Cheese Powder Market Size

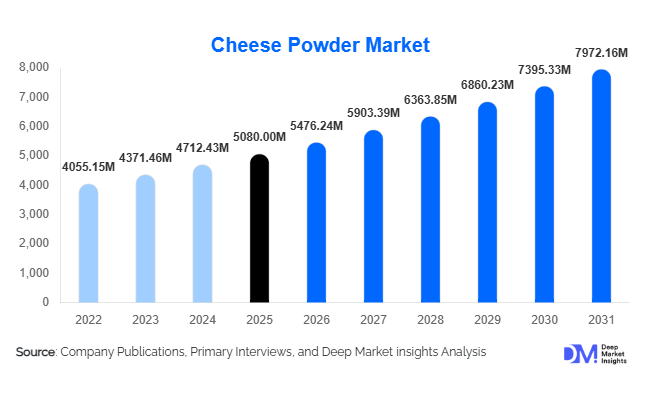

According to Deep Market Insights, the global cheese powder market size was valued at USD 5,080 million in 2025 and is projected to grow from USD 5,476.24 million in 2026 to reach USD 7,972.16 million by 2031, expanding at a CAGR of 7.8% during the forecast period (2026–2031). The cheese powder market growth is primarily driven by rising consumption of processed and convenience foods, expanding applications across snacks and ready-to-eat meals, and the increasing preference for shelf-stable dairy ingredients among food manufacturers globally.

Key Market Insights

- Cheddar cheese powder dominates global demand, supported by its versatile flavor profile and extensive use in snacks, sauces, and bakery products.

- Spray-dried cheese powder remains the preferred processing method due to cost efficiency, scalability, and consistent functional performance.

- North America leads global consumption, driven by high per capita cheese intake and a mature food processing industry.

- Asia-Pacific is the fastest-growing regional market, fueled by rapid expansion of Western-style food products and QSR chains.

- Clean-label and organic cheese powders are gaining traction, particularly in Europe and North America.

- Technological advancements in drying and encapsulation are improving flavor retention, shelf life, and nutritional profiles.

What are the latest trends in the cheese powder market?

Clean-Label and Organic Cheese Powders Gaining Momentum

Manufacturers are increasingly focusing on clean-label formulations with reduced sodium, non-GMO sourcing, and organic dairy inputs. This trend is particularly prominent in developed markets where consumers are actively scrutinizing ingredient lists. Organic cheese powder variants, although currently representing a smaller share of the market, are witnessing above-average growth as food brands position premium snack and ready-meal offerings around health and transparency.

Technology-Driven Product Innovation

Advancements in spray-drying technology, microencapsulation, and fat-reduction techniques are reshaping the cheese powder landscape. These innovations enable enhanced flavor stability, better solubility, and improved performance in dry food systems. Food manufacturers are increasingly adopting customized cheese powder blends designed for specific applications such as extruded snacks, seasoning mixes, and instant sauces.

What are the key drivers in the cheese powder market?

Rising Demand for Processed and Convenience Foods

The global shift toward packaged, ready-to-eat, and convenience foods remains the most significant growth driver for the cheese powder market. Cheese powder offers extended shelf life, ease of storage, and consistent taste, making it an essential ingredient for large-scale food manufacturers producing snacks, instant meals, and seasoning blends.

Expansion of Foodservice and QSR Chains

Rapid growth of fast-food restaurants, cloud kitchens, and casual dining formats is accelerating bulk demand for cheese powder. Foodservice operators prefer cheese powder over fresh cheese for standardized flavor delivery, reduced spoilage, and simplified logistics, particularly across multi-location restaurant chains.

What are the restraints for the global market?

Volatility in Dairy Raw Material Prices

Fluctuating milk prices driven by climate conditions, feed costs, and supply-demand imbalances pose a significant challenge for cheese powder manufacturers. Rising raw material costs directly impact production economics and profit margins, especially for conventional cheese powder producers.

Health and Regulatory Pressures

Growing concerns related to sodium and fat content in processed foods are leading to tighter regulatory oversight. Compliance with evolving food safety, labeling, and nutritional regulations across regions adds complexity and increases reformulation costs for market participants.

What are the key opportunities in the cheese powder industry?

Rapid Growth in Asia-Pacific Processed Food Demand

Asia-Pacific presents a high-growth opportunity driven by increasing urbanization, rising disposable incomes, and expanding Western-style food consumption. Localizing cheese powder flavors to regional preferences offers strong potential for market penetration, particularly in China, India, and Southeast Asia.

Functional and Specialty Cheese Powder Applications

Emerging applications in clinical nutrition, infant food, and premium pet nutrition are creating new revenue streams. Cheese powders enriched with functional proteins and controlled fat content are gaining adoption in specialized dietary formulations.

Product Type Insights

Cheddar cheese powder dominates the global cheese powder market, accounting for approximately 34% of total market share in 2025. This leadership is primarily driven by its broad consumer acceptance, rich flavor profile, and high compatibility across a wide range of food formulations. Cheddar powder is extensively used in snacks, sauces, bakery items, and ready meals, making it the preferred choice for manufacturers seeking consistent taste and cost efficiency.

Mozzarella and parmesan cheese powders follow as key product categories, supported by the rising global consumption of pizzas, pasta sauces, and Italian-inspired ready-to-eat meals. These variants benefit from growing demand for authentic flavors in frozen and convenience foods. Meanwhile, processed cheese blends are gaining traction due to their extended shelf life, uniform meltability, and economical pricing, particularly in mass-produced snack foods and institutional foodservice applications.

Application Insights

Snacks and savory foods represent the largest application segment, contributing nearly 38% of global demand in 2025. The segment’s dominance is driven by the widespread use of cheese powder in chips, extruded snacks, popcorn, crackers, and flavored nuts, where it delivers intense flavor, improved shelf stability, and manufacturing convenience.

Ready-to-eat meals and convenience foods form another major application area, supported by rapid urbanization, busy lifestyles, and growing reliance on instant and frozen food products. Cheese powder enables manufacturers to maintain consistent taste profiles while reducing refrigeration needs. Additionally, sauces, dressings, and seasoning blends continue to experience steady growth as packaged condiment consumption rises across both developed and emerging markets.

Distribution Channel Insights

Direct B2B sales dominate the global distribution landscape, accounting for over 70% of total market value. This channel benefits from long-term supply contracts between cheese powder producers and large food manufacturers, ensuring stable pricing, bulk procurement, and customized formulations.

Food ingredient distributors play a critical role in serving small and mid-sized manufacturers by offering flexible order volumes, technical support, and regional reach. Meanwhile, online ingredient platforms are emerging as niche distribution channels, particularly among artisanal producers and startups, offering smaller batch quantities, rapid sourcing, and customized cheese powder blends.

End-Use Industry Insights

The food and beverage manufacturing sector accounts for approximately 64% of global cheese powder consumption, driven by large-scale production of snacks, bakery products, sauces, and ready meals. The segment’s dominance is supported by the increasing use of cheese powder as a cost-effective flavoring and functional ingredient in industrial food processing.

The foodservice and QSR segment is the fastest-growing end-use category, expanding at over 8.5% CAGR. Growth is fueled by rapid restaurant expansion, menu standardization, and rising demand for cheese-flavored offerings across fast food chains and casual dining formats. Additionally, emerging applications in clinical nutrition, sports nutrition, and pet food are further diversifying end-use demand, supported by the protein content and shelf stability of cheese powders.

| By Cheese Type | By Nature | By Processing Method | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounted for approximately 34% of global cheese powder market share in 2025, led by the United States, which alone represented nearly 26% of total global demand. Regional dominance is driven by high per capita cheese consumption, advanced food processing infrastructure, and a strong presence of major dairy and ingredient manufacturers.

Additionally, the growing popularity of flavored snacks, expanding QSR chains, and continuous innovation in processed and convenience foods are sustaining long-term market growth across the region.

Europe

Europe held nearly 29% of the global market, supported by strong demand from Germany, France, the U.K., and Italy. The region benefits from a well-established dairy industry, high consumption of bakery products, sauces, and ready meals, and increasing preference for premium and clean-label ingredients.

Rising demand for organic and specialty cheese powders, along with regulatory support for quality food ingredients, is further strengthening market growth across Western and Northern Europe.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, registering a CAGR of over 9.2%. Growth is driven by expanding snack food production, rising disposable incomes, and increasing Westernization of diets across China, India, Southeast Asia, and South Korea.

Rapid expansion of QSR chains, growth in food processing industries, and rising consumer acceptance of cheese-flavored snacks and convenience foods are positioning the region as a key future growth hub.

Latin America

Latin America represents approximately 5% of global cheese powder demand, led by Brazil and Mexico. Market growth is supported by increasing consumption of processed and packaged foods, urban population growth, and expanding regional food manufacturing capabilities.

Improving cold-chain infrastructure and rising adoption of cheese-based seasonings in snacks and ready meals are further contributing to regional market expansion.

Middle East & Africa

The Middle East & Africa region accounted for around 4% of the global market. Growth is driven by rising food imports, rapid expansion of foodservice and hospitality sectors, and increasing demand for shelf-stable dairy ingredients.

Countries such as the UAE and Saudi Arabia are witnessing strong demand due to growing expatriate populations, expanding QSR presence, and increasing reliance on imported, high-quality food ingredients.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Cheese Powder Market

- Lactalis Group

- Kerry Group

- Arla Foods

- FrieslandCampina

- Fonterra Co-operative Group

- Saputo Inc.

- Glanbia plc

- Ornua Co-operative

- DMK Group

- Land O’Lakes Inc.

- Savencia Fromage & Dairy

- Agropur Cooperative

- Bel Group

- Lactosan A/S

- Alpenhain Käsespezialitäten