Cakes and Pastries Market Size

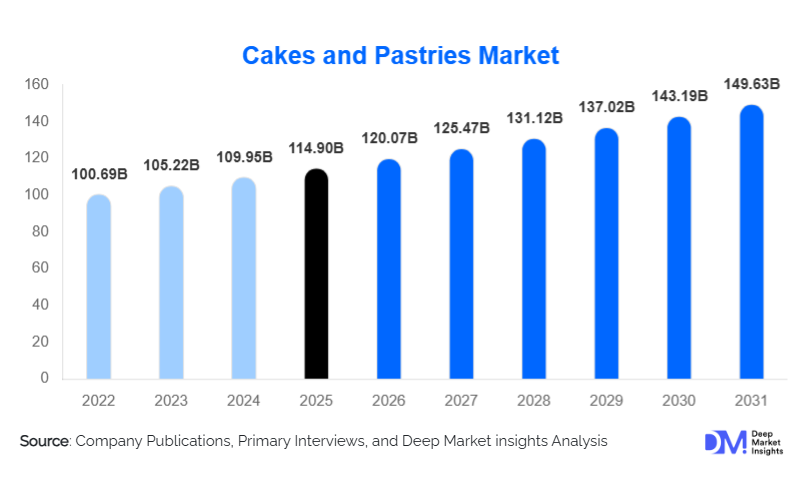

According to Deep Market Insights, the global cakes and pastries market size was valued at USD 114.90 billion in 2025 and is projected to grow from USD 120.07 billion in 2026 to reach USD 149.63 billion by 2031, expanding at a CAGR of 4.5% during the forecast period (2026–2031). The cakes and pastries market growth is primarily driven by rising urbanization, increasing consumption of indulgent and convenience foods, expansion of café culture, and continuous product innovation across flavors, formats, and health-oriented variants.

Key Market Insights

- Cakes remain the dominant product category, accounting for more than half of global market revenue due to strong household and celebration-based demand.

- Fresh bakery products continue to lead, particularly in Europe and premium urban markets, supported by consumer preference for taste and texture.

- Supermarkets and hypermarkets dominate distribution, benefiting from high footfall, private-label offerings, and wide product assortments.

- Asia-Pacific is the fastest-growing region, driven by Westernization of diets, rising disposable incomes, and rapid growth of modern retail.

- Chocolate-based cakes and pastries hold the largest flavor share, reflecting consistent global consumer preference.

- Digital ordering and food delivery platforms are reshaping purchasing behavior, especially among younger consumers.

What are the latest trends in the cakes and pastries market?

Premiumization and Artisanal Bakery Growth

Premium and artisanal cakes and pastries are gaining strong traction globally as consumers increasingly seek high-quality ingredients, visually appealing designs, and unique flavor profiles. Artisanal bakeries emphasizing handcrafted production, clean-label formulations, and locally sourced ingredients are expanding rapidly in urban centers. Seasonal and limited-edition launches, customized celebration cakes, and gourmet pastries are enabling manufacturers to command higher price points and improve margins. This trend is particularly pronounced in Europe and North America, where consumers associate artisanal bakery products with authenticity and superior taste.

Health-Oriented Reformulation and Innovation

Health-conscious consumption is influencing product innovation across the cakes and pastries market. Manufacturers are increasingly launching reduced-sugar, gluten-free, vegan, and high-protein variants to cater to evolving dietary preferences. Whole grains, plant-based fats, natural sweeteners, and functional ingredients such as fiber and probiotics are being incorporated without compromising taste. This trend is expanding consumption occasions beyond indulgence, positioning cakes and pastries as acceptable treats for wellness-focused consumers.

What are the key drivers in the cakes and pastries market?

Expansion of Café Culture and Foodservice

The rapid growth of cafés, coffee chains, and quick-service restaurants is a major driver of cakes and pastries demand. Pastries are increasingly positioned as complementary products to beverages, driving impulse purchases and repeat consumption. Global and regional café chains continue to expand aggressively, particularly in Asia-Pacific and the Middle East, significantly boosting foodservice demand for frozen and ready-to-serve bakery products.

Rising Urbanization and Convenience Consumption

Urban lifestyles characterized by busy schedules are increasing demand for ready-to-eat and on-the-go bakery products. Packaged and frozen cakes and pastries offer convenience, extended shelf life, and consistent quality, making them popular among working professionals and nuclear households. Improved cold-chain logistics and packaging technologies are further supporting market expansion.

What are the restraints for the global market?

Volatility in Raw Material Prices

Fluctuating prices of key raw materials such as wheat flour, sugar, cocoa, butter, and dairy products pose a significant challenge for manufacturers. Input cost volatility directly impacts production costs, profit margins, and pricing strategies, particularly for small and mid-sized bakeries with limited pricing power.

Growing Health Concerns Over Sugar and Calories

Increasing awareness regarding obesity, diabetes, and high sugar intake is restraining consumption of traditional cakes and pastries in some mature markets. Regulatory pressure related to sugar labeling and nutritional disclosures is also prompting manufacturers to reformulate products, adding to operational complexity.

What are the key opportunities in the cakes and pastries industry?

Emerging Market Demand and Localization

Emerging economies in Asia-Pacific, Latin America, and the Middle East present significant growth opportunities. Rising middle-class populations, urbanization, and exposure to Western-style bakery products are driving demand. Localization of flavors, portion sizes, and pricing strategies is enabling manufacturers to penetrate these markets effectively.

Digital Channels and Direct-to-Consumer Models

Online retail, food delivery platforms, and direct-to-consumer bakery models are creating new revenue streams. Brands investing in digital ordering, customized online cake design tools, and cloud kitchen models are well-positioned to capture incremental demand, particularly among younger consumers.

Product Type Insights

Cakes dominate the global market, accounting for approximately 58% of total revenue in 2025. This leadership is driven by strong demand for celebration cakes, home consumption, and packaged cake products. Pastries represent the remaining share, supported by café culture and foodservice demand, particularly for croissants, Danish pastries, and puff pastries.

Category Insights

Fresh cakes and pastries lead the market with nearly 49% share, driven by consumer preference for taste and texture. Packaged products follow, benefiting from convenience and shelf stability, while frozen bakery products are the fastest-growing category due to foodservice expansion and export demand.

Distribution Channel Insights

Supermarkets and hypermarkets account for around 31% of global sales, supported by private-label offerings and broad product assortments. Bakery shops remain strong in premium segments, while online channels are growing rapidly due to convenience and customization options.

End-Use Insights

Household consumption represents approximately 52% of global demand, driven by everyday indulgence and home celebrations. Commercial foodservice is the fastest-growing end-use segment, expanding at over 7% CAGR, supported by cafés, QSRs, and hotels. Institutional demand remains steady, particularly in corporate catering and educational facilities.

| By Product Type | By Category | By Flavor Type | By Distribution Channel | By End Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Europe

Europe holds the largest share of the global cakes and pastries market at approximately 36% in 2025. Countries such as Germany, France, and the U.K. benefit from strong bakery traditions, high per-capita consumption, and premium artisanal demand.

North America

North America accounts for nearly 28% of global revenue, led by the United States. High consumption of packaged cakes, strong retail penetration, and innovation in health-oriented products support market growth.

Asia-Pacific

Asia-Pacific is the fastest-growing region, registering a CAGR of over 8%. China, India, and Japan are key contributors, driven by urbanization, expanding middle-class populations, and growing café culture.

Latin America

Latin America shows steady growth, led by Brazil and Mexico. Urbanization and increasing penetration of modern retail are supporting demand for packaged bakery products.

Middle East & Africa

The Middle East & Africa region is witnessing rising demand for premium and frozen bakery products, particularly in the UAE and Saudi Arabia, supported by foodservice expansion and tourism-driven consumption.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Cakes and Pastries Market

- Grupo Bimbo

- Mondelez International

- Nestlé

- Britannia Industries

- General Mills

- Flowers Foods

- Yamazaki Baking

- Hostess Brands

- Aryzta AG

- Campbell Soup Company

- ITC Limited

- Parle Products

- Lotte Confectionery

- Associated British Foods

- McKee Foods