Clean Label Sweeteners Market Size

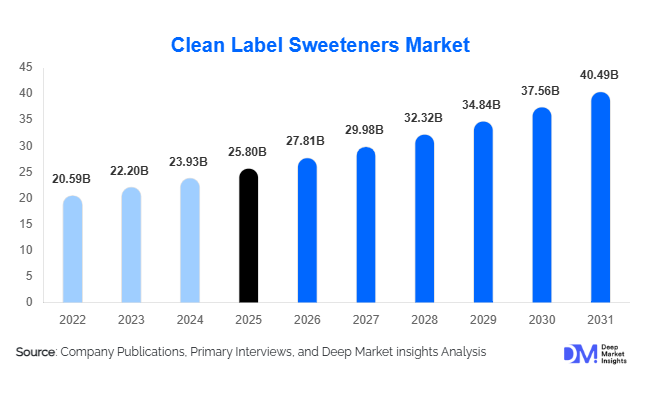

According to Deep Market Insights, the global clean label sweeteners market size was valued at USD 25.8 billion in 2025 and is projected to grow from USD 27.81 billion in 2026 to reach USD 40.49 billion by 2031, expanding at a CAGR of 7.8% during the forecast period (2026–2031). The market growth is primarily driven by rising consumer demand for natural and minimally processed sweeteners, increasing health and wellness consciousness, sugar reduction regulations, and technological advancements in next-generation sweetener production.

Key Market Insights

- High-intensity natural sweeteners like stevia dominate the market, capturing the largest share due to consumer preference, regulatory approvals, and widespread application in beverages and bakery products.

- Plant-derived sources lead globally, with stevia, monk fruit, and agave accounting for the largest market portion, supported by consumer trust in natural ingredients.

- Powder form sweeteners hold the largest share, favored for ease of storage, formulation flexibility, and stability across multiple food and beverage applications.

- Food & beverage remains the dominant application segment, representing the majority of market demand due to sugar reduction trends in beverages, confectionery, dairy, and snacks.

- North America leads the market, supported by strong health-conscious consumption, regulatory support for sugar reduction, and early adoption of clean label products.

- Asia-Pacific is the fastest-growing region, driven by rising middle-class income, urbanization, and increasing demand for natural and health-focused products in China, India, and Japan.

What are the latest trends in the clean-label sweeteners market?

Rising Adoption of Plant-Based and Natural Sweeteners

Manufacturers are increasingly reformulating products using stevia, monk fruit, agave, and honey to replace refined sugar, reflecting consumer demand for clean-label products. The trend is evident across beverages, bakery, confectionery, and dairy applications, as brands aim to reduce calorie content while maintaining taste. New blends and formulations are emerging to overcome sensory challenges such as bitterness or aftertaste, enabling higher penetration of natural sweeteners in mainstream and premium products.

Integration of Next-Generation Sweeteners

Rare sugars such as allulose and D-tagatose, produced via fermentation and enzymatic processes, are gaining popularity for their low-calorie profile and natural origin. These sweeteners allow manufacturers to achieve sugar-like taste and functional properties while maintaining clean label claims. The adoption of these next-generation ingredients is reshaping product formulation strategies and creating differentiation opportunities in health-focused beverages, protein-based snacks, and functional foods.

What are the key drivers in the clean-label sweeteners market?

Health and Wellness Consciousness

Rising global awareness of obesity, diabetes, and sugar-related health concerns is driving consumers toward products with natural, minimally processed ingredients. Clean-label sweeteners such as stevia, monk fruit, and rare sugars allow manufacturers to reformulate beverages, bakery items, and snacks to meet these health-conscious demands. Social media and nutritional education campaigns further amplify this behavioral shift, leading to higher adoption across developed and emerging markets.

Regulatory Support and Sugar Reduction Initiatives

Governments worldwide are enforcing sugar reduction policies, front-of-pack labeling, and clean ingredient transparency requirements. These regulations incentivize food and beverage companies to integrate clean-label sweeteners into their portfolios. Sugar taxes, health labeling mandates, and public campaigns in North America and Europe are particularly influential, encouraging manufacturers to switch from artificial or high-calorie sweeteners to natural alternatives while maintaining regulatory compliance.

Technological Innovations

Advances in fermentation, enzymatic synthesis, and plant extraction have improved the availability, taste profile, and scalability of clean-label sweeteners. Fermentation-derived rare sugars and high-intensity plant extracts enable manufacturers to create products with reduced sugar and calories without compromising taste. Such technological progress is fostering product innovation, cost efficiency, and expansion into new applications such as nutraceuticals and functional beverages.

What are the restraints for the global market?

High Production Costs

Clean-label sweeteners are generally more expensive than refined sugar due to sourcing, extraction, and processing complexities. Higher ingredient costs are often passed on to consumers, which can restrict adoption in price-sensitive markets, particularly in emerging economies.

Functional and Sensory Challenges

Natural sweeteners may present formulation challenges such as off-tastes, differing sweetness intensity, and functional limitations in baking or confectionery. Manufacturers must invest in blending, taste masking, and technical expertise to maintain product quality, increasing development complexity and cost.

What are the key opportunities in the clean-label sweeteners industry?

Expansion in Nutraceuticals and Functional Foods

As consumers increasingly focus on health supplements, clean-label sweeteners present an opportunity for taste enhancement in nutraceuticals, protein powders, and functional beverages. Sweeteners such as stevia, monk fruit, and allulose allow products to meet clean label demands while maintaining palatability.

Growing Demand in Emerging Markets

Urbanization, rising middle-class incomes, and increasing awareness of natural ingredients in Asia-Pacific and Latin America are creating strong growth prospects. Countries such as China, India, and Brazil are emerging as key markets for natural and plant-derived sweeteners, particularly in beverages and bakery segments.

Technological Advancements and Next-Generation Sweeteners

Biotechnology-driven processes enabling the production of rare sugars offer opportunities for product differentiation and expansion into premium food and beverage categories. Integration of these innovations can reduce cost, improve taste, and broaden applications across functional foods and beverages.

Product Type Insights

High-intensity natural sweeteners dominate the clean-label sweeteners market, with stevia emerging as the leading product type globally, followed by natural bulk sweeteners and naturally derived sugar alcohols. Stevia’s leadership is primarily driven by its zero-calorie profile, plant-based origin, and widespread regulatory approval across major food markets, making it the preferred choice for beverage, dairy, and low-calorie food formulations. Its high sweetness intensity enables significant sugar reduction with minimal dosage, offering both functional and cost advantages for manufacturers.

Natural bulk sweeteners such as honey, agave syrup, and maple syrup continue to hold strong demand in clean-label and premium food categories, supported by consumer preference for minimally processed and familiar ingredients. Meanwhile, sugar alcohols such as erythritol and xylitol are gaining traction in confectionery, bakery, and oral care applications due to their low glycemic index and tooth-friendly properties. Rare sugars like allulose and D-tagatose are emerging as next-generation clean-label sweeteners, particularly in premium and functional food formulations, as they offer sugar-like taste and bulking functionality with significantly reduced caloric impact.

Application Insights

The food & beverage segment accounts for the largest share of the clean label sweeteners market, driven by extensive adoption across beverages, bakery, confectionery, dairy products, and snacks. Beverage applications, including carbonated soft drinks, juices, flavored waters, and ready-to-drink functional beverages, represent the fastest-growing application area. This growth is fueled by global sugar reduction initiatives, changing consumer taste preferences, and increasing demand for low- and zero-sugar drink alternatives without artificial additives.

Bakery and confectionery applications are also witnessing steady growth as manufacturers reformulate traditional products to reduce sugar content while preserving taste, texture, and shelf life. Nutraceuticals and dietary supplements are emerging as high-growth application segments, where clean-label sweeteners are increasingly used to improve the palatability of protein powders, vitamins, gummies, and functional nutrition products. Oral care and pharmaceutical applications are expanding as well, particularly for sugar-free syrups, lozenges, and dental products that require natural taste-masking solutions.

Distribution Channel Insights

Supermarkets and hypermarkets remain the dominant distribution channel for clean-label sweeteners, supported by their extensive shelf space, strong consumer trust, and ability to showcase a wide range of branded and private-label products. These channels benefit from increasing in-store health-focused sections and clean-label product visibility, particularly in developed markets.

Online retail is the fastest-growing distribution channel, driven by convenience, direct-to-consumer brand strategies, subscription-based purchasing models, and access to detailed product information and certifications. Digital platforms enable clean label brands to communicate sourcing transparency and health benefits more effectively. Specialty natural and organic stores continue to play a critical role, especially in North America and Europe, supporting premium, organic, and niche clean-label sweetener products targeted at health-conscious consumers.

End-User Insights

Food & beverage manufacturers represent the largest end-use segment, as they increasingly reformulate products to meet clean label standards, reduce sugar content, and comply with evolving regulatory requirements. Large beverage producers, bakery chains, and dairy companies are integrating stevia, monk fruit, and rare sugars into mainstream product lines, driving sustained volume demand.

Nutraceutical and functional food manufacturers are rapidly expanding their use of clean-label sweeteners to enhance product taste while maintaining natural and health-oriented positioning. Export-driven demand is also rising, with North America and Europe acting as major production and innovation hubs supplying clean-label sweeteners to Asia-Pacific, Latin America, and the Middle East. Beverages and bakery products remain the key growth engines within end-use industries due to their high sugar replacement potential and frequent product innovation cycles.

| By Product Type | By Application | By Distribution Channel | By End User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America leads the global clean label sweeteners market with approximately 32% share in 2025, driven by strong health awareness, widespread sugar-reduction initiatives, and early adoption of clean label food products. The U.S. dominates regional demand due to its large beverage, bakery, and functional food industries actively incorporating stevia, monk fruit, and rare sugars. Key regional growth drivers include favorable regulatory approvals, high consumer acceptance of natural sweeteners, strong presence of leading ingredient manufacturers, and advanced retail infrastructure that accelerates clean label product penetration.

Europe

Europe holds around 29% of the global market, with Germany, the UK, and France as major contributors. Growth is driven by stringent food labeling regulations, government-led sugar reduction programs, and strong consumer preference for natural and sustainably sourced ingredients. The region’s emphasis on transparency, organic certification, and clean formulation standards supports steady adoption. Rising demand for functional foods, plant-based products, and premium bakery items is further accelerating clean-label sweetener usage across Europe.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at an estimated CAGR of ~10%, driven by rapid urbanization, rising disposable incomes, and increasing health awareness among middle-class consumers. China and India are emerging as high-growth markets due to expanding beverage and packaged food sectors and growing demand for diabetes-friendly and reduced-sugar products. Japan and Australia show strong adoption in premium applications such as nutraceuticals and functional beverages. Improved retail penetration, e-commerce growth, and local manufacturing investments are key regional growth drivers.

Latin America

Latin America is experiencing steady growth, led by Brazil and Mexico, supported by increasing awareness of sugar-related health issues and gradual shifts toward natural ingredients. Expanding urban populations, modernization of retail infrastructure, and government efforts to address obesity and diabetes are driving the adoption of clean-label sweeteners, particularly in beverages, dairy, and processed foods.

Middle East & Africa

The Middle East & Africa region accounts for approximately 9% of the global market. Growth is driven by rising demand for premium, health-focused food products in countries such as the UAE, Saudi Arabia, and South Africa. High-income consumers and strong import dependence support demand for clean-label sweeteners. Africa also plays a strategic role as a source region for plant-based sweeteners, including stevia and monk fruit, supporting supply chain development and future regional expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Clean Label Sweeteners Market

- Archer Daniels Midland Company

- Cargill, Incorporated

- Ingredion Incorporated

- Tate & Lyle PLC

- DuPont de Nemours, Inc.

- Roquette Frères

- Kerry Group plc

- PureCircle Ltd

- DSM-Firmenich AG

- Ajinomoto Co., Inc.

- Sunwin Stevia International, Inc.

- MacAndrews & Forbes Holdings Inc.

- Foodchem International Corporation

- Kalsec, Inc.

- Royal DSM N.V.