Chocolate Fillings Market Size

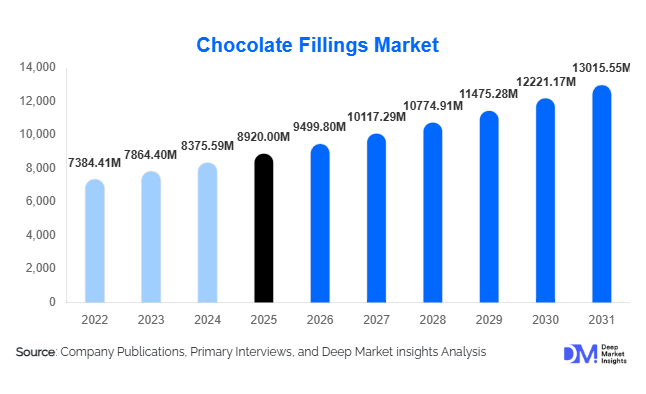

According to Deep Market Insights, the global chocolate fillings market size was valued at USD 8,920 million in 2025 and is projected to grow from USD 9,499.80 million in 2026 to reach USD 13,015.55 million by 2031, expanding at a CAGR of 6.5% during the forecast period (2026–2031). The chocolate fillings market growth is primarily driven by rising global confectionery consumption, rapid expansion of premium bakery and frozen dessert applications, and increasing demand for clean-label and sugar-reduced formulations. Growing innovation in nut-based, plant-based, and functional chocolate fillings is further supporting industry expansion across developed and emerging economies.

Key Market Insights

- Nut-based chocolate fillings dominate globally, supported by strong demand for hazelnut and praline centers in premium confectionery products.

- Industrial food processors account for the largest share of chocolate filling consumption, driven by large-scale production of filled bars, truffles, and pastries.

- Europe leads the global market, benefiting from strong chocolate manufacturing hubs in Germany, Belgium, Italy, and France.

- Asia-Pacific is the fastest-growing region, fueled by rising disposable incomes and westernized snacking patterns in China and India.

- Clean-label and sugar-free innovations are gaining traction as regulatory pressure on sugar reduction intensifies globally.

- Direct B2B distribution channels dominate, with long-term supply contracts between ingredient manufacturers and global confectionery brands.

What are the latest trends in the chocolate fillings market?

Premiumization and Gourmet Flavor Innovation

Premium chocolate fillings featuring single-origin cocoa, alcohol infusions, exotic fruits, and specialty nuts are gaining momentum across North America and Europe. Consumers are increasingly willing to pay higher prices for indulgent, artisanal experiences, encouraging manufacturers to invest in texture-enhanced ganache, layered fillings, and multi-sensory flavor combinations. Limited-edition and seasonal flavors are becoming important tools for brand differentiation, particularly in pralines and filled chocolate bars. Sustainable cocoa sourcing and traceability certifications are also emerging as critical brand positioning strategies within the premium segment.

Plant-Based and Sugar-Reduced Reformulations

With growing global health awareness, manufacturers are reformulating chocolate fillings using plant-based emulsifiers, alternative sweeteners, and dairy-free fats. Vegan chocolate fillings are witnessing accelerated demand in North America and Western Europe. Reduced-sugar and polyol-based fillings are increasingly incorporated into functional snack bars and diabetic-friendly confectionery. Clean-label formulations, avoiding artificial stabilizers and preservatives, are reshaping R&D priorities and driving new product launches across bakery and frozen dessert applications.

What are the key drivers in the chocolate fillings market?

Expansion of Global Confectionery Production

The steady rise in chocolate confectionery consumption worldwide is a primary growth driver. Filled chocolates account for a substantial share of premium confectionery sales, creating sustained demand for industrial-scale chocolate filling production. Emerging economies are expanding domestic confectionery manufacturing capacities, increasing procurement volumes from ingredient suppliers.

Rapid Growth of Bakery and Frozen Dessert Applications

Chocolate-filled croissants, donuts, layered cakes, and ice cream inclusions are experiencing robust demand growth. Industrial bakeries are incorporating stable, heat-resistant fillings that maintain texture and flavor integrity. The frozen dessert sector increasingly relies on swirl and core chocolate fillings to differentiate product offerings.

Technological Advancements in Processing

Advancements in fat crystallization control, emulsification systems, and shelf-stable formulations are improving product consistency and extending shelf life. Automated filling lines and precision dosing technologies are enhancing production efficiency, reducing waste, and enabling higher throughput for large manufacturers.

What are the restraints for the global market?

Cocoa Price Volatility

Fluctuations in global cocoa prices significantly impact raw material costs and profit margins. Supply chain disruptions and climate-related production challenges in cocoa-producing regions create pricing instability, posing challenges for smaller manufacturers.

Shelf-Life and Temperature Sensitivity Issues

Chocolate fillings are highly sensitive to temperature variations and fat bloom formation. Maintaining structural integrity during storage and transportation requires specialized packaging and controlled logistics, increasing operational expenses.

What are the key opportunities in the chocolate fillings industry?

Functional and High-Protein Fillings

The expanding health-snacking segment presents opportunities for protein-enriched and fiber-fortified chocolate fillings. Integration into energy bars, meal replacements, and sports nutrition products can expand addressable market segments beyond traditional confectionery.

Emerging Market Manufacturing Expansion

Asia-Pacific and the Middle East are investing in domestic food processing capabilities. Government initiatives supporting food manufacturing infrastructure are encouraging local production of filled chocolates and bakery items, creating new demand centers for chocolate filling suppliers.

Product Type Insights

Nut-based chocolate fillings lead the global market, accounting for approximately 26% of the 2025 market share. The segment’s dominance is primarily driven by strong consumer preference for hazelnut, almond, and praline variants, particularly in premium and mid-premium confectionery products. The leading segment driver is the growing global demand for indulgent, texture-rich chocolate experiences, supported by product innovation in spreads, layered bars, and filled pralines. Nut-based fillings offer superior mouthfeel, balanced sweetness, and compatibility with both milk and dark chocolate formulations, making them highly versatile across applications.

Cream-based and ganache fillings follow closely, supported by widespread usage in truffles, enrobed chocolates, and layered desserts. Their smooth texture, customizable flavor profiles, and ability to incorporate functional ingredients such as plant-based fats are expanding their appeal. Caramel and fruit-based fillings are steadily gaining traction in bakery and snack applications, driven by consumer interest in sweet-salty flavor combinations and fruit-infused premium offerings. Meanwhile, liqueur-infused and specialty fillings represent a high-margin niche segment, catering to luxury confectionery brands and seasonal gifting markets where premiumization remains a key revenue lever.

Application Insights

Confectionery applications dominate the market, representing nearly 48% of the global market in 2025. The leading segment driver is sustained global demand for filled chocolate bars, pralines, and truffles, supported by premium product launches and seasonal sales cycles. Manufacturers are increasingly incorporating multi-layered fillings, texture contrasts, and reduced-sugar formulations to differentiate offerings in competitive retail environments.

Bakery applications account for a significant share, with rapid adoption in croissants, donuts, muffins, and premium cakes. Growth in this segment is supported by the expansion of café chains, in-store bakeries, and frozen bakery solutions. Ice cream and frozen desserts represent an emerging high-growth segment, as manufacturers incorporate swirl, ripple, and core chocolate fillings to enhance product differentiation and improve consumer appeal. The expansion of premium ice cream brands and indulgent snacking culture further supports incremental growth.

Distribution Channel Insights

Direct B2B sales account for approximately 64% of total market revenue, reflecting the high concentration of industrial buyers and large-scale food manufacturers. The leading segment driver is the prevalence of long-term supply contracts between ingredient manufacturers and global confectionery producers, ensuring stable procurement volumes and predictable revenue streams. These partnerships enable customized formulations, technical support, and co-development of new product lines.

Specialty ingredient distributors and foodservice suppliers play a critical role in serving artisanal, mid-scale, and regional manufacturers. Growth in this channel is supported by rising demand for small-batch production, premium customization, and localized flavor innovation. Additionally, e-commerce-based ingredient sourcing platforms are gradually expanding accessibility for small and independent producers.

End-Use Industry Insights

Industrial food processing leads the market with around 61% market share, driven by high-volume production of chocolate confectionery, filled snacks, and baked goods. The leading segment driver is large-scale automation combined with increasing global chocolate consumption, particularly in emerging economies. Industrial manufacturers benefit from economies of scale, consistent quality control, and strong global distribution networks.

Artisanal and craft manufacturers are expanding rapidly in premium urban markets, emphasizing customization, gourmet offerings, and clean-label formulations. Consumer preference for handmade, small-batch chocolates is strengthening this segment’s growth potential. Quick service restaurants (QSRs) are also incorporating chocolate-filled pastries, donuts, and desserts into breakfast and snack menus, contributing incremental demand and supporting cross-category expansion.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds approximately 28% of the 2025 market share, with the United States contributing nearly 22% globally. Regional growth is primarily driven by strong premiumization trends, rising demand for sugar-free and reduced-calorie variants, and continuous innovation in seasonal and limited-edition chocolate products. The expansion of convenience retail channels and private-label confectionery also supports demand. Canada contributes stable growth through artisanal chocolate production, bakery innovation, and increasing adoption of plant-based chocolate fillings.

Europe

Europe dominates the market with around 34% share in 2025, supported by its deep-rooted chocolate manufacturing heritage and high per-capita chocolate consumption. Germany accounts for nearly 9% of global demand due to strong confectionery exports and advanced production infrastructure. Belgium, Italy, and France contribute significantly through premium praline manufacturing and luxury chocolate exports. Regional growth drivers include established supply chains, strong R&D capabilities, premium gifting culture, and increasing demand for organic and clean-label chocolate fillings.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at nearly 8% CAGR. Key demand centers include China, India, Japan, and Indonesia. Growth is driven by rising disposable incomes, rapid urbanization, westernization of snacking habits, and expansion of organized retail networks. Multinational confectionery brands are investing heavily in local manufacturing facilities to cater to evolving taste preferences. Additionally, increasing demand for premium and imported chocolate products in metropolitan areas is accelerating market expansion.

Latin America

Latin America accounts for roughly 8% of global demand, led by Brazil and Mexico. Regional growth is supported by expanding domestic confectionery manufacturing, improving retail penetration, and growing middle-class consumption. Export-oriented production and favorable cocoa availability in certain countries further enhance regional competitiveness. Rising demand for affordable indulgence products continues to drive steady expansion.

Middle East & Africa

The Middle East and Africa region is growing at around 7% annually, supported by expanding bakery sectors and increasing premium confectionery consumption in urban centers. The UAE and Saudi Arabia are key growth markets due to strong gifting culture and high disposable income. South Africa serves as a regional manufacturing hub, supporting intra-African trade and distribution. Growth is further driven by modern retail expansion, tourism-driven confectionery sales, and rising youth demographics.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Chocolate Fillings Market

- Barry Callebaut AG

- Cargill Incorporated

- Olam Food Ingredients

- Puratos Group

- Fuji Oil Holdings Inc.

- AAK AB

- Blommer Chocolate Company

- Tate & Lyle PLC

- Ingredion Incorporated

- Ferrero International S.A.

- Mars Incorporated

- Nestlé S.A.

- Lindt & Sprüngli AG

- Meiji Holdings Co., Ltd.

- Ezaki Glico Co., Ltd.