Clove Oil Market Size

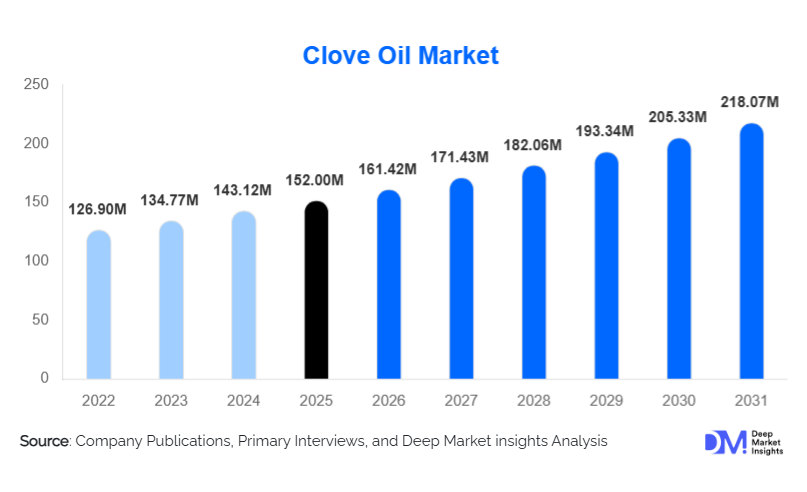

According to Deep Market Insights, the global clove oil market size was valued at USD 152.00 million in 2025 and is projected to grow from USD 161.42 million in 2026 to reach USD 218.07 million by 2031, expanding at a CAGR of 6.2% during the forecast period (2026–2031). The clove oil market growth is primarily driven by rising demand for natural and plant-based ingredients across pharmaceuticals, food & beverages, cosmetics, and wellness industries, along with increasing use of clove oil as a bioactive compound in medicinal and industrial applications.

Key Market Insights

- Pharmaceutical and dental applications dominate global demand, driven by the high eugenol content of clove oil and its analgesic and antimicrobial properties.

- Asia-Pacific leads the global market in both production and consumption, supported by abundant raw material availability and expanding export volumes.

- Steam distillation remains the most widely adopted extraction method, balancing cost efficiency and scalable production.

- Clean-label and natural ingredient trends are accelerating clove oil adoption in food flavoring and personal care formulations.

- Supercritical CO₂ extraction is gaining traction for high-purity and pharmaceutical-grade clove oil, enabling premium pricing.

- Raw material price volatility remains a key challenge due to the climatic dependency of clove cultivation.

What are the latest trends in the clove oil market?

Rising Demand for Natural Bioactives

The clove oil market is increasingly shaped by the global shift toward natural bioactive ingredients. Eugenol-rich clove oil is being widely incorporated into pharmaceutical formulations, dental care products, and functional foods due to its proven antimicrobial and anti-inflammatory properties. This trend is reinforced by stricter regulations on synthetic additives and growing consumer awareness around plant-based alternatives. Manufacturers are responding by focusing on standardized quality grades, traceability, and certification to meet pharmaceutical and food safety requirements.

Technological Advancements in Extraction

Advancements in extraction technologies are transforming the competitive landscape of the clove oil market. While steam distillation continues to dominate, supercritical CO₂ extraction is emerging as a high-growth segment, particularly for applications requiring superior purity and minimal thermal degradation. These innovations allow producers to improve yields, reduce solvent residues, and target high-margin segments such as pharmaceuticals, fragrances, and specialty chemicals. As a result, technology-driven differentiation is becoming a key competitive lever.

What are the key drivers in the clove oil market?

Growth of Pharmaceutical and Dental Industries

The pharmaceutical sector is the largest growth driver for the clove oil market, accounting for approximately 28% of global demand in 2025. Clove oil’s use in dental cements, antiseptics, topical analgesics, and oral care products continues to expand, particularly in emerging economies where access to affordable natural medicines is increasing. Rising healthcare expenditure and growing awareness of oral hygiene are further supporting demand.

Expansion of Clean-Label Food & Beverage Products

Food manufacturers are increasingly incorporating clove oil as a natural flavoring agent and preservative. Clean-label regulations and consumer preference for recognizable ingredients are accelerating adoption across bakery, confectionery, and spice blends. This driver is particularly strong in Europe and Asia-Pacific, where traditional culinary applications align well with modern clean-label trends.

What are the restraints for the global market?

Raw Material Price Volatility

Clove oil production is highly dependent on agricultural output from a limited number of countries, primarily Indonesia, Madagascar, and Tanzania. Climatic fluctuations, crop diseases, and supply chain disruptions can lead to sharp volatility in clove bud prices, directly impacting production costs and profit margins for manufacturers.

Quality Inconsistency and Adulteration Risks

Inconsistent eugenol content and the risk of adulteration with synthetic compounds remain key challenges, particularly in unorganized supply chains. This limits adoption by high-end pharmaceutical and cosmetic companies unless stringent quality assurance systems are implemented.

What are the key opportunities in the clove oil industry?

High-Growth Pharmaceutical-Grade Clove Oil

Pharmaceutical-grade clove oil represents one of the most attractive opportunities in the market. Demand for standardized, high-purity eugenol-rich oil is increasing, particularly in the Asia-Pacific, Africa, and Latin America. Producers investing in GMP-compliant facilities, quality certifications, and long-term sourcing contracts can secure premium margins and stable demand.

Bio-Based Industrial and Agricultural Applications

Clove oil is gaining traction as a bio-based alternative in industrial chemicals, natural pesticides, and veterinary applications. Its role as a chemical intermediate for vanillin synthesis and eco-friendly agrochemicals aligns with global sustainability and green chemistry initiatives, creating new demand avenues beyond traditional uses.

Product Type Insights

Eugenol-rich clove oil dominates the global clove oil market, accounting for approximately 46% of the total market value in 2025. The leadership of this segment is primarily driven by its high eugenol concentration (typically ≥80%), which makes it indispensable for pharmaceutical, dental, and industrial chemical applications. Eugenol-rich clove oil is widely used in dental analgesics, antiseptic formulations, topical pain-relief products, and as a chemical intermediate in vanillin synthesis, where consistency and potency are critical. Rising pharmaceutical production in the Asia-Pacific and increasing dental care expenditure globally have further reinforced demand for this segment.

Eugenol-normal clove oil, with moderate eugenol content, serves as a cost-effective solution for food flavoring and personal care applications. This segment benefits from growing clean-label food trends and increased use in soaps, oral hygiene products, and traditional medicinal formulations. Meanwhile, eugenol-depleted and rectified clove oils cater to fragrance and specialty aroma applications, where controlled scent profiles are required. Although smaller in market share, these segments are gaining traction in high-end perfumery and customized fragrance formulations, particularly in Europe.

Application Insights

Pharmaceutical and medicinal applications represent the largest application segment, contributing nearly 28% of global clove oil demand in 2025. This segment leads due to clove oil’s established efficacy as an antimicrobial, analgesic, and anti-inflammatory agent. Increasing use in dental care products, topical antiseptics, and traditional medicine systems, combined with rising healthcare access in emerging markets, continues to drive strong and resilient demand.

Food flavoring and preservative applications account for approximately 24% of total demand, supported by the global shift toward natural flavoring agents and clean-label food formulations. Clove oil is extensively used in bakery products, confectionery, spice blends, and processed foods, particularly in Asia-Pacific and Europe, where regulatory pressure on synthetic additives is intensifying.

Distribution Channel Insights

Direct B2B sales dominate the clove oil market, accounting for approximately 55% of global market share. This channel is preferred by large pharmaceutical, food, fragrance, and chemical manufacturers that require consistent quality, bulk volumes, and long-term supply contracts. Direct sourcing also allows buyers to ensure compliance with regulatory standards and traceability requirements, which is critical for pharmaceutical- and food-grade clove oil.

Specialty ingredient distributors play a crucial role in expanding regional market penetration, particularly in Europe and North America, where buyers demand certified, application-specific formulations. These distributors act as value-added partners by offering blending, technical support, and regulatory assistance. Meanwhile, online B2B platforms are gaining importance among small and mid-sized manufacturers seeking flexible sourcing options, competitive pricing, and access to multiple suppliers, especially in emerging markets.

End-Use Industry Insights

The pharmaceutical industry is the fastest-growing end-use segment, expanding at an estimated CAGR of over 8.5% during the forecast period. Growth is driven by increasing production of dental care products, topical analgesics, and natural medicinal formulations, particularly in Asia-Pacific, Africa, and Latin America. Pharmaceutical-grade clove oil commands premium pricing due to stringent purity and quality requirements.

The food & beverage and cosmetics industries provide a stable base of demand, supported by clean-label trends, rising consumption of processed foods, and growing preference for natural personal care products. Agrochemical and veterinary applications are emerging as niche, but high-potential end uses, as clove oil is increasingly explored as a bio-based pesticide, antifungal agent, and animal health additive. Export-driven demand from developed markets continues to support production expansion and capacity investments in clove-producing regions.

| By Product Type | By Application | By Distribution Channel | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific dominates the global clove oil market with approximately 48% market share in 2025, supported by its dual role as the largest producer and consumer. Indonesia is the world’s leading clove producer and exporter, benefiting from abundant raw material availability and established distillation infrastructure. India and China are major growth markets, driven by expanding pharmaceutical manufacturing, food processing industries, and increasing adoption of natural wellness products. Strong export demand, lower production costs, and government support for spice processing and value-added exports are key drivers making Asia-Pacific the fastest-growing region, witha CAGR exceeding 8.5%.

North America

North America accounts for nearly 19% of global clove oil demand, led by the United States, which is the largest importer by value. Regional growth is driven by high consumption of pharmaceutical formulations, natural personal care products, and aromatherapy solutions. Strong regulatory frameworks favoring natural ingredients, high consumer purchasing power, and advanced R&D capabilities in pharmaceuticals and cosmetics support sustained demand. The region also leads in high-purity and pharmaceutical-grade clove oil consumption.

Europe

Europe holds around 18% market share, with Germany, France, and the U.K. as key consumers. Growth is driven by stringent regulations restricting synthetic additives, which accelerate the shift toward natural essential oils. Europe’s well-established fragrance, cosmetic, and flavor industries create strong demand for high-quality and rectified clove oil. Sustainability certifications, traceability, and ethical sourcing are particularly important purchasing drivers in this region.

Latin America

Latin America represents approximately 8% of global demand, with Brazil and Mexico leading consumption. Growth in the region is supported by expanding food processing industries, rising adoption of natural ingredients in personal care products, and increasing pharmaceutical manufacturing capabilities. Improving trade linkages with Asia-Pacific suppliers and growing domestic demand for herbal and traditional remedies are further strengthening regional market growth.

Middle East & Africa

The Middle East & Africa account for roughly 7% of the global clove oil market. Tanzania and Madagascar play critical roles on the supply side as key clove-producing nations, benefiting from export-oriented production. Demand growth is concentrated in South Africa, the UAE, and Egypt, driven by pharmaceutical imports, expanding wellness markets, and increasing use of natural ingredients in personal care products. Rising healthcare investment and growing interest in alternative medicine are supporting long-term demand across the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Clove Oil Market

- Symrise AG

- Givaudan SA

- Firmenich SA

- Mane SA

- Takasago International

- Robertet Group

- Privi Organics

- Indesso

- PT Haldin Pacific Semesta

- Albert Vieille

- Ultra International

- Ernesto Ventós

- Berje Inc.

- Vigon International

- Kancor Ingredients