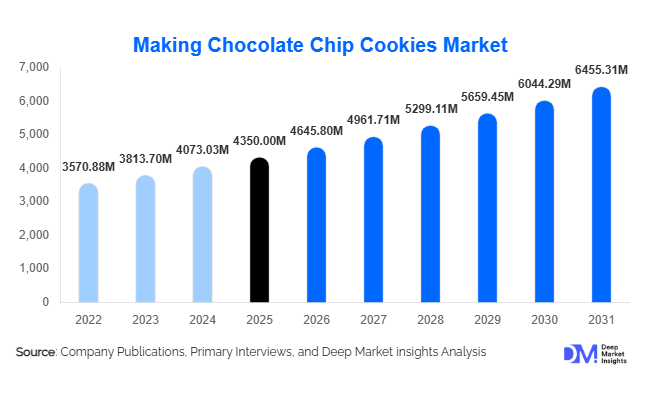

Making Chocolate Chip Cookies Market Size

According to Deep Market Insights, the global making chocolate chip cookies market size was valued at USD 4,350 million in 2025 and is projected to grow from USD 4,645.80 million in 2026 to reach approximately USD 6,455.31 million by 2031, expanding at a CAGR of 6.8% during the forecast period (2026–2031). Market growth is driven by the sustained popularity of home baking, increasing penetration of ready-to-bake and DIY cookie solutions, and rising demand from commercial bakeries and foodservice operators seeking consistency, speed, and cost efficiency.

Key Market Insights

- Home baking remains the largest demand driver, supported by lifestyle shifts toward comfort foods and experiential cooking.

- Ready-to-bake and frozen cookie dough formats are expanding rapidly, particularly across foodservice and QSR channels.

- North America dominates global consumption, with the U.S. accounting for over one-quarter of total demand.

- Asia-Pacific is the fastest-growing region, fueled by Western dessert adoption and rising disposable incomes.

- Premium and clean-label cookie solutions are gaining share, reflecting evolving consumer preferences for quality and transparency.

- E-commerce and DTC channels are reshaping distribution, especially for DIY baking kits and specialty mixes.

What are the latest trends in the making chocolate chip cookies market?

Premiumization and Clean-Label Baking Solutions

Consumers are increasingly trading up from conventional cookie mixes to premium and clean-label alternatives made with organic flour, real butter, natural vanilla, and high-quality chocolate inclusions. Brands are reformulating products to remove artificial preservatives, colors, and flavors while maintaining shelf stability. This trend is particularly strong in North America and Europe, where clean-label positioning supports premium pricing and brand differentiation. Free-from variants such as gluten-free, dairy-free, and vegan cookie doughs are also gaining traction, supported by rising dietary awareness and allergy considerations.

Growth of Ready-to-Bake and DIY Formats

Convenience-driven formats such as refrigerated dough, frozen dough, and DIY baking kits are witnessing accelerated adoption. Ready-to-bake dough appeals to consumers seeking consistent texture and minimal preparation time, while DIY kits cater to experiential baking, gifting, and family-oriented consumption. Social media-driven baking trends and influencer-led recipes are further boosting visibility of these formats, particularly through online and direct-to-consumer channels.

What are the key drivers in the making chocolate chip cookies market?

Rising Home Baking Culture

Home baking has evolved into a sustained lifestyle habit rather than a temporary trend. Chocolate chip cookies remain a staple entry product for both novice and experienced bakers due to their simplicity and universal appeal. This has resulted in strong repeat demand for dry mixes, dough, and baking kits across retail channels.

Expansion of Foodservice and Café Chains

Cafés, QSRs, and cloud kitchens increasingly rely on frozen and bulk cookie dough to deliver standardized, high-margin dessert offerings. Chocolate chip cookies are among the most profitable baked add-ons, driving consistent B2B demand globally.

What are the restraints for the global market?

Raw Material Price Volatility

Fluctuating prices of cocoa, sugar, dairy fats, and wheat impact production costs and profit margins. Manufacturers face challenges in maintaining price stability while absorbing cost inflation, particularly in mass-market segments.

Cold-Chain and Shelf-Life Limitations

Refrigerated and frozen cookie dough formats require robust cold-chain infrastructure, limiting penetration in emerging markets and increasing logistics costs for manufacturers and distributors.

What are the key opportunities in the making chocolate chip cookies industry?

Asia-Pacific Market Expansion

Rapid urbanization, Western food adoption, and growing middle-class populations in China, India, Indonesia, and South Korea present significant growth opportunities. Localized flavors, smaller pack sizes, and mid-premium pricing strategies are expected to accelerate penetration.

Direct-to-Consumer and Subscription Models

DTC baking kits, personalized cookie mixes, and subscription-based offerings enable brands to build direct consumer relationships, improve margins, and leverage data-driven product customization.

Product Type Insights

Dry chocolate chip cookie mixes dominate the global market, accounting for approximately 38% of total revenue in 2025. This leadership is primarily driven by their extended shelf life, cost efficiency, ease of storage, and widespread availability across supermarkets and online retail platforms. These attributes make dry mixes particularly appealing to households and small bakeries seeking consistent quality with minimal preparation.

Refrigerated ready-to-bake cookie dough represents around 29% of the market, supported by rising consumer preference for convenience combined with homemade taste and freshness. The segment benefits from increasing demand among urban consumers and working households seeking quick dessert solutions.Frozen cookie dough continues to gain traction, particularly within foodservice and commercial bakery channels, where portion control, extended storage, and operational efficiency are critical. Meanwhile, DIY baking kits are emerging as a premium niche segment, driven by experiential consumption trends, gifting occasions, and growing interest in at-home culinary activities.

Application Insights

The household segment remains the largest application category, contributing nearly 55% of total market demand. Growth in this segment is primarily driven by rising home baking adoption, increased availability of ready-to-use mixes, and strong promotional activity across retail channels.

Commercial bakeries, cafés, and foodservice operators collectively account for approximately 45% of demand and are expected to witness faster growth over the forecast period. The key driver for this segment is the rapid expansion of quick-service restaurants (QSRs), café chains, and dessert-focused outlets, which increasingly rely on standardized cookie mixes to ensure product consistency and operational efficiency.

Distribution Channel Insights

Supermarkets and hypermarkets remain the dominant distribution channel, representing about 42% of global sales. Their leadership is supported by strong consumer trust, wide product assortment, and frequent promotional campaigns that encourage bulk and impulse purchases.

Online retail and direct-to-consumer (DTC) channels, currently accounting for around 14% of sales, are the fastest-growing distribution segment. Growth is driven by increasing internet penetration, targeted digital marketing, subscription-based baking kits, and the convenience of doorstep delivery. Specialty stores and foodservice distributors continue to play a supporting role, particularly in premium and commercial applications.

Formulation Type Insights

Conventional formulations dominate the market with approximately 61% share, owing to their affordability, familiar taste profiles, and broad consumer acceptance. However, the clean-label, free-from (gluten-free, allergen-free), and vegan formulations segment is expanding at a significantly higher growth rate, exceeding 9% CAGR.

This accelerated growth is driven by rising health consciousness, increasing prevalence of dietary restrictions, and growing demand for transparency in ingredient sourcing. Manufacturers are actively reformulating products to reduce artificial additives while maintaining taste and texture parity with conventional offerings.

| By Product Type | By End-Use Application | By Distribution Channel | By Formulation Type | By Price Tier |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds approximately 34% of the global market share, with the United States accounting for the majority of regional revenue. Market growth is driven by high home baking penetration, strong demand from cafés and foodservice chains, and continuous product innovation focused on clean-label and premium offerings. Seasonal baking traditions and high per-capita consumption of baked goods further reinforce regional dominance.

Europe

Europe represents around 27% of global demand, led by the UK, Germany, and France. Growth in the region is driven by rising consumer preference for premium, organic, and sustainably sourced baking solutions. Increasing demand for artisanal-style cookies and plant-based formulations, combined with strong private-label penetration, continues to shape the regional market landscape.

Asia-Pacific

Asia-Pacific accounts for approximately 23% of the global market and is the fastest-growing region, expanding at over 8.5% CAGR. Key growth drivers include rapid urbanization, rising disposable incomes, westernization of food habits, and growing popularity of home baking among younger consumers.China and India serve as major growth engines, supported by expanding modern retail infrastructure, increasing penetration of e-commerce platforms, and growing café and bakery chains across urban centers.

Latin America

Latin America holds about 9% of the global market share, with Brazil and Mexico leading regional demand. Market growth is driven by urbanization, expanding middle-class populations, and the rising influence of café culture and quick-service restaurants. Improving retail accessibility and increasing adoption of convenience food products further support regional expansion.

Middle East & Africa

The Middle East & Africa region accounts for nearly 7% of the global market. Growth is supported by rising bakery and foodservice infrastructure, increasing demand for premium and indulgent food products, and strong tourism-driven consumption in countries such as the UAE and Saudi Arabia.In Africa, South Africa remains a key market, driven by expanding retail networks and increasing consumer exposure to packaged baking solutions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Making Chocolate Chip Cookies Market

- General Mills

- Nestlé

- Mondelez International

- Conagra Brands

- The Hershey Company

- Associated British Foods

- Kerry Group

- Puratos Group

- Dawn Foods

- Barry Callebaut

- Cargill

- ADM

- Tate & Lyle

- Orkla

- Britannia Industries