Cashew Nut Kernel Market Size

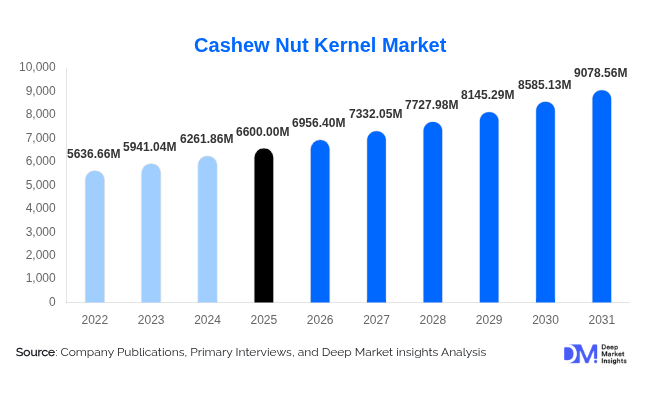

According to Deep Market Insights, the global cashew nut kernel market size was valued at USD 6,600.00 million in 2025 and is projected to grow from USD 6,956.40 million in 2026 to reach USD 9,078.56 million by 2031, expanding at a CAGR of 5.4% during the forecast period (2026–2031). The cashew nut kernel market growth is primarily driven by rising health-conscious consumption, increasing adoption of plant-based diets, strong demand from food processing industries, and the growing popularity of premium and value-added nut products across global markets.

Key Market Insights

- Whole white cashew kernels dominate global trade, driven by their superior appearance, uniformity, and wide acceptance across retail and industrial applications.

- Asia-Pacific leads both production and consumption, supported by strong processing ecosystems in India and Vietnam.

- North America remains the largest importing region, with the U.S. accounting for the highest single-country demand globally.

- Value-added and flavored cashew kernels are gaining traction, improving average selling prices and processor margins.

- Plant-based dairy alternatives, such as cashew milk and cheese, are emerging as high-growth application areas.

- Export-oriented trade flows dominate the market, with over 65% of global production entering international trade channels.

What are the latest trends in the cashew nut kernel market?

Premiumization and Value-Added Processing

The cashew nut kernel market is witnessing a strong shift toward premium and value-added products, including roasted, flavored, organic, and coated kernels. Consumers in developed markets are increasingly willing to pay higher prices for differentiated offerings such as low-sodium, clean-label, and exotic-flavored cashews. This trend is encouraging processors to invest in secondary processing, branding, and packaging innovations, enabling them to move beyond commodity trading and improve profitability. Premium grades such as W240 and W320 continue to command strong demand across both retail and foodservice channels.

Rising Demand from Plant-Based Food Applications

Cashew kernels are increasingly being used as base ingredients in plant-based dairy alternatives, sauces, and spreads due to their creamy texture and neutral taste. Food manufacturers are expanding cashew-based product portfolios to cater to vegan, lactose-intolerant, and flexitarian consumers. This trend is driving long-term industrial demand and supporting stable procurement contracts for processors. The integration of cashew kernels into functional foods and nutraceutical formulations is further strengthening demand beyond traditional snack consumption.

What are the key drivers in the cashew nut kernel market?

Growing Health and Wellness Awareness

Rising consumer awareness regarding the nutritional benefits of nuts is a key driver of market growth. Cashew kernels are rich in healthy fats, plant protein, minerals, and antioxidants, making them attractive to health-conscious consumers. Increased emphasis on heart health, weight management, and natural food ingredients has boosted household consumption, particularly in urban markets across North America, Europe, and Asia-Pacific.

Expansion of Food Processing and Ingredient Demand

The growing use of cashew kernels in bakery, confectionery, dairy alternatives, and culinary applications is significantly expanding industrial demand. Food manufacturers prefer cashew kernels for their versatility, flavor compatibility, and functional properties. This driver is strengthening demand stability and reducing reliance on seasonal retail consumption patterns.

What are the restraints for the global market?

Raw Material Price Volatility

The cashew nut kernel market is highly sensitive to fluctuations in raw cashew nut prices, which are influenced by climatic conditions, crop yields, and geopolitical factors in producing regions. Seasonal supply shortages and inconsistent harvests in Africa and Asia can lead to sharp price swings, directly impacting processor margins and export pricing.

Labor Intensity and Quality Compliance Challenges

Despite growing mechanization, cashew kernel processing remains labor-intensive, particularly for peeling and grading premium whole kernels. Rising labor costs, coupled with stringent food safety and quality regulations in importing countries, pose challenges for small and mid-sized processors, potentially constraining capacity expansion.

What are the key opportunities in the cashew nut kernel industry?

Growth of Plant-Based and Vegan Food Markets

The rapid expansion of plant-based food markets presents a major opportunity for cashew kernel producers and processors. Cashews are increasingly used in vegan cheese, milk, and desserts, creating high-volume, recurring demand from food manufacturers. Long-term supply contracts with plant-based food brands can provide revenue stability and improved margins.

Value Chain Integration and Branding

There is a growing opportunity for processors to integrate backward into sourcing and forward into branding and retail. Developing private-label offerings, investing in consumer-facing brands, and adopting traceability systems can help companies capture higher value and differentiate in competitive export markets.

Product Type Insights

Whole white cashew kernels represent the largest product segment, accounting for approximately 32% of the global market value in 2025. These kernels are preferred for retail packaging, gifting, and premium food applications due to their visual appeal and consistent quality. Kernel pieces and splits are widely used in industrial applications such as bakery, confectionery, and spreads, offering cost advantages for manufacturers. Scorched and dessert-grade kernels cater primarily to price-sensitive markets and bulk processing applications.

Application Insights

Direct consumption remains the leading application segment, driven by snack consumption across retail and foodservice channels. Bakery and confectionery applications form the second-largest segment, supported by steady demand from chocolate, dessert, and filling manufacturers. Dairy alternatives represent the fastest-growing application, expanding at double-digit rates as cashew-based milk, cheese, and cream gain popularity. Emerging applications in nutraceuticals and cosmetics remain niche but are gaining attention due to cashew’s functional and emollient properties.

Distribution Channel Insights

Modern retail and e-commerce channels collectively account for nearly 46% of global cashew kernel sales by value, reflecting shifting consumer purchasing behavior. Direct B2B sales dominate industrial procurement, particularly for food manufacturers and foodservice operators. Specialty health food stores are gaining importance for organic and premium cashew variants, while traditional wholesale channels remain relevant in emerging markets.

End-Use Industry Insights

The food and beverage industry dominates end-use demand, accounting for approximately 55% of global consumption in 2025. Retail household consumption remains strong, particularly in urban centers and export-driven markets. Foodservice demand is recovering steadily, driven by bakery chains, dessert outlets, and ethnic cuisines. Nutraceuticals and cosmetics represent emerging end-use industries, offering long-term diversification opportunities.

| By Product Grade | By Processing Form | By Application | By Distribution Channel | By End-Use Industry |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific accounts for approximately 48% of the global cashew nut kernel market in 2025. India is the largest processor and consumer, while Vietnam leads global exports by value. China is a fast-growing consumer market, driven by rising snack consumption and gifting culture. Strong processing infrastructure, export incentives, and growing domestic demand position APAC as the fastest-growing region.

North America

North America holds around 18% of the global market share, with the United States being the largest importing country worldwide. Demand is driven by health-conscious consumers, premium snack consumption, and growing use of plant-based food products. Organic and flavored cashew kernels perform particularly well in this region.

Europe

Europe accounts for nearly 17% of global demand, led by Germany, the U.K., and the Netherlands. The region shows a strong preference for certified, sustainably sourced, and organic cashew kernels, supporting premium pricing and long-term supplier relationships.

Latin America

Latin America represents about 7% of the market, with Brazil and Mexico driving demand. Consumption is supported by rising middle-class incomes and growing awareness of healthy snacks.

Middle East & Africa

The Middle East & Africa region contributes approximately 10% of global demand. The UAE and Saudi Arabia are key consumption markets, while African countries such as Côte d’Ivoire, Nigeria, and Tanzania play a critical role as raw cashew nut suppliers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Cashew Nut Kernel Market

- Olam Group

- Viet Nam Cashew Corporation (VINACAS)

- Cambay Tiger

- The Sanmar Group

- Bismi Cashew Company

- Achal Industries

- Valency International

- Agrocel Industries

- Alpha Nut Company

- Royal Nut Company

- Borges Agricultural & Industrial Nuts

- Tropical General Investments

- East India Cashew Company

- Intersnack Group

- Rakesh Industries