Cherry Crème Filling Market Size

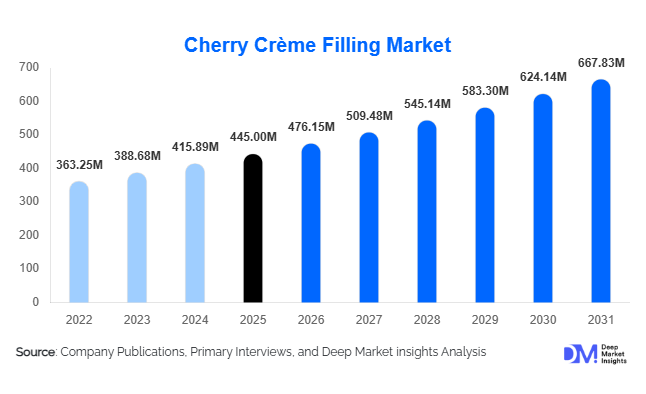

According to Deep Market Insights,the global cherry crème filling market size was valued at USD 445 million in 2026 and is projected to grow from USD 476.15 million in 2026 to reach USD 667.83 million by 2031, expanding at a CAGR of 7.0% during the forecast period (2026–2031). The market growth is primarily driven by rising demand from premium bakery and confectionery applications, increasing adoption of clean-label and natural ingredients, and the expansion of foodservice and retail channels catering to innovative dessert offerings.

Key Market Insights

- Bakery and pastry applications dominate global demand, reflecting the widespread use of cherry crème fillings in cakes, tarts, and donuts.

- Ready-to-use fillings are the leading product type segment, due to convenience, consistent quality, and operational efficiency for commercial bakers.

- North America and Europe together account for over 55% of global market share in 2025, supported by established bakery industries and high consumer preference for premium dessert products.

- Asia Pacific is the fastest-growing region, driven by rising middle-class consumption, modernization of bakeries, and increasing import of specialty fillings.

- Clean-label and natural ingredient trends are transforming product formulations, with sugar-reduced and organic fillings gaining traction.

- Digital procurement and e-commerce channels are expanding reach to smaller bakers and emerging markets, improving distribution efficiency.

What are the latest trends in the cherry crème filling market?

Clean-Label and Natural Ingredient Adoption

Manufacturers are increasingly focusing on natural cherry content, organic formulations, and reduced-sugar products. Clean-label cherry crème fillings appeal to health-conscious consumers and premium bakery operators seeking authentic fruit flavors. Certifications for organic or non-GMO ingredients are becoming key differentiators. This trend is supported by growing consumer awareness and regulatory encouragement in regions like Europe and North America.

Premium Bakery and Confectionery Integration

Cherry crème fillings are widely used in high-value pastries, chocolates, and frozen desserts. Artisanal bakeries and luxury patisseries are integrating these fillings into hybrid products, such as filled croissants, gourmet tarts, and chocolate truffles. The demand is supported by consumers seeking indulgent, visually appealing, and flavor-rich products. This premium positioning also enables higher profit margins for producers and strengthens brand recognition in specialty markets.

What are the key drivers in the cherry crème filling market?

Rising Demand from Commercial Bakeries and Foodservice

Commercial bakeries and foodservice chains are the largest consumers of cherry crème fillings, driven by high-volume production and consistent quality requirements. The growing popularity of filled pastries, desserts, and confectionery items in restaurants, cafés, and retail bakeries is directly propelling market growth. Bakery chains increasingly adopt ready-to-use fillings to reduce operational complexity, further boosting demand.

Expansion of E-Commerce and Direct B2B Supply

Online procurement platforms and specialized B2B channels have expanded access for small-scale and emerging bakery operators, particularly in developing regions. These channels allow manufacturers to reach global customers, improve order management, and reduce intermediaries. The trend is facilitating market penetration in Asia Pacific and Latin America, where bakery modernization is driving demand for imported or specialty fillings.

Consumer Preference for Authentic and Premium Flavors

Cherry crème fillings offer a combination of fruit tang and creamy texture that aligns with evolving taste preferences. Consumers are increasingly favoring natural, high-fruit-content products, creating opportunities for manufacturers to innovate with functional or sugar-reduced formulations. The premium perception of cherry fillings enhances brand positioning, especially in high-end bakeries and gourmet chocolate products.

What are the restraints for the global market?

Raw Material Price Volatility

Cherry prices fluctuate based on seasonal yields, weather patterns, and agricultural supply constraints. This volatility affects manufacturing costs and can compress margins for producers. Sudden spikes in cherry prices may lead to temporary price increases for end-products, impacting demand in price-sensitive markets.

Shelf-Life and Storage Challenges

High fruit-content cherry crème fillings are sensitive to microbial stability, texture changes, and color degradation. Manufacturers must invest in advanced preservation techniques or stabilizers, increasing production complexity and costs. These factors can limit long-distance distribution and affect export volumes.

What are the key opportunities in the cherry crème filling market?

Expansion of Clean-Label and Organic Products

Rising consumer demand for health-conscious and natural ingredients presents a strong opportunity. Companies that invest in sugar-reduced, organic, or fruit-focused formulations can capture premium pricing and appeal to bakery chains and specialty retailers. This trend also aligns with government incentives for natural food production and labeling transparency.

Growth in Emerging Markets

Asia Pacific and Latin America are emerging as high-growth regions due to expanding middle-class consumption, modern retail infrastructure, and increased adoption of Western-style bakery and confectionery products. Investment in local distribution networks and partnerships with foodservice operators can accelerate market penetration.

Integration with Premium and Experiential Bakery Products

Manufacturers can create niche products such as filled pastries, hybrid desserts, and gourmet chocolates using cherry crème fillings. Collaborations with high-end bakeries and cafés can expand visibility and drive innovation-led growth. Customization opportunities for unique flavor profiles, seasonal products, or themed desserts further support revenue expansion.

Product Type Insights

Ready-to-use cherry crème fillings dominate the product type segment, accounting for approximately 42% of global market share in 2025. Their widespread adoption is fueled by convenience, operational efficiency, and consistent quality, making them particularly attractive for commercial bakeries, patisseries, and foodservice operators. Concentrated and sugar-reduced variants are gaining traction among health-conscious consumers, but currently represent smaller portions of the market. The growing trend toward natural, clean-label, and premium ingredients is expected to further shift demand toward high-quality, ready-to-use offerings, driving innovation in flavor profiles, functional ingredients, and product customization.

Application Insights

Bakery and pastry applications are the largest consumers of cherry crème fillings, representing roughly 52% of total demand in 2025. These fillings are widely used in cakes, tarts, donuts, and filled bread products, with demand fueled by premiumization, creative bakery concepts, and rising consumer preference for indulgent desserts. Confectionery applications, including chocolates, candies, and chocolate-coated treats, are experiencing steady growth due to innovation in flavor and texture. Frozen desserts represent a niche but rapidly growing segment, supported by rising interest in artisanal ice creams and frozen pastries.

Distribution Channel Insights

Supermarkets and hypermarkets dominate distribution channels, accounting for ~38% of global sales. These channels provide broad visibility and easy consumer access to packaged cherry crème fillings. Online retail and specialized ingredient suppliers are expanding rapidly, especially in emerging markets, enabling smaller bakeries, patisseries, and cafés to source high-quality fillings efficiently. Direct B2B supply to commercial bakeries ensures bulk procurement with consistent quality and timely delivery, making it a critical channel for large-scale operations.

End-Use Insights

Commercial bakeries represent the largest end-use segment with approximately 46% market share in 2025, benefiting from the operational convenience and consistent quality of ready-to-use fillings. Confectionery manufacturers and foodservice operators follow closely, with growing demand from premium cafes, patisseries, and specialty dessert shops. Fastest growth is projected in frozen dessert producers and niche dessert operators, where innovative cherry crème fillings help differentiate products and enhance brand appeal. Export-driven demand from Europe and North America into Asia-Pacific also supports market expansion, particularly in urban bakery hubs and luxury dessert markets.

| By Product Type | By Application | By End-User | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds the largest market share at ~30% in 2025, driven by sophisticated bakery and confectionery industries, high consumer disposable income, and strong demand for premium dessert products. The U.S. leads the region, followed by Canada, with widespread adoption in both commercial bakeries and large-scale foodservice chains. Growth drivers include rising consumer interest in indulgent desserts, increasing preference for convenience-oriented products, and innovation in premium and artisanal bakery offerings. Strategic partnerships with ingredient suppliers and strong retail penetration further bolster market expansion.

Europe

Europe accounts for ~26–28% of the global market in 2025, with Germany, France, and the U.K. being key contributors. European consumers exhibit a strong preference for clean-label, natural, and premium fillings, supporting growth in bakery and confectionery segments. Market expansion is driven by health-conscious consumption patterns, established distribution networks, and high awareness of product quality and origin. Innovation in functional and sugar-reduced cherry crème fillings, along with rising demand from premium patisseries and artisan bakeries, also contributes to steady growth.

Asia-Pacific

Asia-Pacific is the fastest-growing region, particularly in China, India, and Japan, driven by rapid urbanization, rising middle-class wealth, and increased exposure to Western-style desserts. The modernization of bakeries, growing retail networks, and rising imports of specialty fillings further support market growth. Consumer interest in premium and indulgent bakery products, combined with an expanding foodservice sector, acts as a key growth driver. Additionally, innovative marketing strategies by global brands and localized flavor adaptations are boosting regional adoption.

Latin America

Latin America, led by Brazil, Mexico, and Argentina, contributes approximately 10% of the global market. The region’s growth is supported by rising urbanization, retail modernization, and increasing demand for premium and specialty bakery products. Expanding commercial bakery chains and rising disposable incomes are encouraging adoption of ready-to-use cherry crème fillings. Regional flavor preferences, combined with promotional activities in supermarkets and hypermarkets, also serve as key drivers of growth.

Middle East & Africa

The Middle East, led by the UAE and Saudi Arabia, is emerging as a hub for premium desserts, with increasing imports of cherry crème fillings for bakery and confectionery applications. Growth is driven by high demand in luxury patisseries, cafes, and hospitality sectors. Africa’s contribution remains modest but is growing, particularly in regions experiencing expansion of commercial bakery chains and international foodservice operators. Rising disposable incomes, urbanization, and exposure to global dessert trends are expected to further boost demand across these regions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Cherry Crème Filling Market

- Barry Callebaut

- Puratos Group

- Dawn Food Products

- Agrana Beteiligungs-AG

- CSM Ingredients

- Bakels Worldwide

- Zentis GmbH & Co. KG

- Toje

- Sirmulis

- Fuji Oil Europe

- AAK

- Cargill

- Domson

- Prosto Petro (food division)

- Belgo Star