Chocolate Liquor Market Size

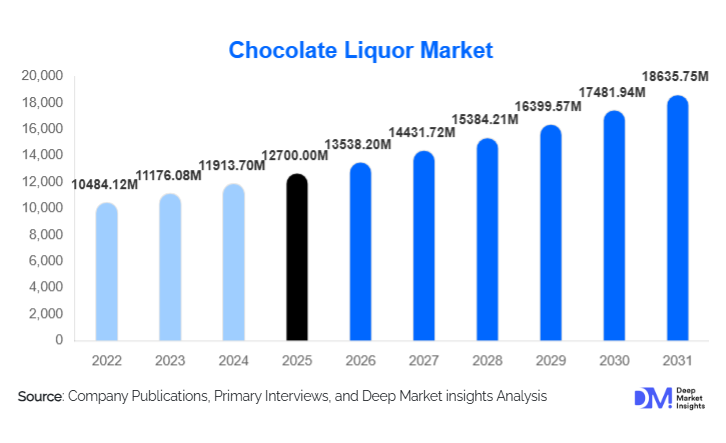

According to Deep Market Insights, the global chocolate liquor market size was valued at USD 12,700 million in 2025 and is projected to grow from USD 13,538.20 million in 2026 to reach USD 18,635.75 million by 2031, expanding at a CAGR of 6.6% during the forecast period (2026–2031). The market growth is primarily driven by increasing global demand for premium and high-cocoa chocolate, expansion of bakery and beverage applications, and rising adoption of sustainable and specialty cocoa liquor variants by manufacturers across the globe.

Key Market Insights

- Natural cocoa liquor dominates global demand, catering to premium chocolate, artisanal confectionery, and dark chocolate segments where authentic cocoa flavor is essential.

- Block form remains the leading product format, favored by industrial chocolate manufacturers for its ease of storage, transportation, and processing efficiency.

- Europe holds the largest market share, driven by strong chocolate consumption traditions in Germany, Switzerland, and Belgium, and a high preference for premium and single-origin cocoa products.

- Asia Pacific is the fastest-growing region, fueled by increasing urbanization, rising disposable income, and the adoption of western-style chocolate consumption in China, India, and Southeast Asia.

- Premiumization and health-focused chocolate products, such as high-cocoa content and functional chocolate, are creating new growth avenues for chocolate liquor suppliers.

- Sustainability and traceability initiatives, including blockchain-enabled cocoa sourcing, are reshaping supplier-consumer relationships and boosting brand trust among multinational confectionery buyers.

What are the latest trends in the chocolate liquor market?

Premium and Specialty Cocoa Products

Chocolate liquor producers are increasingly catering to high-end chocolate manufacturers, emphasizing single-origin, organic, and high-cocoa-content products. Consumer preference for dark chocolate with health benefits is driving demand for natural and specialty cocoa liquor. Artisanal and boutique chocolate brands are adopting single-origin and Criollo/Trinitario varieties to differentiate products. Sustainability certification, fair trade, and traceability have become key purchasing criteria for premium buyers, influencing production practices and sourcing strategies.

Expansion into Adjacent Applications

Beyond confectionery, chocolate liquor is gaining traction in functional foods, nutraceuticals, cosmetics, and beverages. Manufacturers are leveraging the antioxidant properties of cocoa to enter health-focused product segments. Cocoa-based beverages, high-protein snack bars, and skincare products are increasingly incorporating chocolate liquor as a core ingredient, broadening the addressable market.

What are the key drivers in the chocolate liquor market?

Rising Global Chocolate Consumption

The primary driver for chocolate liquor demand is the growth of chocolate consumption worldwide. Premium and dark chocolate segments are expanding rapidly due to increasing health awareness and taste preferences. Developed regions such as Europe and North America sustain high per-capita consumption, while emerging regions like the Asia Pacific and Latin America show accelerating adoption, fueling global market growth.

Growth in Bakery and Beverage Industries

Cocoa liquor is increasingly utilized in bakery products, frozen desserts, and chocolate beverages. The expansion of cafes, patisseries, and industrial bakeries globally has created additional volume demand. Its use enhances flavor, texture, and cocoa content, making it a key ingredient beyond traditional confectionery.

Retail and E-Commerce Expansion

The proliferation of modern retail and e-commerce platforms allows manufacturers and artisanal chocolate brands to reach a wider consumer base. Online channels support premium product sales, subscription-based offerings, and specialty chocolate deliveries, indirectly increasing demand for high-quality chocolate liquor in bulk.

What are the restraints for the global market?

Volatility in Cocoa Bean Supply

Chocolate liquor production is heavily dependent on cocoa bean supply, primarily concentrated in West Africa. Climate-related disruptions, plant diseases, and labor shortages can cause supply instability and price fluctuations, impacting processing margins and product pricing for manufacturers worldwide.

Raw Material Price Sensitivity

Cocoa bean price volatility, coupled with energy and operational cost fluctuations, affects profitability in chocolate liquor manufacturing. Price spikes can result in higher chocolate product prices, affecting demand elasticity and limiting growth in cost-sensitive markets.

What are the key opportunities in the chocolate liquor market?

Premiumization and Health-Driven Product Innovation

Rising consumer interest in high-cocoa, dark, and functional chocolate products presents growth opportunities. Producers can supply specialty cocoa liquor tailored to artisan and premium chocolate brands. Innovations in flavor profiling, organic certification, and antioxidant-rich formulations create added value and enable higher margins.

Emerging Market Expansion

Rapid urbanization and growing disposable incomes in China, India, and Southeast Asia are increasing chocolate consumption. These regions are adopting premium and specialty chocolate products, driving demand for imported cocoa liquor. Expanding retail infrastructure and e-commerce penetration enhance market accessibility and distribution efficiency.

Technology Integration and Sustainable Sourcing

Advances in processing technology, including refined fermentation, debittering, and flavor enhancement, are improving cocoa liquor quality. Blockchain and digital traceability ensure responsible sourcing and compliance with sustainability certifications. Such technological integration strengthens supply chain transparency and attracts global confectionery clients seeking ethical and consistent cocoa liquor supplies.

Product Type Insights

Natural cocoa liquor dominates the market, capturing approximately 45% of global value in 2024. Its authentic flavor, suitability for dark chocolate and premium confectionery, and compatibility with industrial chocolate processing make it the preferred choice for leading manufacturers. Specialty cocoa liquor, including organic and single-origin variants, is gaining traction, particularly in North America and Europe.

Application Insights

Chocolate and confectionery manufacturing account for the largest share (65%) of chocolate liquor demand. Bakery products and chocolate beverages represent growing segments, incorporating cocoa liquor for flavor and texture enhancement. Functional foods, nutraceuticals, and cosmetics are emerging applications, providing opportunities for diversification and higher-value product offerings. Export demand remains significant, particularly from Europe and North America, supplying the Asia Pacific and Middle East markets.

Distribution Channel Insights

Direct B2B supply remains the primary distribution channel, with industrial chocolate manufacturers procuring bulk chocolate liquor. Wholesale markets and specialized commodity exchanges facilitate trade, while e-commerce platforms are expanding for specialty and premium offerings. Companies are increasingly leveraging digital procurement systems and traceability platforms to streamline sourcing and meet sustainability requirements.

| By Product Type | By Form | By Cocoa Variety | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 30% of the global chocolate liquor market in 2024. The U.S. leads demand with high consumption of premium and dark chocolate, while Canada drives specialty chocolate adoption. Expansion of the bakery and beverage sectors and strong e-commerce penetration support market growth. North American manufacturers are also focusing on ethically sourced and high-quality cocoa liquor to cater to conscious consumers.

Europe

Europe holds the largest regional share (35–40%) of the chocolate liquor market in 2024, led by Germany, Switzerland, Belgium, and the U.K. High per-capita chocolate consumption, established processing capacities, and strong preference for premium and single-origin products support demand. Europe is also a key hub for sustainable sourcing and specialty cocoa liquor adoption.

Asia-Pacific

Asia Pacific is the fastest-growing region due to rising incomes, urbanization, and the adoption of Western-style chocolate. China, India, and Southeast Asia show strong growth potential for both premium and mid-tier chocolate products. Local manufacturing expansion and imports of specialty cocoa liquor are driving regional growth.

Latin America

Latin America’s market is supported by domestic cocoa production in Brazil, Ecuador, and Peru. Export-oriented processing and rising consumer adoption in Brazil, Mexico, and Argentina are gradually increasing demand for chocolate liquor, particularly for mid-tier and premium chocolate manufacturing.

Middle East & Africa

Africa remains the primary cocoa source region, with countries like Côte d’Ivoire and Ghana dominating production. The Middle East, led by the UAE, Saudi Arabia, and Qatar, is emerging as a consumer market for premium chocolate products, driving demand for imported cocoa liquor. Regional consumption in Africa is growing slowly but steadily, with intra-African trade supporting local processing industries.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Chocolate Liquor Market

- Barry Callebaut

- Cargill

- Olam International

- Ecom Agroindustrial Corp

- Mars Incorporated

- Mondelez International

- Nestlé

- The Hershey Company

- Puratos Group

- Blommer Chocolate Company

- Guandong / Guan Chong Berhad

- Meiji Holdings

- Lindt & Sprüngli

- Ferrero Group

- Fuji Oil Co., Ltd.