Canned Wines Market Size

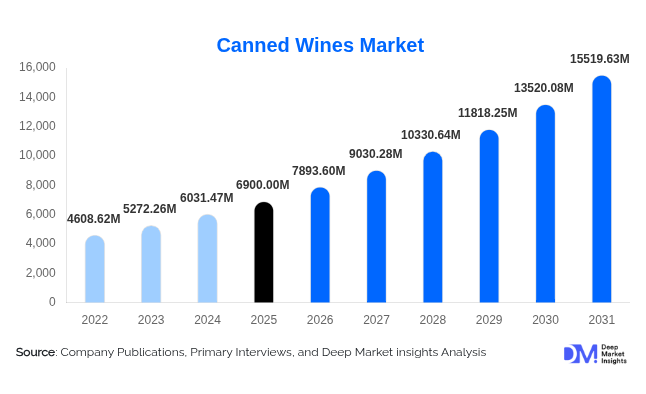

According to Deep Market Insights, the global canned wines market size was valued at USD 6,900.00 million in 2025 and is projected to grow from USD 7,893.60 million in 2026 to reach USD 15,519.63 million by 2031, expanding at a CAGR of 14.4% during the forecast period (2026–2031). The canned wines market growth is primarily driven by shifting consumer preferences toward convenient, portable, and sustainable alcohol packaging, rising acceptance of premium wine formats in cans, and increasing consumption across outdoor, on-the-go, and casual social occasions.

Key Market Insights

- Canned wine is transitioning from a niche to a mainstream category, driven by lifestyle-driven consumption and normalization across premium and mid-priced segments.

- Off-trade channels dominate global sales, supported by strong penetration of canned wines in supermarkets, specialty liquor stores, and online platforms.

- North America leads global demand, with the U.S. accounting for the majority of volume and value consumption.

- Europe remains a mature yet innovation-driven market, particularly in the U.K., France, and Germany, where sustainability influences purchasing decisions.

- Asia-Pacific is the fastest-growing region, driven by evolving alcohol preferences among millennials in China, Japan, and Australia.

- Packaging innovation and sustainability, including BPA-free linings and lightweight aluminum cans, are accelerating premium adoption.

What are the latest trends in the canned wines market?

Premiumization and Craft Positioning

The canned wines market is witnessing strong premiumization, with craft wineries and established producers launching high-quality still and sparkling wines in cans. Brands are focusing on organic certification, single-vineyard sourcing, and minimal-intervention winemaking to reposition canned wine as a credible alternative to bottled formats. Premium design aesthetics and storytelling on cans are reinforcing brand differentiation, particularly in North America and Europe. Super-premium canned wines are increasingly priced at parity or above entry-level bottled wines, reflecting growing consumer confidence in quality.

Sustainability-Driven Packaging Adoption

Sustainability remains a defining trend, as aluminum cans offer significantly higher recycling rates and lower transportation emissions compared to glass bottles. Wine producers are aligning canned offerings with ESG commitments, emphasizing reduced carbon footprint, lightweight logistics, and circular recycling initiatives. Retailers and hospitality venues are actively promoting canned wines as environmentally responsible options, further accelerating adoption. This trend is particularly pronounced in Europe, where regulatory pressure and consumer awareness around sustainable packaging are high.

What are the key drivers in the canned wines market?

Rising Demand for Convenience and On-the-Go Consumption

Changing lifestyles, urbanization, and demand for portable alcohol formats are major drivers of canned wine adoption. Single-serve cans enable portion control and are well-suited for travel, outdoor recreation, festivals, and venues where glass is restricted. This convenience factor has expanded wine consumption beyond traditional at-home dining occasions, supporting sustained volume growth.

Expansion of Outdoor, Travel, and Experiential Consumption

Canned wines are increasingly consumed at beaches, concerts, sporting events, airlines, and hospitality venues. Their durability, rapid chilling capability, and safety advantages over glass have made them a preferred option across tourism and experiential consumption settings. Airlines, cruise operators, and hotels are incorporating canned wines into premium and mid-tier offerings, boosting institutional demand.

What are the restraints for the global market?

Perception Barriers in Traditional Wine Markets

In established wine-producing regions, canned wine still faces perception challenges among traditional consumers who associate quality wine with glass bottles. Overcoming these entrenched preferences requires sustained marketing investment, education, and endorsement by premium producers, which can slow adoption in conservative markets.

Regulatory and Compliance Complexities

Alcohol packaging, labeling, recycling mandates, and import regulations vary significantly across regions. Compliance with country-specific alcohol laws increases operational complexity and costs for global producers, particularly when scaling cross-border distribution of canned wines.

What are the key opportunities in the canned wines industry?

Premium and Super-Premium Canned Wine Expansion

The premium segment represents a high-margin opportunity, as consumers increasingly accept canned formats for quality wines. Organic, biodynamic, and limited-edition canned wines can unlock new revenue streams for wineries seeking diversification beyond bottles. Premiumization also enables brands to enter hospitality, gifting, and airline channels with differentiated offerings.

Emerging Market Penetration in Asia-Pacific and Latin America

Emerging regions present strong growth potential due to rising disposable incomes, Western lifestyle influence, and demand for smaller, affordable alcohol formats. Localized flavors, competitive pricing, and partnerships with regional distributors can accelerate adoption in Asia-Pacific and Latin America, where bottled wine penetration remains relatively low.

Product Type Insights

Still wines dominate the canned wines market, accounting for approximately 58% of global revenue in 2025, driven by strong demand for red and white wines. Sparkling and carbonated canned wines represent the fastest-growing product type, benefiting from social consumption trends and alignment with casual occasions. Flavored and infused canned wines, though smaller in share, are gaining traction among younger consumers seeking differentiated taste profiles and lower alcohol options.

Packaging Size Insights

The 200–250 ml segment leads the market with around 46% share, as it offers an optimal balance between single-serve convenience and value perception. Smaller cans up to 187 ml are popular for sampling and airline consumption, while larger cans above 375 ml cater to sharing occasions and value-focused consumers. Packaging size innovation remains central to brand positioning strategies.

Distribution Channel Insights

Off-trade channels account for approximately 68% of global canned wine sales, driven by supermarkets, hypermarkets, and online retail platforms. E-commerce and direct-to-consumer (D2C) channels are expanding rapidly, supported by subscription models and curated wine packs. On-trade channels, including bars, restaurants, and event venues, are increasingly adopting canned wines to reduce breakage risk and streamline operations.

End-Use Occasion Insights

Casual at-home consumption remains the largest end-use segment, while outdoor and on-the-go consumption is the fastest-growing. Social events, festivals, and hospitality applications are driving incremental demand. Emerging end-use occasions include corporate gifting, premium airline services, and curated wine subscriptions, expanding the overall addressable market.

| By Product Type | By Wine Color | By Packaging Size | By Price Positioning | By Distribution Channel | By End-Use Occasion |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 42% of the global canned wines market in 2025, led by the United States. Strong consumer acceptance, widespread retail availability, and active participation from leading wineries support sustained dominance. Canada contributes steadily through premium and organic canned wine demand.

Europe

Europe holds around 31% market share, with the U.K., France, and Germany leading adoption. Sustainability-driven purchasing behavior and strong retail penetration are key growth drivers. Southern European markets are gradually adopting canned wines, supported by tourism-driven consumption.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expected to register a CAGR exceeding 22%. China, Japan, and Australia are major contributors, driven by urbanization, evolving alcohol preferences, and premium lifestyle branding.

Latin America

Latin America remains an emerging market, with Brazil, Argentina, and Mexico showing early adoption. Demand is driven by affordability, portability, and increasing interest in wine among younger demographics.

Middle East & Africa

Demand is concentrated in tourism-driven markets and duty-free channels. Premium hospitality and airline consumption are supporting niche growth, particularly in the UAE and South Africa.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Canned Wines Market

- E. & J. Gallo Winery

- Constellation Brands

- The Wine Group

- Union Wine Company

- Accolade Wines

- Treasury Wine Estates

- Castel Group

- Pernod Ricard

- Viña Concha y Toro

- Trinchero Family Estates

- Jackson Family Wines

- Delicato Family Wines

- Copestick Murray

- Sans Wine Co.

- Sula Vineyards