Cigarette Butt Market Size

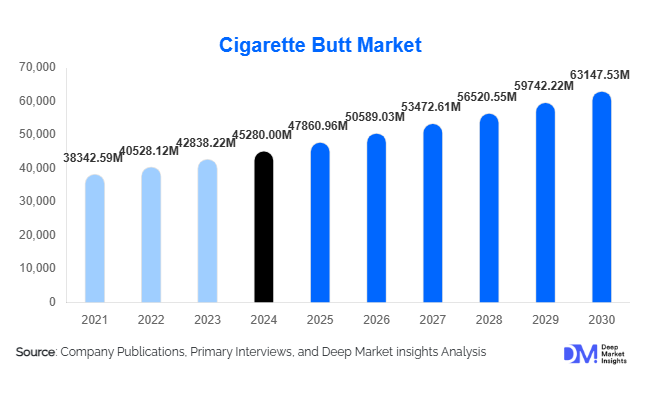

According to Deep Market Insights, the global cigarette butt market size was valued at USD 45,280 million in 2024 and is projected to grow from USD 47,860.96 million in 2025 to reach USD 63,147.53 million by 2030, expanding at a CAGR of 5.7% during the forecast period (2025–2030). The market growth is primarily driven by the increasing need for sustainable waste management, rising regulatory pressure on tobacco waste, and growing adoption of recycling and waste-to-value solutions for cigarette butt disposal.

Key Market Insights

- Cellulose acetate remains the dominant filter material, representing the largest share of cigarette butt waste globally due to its widespread use in conventional cigarettes.

- Disposal and recycling services are leading end-use segments, driven by government regulations, municipal waste management initiatives, and private-sector adoption of formal collection systems.

- Standard cigarettes account for the majority of cigarette butt waste, contributing roughly 70–73% of total global volume in 2024.

- Asia-Pacific dominates the market with high consumption in China, India, and Southeast Asia, while North America is the fastest-growing region due to strong regulatory enforcement and sustainability initiatives.

- Emerging biodegradable filters and eco-friendly disposal technologies are creating new opportunities in the market.

- Technological adoption, including IoT-enabled smart ashtrays, collection sensors, and advanced recycling methods, is transforming cigarette butt waste management.

Latest Market Trends

Regulatory and Sustainability Initiatives Driving Change

Governments worldwide are implementing regulations targeting cigarette butt pollution, often through extended producer responsibility (EPR) programs. This has spurred private companies and municipalities to adopt formal collection, recycling, and disposal programs. Environmental campaigns, coastal clean-ups, and urban litter control initiatives are increasing the demand for structured cigarette butt management. Companies are also exploring recycling technologies to repurpose collected butts into industrial materials or energy, turning waste into value while complying with regulations.

Technological Integration in Waste Management

Emerging technologies, such as smart disposal bins with sensors, IoT-based monitoring systems, and automated recycling processes, are enhancing efficiency and reducing environmental impact. These technologies allow municipalities and private companies to track litter, optimise collection routes, and ensure compliance with waste regulations. Additionally, industrial recycling innovations enable the conversion of cellulose acetate and composite filters into plastics, building materials, or energy, opening new revenue streams.

Cigarette Butt Market Drivers

High Volume of Cigarette Consumption

Despite public health campaigns, global cigarette consumption remains significant, generating trillions of discarded butts annually. This high volume of waste drives consistent demand for collection, disposal, and recycling services, particularly in regions with large smoking populations such as China, India, and Southeast Asia.

Increasing Environmental Awareness

Public concern over pollution from cigarette butts, including microplastics and toxins leaching into soil and waterways, is compelling governments, NGOs, and private firms to invest in sustainable waste management. Coastal and urban clean-up initiatives further emphasise formal disposal solutions.

Innovation in Biodegradable Filters and Recycling Technologies

The development of biodegradable filters and advanced recycling technologies is creating opportunities to convert cigarette butt waste into usable materials or energy. Companies investing in such innovations gain a competitive advantage while meeting sustainability and regulatory demands.

Market Restraints

Dominance of Non-Biodegradable Materials

Most cigarette filters are made of cellulose acetate, a non-biodegradable material that persists in the environment. This complicates disposal and recycling efforts and increases costs for waste-management companies.

Collection and Compliance Challenges

Efficiently collecting cigarette butts from public spaces, streets, and beaches is challenging. Informal littering remains prevalent, limiting the fraction of waste that enters formal disposal systems. Enforcement gaps in many regions also reduce the effectiveness of collection and recycling programs.

Cigarette Butt Market Opportunities

Expansion of Recycling and Waste-to-Value Technologies

Companies can invest in advanced recycling processes to repurpose cigarette butts into plastic pellets, construction materials, or energy. This approach turns waste into a revenue-generating resource while addressing environmental concerns.

Regulatory-Driven Market Growth

Governments implementing EPR and stricter litter control policies are creating long-term demand for formal disposal and recycling services. New entrants can capitalise on municipal contracts and compliance-driven waste management opportunities.

Biodegradable Filters and Eco-Friendly Solutions

Adoption of biodegradable filters is increasing, providing opportunities for filter manufacturers and recycling firms to process and market eco-friendly solutions. Companies offering sustainable disposal services can differentiate themselves in markets with strong environmental awareness.

Material Insights

Cellulose acetate filters continue to dominate the cigarette butt market, accounting for approximately 58–60% of the global market value in 2024. Their dominance is largely driven by their widespread use in conventional cigarettes, high manufacturing prevalence, and cost-effectiveness. Biodegradable and composite filters are emerging as fast-growing segments, fueled by regulatory mandates on sustainable waste management, increasing environmental awareness, and consumer demand for eco-friendly alternatives. Technological advancements in filter materials and industrial recycling processes are further driving the adoption of sustainable options. North America and Europe are witnessing the highest growth in biodegradable filter adoption, as stringent environmental regulations, government-backed recycling programs, and public campaigns against plastic pollution push manufacturers and waste management firms to innovate. Overall, the trend toward eco-friendly materials is expected to accelerate globally, with companies investing in R&D for next-generation, fully degradable filter solutions that reduce long-term environmental impact.

Application Insights

Standard cigarettes remain the largest contributor to cigarette butt waste, representing approximately 70–73% of the global market in 2024. Their continued prevalence is a major driver of market demand for collection and recycling services. E-cigarettes, disposable vaping devices, and other single-use tobacco products represent smaller yet rapidly growing segments, particularly in developed markets like the U.S., Canada, and Western Europe, where urban consumption patterns and younger demographics are shifting toward alternative nicotine delivery systems. Rising concerns over littering, microplastic pollution, and public health drive structured collection programs, particularly in densely populated urban regions. The increase in single-use and convenience-focused tobacco products continues to expand waste volumes, creating opportunities for innovative disposal and recycling technologies while reinforcing the need for effective waste management policies globally.

Distribution Channel Insights

Collection and recycling of cigarette butts are facilitated primarily through municipal waste management programs, private waste companies, NGOs, and specialized recycling firms. The leading driver for this segment is the growing regulatory enforcement requiring formal waste collection and producer responsibility compliance. Smart bins, IoT-enabled sensors, and digital monitoring systems are being adopted increasingly to enhance collection efficiency, track waste volumes, and optimize processing logistics. Public-private partnerships are emerging as key enablers, allowing municipalities and private firms to scale collection infrastructure, reduce operational costs, and ensure compliance with environmental regulations. Europe and North America are leading in digital adoption of these channels due to strong sustainability mandates and higher public awareness, while Asia-Pacific is increasingly investing in formalized collection channels to manage rising cigarette consumption.

| By Material Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for approximately 20–25% of the global cigarette butt market in 2024 and is the fastest-growing region. Growth is driven by stringent environmental regulations, extensive municipal collection programs, and heightened public awareness of environmental pollution. The U.S. leads demand through federal and state-level Extended Producer Responsibility (EPR) policies, smart waste collection infrastructure, and widespread adoption of recycling initiatives. Canada contributes through large-scale urban clean-up campaigns, investment in biodegradable filter research, and increasing incorporation of IoT-enabled collection technologies. Rising public and corporate pressure to reduce urban litter, coupled with a high disposable income population capable of supporting innovative waste-management solutions, continues to fuel regional growth.

Europe

Europe holds a significant share of the global market, with Germany, France, and the U.K. leading the adoption of cigarette butt collection and recycling solutions. Drivers include strong regulatory frameworks, environmental taxes on littering, and EU-wide sustainability directives promoting waste recycling and reduction. Advanced municipal waste infrastructure and high public environmental awareness accelerate the adoption of smart collection systems, biodegradable filters, and eco-friendly disposal practices. Technological adoption, such as sensor-based ashtrays and automated processing facilities, is enhancing efficiency. Additionally, European governments incentivize private companies and NGOs to invest in recycling programs, creating an integrated ecosystem for effective cigarette butt management.

Asia-Pacific

Asia-Pacific dominates the market, accounting for approximately 40–45% of the global market in 2024. High smoking prevalence in China, India, and Southeast Asia drives volume-based demand for collection and recycling programs. Growth is further supported by government-led urban waste-management initiatives, public campaigns against littering, and investments in industrial recycling technologies. Increasing urbanization, rising environmental consciousness, and the expansion of biodegradable filter production are key regional drivers. China leads through large-scale government programs to reduce urban and coastal litter, India through city-level clean-up campaigns and plastic ban policies, and Southeast Asian nations by implementing eco-friendly product standards for tobacco waste management.

Latin America

Latin American countries such as Brazil, Argentina, and Mexico are gradually increasing investments in formal cigarette butt management programs. Drivers include emerging government regulations on public littering, growing environmental awareness, and the expansion of private waste management and recycling services. Export opportunities for processed cigarette butts as industrial raw materials also contribute to growth. Urbanization and rising middle-class income levels are encouraging the adoption of structured collection solutions, while NGOs and municipal partnerships are helping scale programs across major cities.

Middle East & Africa

Africa, home to major tobacco-growing regions, benefits from both local consumption and environmental initiatives targeting cigarette butt litter. South Africa, Nigeria, and Kenya are driving the adoption of formal waste management programs through regulatory enforcement and urban clean-up campaigns. In the Middle East, high-income countries like the UAE, Saudi Arabia, and Qatar are increasingly adopting formal disposal systems supported by sustainability-focused government policies and corporate environmental responsibility programs. Drivers include growing urbanization, high disposable income, government-backed eco-initiatives, and investment in recycling and smart collection infrastructure. Regional growth is further aided by increasing awareness campaigns highlighting the environmental hazards of cigarette butt pollution, especially in urban centers and tourist-heavy areas.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Players in the Cigarette Butt Market

- Philip Morris International

- Japan Tobacco International

- R.J. Reynolds Tobacco Company

- British American Tobacco

- Imperial Brands

- Vector Tobacco Inc.

- China National Tobacco Corporation

- Altria Group

- ITC Limited

- British American Tobacco South Africa

- Universal Corporation

- British American Tobacco Australia

- Kraft Paper & Plastic Waste Solutions

- Terracycle, Inc.

- Cleanaway Waste Management

Recent Developments

- In March 2025, Terracycle expanded its cigarette butt recycling program in the U.S., partnering with municipalities to collect and convert butts into industrial plastic pellets.

- In February 2025, Philip Morris International launched a pilot program for biodegradable filters across Europe, aiming to reduce environmental impact from cigarette litter.

- In January 2025, Cleanaway Waste Management installed smart sensor-enabled bins in Australian cities to track cigarette butt collection in real-time, enhancing municipal clean-up efficiency.