Citrus Aurantium Extract Market Size

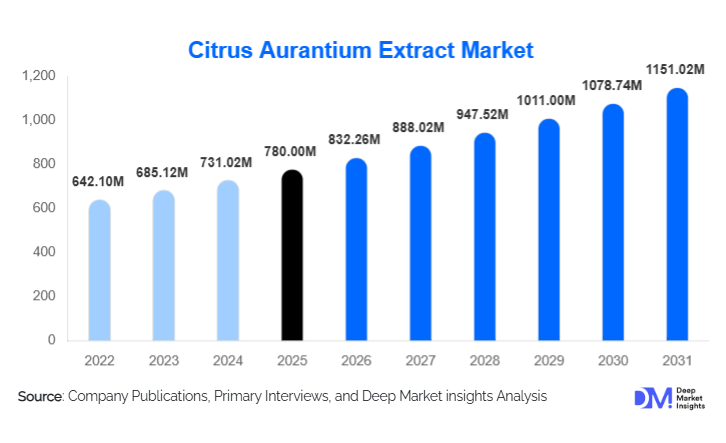

According to Deep Market Insights, the global Citrus Aurantium Extract Market size was valued at USD 780 million in 2025 and is projected to grow from USD 832.26 million in 2026 to reach approximately USD 1,151.02 million by 2031, expanding at a CAGR of 6.7% during the forecast period (2026–2031). The market growth is primarily driven by rising demand for natural and plant-based functional ingredients, increasing adoption in dietary supplements and pharmaceuticals, and the global shift toward clean-label and herbal formulations.

Key Market Insights

- Citrus aurantium extract is increasingly replacing synthetic stimulants in weight management and sports nutrition products due to regulatory and consumer safety concerns.

- Dietary supplements remain the largest application segment, driven by demand for metabolism-enhancing and energy-support formulations.

- North America dominates global consumption, supported by a mature nutraceutical industry and high consumer awareness of herbal supplements.

- Asia-Pacific is the fastest-growing regional market, fueled by expanding pharmaceutical manufacturing, herbal medicine adoption, and export-oriented production.

- Advanced extraction technologies, such as supercritical CO₂ extraction, are gaining traction for pharmaceutical-grade and premium applications.

- Regulatory scrutiny around synephrine content is shaping product formulation strategies and quality standardization globally.

What are the latest trends in the Citrus Aurantium Extract Market?

Rising Adoption in Clean-Label Nutraceuticals

One of the most prominent trends in the Citrus Aurantium Extract Market is its growing use in clean-label nutraceutical products. Consumers are increasingly scrutinizing ingredient lists and favoring supplements derived from recognizable plant sources. Citrus aurantium extract, known for its natural origin and functional benefits, aligns well with this preference. Supplement manufacturers are emphasizing transparent sourcing, standardized synephrine levels, and minimal processing, which has strengthened consumer trust and expanded product penetration across weight management, energy, and metabolic health categories.

Shift Toward Advanced Extraction and Standardization

Manufacturers are increasingly investing in advanced extraction techniques to improve purity, consistency, and bioavailability. Supercritical CO₂ and enzymatic extraction methods are gaining popularity as they reduce solvent residues and enable better control over active compound concentrations. This trend is particularly strong in pharmaceutical and clinical nutrition applications, where regulatory compliance and reproducibility are critical. As a result, premium-grade citrus aurantium extracts are commanding higher prices and margins.

What are the key drivers in the Citrus Aurantium Extract Market?

Growth of the Global Nutraceutical Industry

The rapid expansion of the nutraceutical industry is a major driver for the Citrus Aurantium Extract Market. The rising prevalence of lifestyle-related disorders such as obesity and metabolic syndrome has increased demand for natural supplements that support weight management and energy metabolism. Citrus aurantium extract is widely incorporated into thermogenic blends and functional supplements, benefiting directly from this trend.

Increasing Preference for Herbal and Plant-Based Ingredients

Consumers worldwide are shifting away from synthetic additives toward herbal and botanical ingredients perceived as safer and more sustainable. Citrus aurantium extract benefits from this transition, particularly in regions with strong traditions of herbal medicine. This preference is also influencing pharmaceutical and functional food manufacturers to reformulate products using plant-derived actives.

What are the restraints for the global market?

Regulatory Variability Across Regions

Regulatory inconsistency regarding permissible synephrine levels remains a key restraint for the Citrus Aurantium Extract Market. Differences in guidelines across North America, Europe, and the Asia-Pacific complicate global product launches and increase compliance costs. Manufacturers must invest in extensive testing and reformulation to meet region-specific standards.

Raw Material Price Volatility

The market is highly dependent on citrus crop yields, which are influenced by climatic conditions and agricultural cycles. Fluctuations in raw material availability and prices can directly impact production costs and profit margins, posing challenges for long-term supply contracts and pricing stability.

What are the key opportunities in the Citrus Aurantium Extract Market?

Expansion into Pharmaceutical and Clinical Applications

Ongoing clinical research supporting the efficacy of citrus aurantium extract in metabolic and digestive health is opening new opportunities in the pharmaceutical and clinical nutrition segments. Standardized extracts with validated health claims are increasingly being incorporated into prescription and OTC formulations, significantly increasing value per unit.

Emerging Demand in Asia-Pacific and Latin America

Asia-Pacific and Latin America present strong growth opportunities due to rising healthcare awareness, expanding middle-class populations, and established herbal medicine traditions. Countries such as China, India, Brazil, and Mexico are emerging as both major consumers and producers, supported by government initiatives promoting botanical industries.

Product Form Insights

Powdered citrus aurantium extract dominates the global market, accounting for approximately 42% of total market share in 2025. This leadership is primarily driven by its superior shelf stability, ease of storage and transportation, and high compatibility with large-scale nutraceutical manufacturing processes. Powdered extracts integrate seamlessly into capsules, tablets, sachets, and functional food formulations, making them the preferred format for supplement brands focused on standardized dosing and extended product shelf life.

Additionally, powdered forms offer greater flexibility in blending with other botanical ingredients, supporting the growing demand for multi-ingredient formulations targeting weight management, metabolic health, and energy enhancement. Liquid citrus aurantium extracts hold a strong position in beverage formulations, cosmetics, and aromatherapy applications, where rapid solubility and sensory attributes are essential. Meanwhile, encapsulated and standardized concentrates are gaining momentum within pharmaceutical and clinical nutrition applications, as they enable precise dosage control, improved bioavailability, and compliance with stringent regulatory and quality standards.

Application Insights

Dietary supplements represent the largest application segment, contributing nearly 46% of global market revenue in 2025. The dominance of this segment is driven by rising consumer demand for natural weight management solutions, stimulant-free energy boosters, and metabolism-supporting supplements. Citrus aurantium extract is widely incorporated into thermogenic blends, sports nutrition products, and daily wellness supplements, benefiting from strong consumer acceptance and repeat usage patterns.

Pharmaceutical applications are steadily expanding, supported by increasing clinical validation of synephrine and flavonoids for metabolic, digestive, and cardiovascular health. This segment is experiencing higher value realization due to the use of pharmaceutical-grade, standardized extracts. Functional foods and beverages represent a high-growth application area, particularly within energy drinks, fortified teas, and health-focused snacks, as manufacturers respond to clean-label and functional nutrition trends. Cosmetics and personal care applications, while smaller in volume, command premium pricing due to the extract’s antioxidant, fragrance, and skin-conditioning properties.

Distribution Channel Insights

Direct B2B sales dominate the Citrus Aurantium Extract Market, accounting for approximately 55% of total market volume in 2025. This dominance is driven by long-term supply agreements between extract manufacturers and large nutraceutical, pharmaceutical, and functional food producers. These contracts ensure consistent quality, volume security, and regulatory compliance, which are critical for large-scale product manufacturing.

Specialty ingredient distributors play a vital role in expanding regional reach, particularly for mid-sized and emerging brands that rely on localized technical support, regulatory guidance, and flexible procurement. At the same time, digital B2B platforms and e-commerce-based ingredient marketplaces are gaining traction, especially among small and mid-sized buyers seeking price transparency, faster sourcing, and access to certified suppliers. This shift toward digital procurement is gradually reshaping traditional distribution models.

End-Use Industry Insights

The nutraceutical industry leads end-use demand, accounting for nearly 48% of the global market share. This leadership is driven by sustained consumer interest in preventive healthcare, natural supplements, and lifestyle disease management. Nutraceutical manufacturers benefit from relatively faster product launch cycles and higher margins compared to pharmaceutical applications.

The pharmaceutical industry follows, supported by growing integration of citrus aurantium extract into prescription and over-the-counter formulations targeting metabolic and digestive health. Functional food manufacturers represent an expanding end-use segment, particularly within energy, wellness, and fortified nutrition categories. Cosmetics and personal care applications form a niche but high-margin segment, leveraging antioxidant and aromatic properties. Animal nutrition applications are emerging gradually, especially in performance-enhancing and metabolism-supporting feed formulations, although this segment remains in early development stages.

| By Product Form | By Extraction Method | By Application | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounted for approximately 32% of the global Citrus Aurantium Extract Market in 2025, led overwhelmingly by the United States. Regional growth is driven by a highly mature nutraceutical industry, strong consumer awareness of herbal supplements, and well-established regulatory frameworks governing botanical ingredients. The widespread adoption of weight management, sports nutrition, and energy supplements continues to fuel demand.

Additionally, increasing preference for clean-label and stimulant-free formulations has accelerated the replacement of synthetic ingredients with citrus aurantium extract. Canada contributes steadily through functional foods and nutraceutical applications, supported by rising health-conscious consumer behavior and favorable import policies.

Europe

Europe held around 26% of the global market share in 2025, with Germany, France, and the U.K. as key demand centers. Regional growth is driven by stringent quality standards, strong demand for pharmaceutical-grade botanical extracts, and a deep-rooted preference for herbal therapeutics. Clean-label regulations and sustainability certifications play a critical role in shaping purchasing decisions across European markets.

The region also benefits from advanced research capabilities and strong collaboration between extract manufacturers and pharmaceutical companies, particularly for metabolic and cardiovascular health applications. Consumer trust in standardized herbal ingredients further supports long-term market stability.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, expanding at a CAGR exceeding 8%. China dominates global production and export volumes due to its large-scale extraction infrastructure, cost efficiencies, and access to raw materials. India is emerging as a key manufacturing and export hub, supported by government initiatives such as Make in India, increasing investment in botanical processing, and strong domestic demand for herbal supplements.

Japan and South Korea contribute through high-value functional food and pharmaceutical applications, driven by aging populations and strong demand for preventive healthcare solutions. Expanding export-oriented manufacturing and improving quality certifications are further strengthening the Asia-Pacific’s global position.

Latin America

Latin America accounts for nearly 9% of global demand, with Brazil and Mexico serving as key markets. Regional growth is supported by favorable climatic conditions for citrus cultivation, improving extraction capabilities, and rising nutraceutical consumption among middle-income populations. Export-oriented production is increasing as manufacturers leverage raw material availability and cost advantages to supply North American and European markets.

Middle East & Africa

The Middle East & Africa region remains nascent but demonstrates steady growth potential. Rising adoption of herbal medicine, increasing health awareness, and growing imports for nutraceutical manufacturing are key drivers. The UAE serves as a regional distribution and formulation hub, while South Africa contributes through localized supplement production and regional exports. Increasing investments in healthcare infrastructure and wellness-focused products are expected to support gradual market expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Citrus Aurantium Extract Market

- Naturex (Givaudan)

- Indena S.p.A.

- Sabinsa Corporation

- Martin Bauer Group

- Nexira

- Synthite Industries

- Arjuna Natural

- Kalsec

- Bio-Botanica

- Xi’an Lyphar Biotech

- Chengdu Wagott Bio-Tech

- Nutra Green Biotechnology

- Alps Pharmaceutical

- Frutarom

- Phytovation