Canned Beans Market Size

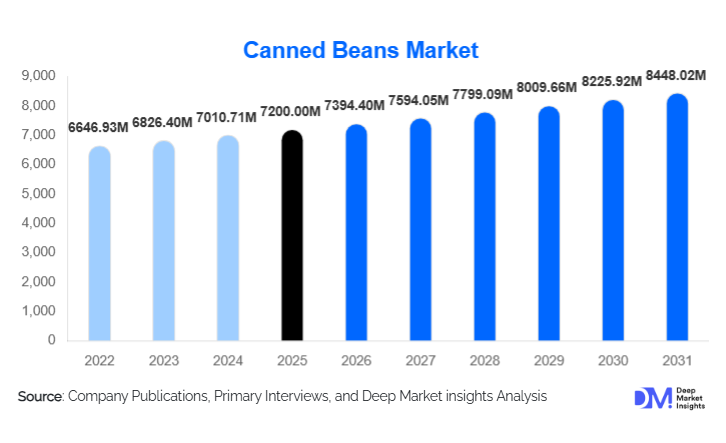

According to Deep Market Insights, the global canned beans market size was valued at USD 7,200 million in 2025 and is projected to grow from USD 7,394.40 million in 2026 to reach USD 8,448.02 million by 2031, expanding at a CAGR of 2.7% during the forecast period (2026–2031). The market growth is primarily driven by rising consumer demand for convenient, nutrient-rich, plant-based protein sources, increasing adoption of canned beans in household and food service sectors, and expansion of modern retail and e-commerce channels across emerging and developed regions.

Key Market Insights

- Health and wellness trends are driving the adoption of canned beans, as consumers seek high-protein, fiber-rich, and plant-based dietary options.

- Emerging markets such as Asia-Pacific and Latin America are witnessing rapid growth, fueled by urbanization, rising disposable incomes, and increasing awareness of convenient food products.

- Metal can packaging dominates globally, accounting for more than 80% of market revenue due to durability, shelf life, and recyclability advantages.

- Supermarkets and hypermarkets are the leading distribution channels, contributing nearly 70% of global canned beans sales, while e-commerce is the fastest-growing segment.

- Household consumption remains the largest end-use segment, while food service and food processing sectors offer strong growth opportunities.

- Product innovation and digital marketing, including flavored, organic, and low-sodium options, are reshaping consumer engagement and driving premiumization trends.

What are the latest trends in the canned beans market?

Rise of Organic and Value-Added Products

Manufacturers are increasingly introducing organic, non-GMO, and fortified canned bean variants to cater to health-conscious consumers. Low-sodium, flavored, and ready-to-eat products are gaining traction, particularly in North America and Europe. Value-added offerings, such as beans blended with spices or sauces, are emerging to meet evolving taste preferences and premiumization trends. Consumers are showing willingness to pay higher prices for health-focused and convenience-driven products, which has encouraged brands to expand these portfolios across retail and e-commerce platforms.

Digital Retail and E-Commerce Expansion

Online grocery platforms are becoming critical for canned beans distribution, enabling direct access to end consumers, personalized promotions, and subscription models. E-commerce adoption has surged, especially in Asia-Pacific and emerging economies, where urban populations are seeking convenience and variety. Digital marketing campaigns, influencer partnerships, and targeted social media content are helping brands increase visibility and capture younger demographics. Retailers are also leveraging data analytics to optimize product assortment and pricing strategies for online consumers.

What are the key drivers in the canned beans market?

Growing Demand for Convenience Foods

Time-pressed lifestyles and urban living have created a strong demand for ready-to-eat and shelf-stable foods. Canned beans offer quick meal preparation without compromising nutrition, making them a preferred choice in households and institutional kitchens. This trend is particularly strong in North America and Europe, where consumers prioritize convenience and versatility in cooking.

Plant-Based Protein Trend

With plant-based diets gaining popularity, canned beans serve as an affordable, sustainable source of protein. Flexitarian, vegetarian, and vegan populations are expanding, creating increased consumption across age groups. Beans are widely used in salads, soups, ready meals, and ethnic cuisines, strengthening their presence in both retail and food service sectors.

Retail and Food Service Expansion

Modern retail chains, hypermarkets, and online platforms have improved accessibility and visibility for canned beans. Food service adoption in quick-service restaurants, cafeterias, and catering services is also boosting demand. These channels allow manufacturers to reach larger audiences while creating consistent repeat demand for packaged beans.

What are the restraints for the global market?

Raw Material Price Volatility

Fluctuations in bean commodity prices and packaging costs can lead to unpredictable pricing for end consumers and margin pressures for manufacturers. Smaller players may struggle to absorb these cost variations, limiting expansion or profitability in price-sensitive markets.

Perception of Processed Foods

Despite their nutritional value, canned products are sometimes viewed as processed and less healthy due to sodium content or preservatives. This perception can limit adoption among highly health-conscious consumers unless brands invest in reformulation and clear labeling.

What are the key opportunities in the canned beans market?

Expansion into Emerging Markets

Rapid urbanization and rising disposable incomes in Asia-Pacific and Latin America create significant growth potential. Consumers are increasingly adopting convenient food products, offering opportunities for both multinational and local manufacturers. Localization of flavors, regional recipes, and culturally relevant marketing strategies can help brands gain a competitive advantage.

Product Innovation and Premiumization

Health-conscious and convenience-seeking consumers are driving the adoption of organic, low-sodium, flavored, and ready-to-eat canned beans. Value-added offerings enable manufacturers to differentiate their products, command premium pricing, and attract new customer segments. Packaging innovations, such as BPA-free cans and eco-friendly materials, further enhance appeal and sustainability credentials.

Digital and E-Commerce Integration

Expansion of digital retail and direct-to-consumer sales presents an opportunity to increase brand visibility and consumer engagement. Subscription services, online promotions, and influencer-led campaigns can drive repeat purchases, especially in younger demographics and urban centers. Analytics-driven targeting enables optimized inventory management and more effective marketing strategies.

Product Type Insights

Among various bean types, black beans dominate globally, accounting for approximately 27% of the total market share in 2024. Their versatility in salads, soups, and ethnic cuisines has contributed to sustained demand. Kidney beans and chickpeas are also significant, but black beans have shown the most consistent growth, particularly in North America and Latin America, due to widespread consumer familiarity and culinary versatility.

Application Insights

Household consumption is the largest end-use segment, representing around 62% of the market in 2024. Food service and ready meal processing sectors are growing steadily, with manufacturers incorporating canned beans as ingredients in soups, ready-to-eat meals, and ethnic cuisines. Export-driven demand is rising, particularly from North America and Europe to emerging regions in the Asia-Pacific and Africa, where modern retail and urban lifestyle adoption is accelerating.

Distribution Channel Insights

Supermarkets and hypermarkets remain the leading distribution channel with nearly 70% share globally, while e-commerce is the fastest-growing segment. Online platforms allow direct consumer engagement, targeted promotions, and subscription services, enhancing reach and sales volume. Convenience stores and wholesale channels support regional penetration, particularly in emerging economies.

End-Use Insights

Households dominate the end-use segment, followed by food service operators and the processed food industry. Growth is particularly strong in meal kits, ready-to-eat products, and restaurant applications. The food processing sector is increasingly incorporating canned beans for protein fortification, ethnic cuisine preparation, and plant-based menu options, providing long-term growth prospects.

| By Product Type | By Category | By Packaging Format | By Distribution Channel | By End Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds the largest market share at approximately 33% in 2024. The U.S. leads consumption, supported by high awareness of plant-based diets, widespread retail infrastructure, and convenience-focused lifestyles. Canada also contributes a significant demand, particularly for organic and low-sodium products. Household adoption and institutional consumption are the primary growth drivers in the region.

Europe

Europe accounts for roughly 27% of the global market in 2024, with Germany, the U.K., and France leading consumption. Health-conscious trends, Mediterranean cuisine influences, and retail availability are major drivers. Organic and flavored canned beans are gaining popularity, particularly among younger, urban consumers.

Asia-Pacific

Although currently contributing about 21% of the market, the Asia-Pacific is the fastest-growing region. China and India are witnessing double-digit growth due to urbanization, rising disposable incomes, and changing eating habits. Japan and South Korea have mature, steady markets focused on convenience and imported premium products.

Latin America

Latin America accounts for 13% of the market, with Brazil and Mexico as key contributors. Cultural affinity for beans and expanding retail penetration are boosting canned beans adoption. Export-driven demand from North America also supports regional growth.

Middle East & Africa

The region contributes approximately 6% of the global market. The Middle East, particularly the UAE and Saudi Arabia, shows strong demand due to high-income consumers and a preference for convenience foods. Africa represents both production and consumption potential, with growing urbanization supporting canned beans penetration.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Players in the Canned Beans Market

- The Kraft Heinz Company

- Bush’s (Bush Brothers & Company)

- Goya Foods

- Conagra Brands

- Del Monte Foods

- Amy’s Kitchen

- Green Giant (B&G Foods)

- H.J. Heinz Company

- Bonduelle

- B&M Foods

- Trader Joe’s

- La Costeña

- AJINOMOTO

- Eden Foods

- Hormel Foods