional dominance.

Europe

Europe accounts for about 26% of global demand, with Germany, the U.K., and France leading consumption. Regulatory rigor supports product quality and consumer trust, while demand for natural and clinically backed supplements continues to grow.

Asia-Pacific

Asia-Pacific represents roughly 24% of the market and is the fastest-growing region, expanding at over 11% CAGR. China and India are key growth engines, supported by rising academic pressure, workplace competitiveness, and cultural familiarity with herbal ingredients.

Latin America

Latin America holds nearly 7% market share, with Brazil and Mexico leading demand. Growth is supported by increasing health awareness and expanding retail availability of nutraceuticals.

Middle East & Africa

The Middle East & Africa region accounts for around 5% of global demand. GCC countries drive premium supplement consumption, while South Africa leads regional production and distribution.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Cognitive Supplement Market

- Nestlé Health Science

- Bayer AG

- Reckitt

- Herbalife

- Amway

- NOW Foods

- Nature’s Bounty

- Blackmores

- Swisse Wellness

- Neurohacker Collective

- HVMN

- Thorne HealthTech

- Pure Encapsulations

- Life Extension

- GNC