Carrageenan Market Size

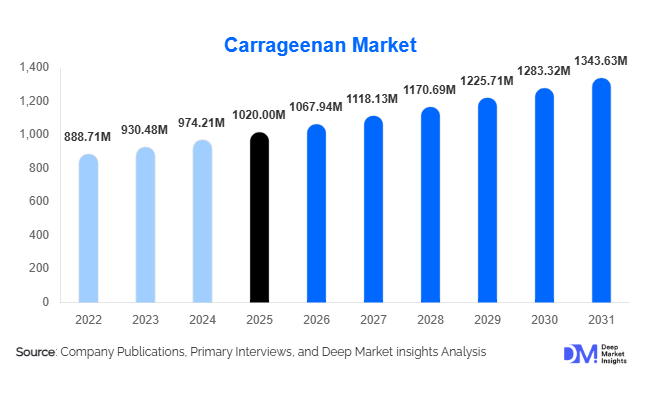

According to Deep Market Insights, the global carrageenan market size was valued at USD 1,020 million in 2025 and is projected to grow from USD 1,067.94 million in 2026 to reach USD 1,343.63 million by 2031, expanding at a CAGR of 4.7% during the forecast period (2026–2031). The carrageenan market growth is primarily driven by rising demand for natural hydrocolloids in processed foods, expanding plant-based product formulations, and increasing applications in pharmaceuticals and personal care products.

Carrageenan, a seaweed-derived polysaccharide extracted mainly from red algae species such as Kappaphycus and Eucheuma, is widely used as a gelling, thickening, and stabilizing agent. Its strong compatibility with dairy proteins and plant-based alternatives has reinforced its relevance in modern food systems. Asia-Pacific dominates global production due to abundant seaweed cultivation in Indonesia and the Philippines, while North America and Europe lead in consumption due to advanced food processing industries. Despite regulatory scrutiny and raw material price volatility, steady industrial demand and functional versatility continue to support long-term market expansion.

Key Market Insights

- Food & beverages account for nearly 72% of global demand, led by dairy, processed meat, and plant-based alternatives.

- Kappa carrageenan dominates the product mix, contributing approximately 45% of total market revenue in 2025.

- Asia-Pacific holds around 42% market share, supported by large-scale seaweed farming and processing capacity.

- Semi-refined carrageenan (SRC) leads by grade, capturing nearly 58% of the global market due to cost advantages.

- Pharmaceutical and biomedical applications are emerging as high-margin segments, growing faster than traditional food uses.

- Vertical integration in seaweed cultivation is increasing among major players to stabilize raw material supply and margins.

What are the latest trends in the carrageenan market?

Growth of Plant-Based and Clean-Label Formulations

The shift toward plant-based diets and clean-label ingredients is significantly influencing carrageenan demand. Manufacturers of oat, almond, soy, and pea-based beverages rely on carrageenan for protein suspension, improved mouthfeel, and stability. As consumers increasingly prefer recognizable, plant-derived ingredients, carrageenan’s natural seaweed origin supports its positioning as a functional yet label-friendly additive. Customized carrageenan blends tailored to specific plant proteins are becoming mainstream, enabling improved texture performance in dairy alternatives and meat substitutes.

Vertical Integration and Sustainable Seaweed Farming

Leading carrageenan producers are investing upstream in seaweed cultivation, particularly in Indonesia and the Philippines. Climate variability and disease outbreaks have historically disrupted supply chains, prompting companies to secure raw material through direct farming partnerships and contract cultivation. Sustainable aquaculture practices, improved drying technologies, and yield optimization are enhancing operational resilience. Certification programs and traceability initiatives are also gaining prominence, addressing buyer concerns around sustainability and long-term availability.

What are the key drivers in the carrageenan market?

Expansion of Processed and Convenience Foods

Rising urbanization and changing dietary patterns are increasing the consumption of dairy desserts, flavored milk, ready-to-eat meals, and processed meats. Carrageenan enhances water retention, gel strength, and shelf-life stability, making it essential in industrial-scale food production. Growth in global packaged food markets directly translates into steady demand for hydrocolloids.

Increasing Pharmaceutical and Biomedical Applications

Carrageenan is being explored in drug delivery systems, antiviral nasal sprays, wound dressings, and dental formulations. Pharmaceutical-grade carrageenan offers higher margins compared to food-grade variants. As global healthcare spending increases and research into biopolymers expands, this segment is expected to grow above the overall market CAGR.

What are the restraints for the global market?

Regulatory Scrutiny and Consumer Perception

Although approved by major regulatory authorities, carrageenan has faced periodic health-related debates, particularly in North America. Reformulation efforts by select food brands and negative media coverage can influence short-term demand fluctuations.

Raw Material Price Volatility

Seaweed farming is vulnerable to climate disruptions such as typhoons and El Niño events. Supply shortages can lead to sharp price swings, compressing processor margins and affecting downstream pricing stability.

What are the key opportunities in the carrageenan industry?

High-Value Pharmaceutical Grade Expansion

Medical and nutraceutical applications present attractive opportunities due to higher profit margins (18–25%). Advanced research into antiviral and bioactive formulations can significantly enhance value capture for producers investing in R&D.

Emerging Market Food Processing Growth

Rapid expansion of food processing industries in Southeast Asia, Latin America, and the Middle East is creating incremental demand. Export-driven processed meat and dairy production in these regions supports consistent carrageenan consumption growth.

Product Type Insights

Kappa carrageenan dominates the global market, accounting for approximately 45% of total revenue in 2025. Its leadership position is primarily driven by its superior gel strength and strong interaction with dairy proteins, making it highly suitable for chocolate milk, processed cheese, yogurt, and restructured meat products. The continued global expansion of processed dairy and convenience meat products acts as the core growth driver for this segment. In addition, kappa carrageenan offers cost efficiency compared to alternative hydrocolloids, further reinforcing its adoption among large-scale food manufacturers.

Iota carrageenan holds the second-largest share, supported by its ability to form soft, elastic gels ideal for dairy desserts, custards, and certain pharmaceutical suspensions. Its compatibility with freeze-thaw systems makes it particularly valuable in premium dessert and frozen product formulations. Meanwhile, lambda carrageenan functions primarily as a thickening agent without gel formation and is widely used in flavored milk, beverages, and sauces where viscosity enhancement is required without structural rigidity. Blended and customized carrageenan systems are gaining traction as manufacturers increasingly demand formulation-specific solutions tailored to plant-based beverages, protein-enriched drinks, and functional foods. This shift toward customized hydrocolloid blends is a key structural trend supporting product innovation and premiumization.

Application Insights

The food & beverages segment accounts for nearly 72% of global market revenue in 2025, making it the leading application area. The dominance of this segment is primarily driven by the rapid expansion of processed dairy, ready-to-eat meals, and plant-based alternatives. Carrageenan’s multifunctionality, acting as a stabilizer, gelling agent, and water-binding ingredient, makes it indispensable in modern industrial food production. The growth of global dairy consumption and rising exports of processed meat from Asia-Pacific and Latin America continue to support strong demand.

Pharmaceutical applications represent a smaller but faster-growing segment, supported by expanding research in drug delivery systems, antiviral nasal sprays, and wound care formulations. Increasing global healthcare expenditure and demand for biopolymer-based excipients are key drivers. In personal care and cosmetics, carrageenan is widely used for viscosity control and texture enhancement in toothpaste, lotions, and gels. The pet food and animal nutrition segment is also expanding steadily, driven by premium pet food trends in North America and Europe, where moisture retention and texture stability are critical formulation requirements.

Form & Grade Insights

Powdered carrageenan dominates the market with approximately 80% share in 2025, primarily due to its ease of storage, transportation, and uniform blending in large-scale food and pharmaceutical manufacturing. Powder form ensures consistent dispersion and dosing accuracy, which is critical for industrial process standardization. Increasing automation in food processing plants further supports powdered format adoption.

By grade, semi-refined carrageenan (SRC) leads the market with nearly 58% share, driven by its cost-effectiveness and suitability for processed meat and pet food applications. SRC offers competitive pricing while maintaining required functionality, making it attractive in price-sensitive markets. Refined carrageenan (RC), although smaller in volume, commands higher margins and is preferred in high-purity food systems and pharmaceutical formulations where regulatory compliance and clarity are critical performance requirements.

End-Use Industry Insights

The global dairy processing industry remains the largest end-use contributor, supported by sustained consumption of flavored milk, yogurt, and cheese products worldwide. As dairy processing expands in emerging economies, carrageenan demand continues to scale proportionally. The plant-based food industry, growing at approximately 8–10% annually in developed markets, is the fastest-expanding end-use vertical, particularly in North America and Europe. Carrageenan plays a critical role in stabilizing plant proteins and improving mouthfeel in dairy alternatives. The pharmaceutical industry, growing at above 6% annually, is generating high-value niche demand, particularly in Europe and North America. Additionally, export-driven processed meat production in Asia-Pacific and Latin America is strengthening incremental consumption, as carrageenan enhances water retention and yield in meat formulations.

| By Product Type | By Application | By Form & Grade | By Source |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific holds approximately 42% of the global market share in 2025, making it the largest regional market. Indonesia and the Philippines dominate global seaweed cultivation, providing a critical raw material supply. China represents a major consumption hub, driven by rapid expansion in processed food manufacturing and rising domestic dairy production. The region benefits from low-cost seaweed farming, supportive aquaculture policies, and increasing investment in food processing infrastructure. Asia-Pacific is also the fastest-growing region, with a projected CAGR above 5%, supported by rising urbanization, export-oriented meat processing, and growing middle-class consumption patterns.

North America

North America accounts for nearly 24% of global revenue, with the United States as the largest importer and consumer. The region’s growth is primarily driven by strong demand for plant-based beverages, premium dairy products, and processed meats. Advanced food technology adoption, high per-capita dairy consumption, and expanding pet food industries act as key drivers. Additionally, increasing pharmaceutical R&D investments support demand for refined carrageenan grades.

Europe

Europe contributes around 22% of global revenue, led by Germany, France, and the UK. The region’s growth is supported by stringent quality standards, clean-label preferences, and a mature dairy processing sector. Rising demand for organic and plant-based products is reinforcing carrageenan usage in dairy alternatives. Europe also benefits from strong pharmaceutical manufacturing capacity, particularly in Germany and France, supporting specialty-grade demand.

Latin America

Latin America holds approximately 7% market share, with Brazil and Mexico as key contributors. The region’s demand is largely driven by expanding meat processing and poultry export industries. Increasing foreign investment in food manufacturing and rising domestic consumption of processed foods are key growth drivers. Competitive labor costs and export-focused production models further stimulate carrageenan usage in the region.

Middle East & Africa

Accounting for roughly 5% of global market share, the Middle East & Africa region is witnessing gradual growth driven by dairy expansion in Saudi Arabia and the UAE, as well as increasing food imports across Africa. Government initiatives aimed at strengthening domestic food security and processing capacity are boosting hydrocolloid demand. Rising urban populations and growing retail penetration of packaged foods further support regional carrageenan consumption.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Carrageenan Market

- CP Kelco

- Cargill Incorporated

- DuPont (IFF Nutrition & Biosciences)

- Ingredion Incorporated

- Gelymar S.A.

- Marcel Trading Corporation

- TBK Manufacturing Corporation

- W Hydrocolloids Inc.

- Shemberg Marketing Corporation

- ACCEL Carrageenan Corporation

- MCPI Corporation

- CEAMSA

- Qingdao Gather Great Ocean Algae Industry Group

- Greenfresh Group

- Karagen Indonesia