Cattle Feed Market Size

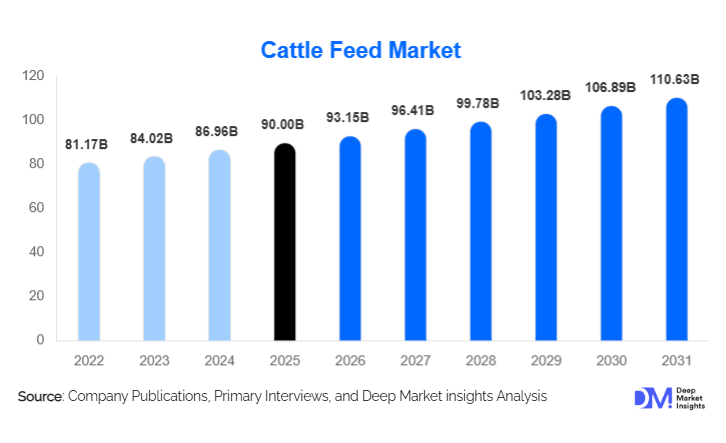

According to Deep Market Insights, the global cattle feed market size was valued at USD 90.00 billion in 2025 and is projected to grow from USD 93.15 billion in 2026 to reach USD 110.63 billion by 2031, expanding at a CAGR of 3.5% during the forecast period (2026–2031). The market growth is primarily driven by increasing global demand for dairy and meat products, rising adoption of scientifically formulated feeds, and innovations in feed additives and nutritional solutions that enhance cattle productivity and health.

Key Market Insights

- Dairy cattle feed dominates the market, reflecting strong demand for milk production and high-value dairy operations globally.

- Feed additives and complete feeds are gaining traction, driven by precision nutrition and performance-enhancing formulations for both dairy and beef cattle.

- Asia-Pacific is the fastest-growing regional market, with India, China, and Southeast Asia expanding intensive dairy and beef production.

- North America holds a major market share, led by the U.S. and Canada, with highly advanced feedlot systems and strong demand for nutritionally optimized feeds.

- Technological integration in feed formulation, including AI-driven ration design and precision feed delivery systems, is reshaping the global cattle feed landscape.

- Sustainability-focused feed innovations are emerging, such as methane-reducing additives and eco-friendly formulations, aligning with environmental and regulatory pressures.

What are the latest trends in the cattle feed market?

Precision Nutrition and Technology Integration

Cattle feed producers are increasingly leveraging advanced feed formulation technologies, AI-based ration optimization, and data analytics to provide tailored nutritional solutions. Precision nutrition improves feed efficiency, supports growth and lactation, and reduces waste. Digital platforms now allow farms to monitor cattle health and adjust feed composition in real time, creating opportunities for premium products and long-term supply contracts with large-scale dairy and beef operations.

Sustainable and Eco-Friendly Feed Solutions

Feed formulations are shifting toward environmentally sustainable options, including methane-reducing additives, organic ingredients, and reduced reliance on high-carbon crops. These innovations not only support regulatory compliance but also help cattle producers meet increasing consumer demand for eco-conscious and ethically produced meat and dairy. Sustainable feed solutions are becoming key differentiators, particularly in Europe, North America, and APAC.

What are the key drivers in the cattle feed market?

Rising Global Demand for Animal Protein

Growing population, increasing incomes, and changing dietary preferences are boosting demand for milk and meat. This directly increases the requirement for high-quality, nutrient-dense feed to improve cattle productivity. Emerging economies in Asia and Latin America are driving this trend, creating opportunities for feed manufacturers to scale production and introduce high-value formulations.

Adoption of Scientific Feeding Practices

Farmers are transitioning from traditional roughage-based feeding to scientifically balanced diets that optimize growth, milk yield, and overall cattle health. Complete feeds, concentrates, and pelletized formulations are increasingly preferred, particularly in commercial dairy farms and feedlots. This adoption enhances efficiency and underpins the market’s revenue growth.

Advancements in Feed Additives and Nutraceuticals

Innovations in feed additives, including enzymes, probiotics, amino acids, and trace minerals, are driving demand for premium feeds. These products enhance feed conversion ratios, improve immunity, and support sustainable livestock operations, making them highly attractive to both dairy and beef producers.

What are the restraints for the global market?

Volatility in Raw Material Prices

The cost of feed ingredients, such as corn, soybean meal, and other grains, is highly variable due to weather conditions, trade policies, and global commodity fluctuations. This can reduce profit margins for feed manufacturers and slow adoption when prices spike unexpectedly.

Regulatory and Quality Compliance Challenges

Stringent regulations governing feed safety, mycotoxin contamination, and additive approvals increase compliance costs. Smaller or regional manufacturers may struggle to meet standards, constraining market growth and occasionally leading to supply disruptions.

What are the key opportunities in the cattle feed market?

Expansion in Emerging Economies

Asia-Pacific and Latin America are experiencing rapid growth in dairy and beef production. Countries such as India, China, Brazil, and Mexico are investing in improved cattle nutrition to meet internal demand and export potential. Government support and rural infrastructure development create favorable conditions for feed adoption, presenting significant market opportunities.

Precision Nutrition and Technological Upgrades

Advanced feed formulation technologies and AI-driven ration optimization allow manufacturers to provide tailored nutrition, enhancing productivity and profitability for large-scale farms. This trend offers premium pricing opportunities and strengthens long-term supplier relationships with institutional buyers.

Eco-Friendly and Sustainable Feed Products

There is increasing demand for environmentally sustainable feed formulations. Methane-reducing additives, organic ingredients, and lower-carbon footprint solutions are gaining traction. Manufacturers focusing on sustainability can differentiate themselves, meet regulatory demands, and attract environmentally conscious cattle producers.

Product Type Insights

Feed additives account for roughly 28% of the global market in 2024 due to high adoption of performance-enhancing products that improve feed conversion and animal health. Dairy cattle feed remains the largest segment, comprising 42% of total market value, driven by premium milk production needs. Pelleted feeds dominate among feed forms (40% market share) due to uniform nutrient delivery and ease of handling, while traditional offline distribution channels account for 75% of sales globally.

End-Use Insights

The dairy and beef sectors are the primary consumers of cattle feed. Dairy operations are growing fastest in India, China, and Southeast Asia due to rising milk demand and the intensification of farming practices. Beef production is expanding in North and Latin America, driven by export demand. Emerging applications, including precision feeding systems and eco-friendly formulations, are further boosting demand. Export-driven markets in the Middle East and East Asia are creating additional revenue streams for high-quality feeds.

| By Product Type | By Cattle Type / Application | By Form | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

The U.S. and Canada dominate the market with advanced feedlot systems and high adoption of feed additives. This region accounts for a major portion of the global market share, with demand driven by productivity optimization and regulatory compliance for feed safety.

Europe

Europe shows steady demand, particularly in Germany, France, and the U.K., emphasizing premium feeds and regulatory-compliant additive use. Sustainability and eco-friendly feed formulations are increasingly adopted, supporting long-term growth.

Asia-Pacific

APAC is the fastest-growing region, led by India, China, and Southeast Asia. Rising middle-class incomes, growing dairy and beef production, and government-led livestock development programs are driving strong adoption of formulated feeds.

Latin America

Brazil and Argentina are major contributors to regional feed demand, with large-scale beef production supporting growth. Export-oriented feedlot expansion is increasing the consumption of high-protein and energy-dense rations.

Middle East & Africa

Demand in Africa is smaller in total volume but benefits from premium export-oriented dairy and beef operations. The Middle East, led by the UAE, Saudi Arabia, and Qatar, is emerging as a critical import market due to high disposable incomes and growing focus on quality animal protein supply chains.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Cattle Feed Market

- Cargill Inc.

- Archer Daniels Midland (ADM)

- ForFarmers Inc.

- De Heus

- Land O’Lakes Inc.

- Nutreco N.V.

- Alltech Inc.

- BASF SE

- Kent Nutrition Group

- Friona Industries

- Charoen Pokphand Foods

- Caprock Products

- Purina Animal Nutrition

- Contibeef

- Four States Feed