Chickpea Flour Market Size

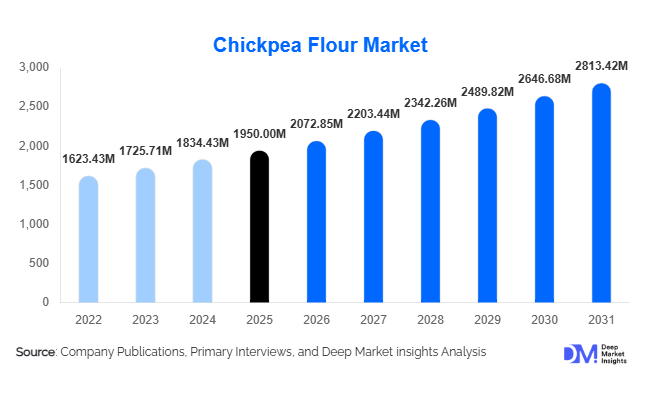

According to Deep Market Insights, the global chickpea flour market size was valued at USD 1,950 million in 2025 and is projected to grow from USD 2072.85 million in 2026 to reach USD 2813.42 million by 2031, expanding at a CAGR of 6.3% during the forecast period (2026–2031). The market growth is primarily driven by increasing demand for plant-based and gluten-free products, rising health consciousness among consumers, and the growing popularity of chickpea flour in bakery, snacks, beverages, and traditional food applications globally.

Key Market Insights

- Organic and gluten-free chickpea flour is gaining traction, fueled by rising health awareness and dietary restrictions such as celiac disease and lactose intolerance.

- Bakery and snack applications dominate the market, with chickpea flour being increasingly used in breads, cookies, extruded snacks, and functional foods due to its high protein and fiber content.

- North America and Europe hold substantial market shares, driven by premium product consumption, health-conscious diets, and functional food adoption.

- Asia-Pacific is emerging as the fastest-growing region, with India, Pakistan, and China driving demand due to traditional consumption patterns and urbanized retail channels.

- Technological advancements, including instant flour processing, fortification, and e-commerce platforms, are reshaping product accessibility and consumer reach.

What are the latest trends in the chickpea flour market?

Rising Preference for Gluten-Free and Plant-Based Diets

Chickpea flour is becoming a staple ingredient in gluten-free diets and plant-based nutrition. The flour’s high protein content and low glycemic index make it an ideal choice for health-conscious consumers and fitness enthusiasts. Manufacturers are leveraging this trend by launching organic, fortified, and instant flour products tailored for bakery, snacks, and beverages. Increasing adoption in protein shakes, pasta, and ready-to-cook mixes is further boosting market visibility. The rise of vegan and vegetarian diets in Europe and North America is also driving demand for chickpea flour as a versatile alternative to wheat and soy flour.

Innovative Applications in Bakery and Snacks

Bakery and snack industries are integrating chickpea flour for its nutritional benefits and functional properties such as water absorption and binding capacity. Cookies, cakes, breads, and extruded snacks are increasingly formulated with chickpea flour to enhance protein content and cater to clean-label product trends. Traditional dishes, particularly in South Asia and the Middle East, continue to rely on chickpea flour, reinforcing its demand across regional culinary practices. Rising experimentation in ready-to-cook mixes, fortified snacks, and functional beverages is expanding application scopes and driving incremental growth globally.

What are the key drivers in the chickpea flour market?

Health and Nutrition Awareness

Consumer focus on protein-rich, low-fat, and gluten-free diets is a major driver. Chickpea flour provides essential nutrients, dietary fiber, and plant-based protein, positioning it as a functional ingredient for bakery, snacks, and beverages. Health-conscious consumers in North America and Europe are particularly influencing product innovation, including fortified and organic variants, which has accelerated adoption across premium product categories.

Expansion of Bakery and Snack Industries

The growth of bakery and snacks globally is propelling chickpea flour demand. Urbanization, increasing disposable income, and changing lifestyles have fueled consumption of packaged and convenience foods. Chickpea flour is used in breads, cookies, noodles, and extruded snacks, with its gluten-free and protein-rich profile driving incorporation into new product lines. Emerging markets in Asia-Pacific and Latin America are witnessing rapid growth in packaged food sectors, enhancing flour demand.

Government Support and Sustainable Agriculture

Policies promoting pulse cultivation, subsidies for chickpea farmers, and campaigns encouraging protein-rich diets are supporting market growth. Initiatives like India’s “Make in India” and Canada’s pulse export programs enhance raw material availability, reduce production costs, and stimulate global exports, thereby strengthening market dynamics.

What are the restraints for the global market?

Price Volatility of Raw Chickpeas

Fluctuations in chickpea crop yields due to climatic changes, pests, and export restrictions impact raw material costs. This volatility affects profitability for manufacturers and may limit expansion, particularly for smaller producers dependent on conventional chickpea supplies.

Limited Awareness in Emerging Markets

In regions where chickpea flour is not traditionally consumed, low awareness of its nutritional benefits can restrict adoption. Educational campaigns and marketing initiatives are required to build demand in such areas, highlighting usage in local recipes and health advantages.

What are the key opportunities in the chickpea flour industry?

New Product Innovation and Fortification

Manufacturers have opportunities to develop fortified and high-protein chickpea flour for bakery, snacks, and beverages. Integration of vitamins, minerals, and functional ingredients can attract health-focused consumers. Ready-to-cook and instant flour mixes allow rapid adoption in urban households and convenience food sectors, increasing market penetration.

Emerging Markets Expansion

Asia-Pacific and Latin America present significant growth opportunities. Countries such as India, Pakistan, Brazil, and Mexico have high consumption potential for chickpea-based foods. Expansion into these regions, coupled with export strategies from India and Canada, can enable manufacturers to tap untapped markets and diversify revenue streams.

Technological Integration in Production and Distribution

Advances in milling, fortification, and instant flour technologies improve product quality, shelf-life, and nutritional value. Digital tools, including e-commerce platforms, D2C channels, and supply chain management software, are creating opportunities for broader consumer access and higher operational efficiency, enabling manufacturers to expand reach and profitability.

Product Type Insights

Organic chickpea flour dominates the global market, accounting for 32% share in 2025. The leading driver for this segment is the rising consumer demand for clean-label, pesticide-free, and sustainably sourced ingredients. Health-conscious consumers in North America and Europe increasingly prefer certified organic products due to concerns over food safety, traceability, and nutritional density. Manufacturers are capitalizing on this trend by emphasizing organic certifications, non-GMO labeling, and transparent sourcing practices.

Conventional chickpea flour remains widely used, particularly in price-sensitive markets and traditional culinary applications where affordability and accessibility are key purchasing factors. Meanwhile, fortified and gluten-free variants are witnessing accelerated growth, driven by increasing awareness of protein enrichment, micronutrient fortification, and the expanding gluten-intolerant population. These value-added variants are gaining traction in bakery, ready-to-eat meals, and functional food products. The premiumization trend continues to shape product innovation, encouraging manufacturers to develop specialty blends tailored for health-focused and performance-oriented consumers.

Application Insights

Bakery products represent the largest application segment, accounting for 35% of the global market. The primary growth driver for this segment is the increasing demand for high-protein, gluten-free, and fiber-rich baked goods. Chickpea flour enhances texture, moisture retention, and nutritional value in cookies, breads, cakes, and specialty gluten-free bakery items. Rising consumer preference for plant-based and functional bakery alternatives continues to strengthen this segment.

Snacks and traditional foods follow closely, particularly in Asia-Pacific and the Middle East, where chickpea-based dishes are deeply rooted in cultural consumption patterns. The growing popularity of roasted snacks, extruded products, and ethnic foods in global markets further supports expansion. Beverages and health drinks represent an emerging and high-potential application area. Protein shakes, meal replacements, and fortified beverages increasingly incorporate chickpea flour due to its plant-based protein profile and emulsifying properties, aligning with the global shift toward sports nutrition and wellness-oriented consumption.

Distribution Channel Insights

Supermarkets and hypermarkets dominate the distribution landscape with a 38% market share. The leading driver for this channel is strong consumer preference for one-stop shopping experiences, broad product assortment, and in-store promotional visibility. Established retail chains provide brand credibility and accessibility, particularly for packaged and premium chickpea flour products.

Online retail is the fastest-growing channel, fueled by increasing e-commerce penetration, digital payment adoption, and convenience-driven urban consumers. Direct-to-consumer (DTC) models and specialty health stores are also gaining importance, especially for organic and fortified variants. Social media marketing, influencer endorsements, and digital product reviews are significantly influencing purchasing decisions, reshaping global buying behavior.

End-Use Insights

Food processing companies account for 45% of the global market share, making them the leading end-use segment. The key driver is the large-scale incorporation of chickpea flour into packaged foods, ready-to-eat products, and private-label brands. Its functional versatility, cost-effectiveness, and nutritional appeal make it highly suitable for industrial applications.

The foodservice sector is expanding steadily, particularly across cafes, restaurants, quick-service chains, and catering services. Chefs are increasingly integrating chickpea flour into both traditional and contemporary recipes due to its versatility and clean-label positioning. Retail and online sales are also expanding as home cooking trends and DIY baking grow in popularity. Emerging applications in functional foods, high-protein meal replacements, and performance nutrition products present strong long-term growth opportunities.

| By Product Type | By Application | By End-Use Industry | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America remains a key revenue-generating region, valued at USD 450 million in 2025. Growth in this region is primarily driven by rising gluten-free adoption, expanding plant-based diets, and a strong health and wellness movement. The United States and Canada lead demand due to advanced retail infrastructure, high disposable incomes, and growing demand for protein-enriched foods. Innovation in bakery and snack manufacturing, coupled with premium organic product positioning, further accelerates regional expansion. Strong regulatory standards and consumer trust in certified labeling also support sustained growth.

Europe

Europe accounts for approximately USD 500 million in 2025, making it one of the largest regional markets. Germany, the U.K., and France are major contributors, driven by high demand for organic, clean-label, and sustainable food products. Government support for sustainable agriculture and increasing vegan and flexitarian populations act as major growth drivers. Rising consumer awareness regarding plant-based protein sources and allergen-free ingredients is accelerating product innovation, particularly in bakery and functional food categories.

Asia-Pacific

Asia-Pacific is the fastest-growing region, registering a CAGR of 7.5%. The primary growth driver is the strong cultural integration of chickpeas in traditional diets across India, Pakistan, and parts of Southeast Asia. Rapid urbanization, expanding middle-class populations, and rising disposable incomes are boosting demand for packaged and branded chickpea flour. Modern retail expansion, improved processing technologies, and increasing exports from major producing countries further strengthen regional growth. Additionally, rising health awareness in China and Southeast Asia is accelerating demand for fortified and protein-rich variants.

Middle East & Africa

The Middle East & Africa market is valued at approximately USD 120 million in 2025. Regional growth is supported by strong demand for traditional chickpea-based foods such as hummus and falafel. Countries including the UAE, Saudi Arabia, and South Africa are witnessing increasing adoption of packaged and branded flour products. Rising urbanization, tourism-driven foodservice expansion, and improved import-export channels from India and Canada are enhancing product availability and market penetration.

Latin America

Latin America is expanding at a CAGR of approximately 6%, led by Brazil and Mexico. Growth drivers include rising health awareness, growing interest in plant-based diets, and innovation in bakery and snack manufacturing. Urban consumers are increasingly seeking protein-rich and gluten-free alternatives, while affluent segments are adopting premium and fortified chickpea flour products. Improved retail distribution networks and expanding e-commerce channels are further contributing to regional growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Chickpea Flour Market

- Bob’s Red Mill Natural Foods

- Agrana Beteiligungs-AG

- Shree Hari Food Products Pvt. Ltd.

- Deep Foods Inc.

- Gulati Enterprises

- Cargill, Inc.

- Archer Daniels Midland Company

- Ruchi Soya Industries Ltd.

- Purity Life Health Products

- Himalayan Naturals

- Grofers Pvt. Ltd.

- Modern Food Enterprises

- Vikas Food Products

- AK International

- Royal Foods