Caustic Soda Market Size

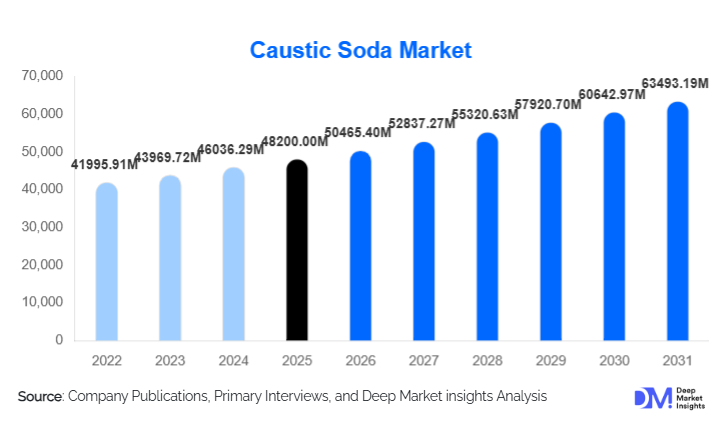

According to Deep Market Insights, the global caustic soda market size was valued at USD 48,200 million in 2025 and is projected to grow from USD 50,465.40 million in 2026 to reach USD 63,493.19 million by 2031, expanding at a CAGR of 4.7% during the forecast period (2026–2031). The caustic soda market growth is primarily driven by sustained demand from alumina refining, pulp & paper manufacturing, chemical processing, and water treatment industries, along with capacity expansions in Asia-Pacific and continued transition toward energy-efficient membrane cell technologies.

Key Market Insights

- Membrane cell technology dominates global production, accounting for over 60% of installed capacity due to lower energy consumption and regulatory compliance.

- Liquid caustic soda remains the preferred form, representing nearly 70% of total demand because of ease of handling in bulk industrial applications.

- Asia-Pacific leads global consumption, driven by large-scale alumina, chemical, and textile manufacturing in China and India.

- Alumina refining is the fastest-growing end-use segment, supported by rising aluminum demand from EVs and renewable energy infrastructure.

- Pricing remains cyclical, influenced by electricity costs, chlorine co-product demand, and regional supply–demand balances.

- Environmental regulations are accelerating capacity upgrades and plant modernization across Europe and North America.

What are the latest trends in the caustic soda market?

Shift Toward Energy-Efficient Production Technologies

The global caustic soda industry is undergoing a structural shift toward membrane cell technology, replacing legacy mercury and diaphragm processes. Producers are prioritizing energy efficiency and emissions reduction to comply with stricter environmental standards and reduce operating costs. This transition is particularly pronounced in Europe, China, and India, where regulatory pressure and rising power tariffs are reshaping production economics. Investments in automation, digital process controls, and energy recovery systems are further enhancing plant efficiency and yield optimization.

Rising Integration with Water and Wastewater Treatment

Growing urbanization and industrialization are driving investments in municipal and industrial water treatment facilities, significantly boosting caustic soda demand for pH control, neutralization, and ion-exchange resin regeneration. Emerging economies in Asia, Africa, and Latin America are witnessing strong growth in water infrastructure projects, positioning water treatment as a stable and long-term demand pillar for the caustic soda market.

What are the key drivers in the caustic soda market?

Expansion of the Alumina and Aluminum Industry

Alumina refining represents one of the largest and fastest-growing applications for caustic soda. Rising aluminum consumption in electric vehicles, lightweight construction, packaging, and renewable energy systems is driving sustained growth in alumina production. Asia-Pacific and the Middle East are witnessing significant capacity additions, directly supporting higher caustic soda demand.

Growth in Pulp & Paper and Packaging Industries

Demand for packaging paper, hygiene products, and specialty paper continues to rise globally, supported by e-commerce growth and changing consumer lifestyles. Caustic soda plays a critical role in pulping and bleaching processes, ensuring consistent demand from this mature but resilient end-use sector.

What are the restraints for the global market?

High Energy and Electricity Costs

Caustic soda production is highly energy-intensive, making producers vulnerable to volatile electricity prices. Rising power tariffs in Europe and parts of Asia are compressing margins and increasing operational risk, particularly for older facilities with lower energy efficiency.

Dependence on Chlorine Co-Product Demand

Caustic soda production is intrinsically linked to chlorine markets. Weak demand for chlorine derivatives can lead to production curtailments or pricing volatility, acting as a structural restraint on market stability.

What are the key opportunities in the caustic soda industry?

Growing Demand from Water Infrastructure Development

Large-scale public investments in water supply and wastewater treatment infrastructure offer long-term growth opportunities. Governments across Asia, the Middle East, and Africa are allocating significant budgets to water security projects, creating a stable demand for industrial-grade caustic soda.

Emerging Applications in Battery Materials and Electronics

The energy transition is opening new demand avenues for caustic soda in battery material processing, electronics cleaning, and specialty chemical synthesis. These applications offer higher-margin opportunities compared to traditional bulk consumption segments.

Product Type Insights

Liquid caustic soda dominates the global market due to its extensive utilization in high-volume industries such as alumina refining, pulp & paper, and chemical manufacturing. Its ease of transport and ability to integrate directly into industrial processes make it the preferred choice for large-scale operations. Solid caustic soda in flakes, pearls, or granules is primarily used in niche applications, including pharmaceuticals, food processing, and specialty chemicals, where precise dosing and stability are critical. Industrial-grade caustic soda accounts for the majority of market volume due to its suitability for bulk industrial applications, while higher-purity grades serve regulated end-use industries such as pharmaceuticals, food-grade production, and electronics manufacturing. The dominance of liquid caustic soda is further reinforced by its high solubility, versatility in concentration, and efficiency in industrial chemical reactions.

Application Insights

Pulp & paper remains the largest application segment by volume, driven by the ongoing demand for packaging paper, hygiene products, and specialty paper globally. Caustic soda is essential for pulping, bleaching, and chemical recovery, making it indispensable in this sector. Alumina refining is the fastest-growing application, fueled by rising aluminum demand for electric vehicles, renewable energy infrastructure, and lightweight construction. Chemical manufacturing continues to represent a stable and significant end-use, with caustic soda supporting the production of solvents, surfactants, plastics, and specialty chemicals. Additionally, water treatment applications are gaining prominence as governments globally implement stricter regulations on municipal and industrial effluents, driving demand for pH control, neutralization, and ion-exchange processes. The convergence of regulatory pressure, industrial growth, and sustainable infrastructure initiatives is expanding application opportunities across the market.

Distribution Channel Insights

Direct supply agreements with large industrial consumers dominate caustic soda distribution, representing nearly 70% of global sales. These long-term contracts provide stability for both producers and industrial buyers, particularly in alumina, pulp & paper, and chemical manufacturing. Chemical distributors cater to small and medium-sized buyers, enabling flexible access to caustic soda for specialty applications and smaller industrial operations. Bulk export contracts facilitate cross-border trade, especially in Asia-Pacific and Latin America, where demand is driven by export-oriented chemical and aluminum industries. Increasing digital procurement platforms and logistics optimization are further enhancing the efficiency of these distribution channels.

End-Use Industry Insights

Alumina refining, pulp & paper, and chemical manufacturing collectively account for over 65% of total caustic soda consumption. These industries are heavily reliant on caustic soda for core processing and account for the majority of industrial-grade demand. Water treatment and specialty applications are expanding at above-average growth rates, driven by regulatory requirements, infrastructure development, and environmental sustainability initiatives. Emerging applications, such as battery material processing and electronics manufacturing, are creating additional high-margin demand opportunities, allowing producers to diversify beyond traditional heavy industrial markets. The combination of stable high-volume applications and emerging niche sectors ensures long-term market resilience.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific accounts for approximately 46% of the global caustic soda market, led primarily by China and India. Strong industrial demand from alumina refining, chemicals, textiles, and pulp & paper, combined with rapid urbanization, infrastructure investments, and ongoing plant capacity expansions, drives market growth. Government initiatives, such as China’s “Made in China 2025” and India’s industrial modernization programs, are accelerating demand for caustic soda in manufacturing hubs. Furthermore, the region benefits from relatively lower production costs, easy access to raw materials, and growing exports of aluminum, chemicals, and paper products, positioning Asia-Pacific as the primary growth engine of the global market.

North America

North America represents approximately 18% of global caustic soda demand, with the U.S. as the key contributor. Demand is supported by mature industries such as pulp & paper, chemicals, and water treatment. The region’s growth is driven by technological upgrades in membrane cell production, improved energy efficiency, and government incentives for industrial modernization. North America’s market is also influenced by strong downstream industrial activity and stable regulatory frameworks that support consistent consumption in core sectors.

Europe

Europe accounts for roughly 16% of the caustic soda market, with Germany, France, and the U.K. as leading consumers. Market growth is supported by stringent environmental regulations and sustainability mandates, which encourage the modernization of existing plants and the adoption of energy-efficient membrane cell technologies. Demand remains strong in chemicals, pulp & paper, and water treatment, while the region’s focus on decarbonization and industrial efficiency further stimulates production upgrades and stable consumption.

Middle East & Africa

The Middle East & Africa together account for about 10% of global demand. Market growth is driven by alumina and aluminum smelting activities, particularly in GCC countries, alongside increasing water and wastewater treatment investments. Industrialization in countries such as Saudi Arabia, the UAE, and South Africa supports steady demand, while government initiatives to expand infrastructure and enhance environmental management are creating additional consumption opportunities for industrial-grade caustic soda.

Latin America

Latin America, led by Brazil and Mexico, contributes roughly 10% to global demand. Market growth is supported by mining, chemicals, and pulp & paper industries, alongside export-oriented production in industrial hubs. Infrastructure development, rising industrial output, and growing regulatory compliance requirements for water treatment and chemicals are driving higher consumption. Brazil’s alumina and pulp sectors, in particular, are key demand engines, while Mexico is seeing rising adoption of membrane cell technologies for efficiency and sustainability.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Caustic Soda Market

- BASF

- Dow

- Olin Corporation

- Shin-Etsu Chemical

- Westlake Corporation

- Formosa Plastics

- Tata Chemicals

- SABIC

- INEOS

- Occidental Chemical

- Nouryon

- Tosoh Corporation

- AGC Inc.

- Hanwha Solutions

- AkzoNobel