Cocoa-Based Polyphenols Market Size

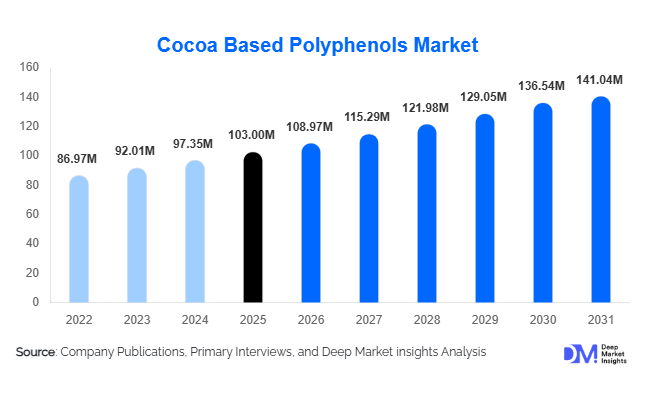

According to Deep Market Insights, the global cocoa-based polyphenols market size was valued at USD 103.00 million in 2025 and is projected to grow from USD 108.97 million in 2026 to reach USD 141.04 million by 2031, expanding at a CAGR of 5.8% during the forecast period (2026–2031). The market growth is primarily driven by rising consumer awareness regarding natural antioxidants, increasing adoption of functional foods and beverages, and expanding applications in dietary supplements and personal care products.

Key Market Insights

- Functional beverages dominate demand, with cocoa polyphenols incorporated for cardiovascular, cognitive, and digestive health benefits.

- Asia Pacific is the largest regional market, led by rising health awareness and increased consumption of fortified foods and beverages in China and India.

- North America remains a significant market, driven by early adoption of natural antioxidant supplements and robust nutraceutical regulations.

- Emerging applications in cosmetics and personal care are creating new growth avenues due to the antioxidant and anti-aging properties of cocoa polyphenols.

- Technological adoption in extraction and standardization is enhancing polyphenol concentration, product quality, and regulatory compliance.

- Distribution is shifting toward direct B2B sales and e-commerce platforms, enabling global reach and personalized solutions for dietary supplement companies.

What are the latest trends in the cocoa-based polyphenols market?

Rise of Functional and Personalized Nutrition

Manufacturers are increasingly integrating cocoa polyphenols into functional foods and personalized supplements. Consumers are seeking products targeting heart health, anti-aging, and cognitive support. Advances in personalized nutrition platforms allow tailored polyphenol intake based on individual metabolic and lifestyle profiles. This trend encourages innovation in powder, capsule, and liquid extract formulations with higher bioavailability.

Technological Innovations in Extraction and Formulation

Emerging extraction technologies, such as solvent-free and green extraction methods, are enabling higher polyphenol yields while maintaining purity. Standardization techniques allow precise quantification of bioactive compounds, which is essential for health claim validation. Improved delivery systems such as microencapsulation and nanoemulsions enhance stability and bioavailability, boosting adoption across food, beverages, and nutraceuticals.

What are the key drivers in the cocoa-based polyphenols market?

Growing Consumer Health Awareness

Increasing awareness of lifestyle diseases and the role of antioxidants is driving demand for cocoa polyphenol-enriched products. Consumers are actively seeking natural ingredients to support heart, cognitive, and digestive health. Functional beverages, fortified foods, and dietary supplements are experiencing high growth as a result.

Expansion of Nutraceutical and Dietary Supplement Segments

The nutraceutical sector is a high-margin growth area for cocoa polyphenols. Aging populations in North America, Europe, and the Asia-Pacific are adopting preventive healthcare measures, favoring supplements rich in antioxidants. Enhanced formulations that improve bioavailability and shelf life are driving widespread adoption.

Cross-Sector Applications and Product Innovation

Beyond food and beverages, cocoa polyphenols are increasingly used in cosmetics and therapeutic nutrition products. Anti-aging skincare, topical antioxidant treatments, and functional wellness beverages are examples of applications expanding market reach. Premium pricing and differentiation support sustained growth in these areas.

What are the restraints for the global market?

High Raw Material and Production Costs

Fluctuating cocoa bean prices and advanced extraction technologies increase production costs, which may limit adoption in price-sensitive markets. Premium products often require standardized polyphenol content, further elevating costs for manufacturers.

Regulatory and Standardization Challenges

Diverse health claim regulations across regions complicate marketing and labeling of cocoa polyphenol products. Lack of globally harmonized definitions can slow product launch timelines and restrict market access in certain jurisdictions.

What are the key opportunities in the cocoa-based polyphenols industry?

Emerging Markets and Rising Health Awareness

Rapid urbanization and increasing disposable incomes in the Asia Pacific and Latin America present opportunities for market expansion. Rising preventive health awareness and adoption of functional foods and supplements in these regions create untapped potential for cocoa polyphenol ingredients.

Integration into Cosmetics and Personal Care

Antioxidant-rich cocoa polyphenols are being incorporated into anti-aging and skin protection products. This emerging segment offers premium pricing and appeals to health-conscious consumers seeking natural, functional cosmetics.

Governance and Sustainable Sourcing Initiatives

Regulatory harmonization and sustainability certifications can enable wider global distribution. Ethical sourcing and environmentally friendly extraction practices appeal to conscious consumers, opening new premium segments and enhancing brand value.

Product Type Insights

Cocoa extract powder continues to dominate the market, accounting for approximately 42% of total revenue in 2025. Its leading position is driven by versatility, cost-efficiency, and ease of integration across multiple applications such as functional foods, beverages, and dietary supplements. Cocoa extract powder can be formulated into a variety of products without affecting taste, texture, or shelf life, making it highly preferred among manufacturers seeking scalability. Liquid extracts and standardized concentrates are experiencing rapid growth due to their higher bioavailability, targeted health benefits, and suitability for specialty applications in nutraceuticals and high-end cosmetics. The rising consumer preference for functional ingredients with clinically proven antioxidant properties is further propelling demand for concentrated cocoa polyphenol formats.

Application Insights

Functional beverages are the leading application, contributing approximately 33% of global market value in 2025. Products such as fortified drinks, cocoa-based wellness beverages, and energy drinks enriched with polyphenols are driving consumption due to growing consumer interest in heart, cognitive, and overall wellness benefits. Functional foods, dietary supplements, and cosmetic applications follow closely, leveraging the antioxidant, anti-aging, and anti-inflammatory properties of cocoa polyphenols. The growth of functional beverages and foods is further fueled by busy urban lifestyles, rising disposable incomes, and increasing awareness of the preventive health benefits of natural polyphenols.

Distribution Channel Insights

B2B direct sales dominate the market, accounting for over 50% of distribution globally. Large beverage, food, and supplement manufacturers prefer long-term supply agreements, reliable formulation support, and consistent quality assurance, which strengthens direct B2B engagement. Emerging e-commerce platforms and specialty retail channels are rapidly expanding, particularly for direct-to-consumer nutraceuticals and functional beverages. This digital channel expansion allows smaller manufacturers and startups to access niche health-conscious consumer segments while providing detailed product information and dosage guidance.

End-Use Insights

Food & beverage manufacturers account for 45% of market demand, incorporating polyphenols into chocolates, bakery items, snacks, and beverages. Nutraceuticals and dietary supplements are the fastest-growing end-use segment, driven by aging populations, rising preventive healthcare awareness, and the popularity of immunity- and wellness-focused products. Cosmetics and personal care represent an emerging high-margin segment, particularly for anti-aging and antioxidant-rich formulations, where cocoa polyphenols are leveraged for skin protection, UV defense, and cosmetic wellness. Increasing consumer interest in natural, plant-based ingredients is boosting adoption across these high-value applications.

| By Product Type | By Application | By Distribution Channel | By End-Use |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia Pacific

Asia Pacific holds the largest market share at approximately 36% in 2025, led by China and India. Rising middle-class incomes, urbanization, and increased health awareness are driving demand for functional foods, beverages, and dietary supplements enriched with cocoa polyphenols. The growth in China is fueled by urban consumers seeking premium and preventive health products, whereas India is witnessing rising adoption of nutraceuticals and functional beverages among younger demographics. Additional drivers include government initiatives promoting nutritional wellness, increasing e-commerce penetration for health products, and rising demand for natural, plant-based ingredients in both food and cosmetic applications.

North America

North America accounts for around 26% of the global market. The U.S. and Canadian markets are driven by early adoption of natural antioxidant supplements, functional beverages, and fortified foods. Strong regulatory frameworks supporting health claims, high consumer purchasing power, and an established preference for premium and clean-label products fuel regional growth. Furthermore, North America benefits from innovation in delivery systems such as bioavailable cocoa extract capsules and beverage formulations, which strengthen adoption in the nutraceutical and functional beverage industries.

Europe

Europe contributes approximately 22% of the market share, with Germany, France, and the U.K. as key contributors. The market is propelled by consumer preference for clean-label, natural, and functional ingredients, along with strong regulatory standards that validate health claims. Key growth drivers include high awareness of preventive healthcare, increasing demand for anti-aging and antioxidant-rich cosmetics, and a trend toward plant-based functional foods. Innovation in product formulations, including beverage concentrates and enriched bakery items, supports steady growth across multiple applications.

Latin America

Latin America accounts for approximately 9–10% of global demand, with Brazil, Argentina, and Mexico leading the market. Growth is driven by rising adoption of functional foods and beverages and increasing outbound consumption of nutraceuticals. Urban population growth, improved distribution channels, and growing consumer interest in preventive health are supporting expansion. Additionally, Brazil’s strong cocoa production heritage allows local manufacturers to produce high-quality polyphenol-rich extracts at competitive prices, encouraging domestic and regional adoption.

Middle East & Africa

The Middle East & Africa region contributes 5–7% of the market. Key drivers include rising disposable incomes, growing health-conscious urban populations, and increasing consumption of premium supplements and functional cosmetics. GCC countries such as the UAE, Saudi Arabia, and Qatar show strong demand for high-quality nutraceuticals and skin care products, while South Africa is emerging as both a production hub and a consumer market. Government support for health initiatives and increasing retail and e-commerce penetration are further accelerating growth in this region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|