Citronella Oil Market Size

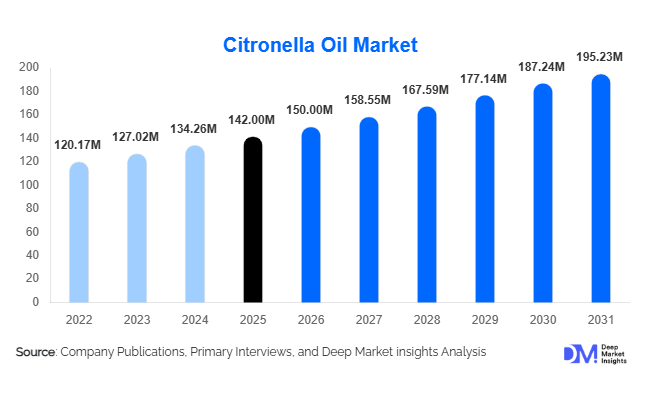

According to Deep Market Insights, the global citronella oil market size was valued at USD 142.00 million in 2025 and is projected to grow from USD 150.09 million in 2026 to reach USD 195.23 million by 2031, expanding at a CAGR of 5.7% during the forecast period (2026–2031). The citronella oil market growth is primarily driven by increasing demand for natural insect repellents, rising adoption in personal care and wellness products, and expanding applications in sustainable agriculture and food-grade industries worldwide.

Key Market Insights

- Natural repellents are becoming the dominant application, as consumers and institutions shift away from synthetic chemicals toward plant-based solutions.

- Personal care and cosmetic integration are accelerating, leveraging citronella oil’s aromatic, antimicrobial, and skin-friendly properties to meet clean-label and organic trends.

- Asia-Pacific is emerging as the fastest-growing region, driven by expanding domestic production, increasing middle-class wealth, and growing awareness of natural wellness products.

- North America dominates the market due to high consumption of personal care, household repellents, and wellness-oriented essential oils.

- Technological adoption, including high-efficiency distillation and standardized geraniol/citronellal extraction, is improving product quality and enabling multi-industry applications.

- Export-driven demand, particularly from Indonesia, India, and Sri Lanka, continues to expand global reach, supplying key consumer markets in Europe, North America, and Japan.

What are the latest trends in the citronella oil market?

Expansion in Natural Insect Repellents

Citronella oil continues to gain popularity in natural insect repellent formulations, both in household and personal care products. Heightened awareness of vector-borne diseases, combined with regulatory encouragement for plant-based solutions, has resulted in year-round demand. Manufacturers are increasingly offering ready-to-use sprays, wipes, and candles, while larger FMCG players integrate citronella oil in multi-ingredient repellents to appeal to eco-conscious consumers. Premiumized products, particularly organic-certified formulations, are strengthening brand differentiation and driving higher-margin sales.

Integration in Personal Care, Cosmetics & Wellness

Emerging trends highlight the growing use of citronella oil in deodorants, lotions, shampoos, soaps, and aromatherapy blends. Consumers prefer multi-functional products that provide antimicrobial benefits, natural fragrance, and insect-repelling properties. Wellness and aromatherapy applications, including essential oil diffusers, spa products, and therapeutic blends, are expanding rapidly. Manufacturers are also emphasizing clean-label formulations and sustainability claims to meet evolving consumer preferences, increasing the overall market adoption of citronella oil in premium personal care categories.

What are the key drivers in the citronella oil market?

Rising Preference for Natural and Sustainable Products

Global consumers are increasingly shifting toward natural, chemical-free products. Citronella oil, with its botanical origin, aligns with this trend across personal care, household repellents, and wellness industries. Regulatory approval for safe botanical use in major markets like North America and Europe further incentivizes manufacturers to adopt citronella oil as a key ingredient.

Growing Awareness of Vector-Borne Diseases

Health concerns related to mosquito-borne illnesses such as dengue, malaria, and Zika virus are driving demand for plant-based repellents. Citronella oil’s proven efficacy and regulatory approval as a minimum-risk pesticide are enabling stronger adoption in household and outdoor applications worldwide.

Multi-Industry Adoption and Diversification

Citronella oil is increasingly being applied beyond repellents, including personal care, aromatherapy, functional foods, and agricultural pest control. Its aromatic and antimicrobial properties allow companies to diversify product portfolios and meet consumer demands for multifunctional natural ingredients.

What are the restraints for the global market?

Raw Material Supply Volatility

Citronella oil production depends heavily on geographic and climatic conditions, making supply vulnerable to weather variations, crop diseases, and yield fluctuations. This can increase production costs and impact consistent availability, affecting pricing and profitability for manufacturers.

Competition from Alternative Botanicals and Synthetic Products

Other essential oils, such as lemongrass and eucalyptus, and synthetic repellents compete with citronella oil in price-sensitive applications. To maintain market share, producers must emphasize quality, active content, and certified organic claims, particularly in premium segments.

What are the key opportunities in the citronella oil market?

Expansion in Functional Personal Care and Cosmetics

There is a strong opportunity for manufacturers to integrate citronella oil in skincare, deodorants, hair care, and wellness products, leveraging its multifunctional benefits. Growth in clean beauty, organic cosmetics, and eco-conscious consumer trends supports product differentiation and premium pricing potential.

Natural Pest Control for Agriculture

Citronella oil’s effectiveness as a botanical pesticide supports adoption in sustainable agriculture and integrated pest management initiatives. Farmers and agribusinesses are increasingly seeking eco-friendly alternatives to chemical pesticides, providing growth potential in emerging markets.

Wellness and Aromatherapy Applications

The rising global interest in wellness, aromatherapy, and natural lifestyle products creates opportunities for citronella oil as an ingredient in spa treatments, diffusers, and holistic health solutions. This cross-industry adoption is likely to expand market reach and product innovation.

Product Type Insights

Java citronella oil dominates the global market due to its higher geraniol content, which provides superior insect-repelling efficacy, versatility across multiple applications, and consistent quality suitable for large-scale production. Its widespread adoption in personal care, household repellents, and agricultural pest control is further reinforced by cost-efficiency and abundant availability in major producing countries like Indonesia and China. This segment accounted for a 57% share of the global market in 2025, reflecting strong preference among both industrial buyers and consumer product manufacturers seeking reliable, high-potency citronella oil. Meanwhile, Ceylon citronella oil is carving a niche in high-value markets, favored for its premium fragrance profile and therapeutic benefits, which appeal to wellness, aromatherapy, and luxury cosmetic applications.

Application Insights

Natural insect repellents remain the leading application, capturing approximately 45% of the market in 2025. This dominance is driven primarily by the rising consumer preference for eco-friendly, chemical-free solutions and increasing regulatory support for botanical repellents in major markets such as North America and Europe. The driver behind this growth is both the effectiveness of citronella oil in deterring mosquitoes and other insects and the broader shift toward sustainable living. Personal care and wellness applications are rapidly expanding, fueled by clean-label, multifunctional formulations, while agricultural pest control and food flavoring represent emerging niches that enhance overall market diversification and provide avenues for export-driven demand.

End-Use Industry Insights

The personal care and cosmetics industry is the largest end-use segment, representing roughly 38% of global demand in 2025. Growth is fueled by increasing consumer preference for organic, multifunctional, and sustainably sourced ingredients, which have positioned citronella oil as a high-value component in deodorants, lotions, shampoos, and aromatherapy products. Agriculture and wellness sectors are also expanding rapidly, driven by the adoption of citronella oil as a natural pesticide and holistic wellness ingredient. Export-oriented demand from major producers in Indonesia, India, and Sri Lanka continues to bolster market growth, particularly in North America, Europe, and emerging APAC markets.

| By Product Type | By Application | By End-Use Industry |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds approximately 34% of the global market, making it the largest regional consumer. Growth is primarily driven by strong consumer awareness of natural and eco-friendly products, widespread adoption of personal care and household repellents, and supportive regulations for botanical ingredients. The U.S. and Canada are key contributors due to well-developed retail distribution networks, high disposable income, and rising demand for multifunctional wellness products. Increased urbanization and concern over mosquito-borne diseases are also supporting sustained demand for natural insect repellents.

Europe

Europe represents roughly 28–30% of the market, with Germany, the U.K., and France as major consumers. The region’s growth is supported by stringent restrictions on synthetic chemicals, increasing environmental consciousness, and high adoption of organic personal care and wellness products. Consumers in Europe are highly inclined toward eco-certified products, which has created strong demand for citronella oil in both personal care and household applications. Rising health awareness, coupled with regulatory incentives to replace chemical repellents with botanical alternatives, continues to fuel market expansion.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by production hubs in Indonesia, India, and China. Drivers of growth include rising middle-class income, rapid urbanization, increasing wellness awareness, and strong export demand to North America and Europe. Citronella oil’s agricultural applications, particularly as a natural pesticide, are increasingly critical in APAC, supporting both domestic consumption and international trade. Additionally, growing adoption of personal care and aromatherapy products is further stimulating market growth across urban and semi-urban regions.

Latin America

Latin America, including Brazil, Mexico, and Argentina, represents an emerging market for citronella oil. Regional growth is driven by increased awareness of natural and sustainable ingredients in personal care and household products, along with a rising interest in health and wellness solutions. Export-driven demand is gradually increasing as producers target U.S. and European markets. Additionally, the growing middle-class population in these countries is creating new domestic opportunities for multifunctional personal care and wellness applications.

Middle East & Africa

Africa remains the core production and consumption base for citronella oil, with countries such as Kenya, Tanzania, and South Africa driving local and regional demand. Production infrastructure, coupled with favorable climatic conditions for citronella cultivation, positions Africa as a key supplier to global markets. The Middle East, led by the UAE and Saudi Arabia, is increasingly importing citronella oil for use in high-end personal care, wellness, and household products. Growth in these regions is further driven by rising disposable income, increasing health consciousness, and the expanding demand for natural fragrances and eco-friendly products. Investment in modern distillation and extraction technologies across these regions is also enhancing product quality and supporting export competitiveness.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|